Sacramento Sales Tax

Welcome to the comprehensive guide on the Sacramento Sales Tax, an essential aspect of doing business in the vibrant city of Sacramento, California. In this expert-led exploration, we delve into the intricacies of Sacramento's sales tax landscape, offering valuable insights and practical information for businesses and consumers alike. As one of the most significant tax sources for local governments, sales tax plays a pivotal role in shaping the economic landscape of any region. In Sacramento, it is not merely a financial obligation but a critical component that influences the city's growth, development, and overall economic health. Understanding the nuances of Sacramento Sales Tax is therefore crucial for businesses looking to thrive in this dynamic market and for consumers who wish to make informed decisions.

Understanding Sacramento Sales Tax: A Comprehensive Overview

Sacramento, the bustling capital of California, operates under a unique sales tax structure, influenced by both state and local regulations. This section aims to provide a detailed breakdown of Sacramento Sales Tax, covering its composition, rates, and the goods and services it applies to. By understanding these fundamentals, businesses can navigate the tax landscape with precision, ensuring compliance and optimizing their financial strategies.

Sales Tax Composition and Rates

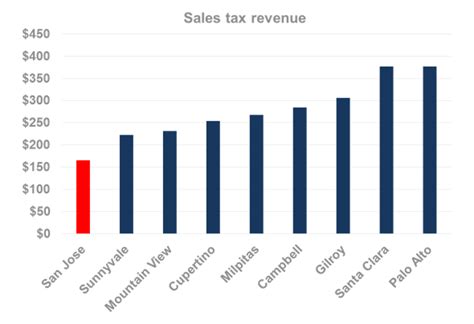

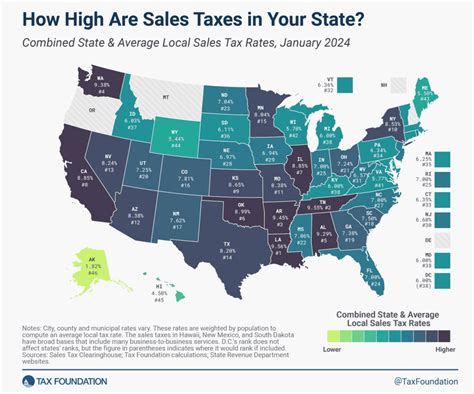

The sales tax in Sacramento is composed of a combination of state, county, and city tax rates. As of the latest update, the state sales tax rate stands at 7.25%, one of the highest in the nation. This base rate is then supplemented by additional county and city taxes, which can vary depending on the specific location within Sacramento County. For instance, within the city limits of Sacramento, the total sales tax rate can reach 8.75%, which includes a 1.5% city tax on top of the state and county rates.

It's important to note that sales tax rates are subject to change, often in response to economic conditions or local initiatives. Therefore, staying updated with the latest tax rates is crucial for accurate pricing and financial planning. Businesses can refer to the California State Board of Equalization for the most current sales tax rates applicable to their specific location within Sacramento County.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Sacramento County Tax | 0.25% |

| City of Sacramento Tax | 1.5% |

| Total Sales Tax (Within City Limits) | 8.75% |

Goods and Services Subject to Sales Tax

Sales tax in Sacramento applies to a wide range of goods and services, including but not limited to: tangible personal property, digital products, certain services like repair and maintenance, and even admissions to certain events and venues. It’s important to note that certain items, such as prescription medications and groceries, are exempt from sales tax in California. However, this exemption does not extend to all food items, and certain prepared foods or meals may still be subject to sales tax.

The applicability of sales tax can also vary based on the nature of the transaction. For instance, sales made through remote sellers or online marketplaces may be subject to different tax rules, often referred to as "marketplace facilitator laws." These laws hold remote sellers responsible for collecting and remitting sales tax on behalf of the marketplace.

Compliance and Reporting: Navigating Sacramento Sales Tax Regulations

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Sacramento. Non-compliance can result in severe penalties, including fines, interest charges, and even legal consequences. This section will guide businesses through the process of registering, collecting, and reporting sales tax in Sacramento, offering practical tips and best practices to maintain compliance.

Registering for Sales Tax in Sacramento

Businesses operating within Sacramento County are required to register for a Seller’s Permit through the California State Board of Equalization. This permit authorizes businesses to collect and remit sales tax on behalf of the state. The registration process typically involves completing an online application, providing business details, and selecting the appropriate tax filing frequency.

It's crucial for businesses to register promptly, as the obligation to collect sales tax begins with the first taxable sale. Late registration can result in penalties and interest charges, so it's advisable to prioritize this step as soon as a business starts operating in Sacramento.

Collecting and Remitting Sales Tax

Once registered, businesses must collect sales tax from customers at the point of sale. This involves adding the applicable sales tax to the purchase price and clearly displaying the tax amount on the customer’s receipt. It’s important to maintain accurate records of all sales transactions, including the tax collected, to facilitate accurate reporting.

The frequency of sales tax reporting and remittance can vary based on the business's annual sales volume. Businesses with lower sales volumes may be required to file quarterly, while those with higher sales may need to file monthly. It's crucial to adhere to the specified filing frequency to avoid late fees and penalties.

Sales Tax Reporting and Payment

Sales tax reporting involves submitting a detailed report of all sales transactions, including the tax collected, to the California State Board of Equalization. This report is typically due on the 20th day of the month following the reporting period. For instance, sales tax collected in January would be reported by the 20th of February.

Along with the sales tax report, businesses are also required to remit the collected tax amount to the state. It's essential to ensure that the payment matches the reported tax amount to avoid discrepancies and potential penalties.

Impact of Sacramento Sales Tax on Businesses and Consumers

Sacramento Sales Tax has a significant impact on both businesses and consumers within the city. For businesses, it represents a critical financial obligation that can influence pricing strategies, profitability, and cash flow management. For consumers, it directly affects the cost of goods and services, influencing purchasing decisions and overall spending habits.

Business Implications

From a business perspective, Sacramento Sales Tax can present both challenges and opportunities. On one hand, it adds a layer of complexity to financial management, requiring businesses to accurately collect, report, and remit sales tax. This process can be time-consuming and may require dedicated resources, especially for businesses with high sales volumes or complex product offerings.

On the other hand, sales tax can also serve as a valuable revenue stream for businesses, particularly those with a strong local customer base. By strategically managing sales tax, businesses can optimize their pricing strategies, potentially increasing their competitive advantage and overall profitability. For instance, businesses can consider absorbing a portion of the sales tax to offer competitive pricing, or passing the tax on to customers while highlighting the value of their products or services.

Consumer Impact

For consumers, Sacramento Sales Tax directly affects the cost of goods and services, impacting their purchasing power and overall financial planning. The higher the sales tax rate, the greater the impact on the final purchase price, which can influence consumer behavior and spending patterns.

Consumers may also face additional complexities when shopping online or through remote sellers. In such cases, they may be subject to different sales tax rates or rules, which can make it challenging to compare prices accurately. Educating consumers about these nuances can help them make informed purchasing decisions and manage their expectations regarding pricing.

Future Implications and Potential Changes

As Sacramento continues to evolve and adapt to changing economic conditions, the city’s sales tax landscape may also undergo transformations. This section explores potential future developments, including changes in tax rates, the impact of emerging technologies, and the role of sales tax in funding local initiatives.

Potential Rate Changes

Sales tax rates in Sacramento, like many other jurisdictions, are subject to change based on economic conditions and local needs. While the current rates provide a stable foundation for businesses and consumers, future rate adjustments cannot be ruled out. These changes could be driven by various factors, including the need to fund specific projects or initiatives, address budget deficits, or align with regional economic trends.

Businesses and consumers should stay vigilant and informed about any proposed or enacted tax rate changes. Such changes can significantly impact pricing strategies, consumer behavior, and overall financial planning.

Impact of Emerging Technologies

The rise of e-commerce and digital technologies has brought about significant changes in the way sales tax is collected and managed. In Sacramento, as in many other cities, the increasing popularity of online shopping and remote sellers has led to the adoption of marketplace facilitator laws. These laws hold remote sellers responsible for collecting and remitting sales tax on behalf of the marketplace, simplifying the tax collection process and ensuring compliance.

As technology continues to advance, businesses and consumers can expect further innovations in sales tax management. This could include more efficient reporting and payment processes, real-time tax calculation tools, and enhanced data analytics to optimize tax strategies.

Sales Tax as a Funding Mechanism

Sales tax plays a critical role in funding local initiatives and infrastructure projects in Sacramento. The revenue generated from sales tax contributes to various aspects of the city’s development, including public transportation, education, public safety, and cultural programs. As such, sales tax is not just a financial obligation but a vital tool for shaping the city’s future.

Businesses and consumers should be aware of how their sales tax contributions support the community. This understanding can foster a sense of civic responsibility and encourage active participation in local initiatives and projects.

Conclusion

Sacramento Sales Tax is a complex yet crucial aspect of doing business and living in Sacramento. By understanding the composition, rates, and applicability of sales tax, businesses can navigate the tax landscape with confidence, ensuring compliance and optimizing their financial strategies. For consumers, understanding sales tax helps make informed purchasing decisions and supports the vibrant community of Sacramento.

As we look to the future, the sales tax landscape in Sacramento is likely to evolve, influenced by economic trends, technological advancements, and local initiatives. Staying informed and adapting to these changes will be key for businesses and consumers alike, ensuring continued success and participation in the dynamic city of Sacramento.

How often do I need to file sales tax returns in Sacramento?

+The frequency of sales tax filing depends on your business’s annual sales volume. If your annual sales are less than 1 million, you typically file quarterly. If your sales exceed 1 million, you are required to file monthly. However, it’s best to consult with a tax professional or refer to the guidelines provided by the California State Board of Equalization for the most accurate information based on your specific business circumstances.

Are there any sales tax holidays in Sacramento?

+Yes, Sacramento, like many other cities in California, observes sales tax holidays. These are designated periods when certain items, often back-to-school supplies or clothing, are exempt from sales tax. These holidays are typically announced in advance and can provide significant savings for consumers. It’s important to stay updated with the dates and eligible items to take full advantage of these tax-free periods.

What happens if I fail to collect or remit sales tax in Sacramento?

+Failure to collect or remit sales tax can result in severe penalties, including fines, interest charges, and even legal consequences. The California State Board of Equalization takes non-compliance seriously and has a range of enforcement measures in place. It’s crucial to stay compliant with sales tax regulations to avoid these penalties and maintain a positive relationship with the state.

Can I claim a sales tax deduction on my business taxes in Sacramento?

+No, sales tax is not deductible for businesses in Sacramento or anywhere else in California. However, you can claim a credit for sales tax paid on purchases that are later resold, which effectively offsets the sales tax you collect from your customers. It’s important to maintain accurate records of these purchases and sales to take full advantage of this credit.