Virginia Sales Tax Auto

In the state of Virginia, understanding the intricacies of sales tax regulations is crucial, especially when it comes to the automotive industry. Whether you're a car enthusiast, a business owner, or simply a resident navigating the roads, knowing how sales tax applies to auto purchases is essential. This comprehensive guide aims to shed light on the specific rules and regulations surrounding Virginia sales tax in the context of automobiles, ensuring you're well-informed and prepared for any automotive transactions.

The Fundamentals of Virginia Sales Tax on Automobiles

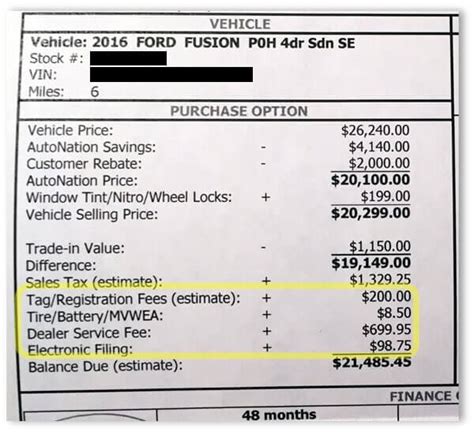

Virginia imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property and certain services. This tax is an important source of revenue for the state and is applied to a wide range of goods and services, including automobiles. The current sales tax rate in Virginia is 4.3%, with additional local taxes varying by jurisdiction, typically ranging from 1% to 3%.

When it comes to auto sales, the tax is calculated based on the purchase price of the vehicle, including any additional fees and charges. This means that when you buy a car in Virginia, the sales tax will be added to the total cost, making it a significant factor in your overall expense. The tax is collected by the seller and then remitted to the Virginia Department of Taxation, which oversees the administration and enforcement of sales tax laws in the state.

Key Considerations for Auto Sales Tax in Virginia

While the general principles of sales tax apply to automobile purchases, there are several specific considerations to keep in mind. Firstly, the tax rate can vary depending on the location of the sale and the type of vehicle. For instance, certain localities in Virginia have higher tax rates for vehicles, particularly in urban areas where traffic congestion is a concern. Additionally, different tax rates may apply to different types of vehicles, such as hybrid or electric cars, which often benefit from reduced or waived sales tax as an incentive to promote environmentally friendly transportation.

Another crucial aspect is the timing of the tax payment. In most cases, the sales tax is due at the time of purchase, and the dealer or seller is responsible for collecting and remitting this tax to the state. However, there are situations where the tax may be deferred or paid in installments, especially for larger purchases or special circumstances. Understanding these payment options is essential for both buyers and sellers to ensure compliance with the law and avoid any penalties.

| Vehicle Type | Sales Tax Rate |

|---|---|

| Standard Passenger Vehicle | 4.3% (state) + Local Rate (varies) |

| Electric Vehicles | Varies by locality, often reduced or waived |

| Hybrid Vehicles | Subject to local rates, potential incentives |

Exemptions and Special Cases

While the general sales tax rules apply to most auto purchases, there are certain situations where exemptions or special considerations come into play. For instance, vehicles purchased for resale, such as those by licensed dealers, are typically exempt from sales tax. Additionally, certain types of vehicles, like those used exclusively for agricultural or commercial purposes, may also be exempt from the standard sales tax rate.

Another significant exemption is for vehicles purchased by qualified organizations, such as non-profit entities or government agencies. These purchases are often exempt from sales tax, provided the necessary documentation is presented at the time of sale. This exemption can result in substantial savings for these organizations, allowing them to allocate resources more efficiently.

Common Exemptions and Their Requirements

- Dealer Purchases: Sales tax is not applied to vehicles purchased for resale by licensed dealers. This exemption ensures that dealers are not double-taxed on inventory.

- Commercial Vehicles: Vehicles used exclusively for commercial purposes, such as trucks and vans, may be exempt from sales tax if they meet specific criteria, including weight and usage requirements.

- Non-Profit and Government Entities: Qualified non-profits and government agencies can purchase vehicles exempt from sales tax. This exemption requires proper documentation and proof of status.

The Role of the Virginia Department of Taxation

The Virginia Department of Taxation plays a critical role in ensuring compliance with sales tax laws, including those pertaining to automobile purchases. The department provides guidance and resources to help businesses and individuals understand their tax obligations. They also conduct audits and enforce regulations to prevent tax evasion and ensure a fair tax system.

For businesses engaged in auto sales, the department offers resources to help them understand their tax responsibilities. This includes guidance on calculating and remitting sales tax, as well as advice on record-keeping and reporting. By ensuring compliance, businesses can avoid penalties and maintain a positive relationship with the state.

Compliance and Penalties

Compliance with sales tax laws is not only a legal obligation but also crucial for maintaining a fair and transparent market. Failure to comply with sales tax regulations can result in significant penalties, including fines and, in some cases, criminal charges. The Virginia Department of Taxation has the authority to audit businesses and individuals to ensure they are accurately calculating and remitting sales tax.

To avoid penalties, it's essential for businesses and individuals to understand their tax obligations and keep accurate records. This includes properly documenting sales, calculating tax amounts, and remitting payments on time. By staying informed and compliant, you can navigate the complex world of sales tax with confidence.

Looking Ahead: Future Trends and Considerations

As the automotive industry continues to evolve, with a growing focus on electric and autonomous vehicles, it’s essential to consider how these changes may impact sales tax regulations. Virginia, like many other states, is exploring ways to adapt its tax system to accommodate these emerging technologies.

One potential consideration is the shift from a sales tax model to a usage-based tax system. With the rise of subscription-based car services and the potential for autonomous vehicles to be shared rather than owned, a usage-based tax could be more appropriate. This would involve taxing vehicle usage rather than the purchase price, ensuring a fair and sustainable tax system for the future.

Potential Future Adaptations

- Usage-Based Taxation: As car ownership models evolve, a shift to usage-based taxation could be considered, aligning tax revenue with actual vehicle usage rather than purchase price.

- Incentives for Electric Vehicles: With a growing focus on sustainability, Virginia may explore further incentives for electric vehicle purchases, potentially through reduced or waived sales tax rates.

- Online Sales and Remote Transactions: As more automotive transactions move online, the state may need to adapt its tax regulations to address remote sales and ensure proper tax collection.

Conclusion

Understanding the intricacies of Virginia sales tax as it applies to auto purchases is essential for anyone navigating the automotive market in the state. From the basic principles to the specific exemptions and future considerations, this guide has provided a comprehensive overview. By staying informed and compliant, you can ensure a smooth and legal automotive experience in Virginia.

Remember, the world of sales tax is complex, but with the right knowledge and resources, you can navigate it with confidence. Whether you're a buyer, a seller, or simply an interested resident, understanding these regulations empowers you to make informed decisions and contribute to a fair and transparent market.

What is the current sales tax rate for auto purchases in Virginia?

+The current sales tax rate in Virginia for auto purchases is 4.3% at the state level, with additional local taxes varying by jurisdiction, typically ranging from 1% to 3%.

Are there any incentives or exemptions for purchasing electric or hybrid vehicles in Virginia?

+Yes, Virginia offers incentives for electric and hybrid vehicle purchases. These incentives can vary by locality, but often include reduced or waived sales tax rates to encourage the adoption of environmentally friendly vehicles.

How can I ensure I’m complying with sales tax regulations when purchasing a vehicle in Virginia?

+To ensure compliance, it’s essential to understand your tax obligations and keep accurate records. This includes properly documenting the sale, calculating the tax amount, and remitting payments on time. The Virginia Department of Taxation provides resources and guidance to help businesses and individuals navigate these regulations.