Williamson County Property Taxes

Williamson County, located in the vibrant region of Central Texas, is renowned for its thriving communities, picturesque landscapes, and a thriving real estate market. One of the key aspects that every homeowner or prospective buyer needs to understand is the property tax system. In this comprehensive guide, we will delve into the intricacies of Williamson County property taxes, providing you with expert insights and a thorough understanding of this essential topic.

Understanding the Williamson County Property Tax Landscape

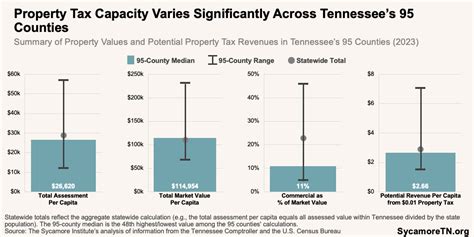

Williamson County, with its diverse range of cities and towns, offers a unique property tax experience. The property tax system in the county is designed to fund essential services such as education, public safety, infrastructure, and other vital governmental functions. As a homeowner, it is crucial to grasp the nuances of this system to make informed decisions and effectively manage your financial obligations.

The property tax in Williamson County is primarily based on the appraised value of your property. This value is determined by the Williamson Central Appraisal District (WCAD), an independent entity responsible for assessing the value of all taxable properties within the county. The appraised value takes into account various factors, including the property's location, size, improvements, and market conditions.

The tax rate, also known as the tax rate ceiling, is established by the various taxing authorities within the county. These authorities include the county government, cities, school districts, and special districts. Each entity sets its own tax rate, which, when combined, forms the total tax rate for a particular property. It is important to note that the tax rate can vary significantly depending on the location of your property and the services it receives from these taxing authorities.

The Property Tax Process: A Step-by-Step Guide

-

Property Appraisal: The process begins with the WCAD conducting an appraisal of your property. This typically occurs once every three years, with certain properties subject to more frequent appraisals. The appraisers consider a range of factors to determine the property’s value, ensuring fairness and accuracy.

-

Notice of Appraised Value: After the appraisal, WCAD sends a Notice of Appraised Value to property owners. This notice informs you of the appraised value and provides an opportunity to review and potentially protest the value if you believe it is incorrect or unfair.

-

Protest and Review: Property owners have the right to protest the appraised value. You can do so by submitting a protest to WCAD, explaining your concerns and providing supporting evidence. The protest process includes a hearing, where you can present your case before an independent review board.

-

Tax Rate Adoption: While the appraisal process is ongoing, the various taxing authorities within the county determine their tax rates for the upcoming year. These rates are set based on the budget requirements and services provided by each entity.

-

Tax Bill Generation: Once the appraised values are finalized and tax rates are adopted, WCAD calculates the property taxes owed by each homeowner. This calculation is based on the appraised value, tax rates, and any applicable exemptions or discounts.

-

Payment Options: Property owners have several payment options to choose from. You can pay your taxes in full or opt for installment plans, depending on your financial preferences and the policies set by the county.

Tax Rates and Calculations: A Deeper Dive

Understanding how tax rates are calculated and applied is crucial for budgeting and financial planning. In Williamson County, the tax rate is expressed as a percentage of the property’s appraised value. For instance, if the tax rate is set at 2%, it means that for every 100 of appraised value, you would pay 2 in taxes. However, it is important to note that the tax rate is not a flat rate across the county.

The tax rate is composed of several components, each representing a different taxing authority. These components are added together to form the total tax rate for your property. For example, your tax bill might include rates for the county, city, school district, and any special districts serving your area. Each entity's tax rate is determined independently, considering their budgetary needs and the services they provide.

To illustrate, let's consider a hypothetical scenario. Imagine your property has an appraised value of $300,000. If the total tax rate for your area is 2.5%, your tax bill would be calculated as follows:

| Taxing Authority | Tax Rate (%) | Tax Amount |

|---|---|---|

| County | 0.75 | $2,250 |

| City | 0.5 | $1,500 |

| School District | 1.25 | $3,750 |

| Special District | 0.25 | $750 |

| Total Tax | 2.5 | $8,250 |

In this example, your total tax liability for the year would be $8,250. This breakdown helps you understand how your tax dollars are allocated to support various services in your community.

Property Tax Exemptions and Discounts: Maximizing Your Savings

Williamson County offers a range of exemptions and discounts to eligible property owners, providing an opportunity to reduce their tax liability. These exemptions and discounts are designed to ease the financial burden for specific groups and promote certain community goals.

Homestead Exemptions

One of the most significant tax benefits available to Williamson County homeowners is the homestead exemption. This exemption reduces the appraised value of your primary residence, effectively lowering your tax bill. To qualify for the homestead exemption, you must own the property and use it as your primary residence. The exemption amount varies depending on the taxing authority and can significantly impact your tax liability.

Senior Citizen Exemptions

Williamson County extends special consideration to senior citizens through various exemption programs. These exemptions can provide significant tax relief to homeowners who are 65 years or older and meet certain income and residency requirements. The specific exemptions and their eligibility criteria vary, so it is advisable to consult the WCAD website or seek professional advice to understand your options.

Disability ExemptionsThe county also offers exemptions for disabled homeowners. These exemptions are designed to assist individuals with disabilities by reducing their tax burden. To qualify, you must meet specific disability criteria and own the property as your primary residence. The exemption amount can vary, and it is essential to review the eligibility requirements to determine if you qualify.

Veteran Exemptions

Williamson County honors its veterans by offering tax exemptions. These exemptions recognize the service and sacrifices made by veterans and can provide substantial tax savings. The specific exemptions and eligibility criteria depend on various factors, including the veteran’s disability status, length of service, and other qualifications. It is recommended to consult the WCAD or relevant veteran’s organizations to understand the available options.

Property Tax Payment Options and Deadlines

Understanding the payment options and deadlines for Williamson County property taxes is crucial to avoid penalties and ensure timely payments. The county offers several payment methods to cater to different preferences and circumstances.

Online Payment

The most convenient and popular method is online payment. WCAD provides an online platform where you can access your tax account, view your tax bill, and make payments securely. This method is efficient, allowing you to pay your taxes from the comfort of your home or office.

Mail-In Payment

If you prefer a more traditional approach, you can mail your tax payment to the designated address. WCAD provides payment coupons with your tax bill, which you can use to ensure accurate payment processing. It is essential to allow sufficient time for the mail to reach the county office and to consider any potential delays.

Payment Plans

Williamson County understands that paying your property taxes in full may not be feasible for everyone. To accommodate various financial situations, the county offers payment plans. These plans allow you to pay your taxes in installments, typically with a small fee or interest charge. The specific terms and conditions of the payment plans vary, so it is advisable to contact WCAD for more information.

Payment Deadlines

It is crucial to be aware of the tax payment deadlines to avoid penalties and interest charges. In Williamson County, the deadlines vary depending on the taxing authority and the payment method. Generally, property taxes are due by a specific date, and failure to pay by this deadline may result in penalties and additional fees. It is recommended to stay updated on the payment deadlines and plan your payments accordingly.

Appealing Your Property Taxes: A Guide to the Process

If you believe that your property taxes are unfairly assessed or that your property’s appraised value is inaccurate, you have the right to appeal. The protest process in Williamson County is designed to provide homeowners with an opportunity to challenge their tax assessments and seek a fair resolution.

Understanding the Protest Process

The protest process begins with submitting a written notice of protest to WCAD. This notice should clearly state the reasons for your protest and provide any supporting evidence or documentation. It is essential to submit your protest within the specified deadline, as late protests may not be accepted.

Once your protest is received, WCAD will schedule a hearing before an independent review board. This board is responsible for evaluating your protest and making a determination. You have the right to present your case, provide evidence, and answer any questions during the hearing.

Preparing for Your Protest Hearing

To increase your chances of a successful protest, it is advisable to gather relevant information and evidence in advance. This may include recent property sales data in your area, comparable property values, and any other factors that support your claim. It is also beneficial to seek professional advice from tax consultants or attorneys who specialize in property tax matters.

The Hearing Process

During the hearing, you will have the opportunity to present your case to the review board. It is important to be prepared and organized, presenting your arguments and evidence clearly and concisely. The board will consider your protest and make a decision based on the evidence presented. You will receive a written decision outlining the outcome of your protest.

Appealing the Decision

If you are not satisfied with the review board’s decision, you have the right to appeal further. The appellate process involves taking your case to the Williamson County Appraisal Review Board (ARB). The ARB is an independent body that reviews protests and makes final decisions. To appeal to the ARB, you must submit a written request within a specified deadline.

Conclusion: Navigating the Williamson County Property Tax System

Understanding the Williamson County property tax system is an essential aspect of homeownership. By grasping the appraisal process, tax rate calculations, available exemptions, and the protest process, you can effectively manage your financial obligations and ensure a fair assessment of your property taxes. Remember to stay informed, seek professional advice when needed, and take advantage of the resources provided by WCAD and other relevant authorities.

As you navigate the property tax landscape in Williamson County, keep in mind that each property and situation is unique. Stay engaged with the community, attend local meetings, and stay updated on tax-related news and changes. By doing so, you can make informed decisions and contribute to the vibrant and thriving communities within Williamson County.

FAQ

How often are properties appraised in Williamson County?

+Properties in Williamson County are typically appraised once every three years. However, certain properties, such as new construction or significantly improved properties, may be subject to more frequent appraisals.

Can I protest my property’s appraised value if I disagree with it?

+Yes, you have the right to protest your property’s appraised value if you believe it is inaccurate or unfair. You must submit a written notice of protest to WCAD within the specified deadline and provide supporting evidence for your claim.

What are the payment options for Williamson County property taxes?

+Williamson County offers various payment options, including online payments, mail-in payments, and payment plans. You can choose the method that best suits your preferences and financial situation.

Are there any exemptions or discounts available for property taxes in Williamson County?

+Yes, Williamson County offers a range of exemptions and discounts to eligible property owners. These include homestead exemptions, senior citizen exemptions, disability exemptions, and veteran exemptions. It is advisable to explore these options and determine your eligibility.

What happens if I fail to pay my property taxes by the deadline?

+Failure to pay your property taxes by the deadline can result in penalties and interest charges. It is important to stay updated on the payment deadlines and plan your payments accordingly to avoid any additional financial burdens.