Hillsborough County Fl Property Tax

In the heart of Florida, Hillsborough County stands as a bustling region, renowned for its vibrant cities, diverse landscapes, and thriving economy. As property values continue to soar, property taxes have become a topic of interest and curiosity for residents and investors alike. This comprehensive guide aims to unravel the intricacies of Hillsborough County Property Tax, offering an in-depth analysis of its assessment process, tax rates, exemptions, and strategies for managing these financial obligations effectively.

Understanding Hillsborough County Property Tax

Hillsborough County’s property tax system is a vital component of the local economy, contributing significantly to the funding of essential services and infrastructure. The tax is levied on both real estate and tangible personal property within the county, encompassing everything from residential homes and commercial buildings to agricultural lands and mobile homes.

The property tax in Hillsborough County is governed by a complex interplay of local, state, and federal regulations. At the local level, the Hillsborough County Property Appraiser's Office plays a pivotal role, responsible for assessing the value of each property within the county. This assessment forms the basis for calculating the property tax liability for each owner.

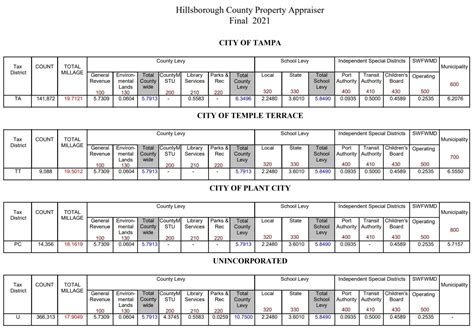

The tax rate, on the other hand, is determined by a combination of factors, including the millage rates set by various taxing authorities such as the county government, school districts, and special districts. These millage rates, expressed in mills (where one mill equals $1 of tax for every $1,000 of assessed value), are crucial in determining the final tax bill for property owners.

Key Players and Their Roles

- Hillsborough County Tax Collector: Responsible for collecting property taxes and issuing tax receipts.

- Hillsborough County Property Appraiser: Conducts annual assessments to determine the taxable value of properties.

- Local Government: Sets the millage rate, which is a crucial factor in calculating property taxes.

- School Districts: Play a significant role in determining tax rates, as they are funded partly through property taxes.

Property Tax Assessment Process

The property tax assessment process in Hillsborough County is a meticulous endeavor. It begins with the Property Appraiser’s Office conducting a comprehensive analysis of each property, taking into account various factors such as location, size, improvements, and market conditions. This initial assessment forms the basis for the Just Value, which is the estimated market value of the property as of January 1st of the tax year.

However, property owners are not subject to taxes based solely on this Just Value. Florida, including Hillsborough County, has a Save Our Homes (SOH) benefit, which caps the increase in the assessed value of a homestead property to 3% or the Consumer Price Index (CPI), whichever is lower. This SOH cap provides stability and predictability for homeowners, ensuring that their tax liability does not increase drastically from year to year.

For non-homestead properties, such as investment properties or second homes, a different assessment method is applied. These properties are assessed annually, and their taxable value can increase without any caps. This means that the tax liability for non-homestead properties can fluctuate significantly based on market conditions and property improvements.

| Property Type | Assessment Method |

|---|---|

| Homestead Properties | Subject to Save Our Homes (SOH) benefit, with a 3% or CPI cap on assessed value increase. |

| Non-Homestead Properties | Assessed annually without any value caps, leading to potential fluctuations in tax liability. |

Property Tax Rates and Calculations

Understanding the property tax rates in Hillsborough County is essential for property owners to estimate their tax liability accurately. The tax rate is expressed in mills, and it varies depending on the location of the property and the type of taxing authority.

For instance, let's consider a residential property located in an unincorporated area of Hillsborough County. The property has a Just Value of $300,000 and a Save Our Homes (SOH) benefit, resulting in an assessed value of $250,000. The applicable millage rate for this property is 10.3880 mills, as determined by the county government and various special districts.

To calculate the property tax liability for this scenario, the assessed value ($250,000) is multiplied by the millage rate (10.3880 mills), resulting in a tax bill of $2,597.00. This calculation highlights the significant impact of the SOH benefit, as the tax liability is based on the assessed value rather than the full Just Value.

It's important to note that the millage rates can change annually, influenced by factors such as budget requirements and voter-approved initiatives. Therefore, property owners should stay informed about these changes to accurately estimate their tax obligations.

Impact of Special Assessments

In addition to the standard property tax, Hillsborough County property owners may also be subject to special assessments, which are additional charges levied for specific purposes. These assessments can be imposed by various entities, including the county government, municipalities, or special districts.

Special assessments are typically used to fund improvements or services that benefit a specific area or property type. For example, a special assessment might be levied to fund road improvements, stormwater management, or solid waste collection. These assessments are usually included in the annual tax bill and are calculated based on the property's assessed value or the benefit received from the improvement.

Property Tax Exemptions and Relief Programs

Hillsborough County offers a range of property tax exemptions and relief programs to ease the financial burden on certain property owners. These programs are designed to provide relief to specific groups, such as seniors, veterans, and low-income individuals, as well as to promote certain property uses, like agriculture and conservation.

Senior Exemption

The Senior Exemption is available to homeowners who are 65 years or older and meet certain income requirements. This exemption reduces the assessed value of the homestead property by $50,000, resulting in a lower tax bill. To qualify, applicants must have owned and resided in the property as their primary residence for at least five consecutive years and have a total household income below a certain threshold.

Veterans’ Exemption

Hillsborough County recognizes the service and sacrifice of veterans by offering a Veterans’ Exemption. This exemption provides a $25,000 reduction in the assessed value of the homestead property for qualifying veterans. To be eligible, veterans must have served during a period of armed conflict and have a service-connected disability of at least 10%. The exemption is also available to surviving spouses of veterans who meet these criteria.

Homestead Exemption

The Homestead Exemption is a widely utilized benefit in Florida, providing a significant reduction in the assessed value of a primary residence. To qualify, homeowners must own and reside in the property as their permanent residence. The exemption reduces the assessed value by $25,000, resulting in a lower tax liability. Additionally, the Save Our Homes (SOH) benefit mentioned earlier is also tied to the homestead status, providing further protection against drastic increases in tax liability.

Other Relief Programs

Hillsborough County also offers various other relief programs, such as the Low-Income Senior Exemption, which provides a reduction in assessed value for seniors with limited income, and the Low-Income Non-Homestead Exemption, which assists low-income individuals who own non-homestead properties. These programs aim to make property ownership more affordable for those in need.

| Exemption Type | Description |

|---|---|

| Senior Exemption | Reduces assessed value by $50,000 for homeowners 65+ with income below a certain threshold. |

| Veterans' Exemption | Offers a $25,000 reduction for qualifying veterans and their surviving spouses. |

| Homestead Exemption | Reduces assessed value by $25,000 for homeowners who own and reside in the property. |

| Low-Income Senior Exemption | Provides relief for seniors with limited income. |

| Low-Income Non-Homestead Exemption | Assists low-income individuals with non-homestead properties. |

Managing Property Tax Obligations

Navigating the complexities of property taxes in Hillsborough County requires a strategic approach. Here are some key strategies for managing your property tax obligations effectively:

Stay Informed

Keep yourself updated on the latest tax rates, millage changes, and special assessments. Subscribe to newsletters or follow official channels to receive timely information. Being aware of these changes can help you budget effectively and plan for potential increases.

Understand Your Property’s Value

Familiarize yourself with the factors that influence your property’s assessed value. Regularly review the Property Appraiser’s records to ensure the information is accurate. If you disagree with the assessed value, you have the right to appeal, which can potentially reduce your tax liability.

Explore Exemption Opportunities

Research and apply for any exemptions or relief programs for which you may be eligible. These benefits can significantly reduce your tax burden, especially if you meet the criteria for multiple exemptions.

Consider Prepayment Options

Hillsborough County offers the option to prepay your property taxes. This can be advantageous if you have the financial means to do so, as it allows you to lock in the current tax rate and avoid potential increases. Prepayment can also provide peace of mind and simplify your financial planning.

Seek Professional Advice

Consulting with a tax professional or a real estate attorney can provide valuable insights into managing your property tax obligations. They can help you navigate the complexities of the tax system, optimize your exemptions, and ensure compliance with all regulations.

Utilize Online Resources

Hillsborough County provides a wealth of online resources and tools to assist property owners. The Property Appraiser’s website offers access to property records, tax estimates, and exemption application forms. Utilize these resources to stay informed and make informed decisions.

Future Implications and Trends

The landscape of property taxes in Hillsborough County is constantly evolving, influenced by various factors such as economic conditions, population growth, and policy changes. As the county continues to thrive and develop, property values are likely to increase, leading to potential shifts in tax rates and assessment methodologies.

One key trend to watch is the potential impact of rising property values on the Save Our Homes (SOH) benefit. As property values increase, the SOH cap may become less effective in limiting tax increases for homestead properties. This could result in higher tax liabilities for homeowners, especially if the cap is not adjusted to keep pace with inflation.

Additionally, the demand for certain types of properties, such as multifamily housing and commercial spaces, may drive changes in assessment practices. The county may need to adapt its valuation methods to accurately reflect the market value of these properties, which can have implications for tax rates and revenue generation.

From a broader perspective, the county's commitment to infrastructure development and public services will continue to shape property tax policies. As the county invests in projects like transportation improvements, environmental initiatives, and educational facilities, property taxes may play a crucial role in funding these endeavors.

Furthermore, the county's response to external factors, such as climate change and natural disasters, may also influence property tax strategies. As Hillsborough County addresses these challenges, it may implement measures to ensure the sustainability and resilience of its tax base.

Conclusion

Navigating the world of Hillsborough County Property Tax requires a deep understanding of the local regulations, assessment processes, and available exemptions. By staying informed, leveraging available resources, and adopting strategic approaches, property owners can effectively manage their tax obligations and ensure compliance with the ever-evolving tax landscape.

FAQ

When are property taxes due in Hillsborough County?

+Property taxes in Hillsborough County are due in two installments. The first installment is due on November 1st, and the second installment is due on March 31st. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

How can I pay my property taxes in Hillsborough County?

+Hillsborough County offers various payment methods for property taxes. You can pay online through the Hillsborough County Tax Collector’s website, by mail with a check or money order, in person at the Tax Collector’s office, or through a third-party payment service provider.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes in Hillsborough County may result in additional fees and interest. If taxes remain unpaid, the county may place a tax lien on the property, which could lead to foreclosure proceedings.

Can I appeal my property’s assessed value in Hillsborough County?

+Yes, property owners in Hillsborough County have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting documentation and evidence to support your case. It’s important to note that appeals must be filed within a specific timeframe, typically before the tax roll is certified.

Are there any property tax exemptions available for seniors in Hillsborough County?

+Yes, Hillsborough County offers the Senior Exemption program, which provides a reduction in the assessed value of the homestead property for homeowners who are 65 years or older and meet certain income requirements. This exemption can significantly lower the tax liability for qualifying seniors.