Status Of Pennsylvania Tax Refund

As of my last update in January 2023, the Pennsylvania Department of Revenue has streamlined its processes to ensure timely tax refund disbursements to eligible taxpayers. The status of your Pennsylvania tax refund is an important matter, and understanding the process and your options can help alleviate any concerns. This article aims to provide an in-depth analysis of the status of Pennsylvania tax refunds, covering everything from the refund cycle to the various methods of receiving your refund.

Understanding the Pennsylvania Tax Refund Cycle

The tax refund cycle in Pennsylvania is a well-defined process that begins with the submission of your tax return and concludes with the receipt of your refund. It’s important to note that the timeline for receiving your refund can vary depending on several factors, including the method of filing, the complexity of your return, and any potential issues with your tax information.

Here's a breakdown of the key stages in the Pennsylvania tax refund cycle:

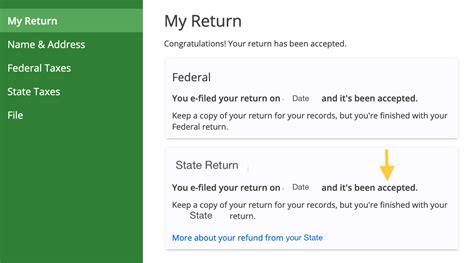

- Filing Your Tax Return: The first step in claiming your tax refund is to accurately file your Pennsylvania state tax return. You can do this either through paper filing or by using electronic filing options, such as tax preparation software or online filing platforms. It's crucial to ensure that all your tax information is correct and complete to avoid delays.

- Processing Your Return: Once your tax return is received by the Pennsylvania Department of Revenue, it undergoes a thorough review process. This step ensures that your return is accurate, compliant with state tax laws, and free from errors. During this stage, the department may contact you if they require additional information or if they identify any discrepancies.

- Refund Approval: If your tax return is approved without any issues, the Pennsylvania Department of Revenue will authorize the release of your refund. This approval process typically takes several weeks, and you can expect to receive a notification once your refund has been approved.

- Refund Disbursement: After your refund is approved, the Department of Revenue will disburse your refund according to the method you selected during the filing process. This could be a direct deposit to your bank account, a check mailed to your address, or a refund loaded onto a prepaid debit card.

Checking the Status of Your Pennsylvania Tax Refund

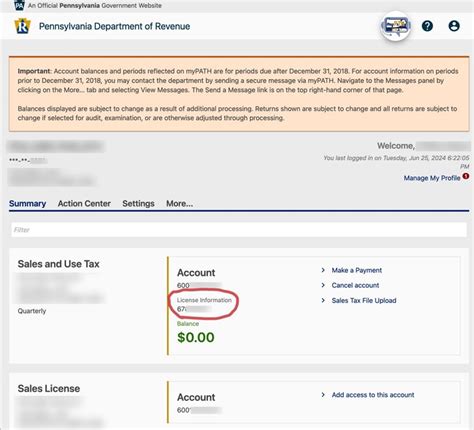

To stay informed about the status of your Pennsylvania tax refund, the Department of Revenue provides several convenient options:

Online Refund Status Check

The Pennsylvania Department of Revenue offers an online tool called Where’s My Refund that allows taxpayers to track the progress of their refund. To use this service, you’ll need to provide your Social Security Number, your filing status, and the exact refund amount you’re expecting. This tool provides real-time updates on the status of your refund, ensuring you stay informed throughout the process.

Telephone Inquiry

If you prefer a more personalized approach, you can contact the Pennsylvania Department of Revenue’s Refund Hotline at 717-787-8201. This dedicated phone line provides assistance to taxpayers who have questions about their refund status. Keep in mind that this option may have longer wait times during peak tax seasons.

Written Correspondence

For those who prefer written communication, you can send a letter to the Department of Revenue’s Taxpayer Services Office. Include your full name, Social Security Number, and the tax year for which you’re inquiring about your refund. The address for written correspondence is:

Pennsylvania Department of Revenue

Bureau of Individual Taxes

Taxpayer Services Office

PO Box 280946

Harrisburg, PA 17128-0946

Methods of Receiving Your Pennsylvania Tax Refund

Pennsylvania offers taxpayers several options for receiving their tax refunds, each with its own advantages and considerations. Understanding these options can help you choose the method that best suits your preferences and financial situation.

Direct Deposit

Direct deposit is the fastest and most efficient way to receive your Pennsylvania tax refund. When you file your tax return electronically, you’ll have the option to provide your bank account information for direct deposit. This method ensures that your refund is securely transferred directly into your account, typically within 7 to 10 business days after your refund is approved.

| Pros | Cons |

|---|---|

| Fastest refund receipt method | Requires accurate bank account information |

| Secure and convenient | May not be suitable for those without a bank account |

| Reduces risk of mail delays or loss | May take several days to become available in your account |

Check by Mail

If you prefer a more traditional method, you can opt to receive your Pennsylvania tax refund by check. The Department of Revenue will mail a physical check to the address provided on your tax return. While this method may take longer than direct deposit, it offers the flexibility of receiving a tangible refund that can be deposited or cashed at your convenience.

| Pros | Cons |

|---|---|

| No need for a bank account | Slower refund receipt compared to direct deposit |

| Flexibility in depositing or cashing the check | Risk of mail delays or loss |

| Suitable for those without online banking | May require additional time to clear if deposited |

Prepaid Debit Card

Pennsylvania also offers the option to receive your tax refund on a prepaid debit card. This method provides a convenient and secure way to access your refund without the need for a traditional bank account. The refund is loaded onto the prepaid card, which can be used to make purchases, withdraw cash, or transfer funds to a bank account.

| Pros | Cons |

|---|---|

| No need for a bank account | Potential fees associated with card usage |

| Convenient and secure | May have limited ATM network access |

| Can be used like a regular debit card | Potential activation and maintenance fees |

Potential Delays and Issues with Pennsylvania Tax Refunds

While the Pennsylvania Department of Revenue aims to process tax refunds promptly, there are instances where delays or issues may arise. Understanding these potential roadblocks can help you navigate any challenges and expedite the resolution process.

Error Corrections and Amendments

If the Department of Revenue identifies errors or discrepancies on your tax return, they may contact you to request additional information or documentation. It’s important to respond promptly to these requests to avoid further delays in processing your refund. Additionally, if you need to amend your tax return after filing, it may take additional time for the amendment to be processed and your refund to be recalculated.

Identity Verification and Fraud Prevention

To protect taxpayers from fraud and identity theft, the Department of Revenue employs robust security measures. In some cases, this may involve additional identity verification steps, which can extend the processing time for your refund. If you receive a notice requesting further verification, it’s crucial to cooperate and provide the necessary information to expedite the process.

Audit and Review Processes

In certain situations, the Department of Revenue may select your tax return for an audit or review. This is a standard part of the tax system and is not necessarily indicative of an error or issue with your return. Audits and reviews can take additional time to complete, but they are essential to ensure the accuracy and integrity of the tax system.

Future Implications and Improvements

The Pennsylvania Department of Revenue continuously strives to improve its tax refund processes and enhance the taxpayer experience. Here are some potential future developments and improvements to look forward to:

- Enhanced Online Services: The Department of Revenue is likely to continue investing in its online platforms and tools, making it easier and more convenient for taxpayers to access information, file returns, and track refunds.

- Improved Refund Tracking: Ongoing improvements to the Where's My Refund tool may include real-time updates, personalized notifications, and a more user-friendly interface.

- Mobile Accessibility: With the increasing popularity of mobile devices, the Department of Revenue may introduce dedicated mobile apps or optimized mobile websites to provide taxpayers with convenient access to their refund status and other tax-related information.

- Streamlined Direct Deposit Process: Future enhancements may include simplifying the direct deposit process, allowing taxpayers to provide bank account information directly within the tax filing software or online platform, reducing the risk of errors and streamlining the refund receipt process.

Frequently Asked Questions

How long does it typically take to receive a Pennsylvania tax refund?

+The typical processing time for a Pennsylvania tax refund is 6 to 8 weeks from the date your return is received. However, factors like filing method, payment type, and any errors or discrepancies can affect the timeline.

Can I check the status of my refund online if I filed my return on paper?

+Yes, you can use the Where’s My Refund online tool even if you filed your return on paper. You’ll need to provide your Social Security Number, filing status, and exact refund amount to access your refund status.

What should I do if my refund status shows “Return Received,” but I haven’t received my refund yet?

+If your refund status indicates “Return Received” but you haven’t received your refund, it’s best to wait a few more days. Refunds can sometimes take longer to process due to various factors. If you haven’t received your refund within a reasonable timeframe, contact the Pennsylvania Department of Revenue for further assistance.

Can I change my refund method after filing my tax return?

+Changing your refund method after filing your tax return is not possible. It’s important to select the refund method that best suits your needs during the filing process.

What should I do if I think there’s an error with my Pennsylvania tax refund amount or status?

+If you suspect an error with your refund amount or status, contact the Pennsylvania Department of Revenue’s Refund Hotline at 717-787-8201. They can assist you in resolving any issues and provide guidance on the next steps.