Nys State Taxes Refund

New York State, often referred to as the Empire State, is renowned for its vibrant cities, breathtaking landscapes, and thriving businesses. One of the critical aspects of financial management for both residents and businesses in New York is understanding the state's tax system, especially when it comes to tax refunds. In this comprehensive guide, we will delve into the intricacies of New York State taxes, focusing specifically on the process of claiming and receiving tax refunds. From the fundamentals of the tax system to the steps involved in obtaining refunds, we aim to provide an expert analysis that will benefit individuals and businesses alike.

Understanding New York State Taxes

New York State’s tax system is a multifaceted structure, comprising various taxes that residents and businesses are obligated to pay. These taxes include income tax, sales tax, property tax, and several others. The income tax, in particular, is a progressive tax system, meaning that the tax rate increases as income rises. This progressive nature ensures that individuals and businesses with higher earnings contribute a larger proportion of their income to the state’s revenue.

The state's income tax rates range from 4% to 8.82%, depending on an individual's or business's taxable income. For instance, individuals with taxable income between $40,100 and $161,450 are subject to a 6.09% tax rate. On the other hand, those with income exceeding $2,140,000 fall into the highest tax bracket, incurring an 8.82% tax rate.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $40,099 | 4% |

| $40,100 - $161,450 | 6.09% |

| $161,451 - $1,073,550 | 6.5% |

| $1,073,551 - $2,140,000 | 6.85% |

| $2,140,001 and above | 8.82% |

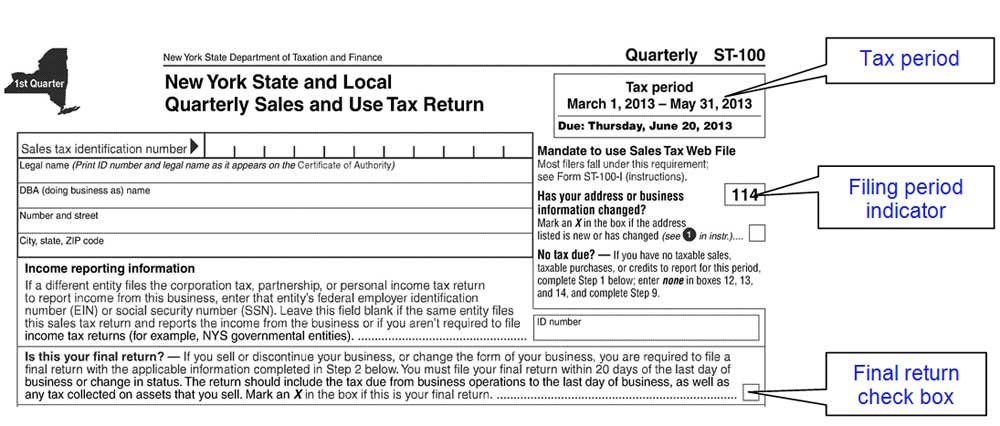

Apart from income tax, New York State also imposes a sales tax, which is a flat rate of 4% on most goods and services. However, certain items like clothing, shoes, and some food products are exempt from this tax. Additionally, there are local sales tax rates that vary by county, which can be as high as 4.5%, bringing the total sales tax rate to 8.5% in certain areas.

The Process of Claiming a Tax Refund in New York State

Claiming a tax refund in New York State involves a straightforward process that can be completed either manually or electronically. The first step is to determine if you are eligible for a refund. This is typically done by comparing the total tax you paid during the tax year with the amount you should have paid based on your taxable income and applicable tax brackets.

If you believe you are entitled to a refund, the next step is to gather the necessary documentation. This includes your previous year's tax return, W-2 forms, and any other relevant financial documents that can support your claim. It's crucial to ensure that all information is accurate and up-to-date to avoid delays or potential audits.

Once you have your documents ready, you can proceed to fill out the appropriate tax forms. For individual taxpayers, this is typically Form IT-201, while businesses will use Form CT-201. These forms can be downloaded from the New York State Department of Taxation and Finance's website or obtained from a local tax office.

After completing the forms, you will need to submit them, along with your supporting documents, to the Department of Taxation and Finance. This can be done either by mail or, if you prefer a more efficient method, electronically through the department's website. Electronic filing often results in faster processing times and can reduce the risk of errors.

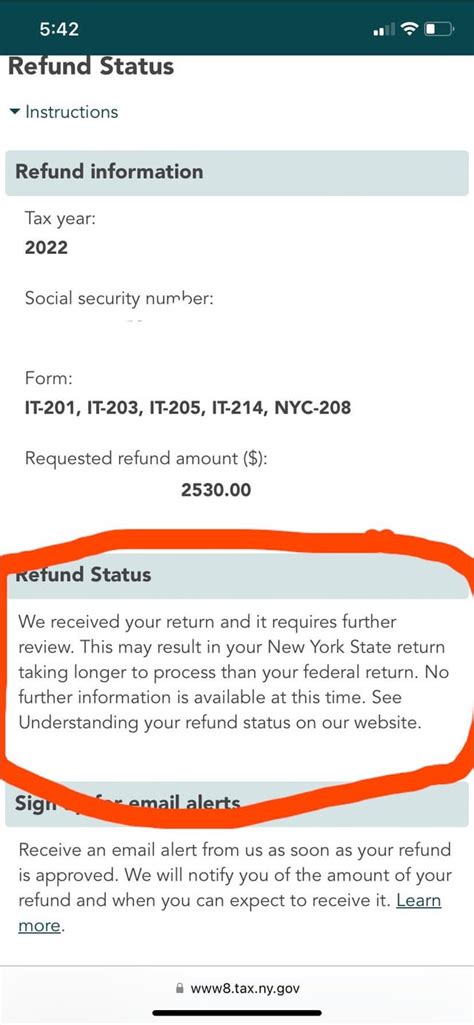

Timelines and Expectations

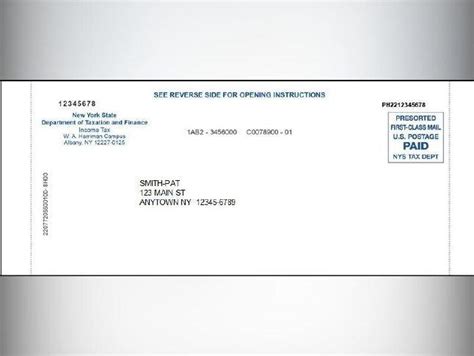

The time it takes to receive a tax refund in New York State can vary depending on several factors. If you file your tax return electronically and choose direct deposit as your refund method, you can typically expect to receive your refund within 4 to 6 weeks. However, if you file a paper return or choose to receive your refund by check, the process may take longer, up to 12 weeks or more.

It's important to note that delays can occur for various reasons, such as missing or incorrect information, additional reviews by the Department of Taxation and Finance, or even high volumes of tax returns during peak seasons. To ensure a smooth process, it's advisable to file your tax return as early as possible and double-check all information for accuracy.

Maximizing Your Tax Refund: Strategies and Considerations

While claiming a tax refund is a straightforward process, there are strategies and considerations that can help you maximize the amount you receive. One of the most effective ways is to take advantage of all the deductions and credits you’re eligible for. These can significantly reduce your taxable income and, consequently, the amount of tax you owe.

For individuals, common deductions include mortgage interest, property taxes, charitable contributions, and certain medical expenses. Businesses, on the other hand, can deduct a wide range of expenses, including advertising costs, employee salaries, and office rent. It's crucial to consult with a tax professional or carefully review the guidelines provided by the Department of Taxation and Finance to ensure you're taking advantage of all applicable deductions.

Utilizing Tax Credits

In addition to deductions, tax credits can also play a significant role in reducing your tax liability. Unlike deductions, which reduce the amount of income subject to tax, credits directly reduce the amount of tax you owe. New York State offers various tax credits, such as the Child and Dependent Care Credit, the Earned Income Credit, and the College Tuition Credit, among others.

For instance, the Child and Dependent Care Credit can help offset the cost of childcare expenses, while the Earned Income Credit provides a financial boost to low- to moderate-income families and individuals. The College Tuition Credit, on the other hand, can reduce your tax liability if you or your dependents are enrolled in a qualified educational institution. By understanding and claiming these credits, you can significantly increase your tax refund.

Avoiding Common Pitfalls

While the process of claiming a tax refund is relatively simple, there are several common mistakes that taxpayers make. One of the most frequent errors is failing to report all sources of income. Whether it’s rental income, self-employment earnings, or interest and dividends, it’s crucial to report all income to avoid penalties and potential audits.

Another pitfall is claiming deductions or credits for which you're not eligible. While it's tempting to take advantage of every possible deduction, doing so incorrectly can lead to penalties and, in some cases, criminal charges. It's always best to consult with a tax professional or carefully review the guidelines to ensure you're claiming only what you're rightfully entitled to.

Additionally, failing to keep proper records and documentation can lead to issues when it comes time to file your tax return. It's essential to maintain a well-organized system of records, including receipts, invoices, and any other supporting documents. This not only makes the process of filing your tax return easier but also provides evidence in case of an audit.

The Future of New York State Taxes: Trends and Implications

The landscape of New York State taxes is constantly evolving, with new trends and developments shaping the future of the state’s tax system. One of the most significant trends is the increasing focus on digital tax solutions. The Department of Taxation and Finance has been actively encouraging taxpayers to utilize electronic filing and payment methods, which not only streamline the process but also reduce costs and errors.

Furthermore, the state is exploring the implementation of a sales tax on certain online transactions, particularly those made through online marketplaces like Amazon and eBay. This move aims to level the playing field between brick-and-mortar businesses and their online counterparts, ensuring that all retailers are contributing fairly to the state's revenue.

Another area of focus is the state's commitment to providing tax relief to its residents and businesses. In recent years, New York has introduced several tax incentives and credits aimed at stimulating economic growth and supporting small businesses. These initiatives include the Empire State Child Credit, which provides a credit for each child under the age of 18, and the Start-Up NY program, which offers tax-free zones for qualifying businesses.

Looking ahead, the future of New York State taxes is likely to be shaped by ongoing debates around tax fairness and economic development. With a growing focus on social and economic equity, the state may continue to explore ways to make its tax system more progressive and supportive of its residents and businesses.

Expert Insights

Conclusion

Understanding and effectively managing your tax obligations is a crucial aspect of financial well-being in New York State. By familiarizing yourself with the state’s tax system, from income and sales taxes to the process of claiming refunds, you can navigate the financial landscape with confidence. This guide has provided an in-depth look at New York State taxes, offering practical insights and strategies to maximize your tax refund while avoiding common pitfalls. As the state’s tax system continues to evolve, staying informed and adapting to new trends and developments will be key to ensuring your financial success.

When is the deadline for filing my New York State tax return?

+

The deadline for filing your New York State tax return typically aligns with the federal tax return deadline, which is April 15th. However, it’s always best to check with the Department of Taxation and Finance for any potential changes or extensions.

Can I file my New York State tax return electronically?

+

Yes, you can file your New York State tax return electronically through the Department of Taxation and Finance’s website. Electronic filing is often faster and more efficient, and it reduces the risk of errors.

What documents do I need to claim a tax refund in New York State?

+

To claim a tax refund, you’ll need your previous year’s tax return, W-2 forms, and any other relevant financial documents that support your claim. It’s essential to have accurate and up-to-date information to avoid delays.

How long does it take to receive a tax refund in New York State?

+

The time it takes to receive a tax refund can vary. If you file electronically and choose direct deposit, you can typically expect to receive your refund within 4 to 6 weeks. Paper returns and refunds by check may take longer, up to 12 weeks or more.

Are there any tax credits available in New York State that can increase my refund?

+

Yes, New York State offers various tax credits, including the Child and Dependent Care Credit, the Earned Income Credit, and the College Tuition Credit. These credits can significantly reduce your tax liability and increase your refund.