Tax Appraisal Vs Market Value

Welcome to a comprehensive exploration of the differences between tax appraisal and market value in the realm of real estate and property assessments. This article aims to delve into the intricacies of these two valuation concepts, providing a detailed understanding of their definitions, methodologies, and implications for property owners and investors.

Understanding Tax Appraisal

Tax appraisal, a critical component of property taxation, is an official evaluation of a property’s worth conducted by tax assessors on behalf of local governments. The primary purpose of tax appraisal is to determine the value of a property for taxation purposes, ensuring that property owners pay their fair share of taxes based on the property’s assessed value.

The tax appraisal process involves a meticulous examination of various factors, including the property's location, size, condition, and recent sales data of comparable properties in the area. Assessors may also consider the property's income potential, especially for commercial or investment properties. The data collected is then used to assign a taxable value to the property, which is often a percentage of its estimated market value.

For instance, consider a residential property located in an upscale neighborhood. The tax assessor might consider the property's square footage, the number of bedrooms and bathrooms, the quality of construction, and any recent renovations. They would also review sales data for similar properties in the area to ensure that the assessed value is in line with the market.

Methodology and Timing

Tax appraisals typically follow a standardized methodology prescribed by local tax authorities. Assessors may use different approaches, such as the cost approach, sales comparison approach, or income capitalization approach, to estimate a property’s value. The chosen approach often depends on the property type and local assessment practices.

The timing of tax appraisals can vary. Some jurisdictions conduct annual appraisals, while others assess properties every few years. In certain cases, properties may be reappraised when significant improvements are made or when there are substantial changes in the local market conditions.

| Tax Appraisal Methodology | Description |

|---|---|

| Cost Approach | Estimates value by calculating the cost to replace the property, less depreciation, plus the value of the land. |

| Sales Comparison Approach | Compares the property to similar, recently sold properties to determine its value. |

| Income Capitalization Approach | For income-producing properties, estimates value based on the income the property is expected to generate. |

Implications for Property Owners

Tax appraisals have a direct impact on property owners’ tax obligations. A higher tax appraisal can result in increased property taxes, while a lower appraisal may lead to reduced taxes. Property owners have the right to appeal their tax assessments if they believe the appraised value is inaccurate or unfair. The appeal process typically involves providing evidence, such as recent sales data or appraisals, to support a lower valuation.

It's important for property owners to stay informed about the tax appraisal process in their jurisdiction. Understanding the assessment methodology and keeping track of local market trends can help property owners anticipate potential changes in their tax liability.

Unveiling Market Value

Market value, on the other hand, represents the price a property is likely to fetch in an open and competitive market. It is the amount a willing buyer and a willing seller would agree upon in an arm’s-length transaction, with neither party being under any compulsion to buy or sell.

Market value is influenced by a myriad of factors, including the property's physical characteristics, its location, market conditions, and the availability of similar properties for sale. In a competitive market, where demand exceeds supply, market values tend to increase. Conversely, in a buyer's market, where there is an abundance of properties for sale, market values may decline.

Determining Market Value

Real estate professionals, particularly appraisers and real estate agents, play a pivotal role in determining market value. They analyze recent sales data of comparable properties, considering factors such as size, condition, amenities, and location. This process, known as comparative market analysis (CMA), helps establish a property’s fair market value.

For instance, if a homeowner is considering selling their property, they might consult a real estate agent who specializes in their neighborhood. The agent would conduct a CMA, reviewing recent sales of similar homes in the area, and provide an estimate of the property's market value based on these comparables.

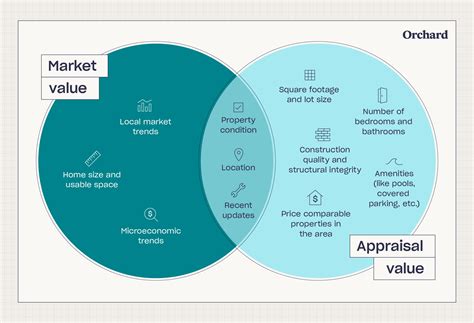

Market Value and Appraisals

While tax appraisals and market value are distinct concepts, they are often interconnected. Tax assessors may use market value as a starting point for their appraisals, especially in jurisdictions where market values are stable and accurately reflect property values. However, it’s important to note that tax appraisals and market values can diverge, particularly in volatile markets or when unique circumstances influence a property’s value.

For example, a property with a historic designation might have a higher market value due to its unique architectural features, while its tax appraisal might be lower due to restrictions on renovations or limited income-generating potential.

Comparative Analysis

Now, let’s delve into a more detailed comparison of tax appraisal and market value to highlight their differences and similarities.

Purpose

- Tax Appraisal: Primarily for determining property taxes.

- Market Value: To establish the price a property would command in a competitive market.

Timing

- Tax Appraisal: Periodic, often every few years, with potential reassessments for significant property changes.

- Market Value: Fluctuates with market conditions and can change rapidly, especially in volatile markets.

Methodology

- Tax Appraisal: Varies by jurisdiction, using approaches like cost, sales comparison, or income capitalization.

- Market Value: Determined through comparative market analysis, considering recent sales of similar properties.

Factors Considered

- Tax Appraisal: Location, size, condition, income potential, and comparable sales data.

- Market Value: Physical characteristics, location, market demand, supply of similar properties, and unique features.

Impact on Property Owners

- Tax Appraisal: Affects property taxes, with the potential for appeals if the appraisal is deemed unfair.

- Market Value: Influences selling or purchasing decisions, as it represents the price a property is likely to fetch in the market.

Real-World Examples

Let’s explore some real-world scenarios to illustrate the concepts of tax appraisal and market value.

Scenario 1: Stable Market, Consistent Values

In a stable real estate market, where property values remain relatively consistent, tax appraisals and market values often align closely. For instance, consider a suburban neighborhood with a steady demand for single-family homes. The tax assessor’s office might conduct annual appraisals, using the sales comparison approach to ensure property values are in line with recent sales.

In this scenario, a homeowner who recently purchased their property for $500,000 might find that their tax appraisal is also $500,000. This alignment ensures that the homeowner pays taxes based on the current market value of their property.

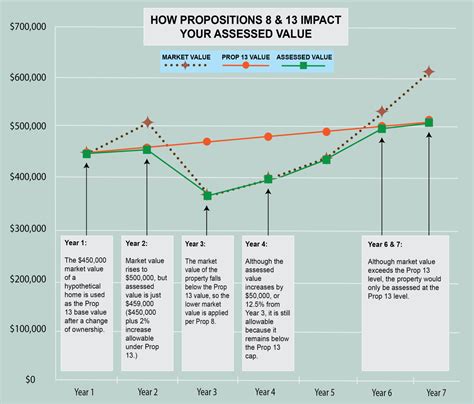

Scenario 2: Volatile Market, Discrepancies in Values

Volatile markets, characterized by rapid fluctuations in property values, can lead to discrepancies between tax appraisals and market values. For example, in a hot real estate market with limited inventory, property values can soar quickly. However, tax appraisals, which are typically conducted less frequently, may lag behind these market fluctuations.

Imagine a condominium in a bustling city center. The market value of the condo has increased by 20% over the past year due to a surge in demand. However, the tax appraisal, which was conducted a year ago, still reflects the older, lower value. This discrepancy can result in the property owner paying taxes based on a lower assessed value, potentially saving them money.

The Future of Property Valuation

As technology advances and data becomes more readily available, the future of property valuation is likely to evolve. Automated valuation models (AVMs) and machine learning algorithms are increasingly being used to estimate property values quickly and accurately. These tools can analyze vast amounts of data, including satellite imagery, to provide real-time estimates of property values.

Furthermore, the integration of blockchain technology in real estate transactions could enhance transparency and security in property valuation. Blockchain-based platforms can provide a secure and immutable record of property transactions, sales data, and valuations, making it easier for assessors and appraisers to access reliable information.

Key Takeaways

- Tax appraisal is an official assessment for taxation purposes, while market value represents the price a property would fetch in an open market.

- Tax appraisals are periodic and can be appealed, while market values fluctuate with market conditions.

- The future of property valuation may involve advanced technologies like AVMs and blockchain, enhancing accuracy and transparency.

Conclusion

Understanding the nuances of tax appraisal and market value is crucial for property owners, investors, and real estate professionals. By recognizing the differences and similarities between these valuation concepts, individuals can make informed decisions regarding property purchases, sales, and tax obligations. As the real estate market continues to evolve, staying abreast of advancements in property valuation techniques will be essential for navigating the complex world of real estate.

Can tax appraisals be appealed, and what is the process?

+Yes, property owners have the right to appeal their tax appraisals if they believe the assessed value is inaccurate or unfair. The appeal process typically involves gathering evidence, such as recent sales data or appraisals, to support a lower valuation. It’s advisable to consult with a tax professional or real estate attorney for guidance on the specific procedures in your jurisdiction.

How frequently are tax appraisals conducted, and can they be updated mid-year?

+The frequency of tax appraisals varies by jurisdiction, with some conducting annual appraisals and others assessing properties every few years. In certain cases, properties may be reappraised when significant improvements are made or when there are substantial changes in local market conditions. Mid-year updates are less common but can occur in response to significant changes in property value.

What happens if the market value of a property drops significantly after a tax appraisal?

+In cases where the market value of a property drops significantly after a tax appraisal, property owners may have grounds for an appeal. However, the appeal process can be complex, and the success of such an appeal depends on various factors, including local regulations and the extent of the value drop. Consulting with a tax professional or real estate attorney is advisable in such situations.