Mortgage Tax

The concept of mortgage tax is an essential aspect of the real estate and financial world, impacting individuals and businesses alike. Mortgage tax, often referred to as deed recording tax or mortgage registration tax, is a levy imposed by governmental authorities on the transfer or registration of a mortgage. It is an integral part of the property-buying process and can significantly influence the overall cost of acquiring a home or property. Understanding mortgage tax is crucial for anyone considering a real estate purchase, as it can vary widely based on location and other factors.

This comprehensive article aims to delve into the intricacies of mortgage tax, offering an in-depth analysis of its various aspects, implications, and strategies to manage it effectively. By the end of this guide, readers should have a clear understanding of what mortgage tax entails, how it is calculated, and the steps they can take to navigate this financial obligation successfully.

Understanding Mortgage Tax

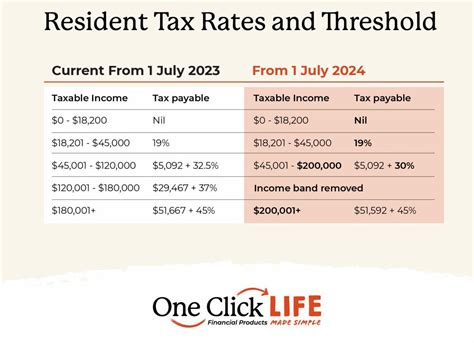

Mortgage tax is a specific type of transfer tax applied when a property changes hands or when a new mortgage is registered against a property. It is typically calculated as a percentage of the property’s value or the mortgage amount, depending on the jurisdiction’s rules. This tax is distinct from property tax, which is an annual levy based on the assessed value of the property, and sales tax, which is applied to the purchase of goods and services.

The primary purpose of mortgage tax is to generate revenue for local, state, or national governments, which then utilize these funds for public services and infrastructure development. In many regions, mortgage tax rates can be substantial, often amounting to thousands of dollars on a single property transaction.

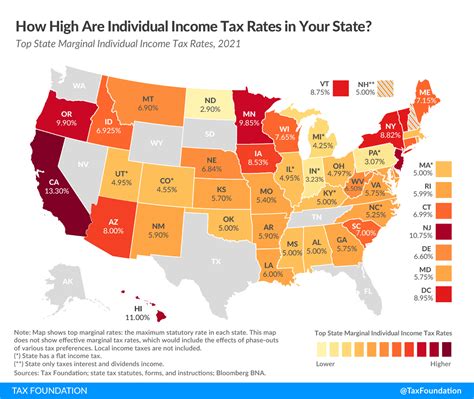

It's important to note that mortgage tax regulations can vary significantly from one jurisdiction to another. Some areas may have a flat rate for mortgage tax, while others employ a sliding scale based on property value. Furthermore, certain localities might offer exemptions or deductions for specific circumstances, such as first-time homebuyers or veterans.

Key Components of Mortgage Tax

- Jurisdictional Variation: Mortgage tax rates and rules can differ significantly between states, counties, and even cities. It’s essential to research the specific regulations of the area where the property is located.

- Taxable Amount: The amount subject to mortgage tax can be either the property’s value or the mortgage loan amount. In some cases, both might be taxed.

- Exemptions and Deductions: Many jurisdictions offer tax breaks or deductions for certain groups, such as senior citizens, disabled individuals, or those buying their first home. Understanding these exemptions can help reduce the overall tax burden.

- Timing of Payment: Mortgage tax is typically due at the time of property transfer or mortgage registration. Failure to pay can result in penalties and legal consequences.

| Jurisdiction | Mortgage Tax Rate | Taxable Amount |

|---|---|---|

| New York City | 1.425% | Property Value |

| Los Angeles County | 0.60% | Mortgage Loan Amount |

| Chicago | 1.75% | Property Value |

| Houston | 0.75% | Mortgage Loan Amount |

Calculating Mortgage Tax

Calculating mortgage tax involves understanding the applicable rate and the base on which the tax is calculated. As mentioned, this can be the property’s value or the mortgage loan amount, and the rate can vary significantly based on location.

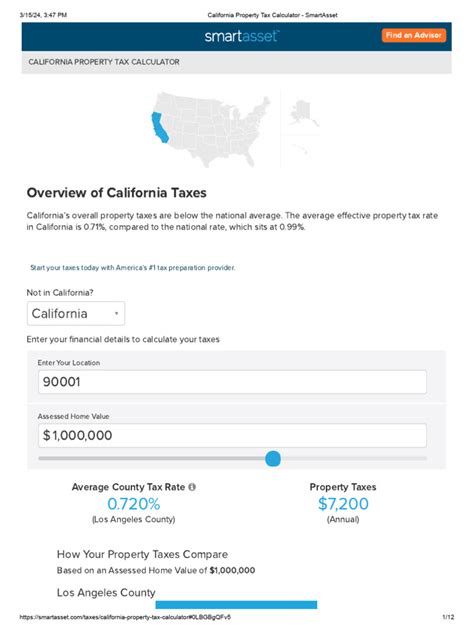

For instance, in New York City, the mortgage tax rate is 1.425% of the property's value. So, for a property valued at $500,000, the mortgage tax would be $7,125 (1.425% of $500,000). However, in Los Angeles County, the tax is calculated at 0.60% of the mortgage loan amount. If the loan amount is $300,000, the mortgage tax would be $1,800 (0.60% of $300,000). These examples demonstrate how the tax can vary greatly depending on the jurisdiction and the specific details of the transaction.

In some cases, mortgage tax can be included in the overall closing costs, which are the expenses above and beyond the purchase price that buyers and sellers are responsible for paying at the time of a real estate transaction. However, it's essential to understand the breakdown of these costs to ensure that you're prepared for the financial obligations associated with your purchase.

Factors Affecting Mortgage Tax Calculation

- Property Value: Higher-value properties generally incur higher mortgage taxes.

- Loan Amount: The mortgage tax might be calculated based on the entire loan amount or a portion of it, depending on the jurisdiction.

- Interest Rate: The interest rate on the mortgage can impact the overall cost of the loan, which in turn can affect the mortgage tax.

- Term of the Loan: Longer loan terms might result in higher overall interest payments, which can influence the mortgage tax.

| Scenario | Property Value/Loan Amount | Mortgage Tax Rate | Estimated Mortgage Tax |

|---|---|---|---|

| Purchase of a $750,000 home in San Francisco | $750,000 | 0.75% | $5,625 |

| Refinancing a $400,000 mortgage in Dallas | $400,000 | 0.40% | $1,600 |

| New construction home valued at $600,000 in Boston | $600,000 | 1.25% | $7,500 |

Strategies to Manage Mortgage Tax

Managing mortgage tax effectively is crucial to ensure that your real estate transaction proceeds smoothly and that you’re not faced with unexpected financial burdens. Here are some strategies to consider:

Research Local Tax Rates and Exemptions

Before making a real estate purchase, thoroughly research the mortgage tax rates and any applicable exemptions in the area where the property is located. This information is often available on the official websites of the relevant government bodies or through local real estate agents or attorneys.

Consider Loan Amount and Term

The loan amount and term can significantly impact the overall cost of your mortgage, including the mortgage tax. Discuss these factors with your lender to understand how they might affect your financial obligations.

Explore Tax Deduction Opportunities

In some cases, mortgage tax can be deducted from your federal or state taxes. Consult with a tax professional to understand the potential deductions available to you based on your specific circumstances.

Negotiate with the Seller

In a buyer’s market or when negotiating a real estate purchase, you might consider asking the seller to cover a portion or all of the mortgage tax. This can be a significant savings for you and might make your offer more competitive.

Seek Professional Advice

Navigating the complexities of mortgage tax can be challenging. Consider seeking advice from a real estate attorney or financial advisor who specializes in real estate transactions. They can provide expert guidance tailored to your specific situation.

What is the average mortgage tax rate in the United States?

+The average mortgage tax rate in the U.S. varies significantly based on location. It can range from 0.25% to 2.15% of the property value or mortgage loan amount. However, it’s crucial to research the specific rates for the area where you’re purchasing property.

Are there any ways to reduce or avoid mortgage tax?

+While mortgage tax is a mandatory expense in most cases, there are ways to minimize its impact. These include exploring tax deductions, negotiating with the seller, and considering loan terms that might result in a lower overall tax burden.

Can I deduct mortgage tax from my federal taxes?

+In certain circumstances, you might be able to deduct mortgage tax from your federal taxes. This typically applies to the interest you pay on your mortgage, but it’s best to consult with a tax professional to understand the specific rules and requirements.

What happens if I don’t pay the mortgage tax on time?

+Failing to pay mortgage tax on time can result in penalties, interest charges, and even legal consequences. It’s crucial to ensure that you understand the payment deadlines and make timely payments to avoid these issues.

Are there any online resources to help calculate mortgage tax?

+Yes, there are several online tools and calculators that can help estimate mortgage tax based on your property’s value, loan amount, and location. These can provide a useful starting point for understanding your potential tax obligations.