What Is The Sales Tax In Nyc

Navigating the sales tax landscape is crucial when conducting business in New York City (NYC), as it directly impacts pricing strategies, customer expectations, and overall profitability. The sales tax in NYC is a complex but essential aspect of doing business in this vibrant metropolis. Let's delve into the specifics to understand its intricacies and implications.

Understanding the NYC Sales Tax

The sales tax in NYC is a vital component of the city’s revenue stream, contributing significantly to the funding of public services and infrastructure. It is imposed on the sale of tangible personal property and certain services within the city limits. Understanding the intricacies of this tax is crucial for businesses and consumers alike, as it directly affects pricing, budgeting, and compliance with tax regulations.

The sales tax in NYC is administered by the New York State Department of Taxation and Finance, with specific rates and regulations set at the state and local levels. The tax is calculated as a percentage of the sale price, and the rates can vary depending on the type of product or service being sold, as well as the location of the sale.

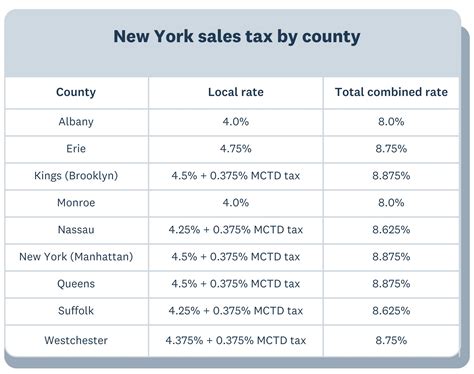

Current Sales Tax Rates in NYC

As of my last update in January 2023, the sales tax rates in NYC are as follows:

| Sales Tax Type | Rate |

|---|---|

| General Sales Tax | 4.5% |

| City Sales Tax | 4.875% |

| Total NYC Sales Tax | 9.375% |

These rates are subject to change, so it is essential to stay updated with the latest information from official sources. The general sales tax is a state-wide rate, while the city sales tax is specific to NYC, reflecting the additional revenue needs of the city government.

Sales Tax Exemptions and Special Cases

It’s important to note that not all products and services are subject to the full sales tax rate. There are various exemptions and special cases that can apply, such as:

- Certain groceries and food items may be exempt from sales tax or have a reduced tax rate.

- Clothing and footwear below a certain price threshold may also be exempt.

- Sales tax on prescription drugs is generally not applicable.

- Some services, like professional services or repairs, might be subject to a different tax rate or be exempt altogether.

These exemptions can vary based on state and local regulations, so businesses operating in NYC should stay informed about the specific rules that apply to their industry and product offerings.

Compliance and Reporting

Compliance with sales tax regulations is a serious matter for businesses in NYC. Failure to collect and remit sales tax accurately can result in penalties and legal consequences. Businesses are responsible for understanding the applicable tax rates, calculating sales tax correctly, and remitting the collected taxes to the appropriate tax authority.

The New York State Department of Taxation and Finance provides resources and guidance to help businesses navigate the sales tax landscape. They offer online tools for tax registration, filing, and payment, making it easier for businesses to meet their tax obligations.

Impact on Business Operations

The sales tax in NYC has a significant impact on how businesses operate and how consumers perceive prices. Here are some key considerations:

Pricing Strategies

Businesses must factor in the sales tax when setting their pricing strategies. Including the sales tax in the displayed price can provide transparency to customers, while excluding it may require additional calculations at the point of sale. Clear communication about pricing is essential to avoid confusion and build trust with customers.

Customer Expectations

Customers in NYC are generally aware of the sales tax and expect it to be included in the final price. Clearly displaying the sales tax rate or providing a breakdown of the tax on receipts can help manage customer expectations and avoid surprises at the point of purchase.

Profitability and Cost Management

Sales tax is a cost of doing business in NYC, and businesses must account for it when calculating their profit margins. Efficient tax management can help minimize costs and ensure that the business remains competitive in the market.

Online Sales and E-commerce

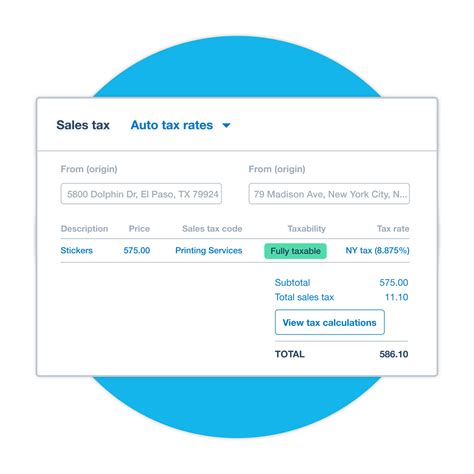

For businesses conducting online sales, understanding the sales tax implications is crucial. The rules for online sales can vary depending on the location of the customer and the nature of the transaction. Utilizing sales tax automation tools can help ensure compliance and accuracy in calculating and collecting sales tax for online orders.

Future Outlook and Considerations

The sales tax landscape in NYC is subject to ongoing changes and developments. Here are some key considerations for the future:

Potential Rate Changes

Sales tax rates can fluctuate based on economic conditions and government policies. Businesses should stay informed about any proposed or implemented rate changes to adapt their pricing and budgeting strategies accordingly.

Tax Automation and Technology

Advancements in technology have led to the development of sales tax automation tools and software. These tools can help businesses streamline their tax compliance processes, reducing the risk of errors and improving efficiency. Investing in such technologies can be a strategic move for businesses looking to optimize their tax management practices.

Tax Reform and Policy Changes

The sales tax system is periodically reviewed and reformed to address changing economic conditions and revenue needs. Businesses should monitor any proposed or enacted tax reforms that could impact their operations. Staying informed about these changes can help businesses plan and adapt their strategies effectively.

Conclusion

Understanding the sales tax in NYC is essential for businesses and consumers alike. By staying informed about the current rates, exemptions, and compliance requirements, businesses can navigate the tax landscape effectively and maintain their competitive edge. For consumers, understanding the sales tax helps manage expectations and make informed purchasing decisions.

As the city's economic landscape evolves, so too will the sales tax system. Staying attuned to these changes will be crucial for all stakeholders in the NYC business community.

How often do sales tax rates change in NYC?

+Sales tax rates can change periodically, often as a result of legislative actions or economic conditions. It is advisable to check for updates annually, as changes may occur.

Are there any resources available to help businesses calculate and manage sales tax?

+Yes, the New York State Department of Taxation and Finance provides online tools and resources to assist businesses with sales tax calculation, registration, and filing. These resources can be invaluable for ensuring compliance and accuracy.

What happens if a business fails to collect or remit sales tax correctly?

+Failure to comply with sales tax regulations can result in penalties, interest charges, and legal consequences. It is crucial for businesses to understand their obligations and seek professional guidance if needed.