Missouri Income Tax Forms

The state of Missouri, nestled in the heartland of the United States, operates its own tax system alongside the federal tax framework. Understanding the Missouri income tax forms and their nuances is crucial for residents and businesses operating within the state. In this comprehensive guide, we will delve into the intricacies of Missouri's tax forms, offering expert insights and a deep analysis to help you navigate this essential aspect of financial management.

Navigating Missouri’s Tax Landscape: An Overview

Missouri’s tax system is a vital component of the state’s economic framework, contributing to the funding of essential services and infrastructure. The state’s income tax structure is designed to support its residents and businesses, while also ensuring a fair and balanced revenue collection process.

Missouri imposes an income tax on its residents and businesses, with rates that vary depending on the taxpayer's income bracket. The state's tax system is progressive, meaning that higher income earners are subject to higher tax rates. This progressive structure aims to ensure that those with greater financial means contribute a larger share to the state's revenue.

Exploring Missouri’s Income Tax Forms: A Comprehensive Guide

Missouri’s income tax forms are the tools through which individuals and businesses report their income and calculate their tax liabilities. These forms are intricate and detailed, requiring careful attention to ensure accurate reporting. Here, we will provide a detailed breakdown of these forms, their requirements, and the step-by-step process of completing them.

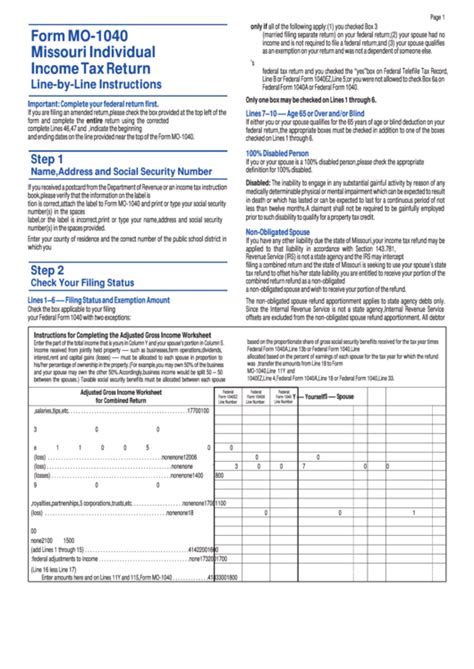

Form MO-1040: Individual Income Tax Return

Form MO-1040 is the primary income tax form for Missouri residents. This form is a comprehensive document that captures all sources of income, including wages, salaries, tips, dividends, interest, capital gains, and more. It also allows taxpayers to claim deductions, credits, and exemptions, reducing their taxable income and, consequently, their tax liability.

Key sections of Form MO-1040 include:

- Income: This section requires taxpayers to report their total income from all sources, including wages, salaries, tips, and self-employment income.

- Adjustments to Income: Here, taxpayers can claim deductions for certain expenses, such as student loan interest, educator expenses, and health savings account contributions.

- Tax and Credits: Taxpayers calculate their tax liability in this section, taking into account any applicable credits, such as the Missouri Earned Income Tax Credit and the Missouri Property Tax Credit.

- Payments and Refunds: This is where taxpayers reconcile their tax liability with any payments already made, such as withholding taxes or estimated tax payments. If a refund is due, this is where it is calculated.

Form MO-1040 also includes schedules for specific types of income and deductions, such as Schedule A for itemized deductions and Schedule C for business income or loss from self-employment.

Form MO-1065: Missouri Partnership Return

Form MO-1065 is used by partnerships operating within Missouri to report their income, gains, losses, deductions, and credits. This form is essential for partnerships to fulfill their tax obligations to the state.

Key sections of Form MO-1065 include:

- Partnership Income: This section captures the partnership's total income from all sources, including business income, interest, dividends, and capital gains.

- Deductions and Credits: Partnerships can claim deductions for business expenses, such as advertising, rent, and depreciation. They can also claim credits, such as the Missouri Research Activities Credit and the Missouri Jobs Act Credit.

- Partners' Shares: This section details the allocation of income, deductions, and credits to each partner. Each partner's share is then reported on their individual Form MO-1040.

Form MO-1120: Missouri Corporation Income Tax Return

Form MO-1120 is used by corporations doing business in Missouri to report their income and calculate their tax liability. This form is a critical component of corporate tax compliance in the state.

Key sections of Form MO-1120 include:

- Income: Corporations report their total income from all sources, including sales, interest, dividends, and capital gains.

- Deductions and Credits: Corporations can claim deductions for business expenses, such as advertising, rent, and depreciation. They can also claim credits, such as the Missouri Research Activities Credit and the Missouri Quality Jobs Tax Credit.

- Tax Computation: This section guides corporations through the process of calculating their tax liability, taking into account any applicable credits and deductions.

Other Missouri Tax Forms

In addition to the forms mentioned above, Missouri has a range of other tax forms tailored to specific situations and entities. These include:

- Form MO-1040X: Used to amend previously filed individual income tax returns.

- Form MO-1040ES: For estimating and paying individual income tax throughout the year.

- Form MO-1040V: Payment voucher for individuals paying their tax liability.

- Form MO-1041: Missouri Fiduciary Income Tax Return for estates and trusts.

- Form MO-1099: Information return for various types of income, such as dividends, interest, and rents.

The Impact of Missouri's Tax Forms on Residents and Businesses

Missouri's income tax forms are more than just legal requirements; they are essential tools for financial planning and tax compliance. For individuals, these forms provide a structured way to claim deductions and credits, reducing their tax burden and potentially increasing their refunds. For businesses, accurate completion of these forms is crucial for tax optimization and strategic financial management.

Furthermore, Missouri's tax forms are designed to support the state's economic development initiatives. Tax credits, such as the Missouri Research Activities Credit and the Missouri Quality Jobs Tax Credit, encourage businesses to invest in research and development and create jobs within the state. These incentives contribute to Missouri's economic growth and competitiveness.

Expert Insights and Future Implications

Staying informed about changes and updates to Missouri’s tax forms is crucial for both residents and businesses. The state’s tax system is dynamic, and amendments are made periodically to align with economic trends and policy objectives. Staying abreast of these changes ensures that taxpayers can take advantage of new credits and deductions and avoid potential penalties for non-compliance.

Frequently Asked Questions

When is the deadline for filing Missouri income tax returns?

+The deadline for filing Missouri income tax returns is typically aligned with the federal tax deadline, which is typically April 15th of each year. However, it’s essential to stay updated, as the state may occasionally extend this deadline.

What happens if I miss the filing deadline for my Missouri income tax return?

+Missing the filing deadline may result in penalties and interest charges. It’s crucial to file your return as soon as possible to minimize these additional costs and maintain compliance with Missouri’s tax laws.

Are there any online tools or software that can help me complete Missouri’s income tax forms?

+Yes, several online tax preparation software platforms offer guidance and assistance for completing Missouri’s income tax forms. These tools can simplify the process and ensure accuracy, especially for more complex tax situations.

Can I file my Missouri income tax return electronically?

+Absolutely! Missouri encourages electronic filing of income tax returns, which is faster, more secure, and reduces the chances of errors. Most tax preparation software and online filing platforms support electronic filing for Missouri tax returns.