Goods Service Tax Meaning

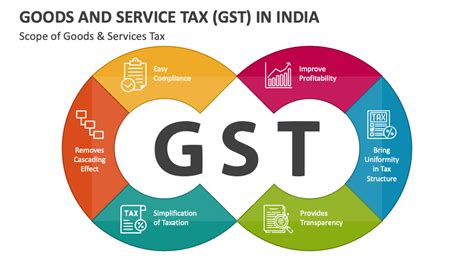

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that has revolutionized the taxation landscape in many countries. It is a complex yet efficient system designed to simplify and unify various indirect taxes, offering a streamlined approach to taxation. This article delves into the intricate world of GST, exploring its definition, structure, benefits, and its impact on businesses and economies.

Understanding the Goods and Services Tax

The Goods and Services Tax is a broad-based consumption tax applied to the supply of goods and services. It is levied at each stage of the production and distribution chain, with set off benefits for all the previous stages. The final consumer bears the GST, making it a destination-based tax. This system ensures a transparent and efficient tax collection process, providing a significant boost to a country’s economy.

The concept of GST is rooted in the idea of value addition at each stage of production and distribution. It is designed to tax the value added to a product or service at each stage, rather than the entire production process. This value-added taxation ensures a fair distribution of tax burden and prevents double taxation.

Key Components of GST

GST is characterized by its multi-stage nature, covering various stages from manufacturing to final consumption. It is also destination-based, which means the tax is levied at the point of consumption, benefiting the state or country where the goods or services are consumed.

The tax is calculated based on the value of goods or services at each stage, with input tax credits available for taxes paid at previous stages. This input tax credit mechanism ensures that taxes are not accumulated at each stage, resulting in a more efficient and transparent system.

Benefits of Implementing GST

The introduction of GST brings about a multitude of advantages, both for businesses and the overall economy.

Simplification of Tax Structure

One of the primary benefits of GST is the simplification of the tax system. By replacing multiple indirect taxes with a single, comprehensive tax, GST reduces the administrative burden on businesses and tax authorities. This streamlined approach saves time and resources, leading to increased efficiency.

The GST system eliminates the cascading effect of taxes, where taxes are levied on taxes, resulting in a higher tax burden. With GST, input tax credits ensure that taxes are not duplicated, making it a more equitable system.

Boost to Economic Growth

GST plays a pivotal role in stimulating economic growth. By reducing the tax burden on businesses, especially small and medium-sized enterprises (SMEs), GST encourages entrepreneurship and investment. It also promotes a more competitive business environment, attracting both domestic and foreign investments.

Furthermore, the destination-based nature of GST ensures that revenue collection is more evenly distributed among states or regions, leading to a more balanced and sustainable economic growth model.

Increased Tax Compliance

The introduction of GST has resulted in improved tax compliance. The transparent and simplified nature of the tax system makes it easier for businesses to understand and fulfill their tax obligations. Additionally, the input tax credit mechanism encourages businesses to maintain accurate records, leading to better tax governance.

The GST system also incorporates advanced technology, such as online filing and real-time tracking, further enhancing compliance and efficiency.

Impact on Businesses

The implementation of GST has a significant impact on businesses, affecting their operations, strategies, and financial health.

Operational Changes

Businesses need to adapt to the new GST system, which involves changes in accounting practices, invoicing, and tax compliance procedures. They must ensure compliance with the GST regulations, which can be complex and vary across different jurisdictions.

Businesses also need to invest in training their staff to understand the new tax system and its implications. This may involve updating accounting software and systems to accommodate the new tax structure.

Financial Implications

GST can have both positive and negative financial implications for businesses. On the positive side, the elimination of cascading taxes can reduce the overall tax burden, leading to cost savings. Additionally, the input tax credit mechanism can provide cash flow benefits, especially for businesses with a high tax liability.

However, the transition to GST may also result in initial costs, such as software upgrades, training expenses, and potential revenue losses during the adjustment period. Businesses need to carefully assess these financial impacts and plan their strategies accordingly.

GST in Practice: A Case Study

To understand the practical implications of GST, let’s consider the case of ABC Manufacturing, a small-scale electronics manufacturing company.

Prior to GST, ABC Manufacturing faced a complex tax structure with various indirect taxes, including Value Added Tax (VAT), Excise Duty, and Service Tax. This led to a high tax burden and administrative challenges.

With the introduction of GST, ABC Manufacturing experienced the following benefits:

- Simplified Tax Structure: The company now deals with a single tax, GST, which has reduced administrative burdens and streamlined their tax compliance processes.

- Input Tax Credits: By claiming input tax credits for taxes paid on inputs, ABC Manufacturing was able to reduce its overall tax liability, leading to significant cost savings.

- Increased Competitiveness: The reduced tax burden and simplified procedures allowed ABC Manufacturing to improve its pricing strategy, making its products more competitive in the market.

- Better Cash Flow: The input tax credit mechanism provided a boost to the company's cash flow, as it could recover taxes paid on inputs, improving its financial stability.

However, ABC Manufacturing also faced challenges during the transition period. The company had to invest in upgrading its accounting software and training its staff to adapt to the new GST system. Additionally, there were initial disruptions in their supply chain as suppliers and partners adjusted to the new tax regime.

Future Implications and Challenges

While GST offers numerous benefits, there are also challenges and implications for the future.

Complex Compliance

GST, with its multi-stage and destination-based nature, can be complex to comply with, especially for small businesses and startups. The need for accurate record-keeping and compliance with various regulations can be a challenge, requiring businesses to invest in compliance expertise.

Technological Advancements

The success of GST relies heavily on technological advancements and infrastructure. As such, continuous investments in technology and infrastructure are necessary to support the efficient functioning of the GST system.

Tax Evasion and Fraud

The GST system, despite its benefits, is not immune to tax evasion and fraud. Governments need to implement robust monitoring and enforcement mechanisms to ensure the integrity of the system and prevent tax evasion.

International Trade

For countries with international trade, the implementation of GST can impact import and export procedures. It is crucial to establish seamless cross-border tax systems to facilitate international trade and prevent unnecessary complexities.

| GST Component | Description |

|---|---|

| Multi-stage | Applied at each stage of production and distribution |

| Destination-based | Levied at the point of consumption |

| Input Tax Credit | Allows for set-off of taxes paid at previous stages |

| Value-added Taxation | Taxes the value added at each stage |

How does GST impact small businesses?

+GST can have a significant impact on small businesses. While it simplifies the tax structure, small businesses may face challenges in adapting to the new system, especially in terms of compliance and record-keeping. However, the input tax credit mechanism can provide cost savings and improve cash flow for these businesses.

What are the key advantages of GST for businesses?

+GST offers several advantages to businesses, including simplified tax structure, reduced tax burden, improved cash flow through input tax credits, and increased competitiveness. It also promotes a more efficient and transparent tax system.

How does GST affect economic growth?

+GST has a positive impact on economic growth. By reducing the tax burden on businesses and promoting a more competitive business environment, GST encourages entrepreneurship and investment. It also leads to a more balanced distribution of revenue among states or regions, contributing to sustainable economic growth.