Tax Percent In Missouri

Taxes are an essential component of any state's revenue system, and understanding the tax landscape is crucial for individuals, businesses, and policymakers alike. In the state of Missouri, taxes contribute significantly to the state's overall financial health and the provision of public services. Let's delve into the world of taxation in Missouri, exploring the various tax rates, their implications, and how they shape the state's economy.

Unraveling the Tax System of Missouri

Missouri boasts a diverse tax system, encompassing a range of taxes that impact different aspects of the state’s economy. From income taxes to sales taxes and property taxes, each component plays a unique role in funding public services and infrastructure.

Income Tax: A Progressive Approach

Missouri’s income tax system follows a progressive structure, meaning that higher income earners are taxed at a higher rate. As of my last update in January 2023, the state has five income tax brackets with corresponding tax rates:

| Tax Bracket | Tax Rate |

|---|---|

| First $1,000 of taxable income | 1.50% |

| $1,001 to $2,000 | 2.00% |

| $2,001 to $3,000 | 2.50% |

| $3,001 to $4,000 | 3.00% |

| Income over $4,000 | 5.225% |

This progressive income tax system ensures that those with higher incomes contribute a larger share of their earnings to the state's revenue. The income tax rates are subject to periodic review and adjustments by the Missouri legislature.

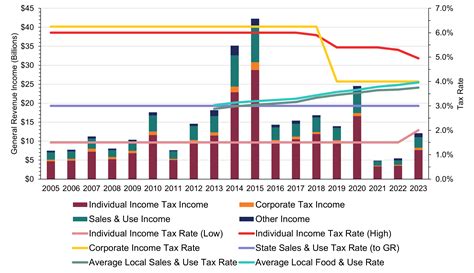

Sales and Use Tax: Funding Everyday Needs

Sales and use taxes are a significant source of revenue for Missouri, and they play a crucial role in funding various public services and infrastructure projects. The state imposes a sales tax rate of 4.225% on most tangible personal property and certain services. However, local jurisdictions have the authority to levy additional sales taxes, resulting in varying rates across the state.

For instance, in the city of St. Louis, the sales tax rate is 8.225%, comprising the state rate and a local tax rate of 4%. This variability in sales tax rates across Missouri can have a notable impact on consumer behavior and business decisions.

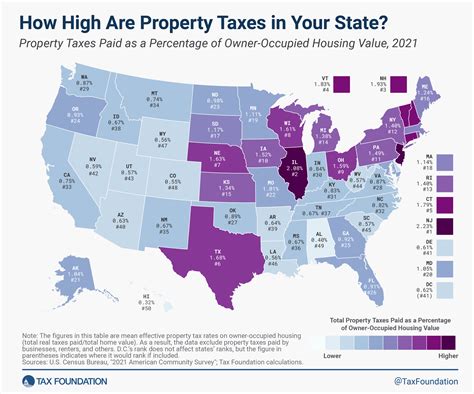

Property Tax: A Local Perspective

Property taxes in Missouri are primarily a local affair, with each county setting its own tax rates. These taxes are levied on real estate, including land and buildings, and they fund essential local services such as schools, fire protection, and emergency services.

The effective property tax rates can vary significantly from one county to another, often reflecting the specific needs and priorities of each locality. While the state provides guidelines and oversight, the actual tax rates are determined at the county level, making property taxes a highly localized form of taxation.

Other Taxes and Levies

In addition to the aforementioned taxes, Missouri also collects revenue through various other means. These include:

- Motor Fuel Taxes: Taxes on gasoline and diesel fuel contribute to the state's transportation infrastructure.

- Corporate Income Tax: Corporations doing business in Missouri are subject to a corporate income tax, which varies based on their taxable income.

- Franchise Taxes: Businesses operating in Missouri may be subject to franchise taxes, which are based on the capital invested in the state.

- Estate and Inheritance Taxes: These taxes are levied on the transfer of property upon an individual's death, providing revenue for the state.

The Impact of Missouri’s Tax System

Missouri’s tax system has a profound influence on the state’s economy and the lives of its residents. Here are some key ways in which taxes shape the state:

Revenue Generation and Public Services

Taxes are the primary source of revenue for the state, funding a wide array of public services. These include education, healthcare, transportation infrastructure, public safety, and social services. The revenue generated through taxes ensures that Missouri can invest in its future and provide essential services to its residents.

Economic Development and Business Climate

The tax environment can significantly impact a state’s economic growth and business attractiveness. Missouri’s tax structure, including its income tax rates and sales tax variability, influences business decisions and investment flows. A competitive tax system can encourage economic development, job creation, and business expansion.

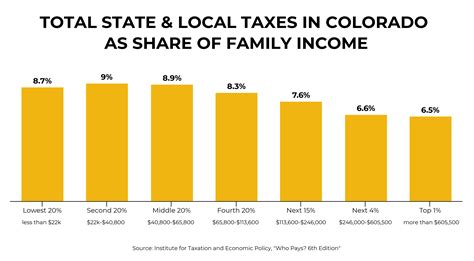

Equity and Social Justice

The progressive nature of Missouri’s income tax system aims to promote equity by ensuring that higher-income individuals contribute proportionally more to the state’s revenue. This approach can help reduce income inequality and support social programs that benefit all residents.

Local Control and Decision-Making

The state’s approach to property taxes, which grants significant autonomy to local counties, empowers local governments to make decisions that best serve their communities. This decentralization allows for tailored tax rates that reflect the unique needs and priorities of each locality.

Future Considerations and Challenges

As with any tax system, Missouri’s approach faces ongoing challenges and opportunities for improvement. Here are some key considerations for the future:

Tax Reform and Simplification

Simplifying the tax code and reducing administrative burdens can benefit both taxpayers and tax authorities. Streamlining processes and reducing complexities can make compliance easier and enhance the overall tax system’s efficiency.

Economic Growth and Investment

A competitive tax environment is crucial for attracting businesses and fostering economic growth. Missouri’s tax policies should aim to strike a balance between generating sufficient revenue and creating an environment that encourages investment and job creation.

Social Safety Net and Equity

The state’s tax system should continue to prioritize social justice and support programs that benefit vulnerable populations. This includes ensuring that the tax burden is distributed fairly and that revenue is allocated effectively to address social and economic disparities.

Infrastructure and Public Investment

Tax revenue plays a vital role in funding infrastructure projects, which are essential for the state’s long-term economic prosperity. Missouri should continue to allocate resources towards maintaining and improving its transportation networks, public facilities, and other critical infrastructure.

Conclusion: A Balancing Act

Missouri’s tax system is a delicate balance between generating sufficient revenue for public services and maintaining a competitive business environment. The state’s approach, with its progressive income tax, variable sales tax rates, and localized property taxes, reflects a commitment to equity, local control, and economic growth.

As Missouri navigates the complexities of taxation, policymakers, businesses, and residents must work together to ensure that the state's tax policies remain fair, efficient, and aligned with the needs of its diverse population. The ongoing dialogue around tax reform and economic development will shape Missouri's future, and a well-informed understanding of the state's tax system is crucial for all stakeholders.

What is the average property tax rate in Missouri?

+

The average effective property tax rate in Missouri is approximately 1.05% as of 2022. However, it’s important to note that property tax rates can vary significantly across counties.

Are there any tax incentives for businesses in Missouri?

+

Yes, Missouri offers various tax incentives to attract and support businesses. These incentives include tax credits for job creation, research and development, and investment in certain industries. The state also has Enterprise Zones, which offer tax abatements and other benefits to encourage economic development.

How often are Missouri’s tax rates reviewed and adjusted?

+

Missouri’s tax rates, particularly income tax rates, are periodically reviewed and adjusted by the state legislature. The frequency of these adjustments can vary, but significant changes are typically made during regular legislative sessions.