Car Sales Tax Ny

Understanding the intricacies of car sales tax in New York is crucial for anyone looking to purchase a vehicle in the state. The tax structure can significantly impact the overall cost of your vehicle, so it's essential to have a clear understanding of how it works. In this comprehensive guide, we will delve into the specifics of car sales tax in New York, providing you with the knowledge you need to navigate the process efficiently.

The Basics of Car Sales Tax in New York

New York State imposes a sales and use tax on the purchase of motor vehicles, which includes cars, trucks, motorcycles, and certain other types of vehicles. This tax is applied to the retail sales price of the vehicle and is collected by the seller at the time of purchase. The sales tax is a percentage of the vehicle’s price and is calculated based on the location where the vehicle is registered.

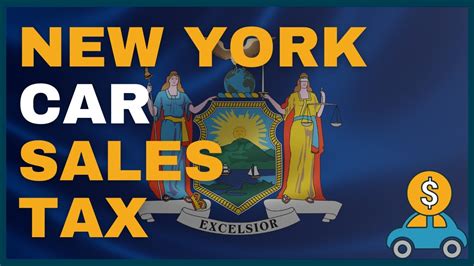

It's important to note that the sales tax rate can vary depending on the county or city where the vehicle is purchased. This means that the tax you pay can differ based on the specific location of the dealership or seller. To provide a clearer understanding, let's break down the sales tax rates for some of the major cities in New York.

Sales Tax Rates in New York Cities

Here are the sales tax rates for some notable cities in New York:

| City | Sales Tax Rate |

|---|---|

| New York City | 8.875% |

| Buffalo | 8.00% |

| Rochester | 8.00% |

| Syracuse | 8.00% |

| Albany | 8.00% |

| Yonkers | 8.375% |

These rates include both the state sales tax and any additional local taxes. It's worth mentioning that certain areas, such as New York City, have additional taxes and fees that can further increase the overall tax burden.

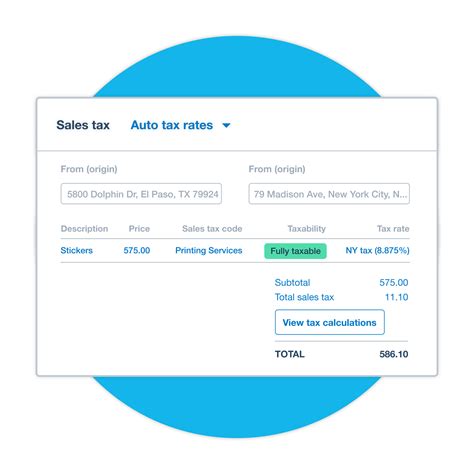

Calculating Sales Tax for Your Vehicle Purchase

To calculate the sales tax you’ll owe on your vehicle purchase, you’ll need to know the following:

- The retail sales price of the vehicle (including any additional fees and options)

- The sales tax rate applicable to the location where the vehicle will be registered

Let's take an example to illustrate the calculation. Imagine you're purchasing a car in New York City with a retail sales price of $30,000. The sales tax rate in New York City is 8.875%. To calculate the sales tax, you would multiply the sales price by the tax rate:

Sales Tax = Retail Sales Price x Sales Tax Rate

Sales Tax = $30,000 x 0.08875 = $2,662.50

So, in this case, the sales tax on your vehicle purchase would be $2,662.50.

Exemptions and Special Considerations

While most vehicle purchases in New York are subject to sales tax, there are certain exemptions and special cases to be aware of:

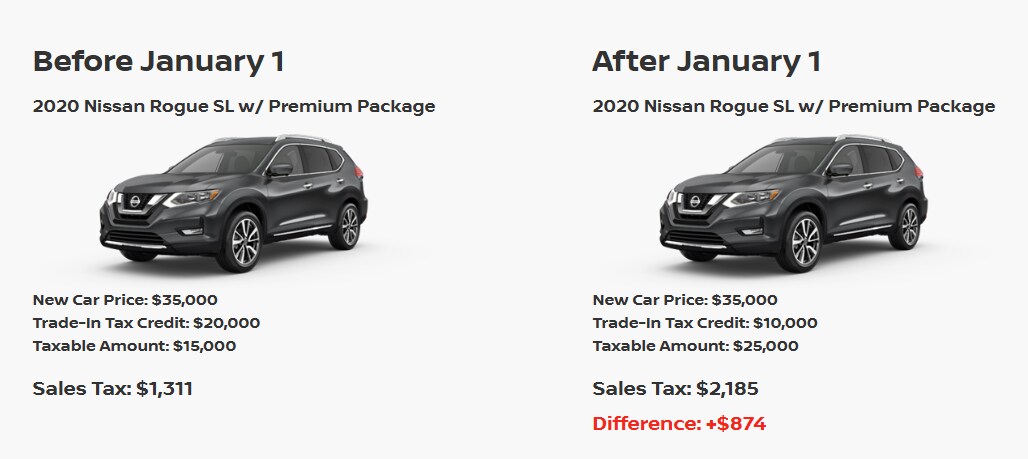

Trade-Ins and Used Vehicles

When trading in your old vehicle as part of the purchase of a new one, the sales tax may be calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This can result in a lower tax burden. Additionally, when purchasing a used vehicle from a private seller, you may be responsible for paying the use tax, which is similar to sales tax but applied to purchases made outside of the regular sales tax collection process.

Tax Exemptions

Certain individuals or organizations may be exempt from paying sales tax on vehicle purchases. This includes:

- Tax-exempt organizations, such as non-profits or government entities

- Individuals with specific disabilities or medical conditions who require a vehicle for transportation purposes

- Active-duty military personnel and veterans (under certain conditions)

It's important to note that to claim tax exemptions, you will need to provide the necessary documentation and meet specific eligibility criteria.

Vehicle Registration and Title Fees

In addition to sales tax, there are other fees associated with registering and titling your vehicle in New York. These fees can vary depending on the type of vehicle and its weight, and they are typically paid at the time of registration.

The Impact of Sales Tax on Your Purchase

Understanding the sales tax implications is crucial when budgeting for your vehicle purchase. The tax can significantly impact the overall cost, especially for higher-priced vehicles. It’s recommended to factor in the sales tax when comparing prices and negotiating with dealers.

For instance, if you're considering a luxury vehicle with a retail price of $60,000 and the applicable sales tax rate is 8.875%, the tax alone would amount to $5,325. This means your total purchase price would be $65,325, a substantial addition to the base price.

Online Purchases and Out-of-State Transactions

If you’re considering purchasing a vehicle online or from an out-of-state dealer, it’s important to understand the tax implications. In such cases, you may be responsible for paying the use tax, which is similar to sales tax but applied to purchases made outside of the regular sales tax jurisdiction.

The use tax rate is typically the same as the sales tax rate in your state of residence. This means that even if you purchase a vehicle from an out-of-state dealer, you still need to pay the applicable tax to your state's Department of Taxation and Finance.

Tips for Navigating Car Sales Tax in New York

Here are some practical tips to help you navigate the car sales tax process in New York:

- Research the sales tax rates in your specific county or city before finalizing your purchase.

- Understand the total cost, including sales tax, before negotiating with dealers.

- If you're eligible for tax exemptions, ensure you have the necessary documentation ready.

- Discuss trade-in values and their impact on sales tax with your dealer.

- Stay informed about any additional fees or taxes that may apply in your area.

Conclusion

Understanding the intricacies of car sales tax in New York is essential for making informed decisions when purchasing a vehicle. By knowing the sales tax rates, exemptions, and special considerations, you can navigate the process efficiently and ensure you’re not caught off guard by unexpected tax burdens. Remember to research, plan, and discuss all aspects of the purchase with your dealer to make the most of your vehicle-buying experience.

What happens if I don’t pay the sales tax on my vehicle purchase in New York?

+Failing to pay the required sales tax on your vehicle purchase can result in penalties and interest charges. It’s important to ensure that you pay the correct amount of tax to avoid legal consequences and additional fees.

Are there any ways to reduce the sales tax burden on my vehicle purchase?

+While sales tax rates are generally set by the state and local governments, there are a few strategies that can help reduce the overall tax burden. These include negotiating a lower purchase price, taking advantage of dealer incentives or rebates, and exploring tax-exempt status if you meet the necessary criteria.

How often do sales tax rates change in New York?

+Sales tax rates in New York are subject to change, but they typically remain stable for extended periods. It’s a good practice to check for any recent updates before making a vehicle purchase, especially if you’re buying in a specific locality with unique tax considerations.