Sales Tax In Ohio For Cars

Ohio, the Buckeye State, is known for its diverse economy, thriving industries, and a robust automotive sector. As a resident or a business owner, understanding the intricacies of sales tax becomes crucial, especially when it comes to purchasing a car. This article aims to provide an in-depth analysis of the sales tax landscape in Ohio, focusing specifically on vehicles. We will delve into the rates, calculations, exemptions, and other pertinent details to ensure a comprehensive understanding of this complex topic.

Ohio’s Sales Tax Fundamentals

Ohio imposes a state-wide sales and use tax on the sale of tangible personal property, including vehicles. The state sales tax is applied uniformly across Ohio, ensuring a consistent tax environment for businesses and consumers. However, it is important to note that local jurisdictions, such as counties and municipalities, are authorized to levy additional taxes, creating variations in the overall tax burden across the state.

The Ohio Department of Taxation, under the guidance of the Ohio Tax Commissioner, administers and enforces the sales tax laws. This department plays a crucial role in ensuring compliance, providing guidance, and collecting revenues for the state and local governments.

Vehicle Sales Tax in Ohio

When it comes to purchasing a car in Ohio, the sales tax calculation can be a bit more complex than for other goods. This is primarily due to the involvement of both the state and local governments in the taxation process. The state sales tax rate for vehicles in Ohio is 6.25%, which serves as the base rate. However, this is just the beginning of the tax calculation journey.

Local Taxes and Variations

Ohio’s local jurisdictions, as mentioned earlier, have the authority to impose additional taxes on vehicle sales. These local taxes can significantly impact the overall tax burden on car buyers. For instance, Cuyahoga County, which includes the city of Cleveland, applies an additional 1.5% tax on vehicle purchases, bringing the total tax rate to 7.75%. On the other hand, Franklin County, home to the state capital Columbus, levies an extra 0.5% tax, resulting in a total rate of 6.75%.

| County | Local Tax Rate | Total Tax Rate |

|---|---|---|

| Cuyahoga County | 1.5% | 7.75% |

| Franklin County | 0.5% | 6.75% |

| Hamilton County | 1% | 7.25% |

| Summit County | 1% | 7.25% |

| Stark County | 1% | 7.25% |

| ... | ... | ... |

The table above provides a glimpse into the variations in local tax rates across Ohio's counties. These rates can significantly affect the final cost of a vehicle, making it essential for car buyers to be well-informed about the tax landscape in their specific county.

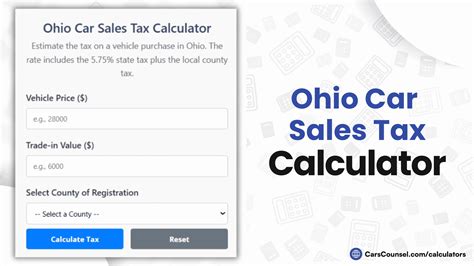

Calculating the Sales Tax on a Vehicle Purchase

To calculate the sales tax on a vehicle purchase in Ohio, one must first determine the total purchase price of the vehicle. This includes the vehicle’s base price, any additional features or options, and applicable fees such as destination charges. Once the total purchase price is known, the tax calculation can be performed using the following formula:

- Taxable Amount = Purchase Price × (1 + Local Tax Rate)

- Sales Tax = Taxable Amount × State Sales Tax Rate

Let's consider an example. Suppose a buyer in Cuyahoga County purchases a new car with a base price of $30,000, and the dealer charges an additional $2,000 for options and fees. The total purchase price would be $32,000. Using the local tax rate of 1.5% for Cuyahoga County, the taxable amount is calculated as $32,000 × (1 + 0.015) = $32,480. The sales tax on this purchase would then be $32,480 × 0.0625 = $2,030. Thus, the total cost of the vehicle, including tax, would be $34,480.

Exemptions and Special Considerations

Ohio, like many other states, provides certain exemptions and special considerations when it comes to sales tax on vehicles. These exemptions can help reduce the tax burden for specific groups of individuals or in specific circumstances.

Exemption for Disabilities

Ohio offers a sales tax exemption for individuals with disabilities who purchase vehicles equipped with specialized equipment or modifications to accommodate their needs. This exemption applies to the sales tax on the vehicle itself and any additional costs associated with the necessary modifications. To qualify for this exemption, individuals must meet specific criteria and provide appropriate documentation to the Ohio Department of Taxation.

Military Personnel Exemption

Active-duty military personnel stationed in Ohio are eligible for a sales tax exemption on the purchase of a vehicle. This exemption is applicable regardless of the state in which the vehicle is registered. Military members must provide proof of their active-duty status and follow the appropriate procedures to claim this exemption.

Trade-In Vehicles

When trading in a vehicle as part of a new purchase, Ohio allows for a credit against the sales tax due on the new vehicle. The credit is calculated based on the trade-in value of the old vehicle, effectively reducing the taxable amount of the new vehicle. This provision can significantly lower the overall tax liability for car buyers who frequently upgrade their vehicles.

Temporary Residents

Individuals who are temporarily residing in Ohio, such as students or those on work assignments, may be eligible for a sales tax exemption if they can demonstrate that they intend to register the vehicle in their home state within a certain timeframe. This exemption aims to prevent double taxation for individuals who are only temporarily present in Ohio.

Compliance and Enforcement

The Ohio Department of Taxation takes sales tax compliance seriously. Dealers and businesses involved in the sale of vehicles are required to collect and remit the appropriate sales taxes to the state and local governments. Failure to comply with these obligations can result in penalties, interest, and even legal consequences.

To ensure compliance, the department conducts regular audits and inspections. These audits may involve reviewing sales records, examining tax returns, and conducting on-site visits. Dealers and businesses are expected to maintain accurate records and provide documentation to support their tax filings.

Future Outlook and Potential Changes

The sales tax landscape in Ohio, like in many other states, is subject to change. While the current rates and regulations provide a stable environment for businesses and consumers, there are ongoing discussions and proposals that could impact the tax system in the future.

Potential Rate Changes

Ohio’s state sales tax rate has remained relatively stable over the past decade. However, there have been occasional proposals to increase or decrease the rate to address budgetary concerns or provide tax relief. Any changes to the state sales tax rate would have a direct impact on the cost of vehicle purchases across Ohio.

Simplification Efforts

The complexity of Ohio’s sales tax system, with its state and local components, has led to calls for simplification. Some proposals suggest consolidating or standardizing tax rates across jurisdictions to create a more uniform tax environment. While such changes could simplify tax calculations, they may also result in a shift in the tax burden between different regions of the state.

Online Sales and Remote Sellers

The rise of e-commerce and online sales has presented challenges for tax collection. Ohio, like many states, is actively working to ensure that online retailers and remote sellers comply with sales tax obligations. This includes implementing laws and regulations to require remote sellers to collect and remit sales taxes on transactions with Ohio residents. As online sales continue to grow, this area of tax enforcement is likely to see further development.

Conclusion

Understanding the sales tax environment in Ohio, particularly when it comes to vehicle purchases, is essential for both consumers and businesses. The state’s combination of a uniform state sales tax rate and variable local taxes creates a unique landscape that requires careful consideration. By staying informed about the rates, exemptions, and compliance requirements, individuals and businesses can navigate the Ohio sales tax system effectively and ensure compliance with the law.

What is the current state sales tax rate in Ohio for vehicles?

+The current state sales tax rate for vehicles in Ohio is 6.25%.

Do all counties in Ohio have the same local tax rate for vehicle sales?

+No, local tax rates for vehicle sales vary across Ohio’s counties. Some counties may have no additional tax, while others can levy up to 1.5% in local taxes.

Are there any exemptions or special considerations for sales tax on vehicles in Ohio?

+Yes, Ohio offers exemptions for individuals with disabilities who purchase specialized vehicles, active-duty military personnel, temporary residents, and trade-in vehicles.

How can I ensure I am calculating the sales tax on my vehicle purchase correctly?

+It is recommended to consult with a tax professional or utilize online calculators that consider your specific county’s tax rate. Additionally, you can review the Ohio Department of Taxation’s guidelines and resources for vehicle sales tax calculations.

What happens if I fail to comply with sales tax obligations when purchasing a vehicle in Ohio?

+Failure to comply with sales tax obligations can result in penalties, interest, and legal consequences. It is crucial to understand your responsibilities as a buyer or seller and to ensure accurate tax calculations and timely remittances.