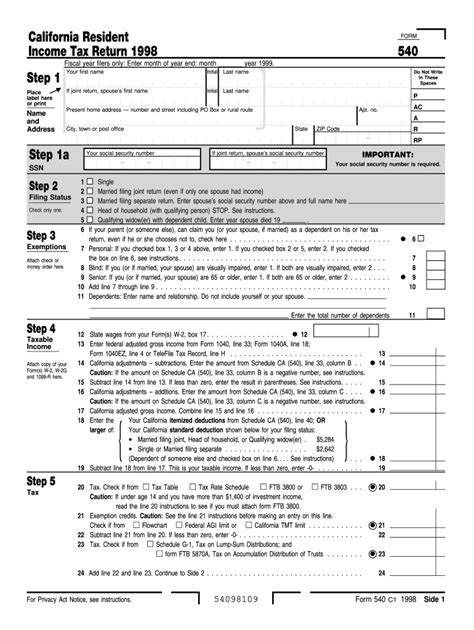

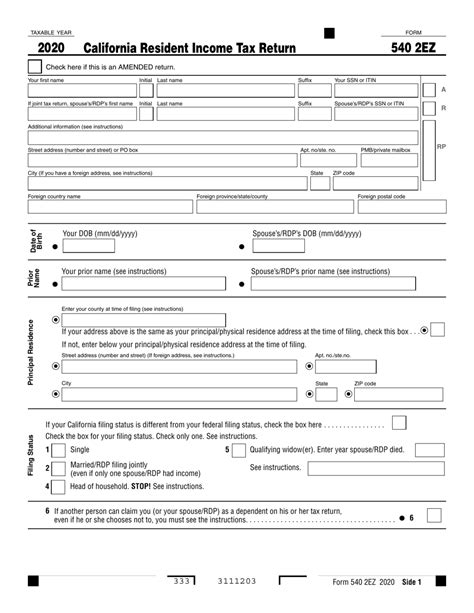

540 Tax Form

The 540 Tax Form, officially known as the California Resident Income Tax Return, is an essential document for individuals and businesses with tax obligations in the state of California. This form plays a crucial role in the state's revenue system, allowing taxpayers to report their income, claim deductions and credits, and calculate their tax liabilities accurately. As a key component of the state's tax administration, the 540 form has evolved over the years to adapt to changing economic landscapes and taxpayer needs.

Understanding the 540 Tax Form

The 540 Tax Form is a comprehensive document that guides taxpayers through the process of filing their state income taxes in California. It consists of various sections and schedules, each designed to capture specific aspects of an individual’s or business’s financial situation. The form covers a wide range of income sources, including wages, salaries, tips, investments, business income, and more.

One of the critical aspects of the 540 form is its adaptability. The California Franchise Tax Board, which oversees the state's tax administration, regularly updates the form to reflect changes in tax laws and regulations. These updates ensure that taxpayers have the tools they need to comply with the latest tax requirements accurately.

Key Sections of the 540 Tax Form

The 540 form is divided into several sections, each focusing on a specific aspect of a taxpayer’s financial life. Here’s a breakdown of some of the critical sections:

- Income: This section covers all sources of income, from traditional wages to rental income, royalties, and even income from the sale of assets.

- Adjustments to Income: Taxpayers can reduce their taxable income by claiming certain adjustments, such as student loan interest, educator expenses, and health savings account deductions.

- Tax Credits: The 540 form allows taxpayers to claim various tax credits, including the California Earned Income Tax Credit, Child and Dependent Care Credit, and various other state-specific credits.

- Taxes Paid: Here, taxpayers report any taxes withheld from their wages or estimated tax payments made during the year.

- Other Taxes: This section covers additional state taxes, such as those related to property, inheritance, or gifts.

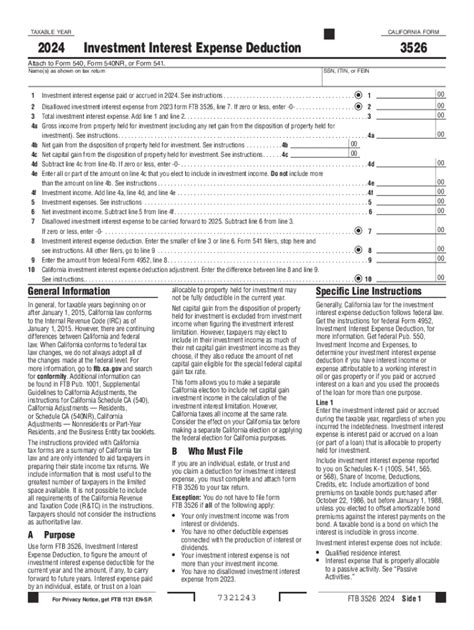

Additionally, the 540 form may require taxpayers to complete additional schedules based on their specific circumstances. For instance, Schedule CA (Resident Income and Tax Worksheet) helps calculate the state's income tax liability, while Schedule W (Capital Loss Limitation Worksheet) is used to determine the limitation on capital losses.

| Schedule | Purpose |

|---|---|

| CA | Calculates state income tax liability |

| W | Determines limitation on capital losses |

| H | Claims California Homeowner and Renter Property Tax Assistance Credit |

| X | Reports additional income or deductions related to California |

Filing the 540 Tax Form

Filing the 540 Tax Form is a straightforward process for many taxpayers, thanks to the availability of online filing options and user-friendly software. The California Franchise Tax Board offers an online filing system, e-file, which allows taxpayers to complete and submit their forms digitally. This system is secure and provides real-time status updates, making the filing process more efficient.

For those who prefer traditional methods, the 540 form can also be downloaded, printed, and mailed to the Franchise Tax Board. However, online filing is generally encouraged due to its convenience and the reduced risk of errors.

Important Dates and Deadlines

The filing deadline for the 540 Tax Form typically aligns with the federal tax deadline, which is usually April 15th. However, it’s crucial to note that this date can vary based on the day of the week and any observed holidays. For instance, if April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day.

Taxpayers who are unable to meet the filing deadline can request an extension. Form FTB 3519, the Application for Automatic Extension to File California Resident Income Tax Return, can be used to extend the filing deadline by six months. However, it's important to note that an extension to file does not extend the deadline to pay any taxes owed.

Who Needs to File the 540 Tax Form

The 540 Tax Form is mandatory for California residents who meet certain income thresholds. The exact income limit can vary depending on the taxpayer’s filing status and whether they are single, married filing jointly, or head of household.

Additionally, non-residents who have income sourced from California, such as wages earned while working in the state or income from California-based investments, may also be required to file the 540 form. This ensures that all income derived from California activities is properly reported and taxed.

Income Thresholds for Filing

As of the most recent tax year, the income thresholds for filing the 540 Tax Form are as follows:

- Single taxpayers: Earnings above $13,520

- Married filing jointly: Earnings above $18,750

- Head of household: Earnings above $17,450

It's important to note that these thresholds are subject to change annually and are influenced by various factors, including inflation and legislative decisions. Taxpayers should refer to the most recent tax guidelines and instructions to determine their exact filing requirements.

Benefits and Challenges of the 540 Tax Form

The 540 Tax Form offers several benefits to taxpayers, including the ability to claim state-specific tax credits and deductions. These credits and deductions can significantly reduce a taxpayer’s overall tax liability, making the filing process worthwhile.

However, the form also presents certain challenges, particularly for taxpayers with complex financial situations. For instance, individuals with multiple sources of income, business owners, or those with investment portfolios may find the form more intricate and time-consuming to complete.

Strategies for Effective Filing

To streamline the filing process, taxpayers can consider the following strategies:

- Gather Information: Collect all necessary documents, such as W-2 forms, 1099s, and records of income and expenses, before beginning the filing process.

- Use Tax Software: Online tax preparation software can guide taxpayers through the completion of the 540 form, reducing the risk of errors and providing real-time calculations.

- Seek Professional Help: For complex financial situations, consulting a tax professional or accountant can ensure accurate filing and maximize potential tax benefits.

- Stay Informed: Keep up-to-date with the latest tax laws and regulations, as changes can impact the filing process and the taxpayer's bottom line.

The Future of the 540 Tax Form

As technology advances and tax administration becomes increasingly digital, the future of the 540 Tax Form looks toward further simplification and efficiency. The California Franchise Tax Board is committed to making the filing process more accessible and user-friendly, especially for those who may face barriers due to language, technology, or financial constraints.

One of the key initiatives is the expansion of online filing options, making it easier for taxpayers to file their returns securely and quickly. Additionally, the tax board is exploring ways to integrate artificial intelligence and machine learning into the filing process, which could reduce the burden on taxpayers by automating certain data entry and calculation tasks.

Potential Changes and Innovations

Some potential future developments for the 540 Tax Form include:

- Digital Wallet Integration: Taxpayers may be able to connect their digital wallets to the filing system, streamlining the process of verifying income and expenses.

- Real-Time Data Sharing: Integration with financial institutions could enable real-time data sharing, reducing the need for manual data entry and minimizing errors.

- Blockchain Technology: The use of blockchain could enhance security and transparency in the filing process, especially for taxpayers with complex financial transactions.

While these innovations are still in the developmental stages, they showcase the California Franchise Tax Board's commitment to modernizing the tax filing experience and keeping pace with technological advancements.

How often is the 540 Tax Form updated, and where can I find the latest version?

+The 540 Tax Form is typically updated annually to reflect changes in tax laws and regulations. The latest version can be found on the California Franchise Tax Board’s official website, which offers a downloadable PDF of the form and its accompanying instructions.

Are there any penalties for late filing or underpayment of taxes using the 540 form?

+Yes, taxpayers who fail to file their 540 Tax Form by the deadline or underpay their taxes may be subject to penalties and interest. The exact penalties can vary based on the severity of the violation and the taxpayer’s history. It’s essential to meet the filing deadline and pay any taxes owed to avoid these penalties.

Can I file my 540 Tax Form jointly with my spouse if we have different last names due to a previous marriage?

+Yes, as long as you meet the requirements for married filing jointly, you can file your 540 Tax Form jointly with your spouse, even if you have different last names. The important factor is your legal marital status, not your shared surname.

What happens if I make a mistake on my 540 Tax Form and need to correct it after filing?

+If you discover a mistake on your 540 Tax Form after filing, you can correct it by filing an amended return using Form 540X. This form allows you to adjust your income, deductions, or credits and recalculate your tax liability. It’s important to file the amended return as soon as possible to avoid potential penalties or interest.