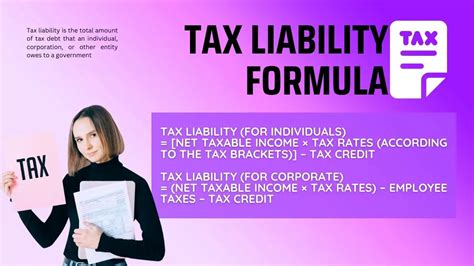

How To Calculate Tax Liability

Understanding tax liability is crucial for individuals and businesses alike, as it directly impacts financial planning and compliance with tax regulations. Tax liability refers to the total amount of tax that an individual or entity owes to the government based on their income, deductions, and other applicable factors. In this comprehensive guide, we will delve into the steps and considerations involved in calculating tax liability, providing you with the knowledge to navigate this complex process effectively.

Determining Taxable Income

The first step in calculating tax liability is to establish your taxable income, which serves as the foundation for subsequent calculations. Taxable income represents the portion of your earnings subject to taxation after various deductions and adjustments. Here's a breakdown of the process:

Gross Income

Begin by identifying your gross income, which encompasses all sources of income, including wages, salaries, commissions, rental income, interest, dividends, and any other forms of revenue. Ensure that you consider all relevant income streams to obtain an accurate representation of your earnings.

| Income Source | Amount |

|---|---|

| Salary | $60,000 |

| Rental Income | $12,000 |

| Dividends | $3,000 |

| Interest Income | $2,000 |

| Total Gross Income | $77,000 |

Adjustments and Deductions

Next, you need to apply adjustments and deductions to your gross income to determine your adjusted gross income (AGI). These adjustments can include deductions for contributions to retirement accounts, certain expenses related to education, student loan interest, and more. The AGI is a crucial figure as it forms the basis for further calculations and determines your eligibility for various tax benefits.

| Adjustment/Deduction | Amount |

|---|---|

| Retirement Contributions | $5,000 |

| Student Loan Interest | $1,200 |

| Education Expenses | $800 |

| Total Adjustments | $6,000 |

Calculating Taxable Income

Subtract the total adjustments from your gross income to arrive at your taxable income. This figure represents the amount on which your tax liability will be calculated.

Taxable Income = Gross Income - Total Adjustments

Taxable Income = $77,000 - $6,000 = $71,000

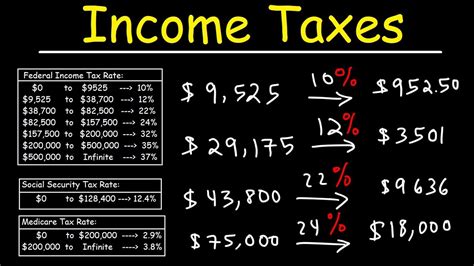

Applying Tax Rates and Brackets

Once you have determined your taxable income, you can proceed to calculate your tax liability by applying the appropriate tax rates and brackets. Tax rates and brackets vary depending on your jurisdiction and tax system. In many countries, the tax system employs a progressive tax structure, where higher income levels are taxed at higher rates.

Understanding Tax Brackets

Tax brackets define the income ranges associated with specific tax rates. For example, in a hypothetical tax system, there might be four tax brackets with corresponding rates:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| Bracket 1 | Up to $10,000 | 10% |

| Bracket 2 | $10,001 - $25,000 | 15% |

| Bracket 3 | $25,001 - $50,000 | 20% |

| Bracket 4 | Over $50,000 | 25% |

Calculating Tax Liability

To calculate your tax liability, you need to determine which tax brackets your taxable income falls into and apply the corresponding tax rates. Let's illustrate this with an example:

Using the hypothetical tax brackets from above, we can calculate the tax liability for our previous taxable income of $71,000.

Tax Bracket 1: $10,000 x 10% = $1,000

Tax Bracket 2: ($25,000 - $10,000) x 15% = $2,250

Tax Bracket 3: ($50,000 - $25,000) x 20% = $5,000

Tax Bracket 4: ($71,000 - $50,000) x 25% = $5,250

Now, sum up the taxes from each bracket to find your total tax liability:

Total Tax Liability = $1,000 + $2,250 + $5,000 + $5,250 = $13,500

Considerations and Adjustments

Calculating tax liability involves several additional considerations and adjustments to ensure accuracy. Here are some key factors to keep in mind:

- Tax Credits: Tax credits can reduce your tax liability directly. Common tax credits include the Child Tax Credit, Education Credits, and Energy Efficiency Credits. These credits can provide significant savings and should be applied after calculating your initial tax liability.

- Withholding and Estimated Taxes: Depending on your income sources and tax obligations, you may need to make estimated tax payments throughout the year to avoid penalties. Additionally, understanding your withholding status and ensuring the right amount is withheld from your income is crucial.

- Taxable Events: Certain life events, such as marriage, divorce, or the birth of a child, can impact your tax liability. It's essential to consider these changes and adjust your tax calculations accordingly.

- Filing Status: Your filing status (single, married filing jointly, head of household, etc.) influences your tax rates and brackets. Choose the appropriate filing status based on your personal circumstances.

Staying Compliant and Seeking Assistance

Calculating tax liability accurately is crucial for maintaining compliance with tax laws and avoiding penalties. While this guide provides a comprehensive overview, it's important to note that tax regulations can be intricate and subject to change. Seeking guidance from tax experts or utilizing reliable tax preparation tools can help ensure you navigate the process smoothly and make the most of available tax benefits.

Frequently Asked Questions

How often should I calculate my tax liability?

+

It’s advisable to calculate your tax liability annually, especially when filing your tax return. However, if your financial situation undergoes significant changes during the year, such as a new job, marriage, or major purchases, it’s beneficial to reassess your tax liability to ensure accurate withholding and planning.

Can I reduce my tax liability through deductions and credits?

+

Absolutely! Deductions and credits are powerful tools to reduce your tax liability. By understanding the available deductions and credits applicable to your situation, you can strategically plan your finances to maximize tax savings. Consult a tax professional or use reputable tax software to explore these opportunities.

What happens if I underestimate my tax liability and owe money at the end of the year?

+

If you underestimate your tax liability and owe money at the end of the year, you may be subject to penalties and interest. To avoid this, it’s crucial to make accurate tax estimates and, if necessary, make estimated tax payments throughout the year. Working with a tax professional can help you manage your tax obligations effectively.

Are there any online tools or software that can assist in calculating tax liability?

+

Yes, numerous online tax preparation software and tools are available to assist with calculating tax liability. These tools guide you through the process, provide personalized recommendations, and ensure compliance with the latest tax regulations. Some popular options include TurboTax, H&R Block, and TaxSlayer.