New Jersey Sales Tax

Welcome to the comprehensive guide on the intricacies of New Jersey Sales Tax, a critical component of the state's fiscal landscape. As one of the most densely populated states in the US, New Jersey's sales tax structure plays a pivotal role in its economic framework. This guide aims to demystify the complexities of this tax system, offering an in-depth analysis for residents, businesses, and anyone with an interest in understanding the financial heartbeat of the Garden State.

The Essentials of New Jersey Sales Tax

New Jersey’s sales tax, a state-level levy, is a consumption tax imposed on the sale of tangible personal property and certain services. It is a vital revenue stream for the state, contributing significantly to its overall budget. The tax is administered by the New Jersey Division of Taxation, which provides guidelines, collects revenue, and ensures compliance with the state’s tax laws.

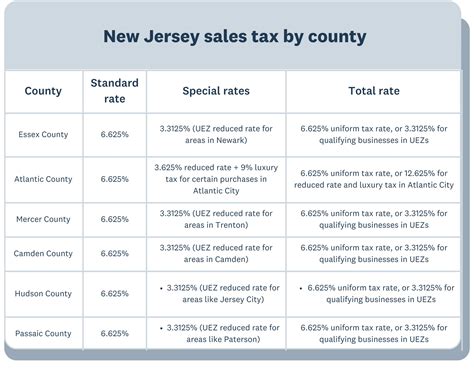

The current statewide sales tax rate in New Jersey is 6.625%, which includes a base rate of 6.625% and an additional 0% rate for most tangible personal property. This rate is applied uniformly across the state, making it a consistent factor in consumer spending and business transactions.

Taxable Items and Exemptions

The scope of New Jersey’s sales tax is broad, covering a wide array of goods and services. Tangible personal property, such as clothing, electronics, and furniture, is generally subject to sales tax. However, certain items like food products (excluding prepared meals), prescription drugs, and residential utility services are exempt.

Additionally, the state offers specific exemptions for select categories. For instance, sales to government entities, non-profit organizations, and some religious institutions are often exempt. Understanding these exemptions is crucial for businesses to ensure they are compliant with the law and not overcharging their customers.

| Taxable Item | Tax Rate |

|---|---|

| Tangible Personal Property | 6.625% |

| Prepared Meals | 10.875% |

| Lodging | 7% |

| Admission to Events | 7% |

Sales Tax Registration and Compliance

For businesses operating in New Jersey, sales tax registration is a critical step. The state requires businesses to register with the Division of Taxation if they meet certain criteria, such as having a physical presence in the state or engaging in remote sales. This registration ensures that businesses can collect and remit sales tax accurately.

Compliance with sales tax regulations is not just a legal obligation; it's a strategic aspect of business management. Accurate sales tax reporting and payment can prevent legal issues and foster a positive relationship with the state. Businesses can utilize sales tax software to streamline this process, ensuring timely and accurate tax calculations and payments.

Sales Tax Calculation and Collection

Calculating sales tax accurately is fundamental for businesses. New Jersey’s sales tax is applied to the total sale amount, including any shipping or handling charges. For businesses selling both taxable and exempt items, understanding how to allocate sales tax correctly is essential.

Once calculated, the sales tax is collected at the point of sale from the customer. It's important to note that the sales tax is a pass-through tax, meaning the business acts as a collection agent for the state. The collected tax is then remitted to the state at regular intervals, typically monthly or quarterly, depending on the business's tax liability.

Impact on Businesses and Consumers

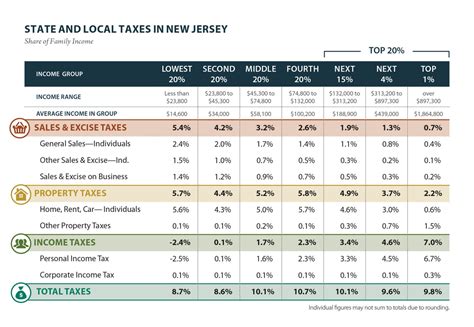

New Jersey’s sales tax structure has a profound impact on both businesses and consumers. For businesses, the tax influences pricing strategies, operational costs, and overall profitability. It also affects consumer behavior, influencing purchasing decisions and patterns.

From a consumer perspective, understanding sales tax is crucial for making informed buying decisions. The tax can significantly impact the total cost of a purchase, especially for higher-priced items. Additionally, consumers should be aware of their rights and obligations regarding sales tax, especially when purchasing goods online or from out-of-state retailers.

Online Sales and Tax Collection

With the rise of e-commerce, the collection of sales tax from online sales has become a critical issue. New Jersey, like many states, has implemented laws to ensure that online retailers collect and remit sales tax. This includes requirements for remote sellers to register with the state and collect sales tax on transactions with New Jersey residents.

Businesses selling online should be aware of these laws and ensure they are compliant. This often involves using sales tax automation tools to accurately calculate and collect sales tax based on the buyer's location. Failure to comply can result in penalties and legal repercussions.

Future of New Jersey Sales Tax

As the economic landscape evolves, so too will New Jersey’s sales tax system. The state may consider adjustments to its tax rates or exemptions to align with changing economic conditions or policy priorities. For instance, discussions around sales tax holidays or specific exemptions for certain industries are not uncommon.

Additionally, the increasing role of technology in tax administration will likely continue. This includes the potential for further automation and digital transformation in sales tax collection and reporting processes, offering increased efficiency and accuracy.

Tax Reform and Policy Considerations

New Jersey, like many states, faces ongoing debates about tax reform. This includes discussions around the fairness and efficiency of the sales tax system. Policy makers may consider reforms to ensure the tax system remains equitable, supports economic growth, and aligns with the state’s fiscal needs.

These reforms could involve adjustments to tax rates, expanding or narrowing the tax base, or implementing new tax structures. For instance, there have been discussions about the potential for a value-added tax (VAT) system, which could offer a more comprehensive and efficient approach to consumption taxation.

Conclusion: Navigating the Landscape

New Jersey’s sales tax system is a dynamic and integral part of the state’s economic framework. For businesses and consumers alike, understanding and navigating this system is crucial for compliance, strategic planning, and informed decision-making.

By staying informed about the latest tax laws, regulations, and potential reforms, businesses can ensure they are operating within the boundaries of the law and maximizing their competitive advantage. Similarly, consumers can make more informed choices, understand their rights, and contribute to a fair and efficient tax system.

What is the current sales tax rate in New Jersey for 2024?

+

The current sales tax rate in New Jersey for 2024 remains at 6.625%.

Are there any sales tax holidays in New Jersey?

+

New Jersey does not currently have sales tax holidays. However, this can change based on legislative decisions, so it’s important to stay updated.

How often do sales tax rates change in New Jersey?

+

Sales tax rates in New Jersey can change periodically, typically as a result of legislative actions. It’s advisable to check for updates annually to ensure compliance with the latest rates.

Are there any special sales tax rates for specific industries in New Jersey?

+

Yes, New Jersey has specific sales tax rates for certain industries, such as a 10.875% rate for prepared meals and a 7% rate for lodging and admission to events. It’s crucial to check these rates for industry-specific transactions.