Tax Clearance Certificate

The Tax Clearance Certificate (TCC) is a vital document issued by tax authorities worldwide, confirming that a business or individual is compliant with their tax obligations. It serves as a green light for various financial transactions and plays a crucial role in maintaining a transparent and fair business environment. In this comprehensive guide, we will delve into the intricacies of the Tax Clearance Certificate, its importance, the process of obtaining it, and its impact on businesses and the economy.

Understanding the Tax Clearance Certificate

A Tax Clearance Certificate is a formal document issued by a country’s tax authority, certifying that the holder has met all their tax obligations for a specified period. It provides assurance to financial institutions, government bodies, and potential business partners that the holder is in good tax standing. The TCC is a prerequisite for a wide range of activities, making it an essential tool for businesses operating within a regulated tax environment.

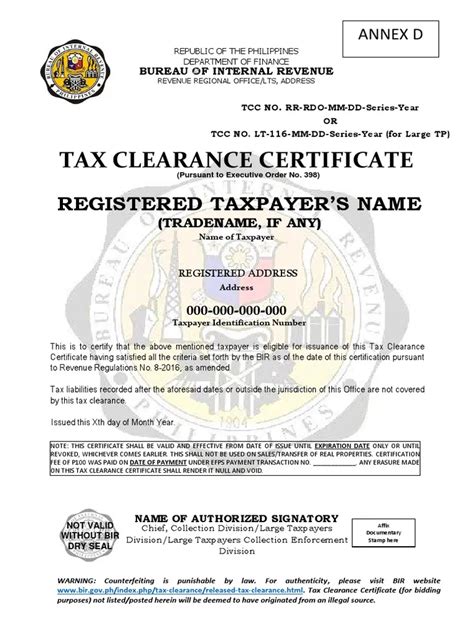

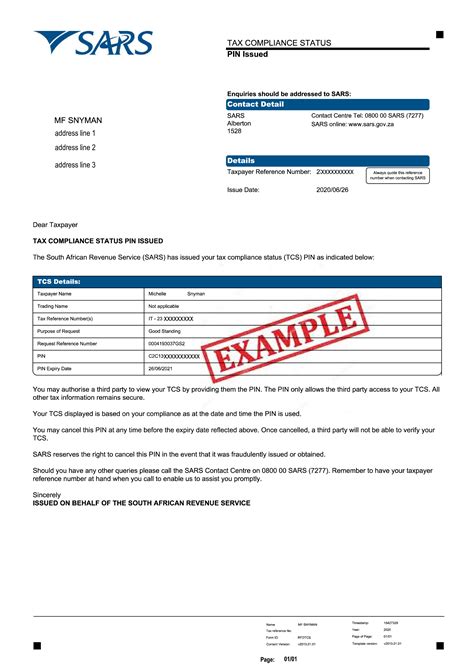

The certificate typically contains the holder's name or business name, tax identification number, the period covered by the clearance, and a unique certificate number. It may also include specific details about the taxes paid, such as income tax, value-added tax (VAT), or payroll taxes. The format and content of the TCC can vary slightly between countries, but its purpose remains the same: to ensure tax compliance and facilitate smooth financial transactions.

The Significance of Tax Clearance Certificates

The Tax Clearance Certificate holds immense importance for both businesses and the overall economy. Here’s a deeper look at its significance:

Compliance and Legal Obligations

Tax clearance is a critical aspect of regulatory compliance. By obtaining a TCC, businesses demonstrate their commitment to adhering to tax laws and regulations. This compliance not only avoids legal repercussions but also fosters a positive reputation, especially when dealing with government agencies or international partners.

Financial Transactions and Tenders

In many countries, a Tax Clearance Certificate is a mandatory requirement for participating in government tenders or contracts. Financial institutions, too, often request TCCs before engaging in significant financial transactions, such as loans or investments. Without a valid TCC, businesses may find themselves locked out of lucrative opportunities, limiting their growth potential.

International Trade and Expansion

For businesses looking to expand globally, a TCC is often a prerequisite. Many countries require proof of tax compliance to allow foreign businesses to operate within their borders. Additionally, when dealing with international clients or suppliers, a TCC can provide the necessary assurance of financial integrity and tax compliance, fostering trust and facilitating smoother international trade.

Employment and Payroll

Tax clearance extends to payroll and employment matters as well. Businesses with a valid TCC can assure employees and contractors that their tax obligations are being met, fostering trust and transparency in employment relationships.

The Process of Obtaining a Tax Clearance Certificate

The process of acquiring a Tax Clearance Certificate can vary slightly depending on the country and the type of entity applying. However, there are some common steps involved:

Application Submission

The first step is to submit an application to the relevant tax authority. This application typically requires the business or individual’s tax identification number, contact details, and a declaration of tax compliance. The application may also need to be accompanied by supporting documentation, such as tax returns and payment receipts.

Verification and Assessment

Once the application is received, the tax authority conducts a thorough verification process. This involves checking the applicant’s tax records, ensuring all taxes due have been paid, and confirming the accuracy of the information provided. The assessment period can vary, depending on the complexity of the tax affairs and the workload of the tax authority.

Issuance of the Certificate

If the applicant’s tax affairs are in order, the tax authority will issue a Tax Clearance Certificate. The certificate is typically valid for a specified period, usually a year, after which a new application must be submitted. In some cases, the certificate may be valid indefinitely, provided the tax obligations continue to be met.

Renewal and Updates

To maintain a valid TCC, businesses must ensure they remain compliant with their tax obligations. This involves timely payment of taxes, accurate filing of tax returns, and keeping the tax authority informed of any changes in business structure or ownership. Regular renewal of the TCC is necessary to avoid any disruptions to business operations.

The Impact of Tax Clearance Certificates on Business

The acquisition and maintenance of a Tax Clearance Certificate can have significant implications for businesses, shaping their operations and growth strategies.

Enhanced Reputation and Trust

A valid TCC serves as a stamp of approval, boosting a business’s reputation and credibility. It demonstrates to stakeholders, investors, and partners that the business operates with integrity and adheres to tax regulations. This can lead to increased trust, which is essential for long-term business relationships and collaboration.

Access to Funding and Opportunities

Financial institutions and investors often view tax compliance as a critical factor when considering funding proposals. A TCC can be a decisive factor in securing loans, investments, or grants. Additionally, as mentioned earlier, many government tenders and contracts require a valid TCC, opening up a wealth of opportunities for compliant businesses.

Regulatory Compliance and Risk Mitigation

Obtaining and maintaining a TCC ensures that businesses remain on the right side of tax laws. This compliance not only avoids legal penalties and fines but also helps mitigate the risk of tax-related controversies or investigations. By staying compliant, businesses can focus on their core operations without the distraction of tax-related issues.

Facilitating International Expansion

For businesses looking to expand globally, a TCC is a crucial step. It provides the necessary assurance of tax compliance, which is often a prerequisite for setting up operations in a new country. With a TCC, businesses can navigate the complexities of international tax laws more confidently, making the expansion process smoother and more efficient.

The Role of Tax Clearance Certificates in the Economy

Beyond individual businesses, Tax Clearance Certificates play a pivotal role in the overall economy.

Ensuring Fair Competition

TCCs help level the playing field by ensuring that all businesses operating within a jurisdiction adhere to the same tax regulations. This prevents tax evasion and ensures a fair and competitive business environment. It also promotes transparency, as businesses are encouraged to operate openly and honestly, contributing to the overall economic health of the country.

Revenue Collection and Economic Growth

Tax clearance is a vital tool for governments to ensure the efficient collection of tax revenues. These revenues are essential for funding public services, infrastructure development, and social programs. By ensuring tax compliance through TCCs, governments can maintain a steady flow of revenue, which is crucial for economic growth and stability.

Attracting Foreign Investment

A robust tax clearance system, coupled with a reliable TCC process, can attract foreign investment. Investors are more likely to consider countries with transparent tax systems and effective compliance mechanisms. A well-established TCC process can thus contribute to a country’s appeal as a destination for foreign investment, fostering economic growth and job creation.

Future Trends and Implications

As tax regulations continue to evolve and technology advances, the Tax Clearance Certificate is likely to undergo changes and adaptations.

Digitalization and Online Processes

Many tax authorities are moving towards digital platforms and online processes for tax clearance. This shift towards digitalization can streamline the TCC application and issuance process, making it more efficient and accessible. It also reduces the risk of errors and delays, enhancing the overall tax compliance experience.

Integration with Other Compliance Mechanisms

In the future, Tax Clearance Certificates may become more integrated with other compliance mechanisms, such as environmental or labor regulations. This integration could lead to a more holistic approach to business compliance, ensuring that businesses meet a wide range of regulatory requirements.

Data-Driven Insights

With the increasing availability of data and advanced analytics, tax authorities may leverage these tools to gain deeper insights into tax compliance. This could lead to more targeted and effective tax clearance processes, identifying potential issues or anomalies early on. It could also pave the way for more personalized tax guidance and support for businesses.

Global Harmonization

As international trade and investment continue to grow, there may be a push for global harmonization of tax clearance processes. Standardizing the TCC process across borders could simplify compliance for businesses operating globally and enhance cross-border collaboration.

Conclusion

The Tax Clearance Certificate is a powerful tool that underpins a fair and transparent business environment. Its importance extends beyond mere compliance, influencing a business’s reputation, access to opportunities, and its role in the economy. As tax regulations continue to evolve, the TCC will likely adapt, becoming even more integral to the smooth functioning of the global business landscape.

How long is a Tax Clearance Certificate valid for?

+The validity period of a TCC can vary depending on the jurisdiction. In some countries, it may be valid for a year, while in others, it could be indefinite, provided tax obligations are met. It’s essential to check with your local tax authority for specific validity periods.

What happens if I don’t have a valid Tax Clearance Certificate?

+The consequences of operating without a valid TCC can be severe. It may result in restricted access to financial services, government contracts, and international business opportunities. In some cases, it could also lead to legal penalties and fines for non-compliance.

Can I apply for a Tax Clearance Certificate online?

+Yes, many tax authorities now offer online application processes for TCCs. This digital approach simplifies the application process and allows for faster processing times. However, it’s essential to check the specific requirements and guidelines of your local tax authority.

Are there any fees associated with obtaining a Tax Clearance Certificate?

+Yes, there are often fees involved in obtaining a TCC. These fees can vary depending on the jurisdiction and the type of business or individual applying. It’s advisable to check with your local tax authority for the specific fee structure.

Can a Tax Clearance Certificate be revoked?

+Yes, a TCC can be revoked if it’s found that the holder is not in compliance with their tax obligations. This could occur if there are outstanding tax payments, inaccuracies in tax returns, or other non-compliance issues. It’s crucial to maintain tax compliance to avoid revocation.