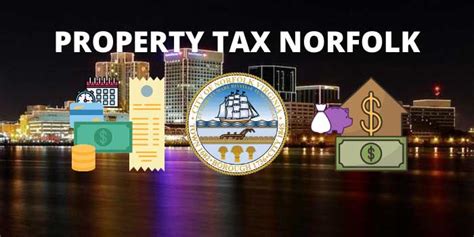

City Of Norfolk Property Tax

Property taxes are an essential revenue source for local governments, funding vital services and infrastructure. This article explores the City of Norfolk's property tax system, shedding light on its rates, assessment processes, and impact on homeowners and businesses. With a unique blend of history and modernity, Norfolk, Virginia, presents a fascinating case study for understanding property taxation.

The Significance of Property Taxes in Norfolk

In the City of Norfolk, property taxes play a pivotal role in financing public services and maintaining the city’s infrastructure. These taxes contribute to funding essential services such as:

- Education: Supporting the city’s public schools and ensuring a quality education for its youth.

- Public Safety: Financing police, fire, and emergency response services.

- Infrastructure Maintenance: Maintaining roads, bridges, and public spaces.

- Social Services: Providing assistance to vulnerable populations.

- Cultural Initiatives: Supporting museums, libraries, and arts programs.

Norfolk’s property tax system is designed to distribute the financial burden equitably, ensuring that all property owners contribute their fair share to the community’s well-being.

Understanding Norfolk’s Property Tax Rates

The City of Norfolk’s property tax rates are set annually by the Norfolk City Council, taking into account the city’s financial needs and the property market’s fluctuations. As of 2023, the general property tax rate stands at 1.17 per 100 of assessed value, one of the highest in the region.

However, Norfolk also offers various tax relief programs to support homeowners and businesses. These include:

- Homestead Exemption: Eligible homeowners can apply for this exemption, which reduces the assessed value of their primary residence by $200,000, resulting in lower property taxes.

- Landmark Property Tax Relief: Owners of designated historic properties may qualify for reduced assessments, providing an incentive for preserving Norfolk’s rich architectural heritage.

- Business Incentives: The city offers tax abatements and other incentives to attract and retain businesses, promoting economic growth and job creation.

These programs aim to ease the tax burden on Norfolk’s residents and businesses while encouraging investment and community development.

Real-Life Example: A Norfolk Homeowner’s Tax Bill

Let’s consider a hypothetical scenario to illustrate how these tax rates and exemptions work in practice. Imagine a homeowner, John, who owns a single-family residence in Norfolk with an assessed value of 300,000</strong>.</p> <p>With the general property tax rate of <strong>1.17 per 100</strong>, John's initial tax calculation would be:</p> <table> <tr> <th>Assessed Value</th> <th>Tax Rate</th> <th>Tax Calculation</th> </tr> <tr> <td>300,000 1.17 per 100 3,510</td> </tr> </table> <p>However, John is eligible for the <strong>Homestead Exemption</strong>, reducing his assessed value by <strong>200,000. This adjustment lowers his tax bill significantly.

| Adjusted Assessed Value | Tax Rate | Tax Calculation |

|---|---|---|

| 100,000</td> <td>1.17 per 100</td> <td>1,170 |

As we can see, the Homestead Exemption has a substantial impact on John’s property taxes, making homeownership more affordable in Norfolk.

Property Assessment: The Key to Fair Taxation

Accurate property assessments are fundamental to ensuring a fair and equitable tax system. The Norfolk Real Estate Assessing Department is responsible for appraising all real estate within the city limits.

Property assessments in Norfolk are conducted on a triennial basis, with the last reassessment occurring in 2021. During this process, assessors consider various factors, including:

- Market Value: The property’s value based on recent sales of comparable properties.

- Location: The impact of the property’s location on its value.

- Improvements: Any additions or renovations made to the property.

- Size and Age: The size of the land and improvements, as well as the age of the structure.

By considering these factors, Norfolk’s assessors ensure that property values are up-to-date and reflective of the current market, leading to a more equitable distribution of the tax burden.

Appealing Your Property Assessment in Norfolk

If a property owner in Norfolk believes their assessment is inaccurate, they have the right to appeal. The Norfolk Board of Equalization is the body responsible for hearing these appeals.

To initiate an appeal, homeowners must:

- File a written appeal with the Board of Equalization within 60 days of receiving their assessment notice.

- Provide evidence supporting their claim, such as recent sales of similar properties or professional appraisals.

- Attend a hearing before the Board, where they can present their case and answer questions.

The Board’s decision is final and can result in a change to the property’s assessed value, potentially leading to a reduction in property taxes.

The Impact of Property Taxes on Norfolk’s Economy

Property taxes in Norfolk not only fund essential services but also play a crucial role in shaping the local economy. By investing in public services and infrastructure, the city attracts businesses and residents, contributing to economic growth.

Additionally, the tax incentives offered by Norfolk, such as the Landmark Property Tax Relief, encourage the preservation of historic properties, fostering a unique and vibrant urban environment that attracts tourists and investors alike.

However, high property taxes can also be a double-edged sword. They can lead to increased living costs, potentially pricing out lower-income residents and small businesses. As such, the City of Norfolk must carefully balance its tax rates to encourage growth while maintaining affordability.

The Future of Property Taxation in Norfolk

Looking ahead, Norfolk’s property tax system is likely to face several challenges and opportunities. As the city continues to grow and develop, the demand for public services and infrastructure will increase, potentially leading to higher tax rates.

However, with its unique blend of history and modernity, Norfolk has the potential to attract new investment and residents, providing a stable tax base. The city’s commitment to tax incentives and relief programs can also help maintain affordability and encourage community development.

Furthermore, advancements in technology and data analysis may lead to more efficient and accurate property assessments, ensuring that Norfolk’s tax system remains fair and equitable.

How often are property assessments conducted in Norfolk?

+Property assessments in Norfolk are conducted on a triennial basis, meaning they occur every three years. The last reassessment was in 2021.

What happens if I disagree with my property assessment in Norfolk?

+If you believe your property assessment is inaccurate, you have the right to appeal. You must file a written appeal with the Norfolk Board of Equalization within 60 days of receiving your assessment notice. Provide evidence supporting your claim and attend a hearing before the Board to present your case.

Are there any tax relief programs available for homeowners in Norfolk?

+Yes, Norfolk offers several tax relief programs, including the Homestead Exemption, which reduces the assessed value of your primary residence by $200,000, and the Landmark Property Tax Relief for owners of designated historic properties.