Tax Form 2210

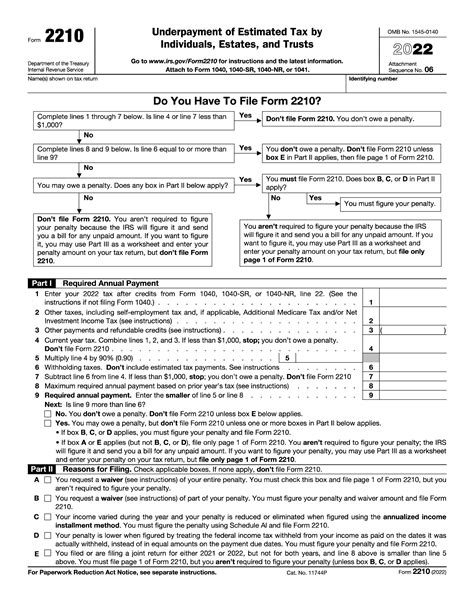

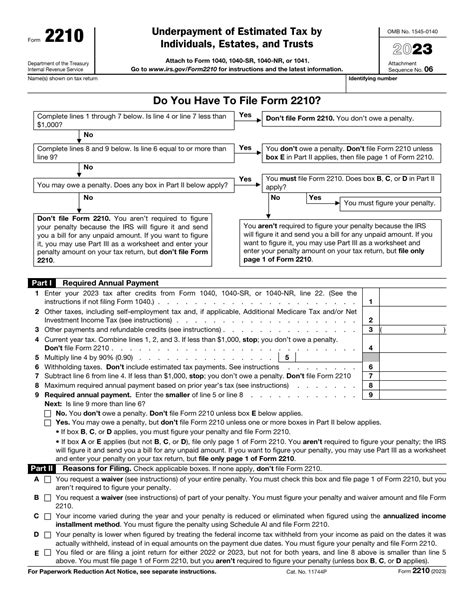

When it comes to tax obligations, one often overlooked yet crucial aspect is the Tax Form 2210, also known as the "Underpayment of Estimated Tax by Individuals" form. This form is a vital component of the tax landscape, especially for individuals with varying income sources or those whose tax liability changes throughout the year. Let's delve into the intricacies of Tax Form 2210, its purpose, and its significance in the complex world of taxation.

Understanding Tax Form 2210

Tax Form 2210 is a specialized document used by the Internal Revenue Service (IRS) to calculate and collect any underpayment of estimated taxes from individuals. It ensures that taxpayers who fail to pay enough tax throughout the year, through either quarterly estimated tax payments or withholding from income, make up the difference by paying additional taxes when filing their annual return.

The concept of estimated tax payments is designed to maintain a steady flow of revenue for the government throughout the year, particularly for those whose income is not subject to traditional withholding, such as self-employed individuals, freelancers, and business owners.

The Importance of Tax Form 2210

While the idea of paying additional taxes may not be pleasant, Tax Form 2210 serves a critical function in the tax system. By ensuring that individuals pay their fair share of taxes as they earn income, it helps maintain financial stability and fairness for all taxpayers.

Here are some key reasons why Tax Form 2210 is an essential tool for taxpayers and the IRS:

- Compliance with Tax Laws: The form helps individuals comply with the Internal Revenue Code, specifically Section 6654, which outlines the requirements for paying estimated taxes. Non-compliance can result in penalties and interest charges.

- Avoiding Penalties: By using Tax Form 2210, taxpayers can calculate and pay any underpayment penalty accurately. This helps them avoid additional financial burdens and ensures they are not penalized for honest mistakes.

- Financial Planning: The process of completing Tax Form 2210 encourages taxpayers to carefully plan their estimated tax payments throughout the year. This can lead to better financial management and reduced stress during tax season.

- Fair Tax Collection: The form ensures that taxpayers with varying income streams contribute their fair share of taxes. It helps distribute the tax burden equitably among all taxpayers.

Who Needs to Use Tax Form 2210

Not every taxpayer will require Tax Form 2210. The need for this form typically arises in the following scenarios:

- Self-Employed Individuals: If you are self-employed or have income from a business, you may need to make estimated tax payments. Tax Form 2210 helps calculate any underpayment of these estimated taxes.

- Variable Income Sources: Taxpayers with fluctuating income, such as freelancers or those with multiple jobs, might have varying tax liabilities. Tax Form 2210 ensures they pay the correct amount of tax throughout the year.

- Significant Life Changes: Major life events like marriage, divorce, or a change in employment status can affect your tax liability. Tax Form 2210 helps adjust for these changes and ensure you pay the right amount of tax.

- High Income Levels: Individuals with high incomes may be required to make estimated tax payments to avoid underpayment penalties. Tax Form 2210 is crucial for these taxpayers to remain compliant.

When to File Tax Form 2210

The deadline for filing Tax Form 2210 is the same as the deadline for filing your annual tax return. Generally, this is April 15th for most taxpayers. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day.

It's important to note that late filing of Tax Form 2210 can result in penalties and interest charges. Therefore, it's advisable to stay informed about the deadlines and plan accordingly.

The Process of Completing Tax Form 2210

Completing Tax Form 2210 involves a series of steps to accurately calculate and report any underpayment of estimated taxes. Here’s a simplified guide to the process:

- Gather Information: Collect all relevant tax documents, including your annual tax return (Form 1040), estimated tax payments made during the year, and any withholding statements (Form W-2 or 1099). Ensure you have accurate records of your income and expenses.

- Calculate Estimated Tax Liability: Determine your estimated tax liability for the year. This involves estimating your taxable income, deductions, and credits. Use IRS publications and tax software to help with this calculation.

- Determine Required Quarterly Payments: Based on your estimated tax liability, calculate the required amount of quarterly estimated tax payments. Generally, these payments are due on April 15th, June 15th, September 15th, and January 15th of the following year.

- Calculate Underpayment: Compare the total amount of estimated tax payments you made during the year with the required quarterly payments. Any difference, if it results in an underpayment, will be reported on Tax Form 2210.

- Complete the Form: Fill out Tax Form 2210 accurately, providing details of your underpayment. This includes calculating the penalty for the underpayment and any applicable interest.

- File and Pay: Attach Tax Form 2210 to your annual tax return (Form 1040) and submit it by the filing deadline. Ensure you pay any additional taxes due along with your return.

It's worth mentioning that Tax Form 2210 is not a stand-alone form. It is typically filed along with Form 1040 or Form 1040-SR (U.S. Tax Return for Seniors) when filing your annual tax return.

Tips for Avoiding Underpayment Penalties

While Tax Form 2210 is designed to handle underpayment situations, it’s always better to avoid penalties altogether. Here are some tips to help you stay on track with your estimated tax payments:

- Use Tax Software: Modern tax software can help you calculate your estimated tax liability and track your payments. This can simplify the process and reduce the chances of errors.

- Make Consistent Payments: Aim to make consistent estimated tax payments throughout the year. This helps spread out your tax liability and reduces the risk of underpayment.

- Review Your Withholdings: If you have a regular job, ensure that enough tax is being withheld from your paycheck. Adjust your W-4 form if necessary to avoid underpayment.

- Consider Payment Schedules: The IRS offers different payment schedules for estimated taxes. Explore these options to find a schedule that aligns with your income and financial situation.

- Stay Informed: Keep yourself updated with tax laws and regulations. Changes in tax rates or brackets can affect your estimated tax payments.

Real-World Examples of Tax Form 2210 in Action

To better understand the practical application of Tax Form 2210, let’s look at some real-world scenarios:

Scenario 1: Self-Employed Business Owner

John, a self-employed web developer, has a successful business but his income varies significantly throughout the year. He makes estimated tax payments quarterly to cover his tax liability. However, due to a particularly busy Q4, his income exceeds his projections, resulting in an underpayment of estimated taxes. John uses Tax Form 2210 to calculate the underpayment and pays the additional tax when filing his annual return.

Scenario 2: Freelancer with Multiple Income Streams

Emily, a freelance writer, has several clients and her income fluctuates monthly. She uses Tax Form 2210 to ensure she pays the correct amount of tax throughout the year. By carefully tracking her income and expenses, Emily is able to make accurate estimated tax payments and avoid any underpayment penalties.

Scenario 3: Recent Life Changes

David recently got married and his spouse brought significant income into the household. Due to this change, their tax liability increased. David uses Tax Form 2210 to calculate any underpayment of estimated taxes and adjusts his payments accordingly to stay compliant with tax laws.

Tax Form 2210 and Its Impact on Taxpayers

Tax Form 2210 can have both positive and negative impacts on taxpayers. On one hand, it ensures compliance with tax laws and helps individuals avoid penalties. On the other hand, it can be a source of stress for those who struggle to meet their estimated tax obligations.

The complexity of tax laws and the potential for errors can make the process of completing Tax Form 2210 challenging. However, with the right guidance and tools, taxpayers can navigate this process effectively.

Resources for Taxpayers

If you’re a taxpayer facing the prospect of completing Tax Form 2210, there are several resources available to assist you:

- IRS Publications: The IRS provides detailed publications, such as Publication 505, which offers comprehensive guidance on estimated taxes and the use of Tax Form 2210. These publications are an excellent starting point for understanding your obligations.

- Tax Software: Advanced tax software, such as TurboTax or H&R Block, can simplify the process of calculating estimated taxes and completing Tax Form 2210. These tools often provide step-by-step guidance and help ensure accuracy.

- Tax Professionals: Engaging the services of a tax professional, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), can be invaluable. They can provide personalized advice and ensure your tax obligations are met accurately.

- Online Communities: Joining online tax communities or forums can provide support and insights from other taxpayers who have navigated similar situations. These communities can offer practical tips and advice.

The Future of Tax Form 2210

As technology continues to advance and tax laws evolve, the landscape of estimated tax payments and Tax Form 2210 is likely to change. Here are some potential future developments:

- Digital Transformation: The IRS is exploring ways to streamline the tax process through digital tools and platforms. This could lead to more efficient and user-friendly ways of managing estimated tax payments and completing Tax Form 2210 online.

- Simplification of Tax Laws: There is ongoing discussion about simplifying tax laws to make them more accessible and understandable for taxpayers. This could reduce the complexity of estimated tax payments and the need for forms like Tax Form 2210.

- Alternative Payment Methods: With the rise of digital currencies and blockchain technology, the IRS may explore new ways of accepting tax payments. This could lead to more flexible and secure methods for taxpayers to meet their estimated tax obligations.

While the future of Tax Form 2210 is uncertain, the underlying principle of estimated tax payments is likely to remain a vital part of the tax system. It ensures fairness and financial stability, especially for those with varying income streams.

Final Thoughts

Tax Form 2210 is a critical component of the tax landscape, especially for individuals with unique income situations. While it may seem complex, understanding its purpose and following the guidelines can help taxpayers stay compliant and avoid penalties. With the right tools and resources, managing estimated tax payments can become a more manageable part of the tax process.

Frequently Asked Questions

What happens if I don’t file Tax Form 2210 when required?

+

Failure to file Tax Form 2210 when required can result in penalties and interest charges. It’s important to stay compliant to avoid additional financial burdens.

Can I use Tax Form 2210 to claim a refund for overpayment of estimated taxes?

+

No, Tax Form 2210 is specifically for calculating and reporting underpayment of estimated taxes. If you believe you’ve overpaid your estimated taxes, you can claim a refund through your annual tax return (Form 1040) or Form 1040-X (Amended U.S. Individual Income Tax Return).

Are there any exceptions to the requirement for filing Tax Form 2210?

+

Yes, there are certain exceptions. For example, if your tax liability for the year is below a certain threshold (currently $1,000), you may not be required to file Tax Form 2210. Additionally, there are special rules for certain types of taxpayers, such as farmers and fishermen.

Can I pay my estimated taxes using Tax Form 2210 itself?

+

No, Tax Form 2210 is solely for calculating and reporting underpayment of estimated taxes. You need to use separate payment methods, such as electronic funds transfer or check, to make your estimated tax payments.

Where can I find more detailed information about Tax Form 2210 and its requirements?

+

For comprehensive information, refer to IRS Publication 505, which provides detailed guidelines on estimated taxes and the use of Tax Form 2210. You can also consult a tax professional or use reliable tax software for guidance.