Ebay Taxes 2025

In the ever-evolving landscape of e-commerce, staying informed about the tax implications of online sales is crucial for both buyers and sellers. As we navigate the year 2025, the topic of eBay taxes demands a comprehensive exploration, especially given the platform's significant role in the global marketplace. This article aims to delve into the intricacies of eBay taxes, offering a detailed guide to help users understand their tax obligations and navigate the tax landscape effectively.

Understanding eBay Taxes: A Comprehensive Overview

eBay, as a global online marketplace, facilitates transactions between buyers and sellers from diverse locations. With its vast reach, the platform presents unique tax challenges and opportunities. In 2025, eBay taxes will continue to be a critical aspect of doing business on the platform, impacting both individual sellers and established businesses.

Tax Obligations for eBay Sellers

Sellers on eBay are responsible for understanding and complying with tax regulations in their respective jurisdictions. These obligations can vary significantly depending on the seller’s location, the nature of their business, and the items they sell. Here’s a breakdown of key tax considerations for eBay sellers:

-

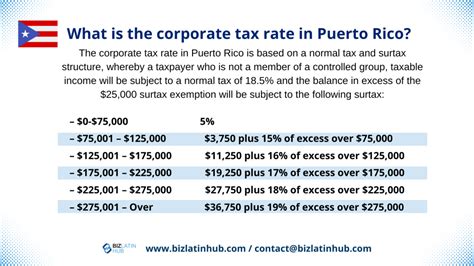

Income Tax: Sellers are required to report and pay income tax on their profits from eBay sales. This involves understanding the tax rates and brackets applicable to their earnings. For instance, in the United States, the IRS has specific guidelines for reporting online sales income.

-

Sales Tax: eBay sellers may need to collect and remit sales tax to the appropriate tax authorities. The sales tax obligations depend on the seller’s location, the buyer’s location, and the nature of the items sold. Many states in the U.S. have specific rules for online sales, such as the Marketplace Facilitator Laws, which hold online marketplaces like eBay responsible for collecting sales tax.

-

Value Added Tax (VAT): For sellers operating in countries with a VAT system, understanding and complying with VAT regulations is essential. This includes registering for VAT, issuing valid invoices, and properly accounting for VAT on eBay transactions.

-

Import Duties and Customs: Sellers who ship items internationally must be aware of import duties and customs regulations. These can vary based on the destination country and the type of goods being shipped. eBay provides resources to help sellers navigate these complexities, but staying updated with the latest regulations is crucial.

eBay’s Role in Tax Compliance

eBay, recognizing the importance of tax compliance, offers tools and resources to assist sellers in managing their tax obligations. These include:

-

Sales Tax Automation: eBay’s sales tax automation feature helps sellers calculate and collect sales tax accurately. This tool integrates with the seller’s account, considering the buyer’s location and the item’s taxability to determine the applicable sales tax.

-

Tax Guides and Resources: eBay provides comprehensive guides and resources on its Help Center, covering various tax-related topics. These resources offer insights into sales tax laws, import duties, and other tax considerations for sellers.

-

Partnerships with Tax Services: eBay has partnerships with tax service providers, offering sellers access to discounted tax filing services. These partnerships aim to simplify the tax filing process for sellers, ensuring compliance with relevant tax laws.

eBay Taxes for Buyers

While the primary tax obligations rest with sellers, buyers on eBay also have certain tax-related responsibilities. These include:

-

Sales Tax: Buyers may be required to pay sales tax on their purchases, depending on their location and the seller’s tax nexus. eBay’s checkout process often includes a sales tax calculation based on the buyer’s shipping address and the item’s price.

-

Import Duties and Customs: When purchasing items from international sellers, buyers should be aware of potential import duties and customs charges. These additional costs can significantly impact the total purchase price, so it’s essential for buyers to factor these into their purchasing decisions.

Tax Reporting and Filing for eBay Sellers

Accurate tax reporting and timely filing are essential aspects of eBay tax compliance. Sellers should maintain proper records of their eBay sales, including income and expenses. These records form the basis for tax calculations and filings. Here are some key considerations for tax reporting and filing:

-

Tax Yearly Earnings Reports: eBay provides sellers with yearly earnings reports, which summarize the seller’s income and sales tax collected. These reports are essential for tax filing and provide a clear picture of the seller’s financial activities on the platform.

-

Quarterly Tax Estimates: Depending on the seller’s income level and location, they may be required to make quarterly tax estimates to ensure they have sufficient funds to cover their tax obligations at the end of the year.

-

Tax Filing Deadlines: Sellers should be aware of the tax filing deadlines in their respective jurisdictions. Missing these deadlines can result in penalties and interest charges. eBay’s resources often include reminders and guidelines to help sellers stay on top of their tax obligations.

eBay’s Tax Policies and Updates

eBay regularly updates its tax policies and guidelines to stay aligned with changing tax laws and regulations. These updates are crucial for sellers to remain compliant. Here are some key aspects to watch for:

-

Policy Changes: eBay may introduce new policies or update existing ones to reflect changes in tax laws. Sellers should stay informed about these changes to ensure they are adhering to the latest guidelines.

-

Country-Specific Updates: Tax regulations can vary significantly from country to country. eBay often provides country-specific updates and resources to help sellers navigate these complexities, ensuring they comply with local tax laws.

-

Tax Tools and Features: eBay continuously improves its tax-related tools and features to enhance the user experience. Sellers should explore these tools to streamline their tax management processes and stay efficient.

eBay Tax Strategies for Success

Understanding the tax landscape on eBay is just the first step. Developing effective tax strategies can help sellers optimize their tax obligations and boost their overall success on the platform. Here are some strategies to consider:

-

Business Structure: Sellers should evaluate their business structure and consider the tax implications. Sole proprietorships, partnerships, and corporations each have different tax obligations and benefits. Consulting with a tax professional can help sellers choose the most advantageous structure for their business.

-

Deductions and Credits: Sellers can explore various deductions and tax credits to reduce their tax liabilities. These can include expenses related to running their eBay business, such as shipping costs, advertising fees, and home office expenses. Understanding which expenses are deductible and how to claim them is crucial for optimizing tax savings.

-

Tax Planning and Strategy: Developing a tax planning strategy can help sellers manage their tax obligations effectively. This involves setting aside funds for tax payments, understanding the timing of tax payments and filings, and considering the tax implications of different business decisions.

The Future of eBay Taxes

As we look ahead to 2025 and beyond, the landscape of eBay taxes is likely to continue evolving. Here are some potential future developments to consider:

-

Increased Automation: eBay and tax authorities may further develop automated systems for tax collection and reporting. This could streamline the tax process for sellers, reducing the time and effort required for compliance.

-

International Tax Harmonization: With eBay’s global reach, there may be efforts to harmonize tax regulations across different countries. This could simplify tax obligations for sellers operating in multiple jurisdictions.

-

Blockchain and Cryptocurrency Integration: The integration of blockchain technology and cryptocurrencies into eBay’s ecosystem could bring new tax considerations. Sellers and buyers using these technologies will need to understand the tax implications of blockchain-based transactions.

Conclusion: Navigating eBay Taxes in 2025

In the dynamic world of eBay, staying informed about tax obligations is crucial for both buyers and sellers. As we navigate 2025, eBay taxes will continue to play a significant role in the platform’s ecosystem. By understanding their tax obligations, leveraging eBay’s resources, and developing effective tax strategies, sellers can thrive on the platform while maintaining tax compliance. For buyers, being aware of their tax responsibilities ensures a seamless and transparent purchasing experience.

eBay's commitment to providing tax tools and resources demonstrates its recognition of the importance of tax compliance. As the platform continues to evolve, sellers and buyers can look forward to enhanced tax management features and a more streamlined tax experience.

How often should I review my tax obligations as an eBay seller?

+It’s recommended to review your tax obligations at least annually, especially when tax laws change. However, more frequent reviews, such as quarterly or even monthly, can be beneficial to ensure you’re on track with your tax obligations and to identify any potential issues early on.

Are there any tax benefits for selling on eBay as a small business?

+Yes, as a small business seller on eBay, you may be eligible for various tax benefits and deductions. These can include deductions for business expenses, such as advertising, shipping costs, and office expenses. Consulting with a tax professional can help you identify and claim these benefits.

How can I stay updated with eBay’s tax policies and changes?

+eBay provides regular updates and resources on its Help Center, including guides and announcements related to tax policies. It’s important to regularly check these resources and subscribe to relevant newsletters or alerts to stay informed about any changes or updates.

What should I do if I receive a tax notice or audit related to my eBay sales?

+If you receive a tax notice or are audited, it’s crucial to respond promptly and accurately. Consult with a tax professional who can guide you through the process and help you address any issues or concerns raised by the tax authorities. Maintaining accurate records and providing complete and transparent information will be key in resolving the matter.

Can I use eBay’s tax tools and resources if I’m not a seller on the platform?

+While eBay’s tax tools and resources are primarily designed for sellers on the platform, some information and resources may still be useful for buyers or those considering selling on eBay. However, it’s important to note that specific tax obligations and strategies may vary based on individual circumstances, so consulting with a tax professional is recommended for personalized advice.