Federal Tax Number For Estate

The Federal Tax Number for an estate, also known as an Employer Identification Number (EIN) or Taxpayer Identification Number (TIN), is a unique identifier assigned by the Internal Revenue Service (IRS) to estates, trusts, and other entities for tax purposes. Obtaining an EIN for an estate is crucial for various administrative and financial tasks, including tax filing, opening bank accounts, and managing the estate's financial obligations. This article aims to provide an in-depth guide on the process of obtaining a Federal Tax Number for an estate, covering the steps, requirements, and potential challenges involved.

Understanding the Need for a Federal Tax Number

When an individual passes away, their estate becomes a separate legal entity responsible for managing their assets, liabilities, and tax obligations. An estate may consist of real estate properties, financial accounts, investments, personal belongings, and other valuable assets. To ensure proper administration and compliance with tax regulations, it is essential to obtain a Federal Tax Number for the estate.

The Federal Tax Number serves as a vital identifier, allowing the estate to file tax returns, pay taxes, and communicate with the IRS effectively. It enables the estate's executors or trustees to fulfill their fiduciary duties and ensure that the estate's financial affairs are handled appropriately. Moreover, the EIN provides a secure means to open and manage bank accounts, facilitating the smooth operation of the estate's financial transactions.

Applying for a Federal Tax Number for an Estate

The process of obtaining a Federal Tax Number for an estate involves several steps and specific requirements. Here is a detailed breakdown of the application process:

Step 1: Determine Eligibility

Not all estates require a Federal Tax Number. According to the IRS, an estate must have a legal or fiduciary relationship and engage in activities that generate income or require the filing of tax returns. If the estate meets these criteria, it is eligible to apply for an EIN.

Step 2: Gather Necessary Information

Before initiating the application process, it is crucial to gather the required information. The IRS mandates specific details to be provided during the application, including the estate’s name, address, and contact information. Additionally, the primary executor or trustee of the estate must be identified, along with their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If the estate has a doing business as (DBA) name, this should also be included.

Step 3: Choose the Application Method

The IRS offers three methods to apply for a Federal Tax Number for an estate: online, by fax or mail, or by phone. The online application is the most convenient and efficient option, as it provides immediate processing and approval. However, if the estate has complex circumstances or requires assistance, the other methods may be preferable.

Step 4: Complete the Application Form

The IRS Form SS-4, also known as the Application for Employer Identification Number, is used to apply for an EIN. The form requires detailed information about the estate, including its legal name, business address, and contact details. Additionally, the primary executor or trustee must provide their SSN or ITIN. It is essential to ensure the accuracy of the information provided to avoid delays in the application process.

Step 5: Submit the Application

Once the Form SS-4 is completed, it can be submitted to the IRS using the chosen application method. For online applications, the IRS provides a user-friendly interface, allowing applicants to input the required information and receive an EIN instantly. Fax or mail applications may take longer, typically 4-6 weeks, while phone applications are processed immediately, with the IRS representative providing the EIN over the phone.

Step 6: Receive and Verify the EIN

After submitting the application, the IRS will assign a unique Federal Tax Number to the estate. The EIN is typically a nine-digit number, structured as XX-XXXXXXX. It is crucial to verify the accuracy of the EIN and ensure it is recorded correctly in the estate’s records. The EIN should be treated as confidential information, as it is a vital identifier for the estate’s tax and financial matters.

Challenges and Considerations

Obtaining a Federal Tax Number for an estate can present certain challenges, particularly in complex estate structures or when dealing with multiple beneficiaries or trustees. Here are some considerations to keep in mind:

Multiple Beneficiaries or Trustees

When an estate has multiple beneficiaries or trustees, it is essential to determine the primary executor or trustee who will represent the estate for tax purposes. The IRS requires the SSN or ITIN of the primary individual responsible for managing the estate’s financial affairs. Clear communication and coordination among all parties involved are crucial to avoid any confusion or delays.

Complex Estate Structures

Estates with complex structures, such as multiple properties, businesses, or investment holdings, may require additional documentation or explanations during the application process. It is advisable to consult with a tax professional or estate planning expert to ensure that all relevant information is provided and that the application meets the IRS’s requirements.

Maintaining Records and Compliance

Once the Federal Tax Number is obtained, it is crucial to maintain accurate records and comply with tax regulations. The estate’s executors or trustees should keep a record of the EIN, along with other relevant tax documents. Proper record-keeping ensures that the estate’s financial affairs are managed efficiently and reduces the risk of non-compliance with tax obligations.

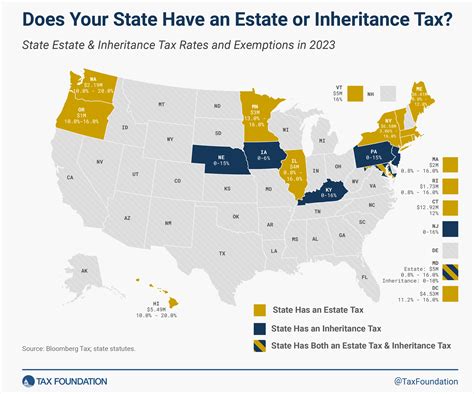

Future Implications and Tax Obligations

Obtaining a Federal Tax Number for an estate is a critical step in ensuring the estate’s financial stability and compliance with tax laws. The EIN enables the estate to meet its tax obligations, such as filing tax returns, paying estate taxes, and reporting income generated by the estate’s assets.

The estate's executors or trustees should consult with tax professionals to understand the specific tax implications and requirements applicable to the estate. This includes staying updated on any changes in tax laws and regulations that may impact the estate's financial management. By obtaining a Federal Tax Number and complying with tax obligations, the estate can effectively administer its financial affairs and fulfill its fiduciary responsibilities.

Conclusion

In conclusion, obtaining a Federal Tax Number for an estate is a necessary step to ensure proper administration and compliance with tax regulations. The process involves gathering the required information, completing the application form, and submitting it to the IRS. While there may be challenges and considerations, particularly in complex estate structures, the benefits of having a Federal Tax Number far outweigh the potential obstacles. By obtaining an EIN, the estate’s executors or trustees can effectively manage the estate’s financial affairs, file tax returns, and ensure compliance with tax laws. This comprehensive guide provides a roadmap for obtaining a Federal Tax Number for an estate, empowering executors and trustees to navigate the process with confidence and expertise.

Can an estate have multiple Federal Tax Numbers?

+No, an estate typically has only one Federal Tax Number (EIN). The EIN is assigned to the estate as a whole and is used for all tax and financial matters related to the estate. However, if the estate has multiple businesses or entities within it, each business may require a separate EIN.

How long does it take to receive an EIN for an estate?

+The processing time for an EIN application varies depending on the method chosen. Online applications are processed instantly, while fax or mail applications may take 4-6 weeks. Phone applications provide immediate processing, with the IRS representative providing the EIN over the phone.

Can a non-resident alien apply for an EIN for an estate?

+Yes, non-resident aliens can apply for an EIN for an estate. However, they must provide a valid ITIN or have an individual with a valid SSN or ITIN act as the primary executor or trustee for the estate. The IRS has specific guidelines for non-resident aliens applying for an EIN, and it is advisable to consult with a tax professional for assistance.

What happens if an estate fails to obtain a Federal Tax Number?

+Failing to obtain a Federal Tax Number for an estate can result in significant complications and potential penalties. The estate may face difficulties in opening bank accounts, managing financial transactions, and complying with tax obligations. Additionally, the IRS may impose penalties for non-compliance, including fines and interest charges. It is crucial to obtain an EIN to ensure the estate’s smooth operation and avoid legal and financial repercussions.