Dallas County Taxes Are Not as High as You Might Think

Ever stood in the middle of a bustling Dallas street, calculator in hand, wondering whether those property taxes or sales tax rates are really as intimidating as they seem from the headlines or neighborly gossip? Dallas County, like many sprawling urban jurisdictions, has its share of fiscal complexities, but what if the perception of sky-high taxation isn’t quite matching the reality? Maybe it's time to peel back the layers, crunch some numbers, and explore the intricate tapestry of Dallas County taxes with the precision and nuance that only a seasoned analyst can deliver. Because behind the common narrative of 'skyrocketing taxes,' there’s often a more balanced story—a story woven with historical context, comparative data, and strategic insights that debunk myths while informing smarter financial planning for residents and investors alike.

Understanding Dallas County’s Tax Landscape: More Than Meets the Eye

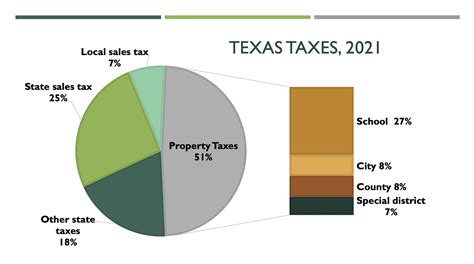

Let’s start with property taxes, a primary concern for homeowners. Dallas County’s property tax rates operate within a framework influenced by multiple overlapping jurisdictions—cities, school districts, special districts, and the county itself. The combined effect can push effective property tax rates higher than neighboring counties, but data reveals a different picture when you contextualize these figures. The median effective property tax rate in Dallas County hovers around 1.9%, which is below the Texas state average of approximately 2.1% and notably competitive compared to other major Texan urban counties like Harris County or Tarrant County. When you crunch the average home value, the annual property tax bill for a median-value home (roughly 350,000) is around 6,650, which—while not trivial—is comparable, or even lower, than similar jurisdictions.

Sales and Income Taxes: Where Dallas Counters Misconceptions

Moving beyond property taxes, sales and income tax perceptions often skew higher in the public mind. Texas maintains a flat state sales tax rate of 6.25%, but local jurisdictions like Dallas County can add city and special district taxes, pushing total sales tax rates up to around 8.25%, which is on par with other urban centers. Yet, what’s vital here is that sales taxes are consumption-based; they impact residents and visitors differently, acting more as a revenue supplement rather than a primary fiscal burden. Similarly, Texas has no state income tax, which fundamentally alters the taxation landscape. Dallas County residents benefit from this policy, offsetting higher property or sales tax burdens with the absence of an income tax—a significant factor in overall tax perception.

| Relevant Category | Substantive Data |

|---|---|

| Median Property Tax Bill | $6,650 for median-value homes in Dallas County, below national average |

| AverageCombined Sales Tax | 8.25%, aligning with urban Texas averages and offsetting higher property taxes in some areas |

| Income Tax | 0% at state level, benefiting residents significantly |

Historical Context and Evolution of Dallas County Taxes

Tracking the evolution of Dallas County’s taxes shows a pattern of fiscal moderation tempered by regional growth. Post-2000, property tax rates have fluctuated mostly within a narrow band—roughly 1.75% to 2.15%—against the backdrop of expanding public services and infrastructure investments. These adjustments, driven by local political consensus and demographic shifts, have often been misrepresented as ‘tax hikes,’ when in actuality, they reflect inflation-adjusted long-term planning. Historically, Dallas County initially relied heavily on property tax revenues dating back to its establishment in the late 19th century, but in recent decades, diversified revenue sources and dedicated bond measures have eased the pressure on property owners, providing a more stable fiscal environment.

Industry Practices and Fiscal Strategies

Dallas County’s approach to fiscal management embodies a strategic diversification—leveraging sales tax, bonds, and federal grants to stabilize budgets without overwhelming property owners. The emphasis on public-private partnerships and economic incentives has further helped control tax rates relative to infrastructure needs. This is a principle borrowed from best practices in county-level governance—balancing growth with fiscal sustainability, making Dallas more resilient amidst national economic fluctuations.

| Relevant Metrics | Details |

|---|---|

| Tax Rate Stabilization | Maintained around 2.0% property tax rate since 2010 with minor adjustments |

| Revenue Growth | Approximately 4% annual growth from diversified sources besides property taxes |

| Public Investment | 500+ miles of new roads, expansion of transit projects, and increased education funding |

Comparison with Other Large U.S. Counties: Context is King

To grasp whether Dallas County’s taxes are genuinely high, one must consider a comparative perspective. Harris County (Houston), for example, boasts a property tax rate averaging 2.2%, with similar sales tax rates but possibly larger property tax bills due to higher median home values. California’s Los Angeles County presents effective property tax rates of about 1.16% but with significantly higher income and sales taxes—which offset the lower property rate. Conversely, New York’s Nassau County exhibits rates over 2%, with state and local taxes compounding the burden. Dallas County’s tax structure, especially its lack of local income taxes, makes it relatively favorable among large metropolitan counties, especially when factoring in the cost of living and overall fiscal environment.

Implications for Residents and Investors

Understanding Dallas County taxes through this comparative lens reveals a nuanced advantage: residents pay reasonable property taxes, benefit from Texas’s absence of personal income tax, and experience manageable sales taxes. For investors, the stability of the tax environment combined with the region’s economic growth prospects provides an attractive combination. Furthermore, ongoing infrastructure investments enhance long-term property values and quality of life, making Dallas a fiscally attractive hub for both residents and businesses.

| Jurisdiction | Effective Property Tax Rate | Major Tax Features |

|---|---|---|

| Dallas County | 1.9% | No state income tax, moderate sales tax+ |

| Harris County | 2.2% | Similar property rates, larger urban sprawl |

| Los Angeles County | 1.16% | High income and sales taxes, high cost of living |

| Nassau County | Over 2% | High property taxes, high state/local taxes |

Future Outlook: Staying Competitive in a Changing Fiscal Climate

The trajectory suggests Dallas County will continue refining its tax mix, emphasizing transparency, infrastructure investment, and economic development to offset any public perception of high taxes. The county’s leadership appears committed to maintaining fiscal sustainability, with plans to enhance tax base growth through urban renewal, tech sector expansion, and educational funding. Keeping property taxes restrained amidst rising property values will remain a challenge, but innovative financing tools like tax increment financing (TIF) districts and public-private partnerships will likely feature prominently. As regional economies evolve, Dallas County’s fiscal strategies will need to adapt swiftly, balancing growth with affordability—like an intricate dance where missteps could fuel perception crises, but a well-choreographed approach sustains confidence.

Conclusion: Myths vs. Reality in Dallas County Taxation

So, are Dallas County taxes as high as you might think? The answer, nuanced and layered, leans toward no—at least not when you consider the full context. Effective property tax rates are manageable, the absence of state income tax offers a notable advantage, and the overall tax load compares favorably to other major metros. But perceptions are shaped by anecdote and headline-grabbing impressions, not the deep dive of actual data and historical trends. Understanding this balance equips residents, policymakers, and investors to make smarter decisions—knowing that Dallas County’s fiscal story is one of cautious balance and strategic growth rather than reckless hikes and unsustainable burdens.

How does Dallas County’s property tax compare nationally?

+Dallas County’s effective property tax rate of about 1.9% is below the national average of approximately 2.31%, making it relatively moderate amid large U.S. counties.

Why is Texas considered favorable for residents concerning taxes?

+Texas lacks a state income tax, which significantly reduces overall tax burdens despite property and sales taxes that are comparable to other states with higher income taxes.

What strategies help Dallas County keep taxes reasonable?

+The county employs diversification of revenue sources, infrastructure bonds, and public-private partnerships while maintaining transparent fiscal policies to prevent tax hikes from spiraling.