Lakewood Township Tax Collector

Welcome to this comprehensive guide on the Lakewood Township Tax Collector's office. This article will delve into the various aspects of the tax collection process, its importance, and the services provided by the dedicated team in Lakewood Township. With a focus on accuracy, efficiency, and transparency, the Lakewood Township Tax Collector's office plays a crucial role in maintaining the financial stability and well-being of the community.

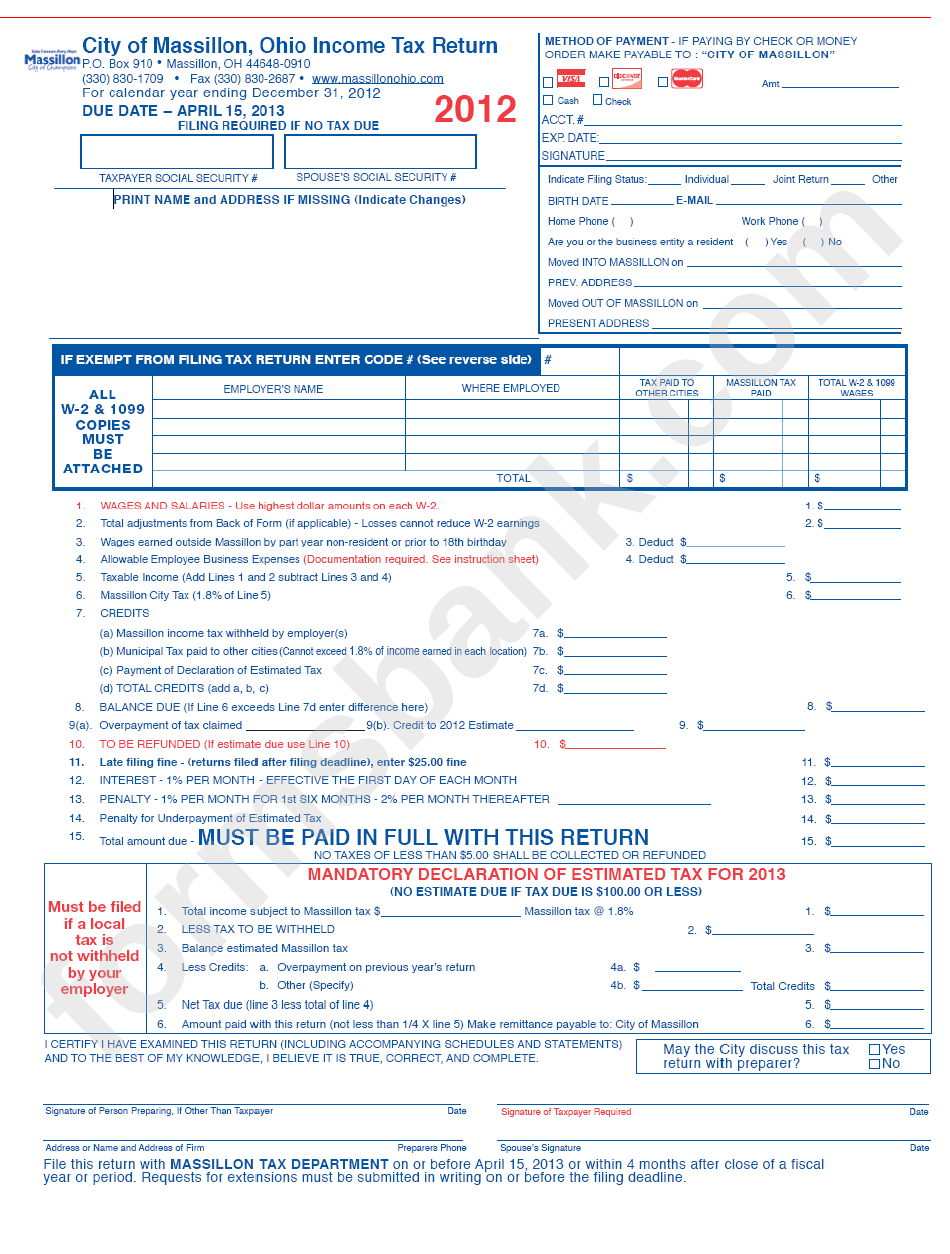

The Role of the Lakewood Township Tax Collector

The Tax Collector’s office in Lakewood Township is responsible for the efficient and effective management of tax collection processes within the township. This includes the assessment, billing, and collection of property taxes, as well as other related fees and charges. The team ensures that residents and businesses fulfill their tax obligations in a timely manner, contributing to the overall financial health of the community.

Under the leadership of the Tax Collector, the office operates with a strong commitment to customer service. They strive to provide clear and concise information to taxpayers, offering guidance and support throughout the tax payment process. The team's expertise and dedication ensure that the tax collection process is fair, transparent, and accessible to all.

Key Responsibilities and Services

- Accurate Assessment: The Tax Collector’s office assesses the value of properties within Lakewood Township, ensuring fair and equitable tax rates.

- Timely Billing: Property owners receive tax bills on time, detailing the amount due and the payment due date.

- Online Payment Options: Taxpayers have the convenience of making payments online, offering a secure and efficient method.

- In-Person Services: The Tax Collector’s office provides a physical location where taxpayers can seek assistance, pay taxes, and resolve any queries.

- Tax Relief Programs: The office administers various tax relief programs, offering assistance to eligible residents, such as the Senior Freeze Program and the Homestead Rebate Program.

The Tax Collector's office also plays a vital role in maintaining transparency and accountability. They publish regular reports on tax collection data, ensuring that the public has access to information about the financial health of the township. This commitment to transparency fosters trust and engagement within the community.

Tax Collection Process: A Step-by-Step Guide

Understanding the tax collection process is essential for residents and businesses in Lakewood Township. Here’s a detailed breakdown of the steps involved:

Step 1: Property Assessment

The Tax Collector’s office begins by assessing the value of each property within the township. This process involves considering factors such as location, size, improvements, and market trends. The assessed value determines the tax rate for each property.

Step 2: Tax Billing

Once the assessments are complete, the Tax Collector’s office generates tax bills for all properties. These bills are sent out to property owners, detailing the amount due, the due date, and payment options. Tax bills are typically issued twice a year, with the option to pay in installments.

Step 3: Payment Options

Taxpayers have several convenient payment options. They can choose to pay online through the township’s secure payment portal, which accepts major credit cards and electronic checks. Alternatively, taxpayers can visit the Tax Collector’s office in person to make payments by cash, check, or money order.

Step 4: Payment Due Dates

It’s important for taxpayers to be aware of the payment due dates to avoid late fees and penalties. The Tax Collector’s office provides clear communication regarding due dates, typically allowing for a grace period before imposing penalties.

Step 5: Tax Relief Programs

The Tax Collector’s office administers various tax relief programs to assist eligible residents. These programs aim to ease the tax burden for seniors, veterans, and low-income households. The team provides information and guidance on how to apply for these programs, ensuring that those in need can access the support they deserve.

Lakewood Township Tax Collector’s Office: Contact and Resources

The Tax Collector’s office is committed to providing excellent customer service and support. They offer a range of resources and contact options to assist taxpayers.

Contact Information

Address: 231 Third Street, Lakewood Township, NJ 08701

Phone: (732) 905-3650

Email: taxcollector@lakewoodtownship.gov

Office Hours

Monday to Friday: 8:30 AM to 4:30 PM

Extended hours during tax season

Online Resources

The Lakewood Township website provides valuable resources for taxpayers, including:

- Tax payment portal

- Tax relief program information and applications

- Frequently Asked Questions (FAQ) section

- Contact details and office hours

In-Person Services

The Tax Collector’s office welcomes taxpayers to visit in person for assistance with:

- Tax bill inquiries

- Payment options and methods

- Tax relief program applications

- Resolution of tax-related issues

Future Outlook: Enhancing Tax Collection Efficiency

The Lakewood Township Tax Collector’s office continuously strives to improve its processes and services. With a focus on technology and innovation, the team aims to streamline the tax collection process further. Here are some initiatives and future plans:

Digital Transformation

The office plans to enhance its online presence and services. This includes improving the user experience of the tax payment portal, adding more features, and ensuring secure transactions. By making the process more digital, the Tax Collector’s office aims to reduce paperwork and provide a faster, more convenient experience for taxpayers.

Data Analytics

Implementing data analytics tools will enable the Tax Collector’s office to gain deeper insights into tax collection patterns and trends. This will help identify areas for improvement, detect potential issues early on, and optimize the allocation of resources.

Community Engagement

The Tax Collector’s office recognizes the importance of engaging with the community. They plan to host informational sessions, workshops, and town hall meetings to educate residents about tax processes, relief programs, and their rights and responsibilities. By fostering a culture of transparency and communication, the office aims to build stronger relationships with taxpayers.

Conclusion: A Dedicated Team, Serving the Community

The Lakewood Township Tax Collector’s office is a vital component of the township’s financial ecosystem. With a focus on accuracy, transparency, and customer service, the team ensures that tax collection processes run smoothly. Their commitment to continuous improvement and innovation ensures that the office remains at the forefront of efficient tax management.

By understanding the role of the Tax Collector and the tax collection process, residents and businesses in Lakewood Township can navigate their tax obligations with confidence. The resources, support, and guidance provided by the Tax Collector's office contribute to a thriving and financially stable community.

How can I pay my property taxes in Lakewood Township?

+

You can pay your property taxes online through the township’s secure payment portal, by visiting the Tax Collector’s office in person, or by mailing a check or money order. The office accepts major credit cards and electronic checks for online payments.

Are there any tax relief programs available in Lakewood Township?

+

Yes, the Tax Collector’s office administers several tax relief programs, including the Senior Freeze Program and the Homestead Rebate Program. These programs provide assistance to eligible residents, reducing their tax burden. The office provides information and guidance on how to apply for these programs.

What happens if I miss the tax payment due date?

+

If you miss the tax payment due date, you may be subject to late fees and penalties. It’s important to stay informed about the due dates and plan your payments accordingly. The Tax Collector’s office provides clear communication regarding due dates and grace periods to avoid any additional charges.

Can I appeal my property tax assessment in Lakewood Township?

+

Yes, if you believe your property tax assessment is incorrect, you have the right to appeal. The Tax Collector’s office can provide information on the appeal process and the necessary steps to initiate it. It’s important to note that appeals must be made within a specified timeframe.