South Carolina Tax Rate

The tax landscape in South Carolina is an intricate system that plays a pivotal role in the state's economic framework. Understanding the various tax rates and their implications is essential for both residents and businesses alike. This comprehensive guide aims to unravel the complexities of South Carolina's tax structure, offering a detailed analysis of the state's tax policies and their practical applications.

An In-Depth Exploration of South Carolina's Tax Rates

South Carolina, nestled in the southeastern region of the United States, boasts a diverse economy and a unique tax system. The state's tax policies significantly influence its economic growth and attract businesses and investors. Let's delve into the specifics of South Carolina's tax rates and uncover the intricacies that shape its fiscal landscape.

Income Tax Rates: A Comprehensive Breakdown

South Carolina operates a progressive income tax system, meaning that higher incomes are taxed at higher rates. This structure ensures fairness and contributes to the state's revenue generation. The income tax rates are divided into six brackets, with the highest rate applicable to incomes above a certain threshold.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $2,969 | 0% |

| $2,970 - $5,929 | 3% |

| $5,930 - $9,879 | 4% |

| $9,880 - $12,869 | 5% |

| $12,870 - $15,859 | 6% |

| $15,860 and above | 7% |

These income tax rates are applicable to both single filers and married couples filing jointly. For married individuals filing separately, the income brackets are adjusted accordingly.

Sales and Use Tax: A Dual Approach

South Carolina employs a dual sales and use tax system, where sales tax is levied on retail sales, and use tax is applied to purchases made outside the state but used within South Carolina.

- Sales Tax: The general sales tax rate in South Carolina is 6%, which is applicable to most goods and services. However, certain items, such as groceries, medications, and certain industrial machinery, are exempt from sales tax.

- Use Tax: Use tax is charged at the same rate as sales tax (6%) and is applicable when goods or services are purchased from out-of-state vendors but used or consumed within South Carolina. This ensures that regardless of the purchase location, the state receives its due revenue.

It's important to note that some localities in South Carolina may impose additional sales and use taxes, known as local option taxes, to fund specific projects or initiatives. These additional taxes can vary across counties and municipalities.

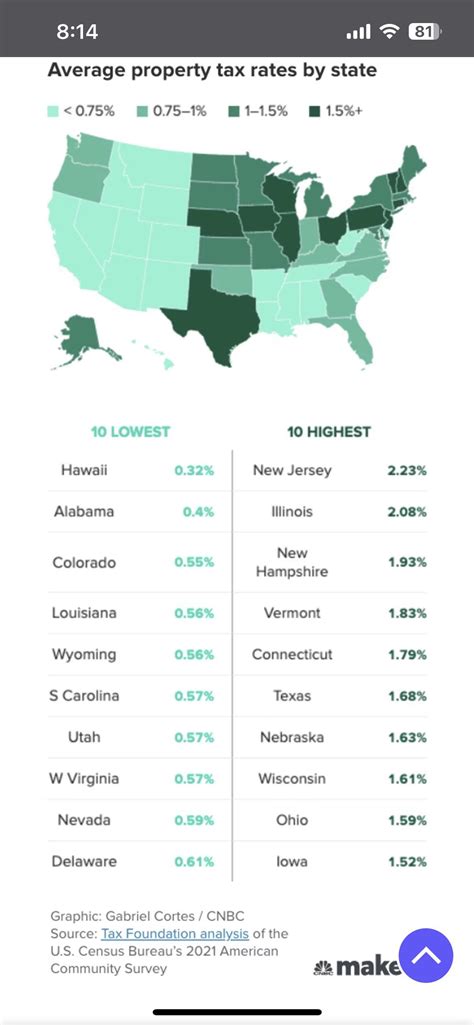

Property Tax: A Localized Perspective

Property taxes in South Carolina are assessed and collected at the county level, resulting in varying rates across the state. The property tax rate is typically expressed as a millage rate, which represents the amount of tax per $1,000 of assessed property value.

For instance, if a county has a millage rate of 100 mills, it equates to $100 in taxes for every $1,000 of assessed property value. These rates can fluctuate based on the county's budget requirements and the assessed value of properties within the jurisdiction.

Property owners in South Carolina can benefit from certain exemptions and deductions, such as the Homestead Exemption, which reduces the assessed value of a primary residence for tax purposes.

Corporate Income Tax: Attracting Businesses

South Carolina's corporate income tax structure is designed to be business-friendly, offering a competitive tax environment to attract and retain businesses. The corporate income tax rate stands at 5%, which is applied to the net income of corporations doing business within the state.

Additionally, South Carolina provides various tax incentives and credits to businesses, particularly those engaged in specific industries or investing in certain regions of the state. These incentives aim to stimulate economic growth and job creation.

Estate and Inheritance Taxes: A Simplified Approach

South Carolina has a straightforward approach to estate and inheritance taxes. The state does not impose an estate tax, which is a tax on the transfer of a deceased person's estate to their heirs. Similarly, South Carolina does not levy an inheritance tax, which is a tax on the recipients of an estate.

This absence of estate and inheritance taxes simplifies the process for families and individuals inheriting assets, making South Carolina an attractive state for estate planning.

Fuel and Motor Vehicle Taxes: Supporting Infrastructure

South Carolina levies taxes on fuel and motor vehicles to fund its transportation infrastructure. The state imposes a gasoline tax of 16.75 cents per gallon, which is dedicated to maintaining and improving roads and bridges.

Additionally, motor vehicle registration fees are charged based on the vehicle's weight and age. These fees contribute to the state's transportation fund, ensuring the continued development and upkeep of its road network.

Other Taxes and Fees: A Comprehensive Overview

South Carolina's tax system encompasses a range of other taxes and fees to support various state services and initiatives. These include:

- Lodging Tax: A tax levied on hotel and motel stays, contributing to tourism development and promotion.

- Alcoholic Beverage Tax: Taxes on the sale of alcoholic beverages, with rates varying based on the type of beverage.

- Cigarette Tax: A tax on cigarette sales, with the revenue often allocated to healthcare initiatives and tobacco prevention programs.

- Gaming and Amusement Tax: Taxes on gaming activities and amusement establishments, supporting the state's entertainment industry.

- Severance Taxes: Taxes on the extraction of natural resources, such as minerals and timber, contributing to the state's revenue and environmental conservation efforts.

Analyzing the Impact of South Carolina's Tax Rates

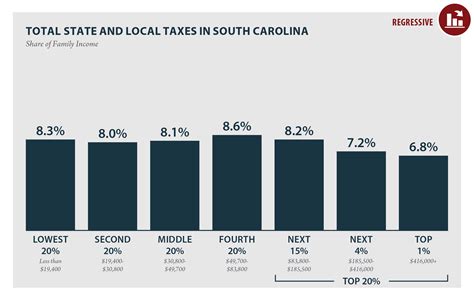

South Carolina's tax policies have a profound impact on the state's economy and its residents. The progressive income tax structure ensures that higher-income earners contribute proportionally more, fostering economic fairness. The business-friendly corporate tax rates and incentives attract and retain businesses, stimulating economic growth and job creation.

The absence of estate and inheritance taxes simplifies estate planning and makes South Carolina an attractive destination for high-net-worth individuals. The dual sales and use tax system ensures that the state receives its due revenue, while the localized property tax system allows counties to tailor their tax rates to meet their specific budgetary needs.

However, it's essential to consider the potential drawbacks and challenges associated with South Carolina's tax rates. The varying local sales and use tax rates can create complexities for businesses operating across multiple counties, necessitating careful tax planning. Additionally, the property tax system, while providing flexibility to counties, can result in higher tax burdens for property owners in certain regions.

Furthermore, while South Carolina's tax rates are generally competitive, ongoing economic trends and legislative changes can impact the state's fiscal landscape. It's crucial for individuals and businesses to stay informed about any tax policy updates to ensure compliance and maximize their tax strategies.

Future Implications and Potential Reforms

As South Carolina's economy continues to evolve, the state's tax policies will play a crucial role in shaping its future. The current tax system has proven effective in attracting businesses and promoting economic growth, but ongoing analysis and potential reforms are essential to adapt to changing economic conditions.

One potential area of reform could involve revisiting the state's sales tax structure. While the current system is relatively straightforward, the absence of certain exemptions, such as sales tax on groceries, can impact low-income households disproportionately. Exploring options to provide relief to these households, such as a sales tax holiday or targeted exemptions, could be a potential avenue for reform.

Additionally, as remote work and e-commerce continue to rise, the state may need to reconsider its approach to use tax. Ensuring that the use tax system remains effective in capturing revenue from out-of-state purchases will be crucial for maintaining a balanced tax structure.

Furthermore, with the ongoing debate surrounding tax fairness and progressive taxation, South Carolina may explore options to further enhance its progressive income tax system. This could involve adjustments to tax brackets or the introduction of additional tax credits to support lower-income earners.

In conclusion, South Carolina's tax rates and policies are a complex yet crucial aspect of the state's economic framework. By understanding the intricacies of these tax structures, individuals and businesses can navigate the state's fiscal landscape effectively. As South Carolina continues to evolve, ongoing analysis and potential reforms will ensure that its tax system remains competitive, equitable, and adaptable to the changing economic landscape.

How often are South Carolina’s tax rates reviewed and updated?

+South Carolina’s tax rates are typically reviewed and updated annually or biennially by the state legislature. These reviews consider factors such as economic trends, revenue needs, and taxpayer feedback.

Are there any tax incentives for businesses operating in specific industries in South Carolina?

+Yes, South Carolina offers various tax incentives to businesses, particularly those engaged in manufacturing, research and development, and specific high-growth industries. These incentives aim to attract and support business growth.

What is the impact of South Carolina’s property tax system on homeowners and businesses?

+The localized property tax system in South Carolina allows counties to set their tax rates, resulting in varying property tax burdens across the state. While this provides flexibility, it can lead to higher taxes for homeowners and businesses in certain regions.