Arapahoe County Property Taxes

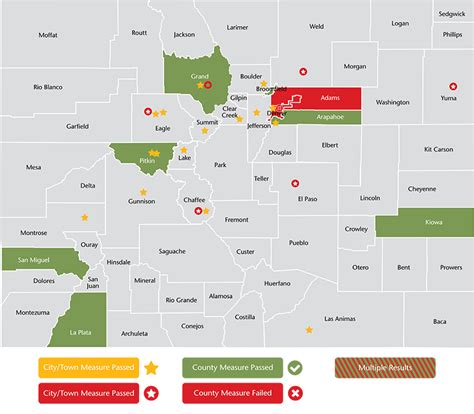

Arapahoe County, located in the state of Colorado, USA, is renowned for its diverse landscapes, vibrant communities, and thriving economy. However, when it comes to property ownership, one of the key concerns for residents and prospective buyers is understanding the property tax system. Arapahoe County's property taxes are an essential aspect of local government funding, contributing to vital services and infrastructure development. In this comprehensive guide, we delve into the intricacies of Arapahoe County property taxes, exploring how they are calculated, the assessment process, and the various factors influencing tax rates.

Understanding the Property Tax Landscape in Arapahoe County

Arapahoe County, like many other counties across the United States, relies on property taxes as a significant source of revenue to fund essential public services. These services encompass a wide range of areas, including education, public safety, transportation, and healthcare. Property taxes are levied on both residential and commercial properties within the county, with the revenue generated being distributed among various local government entities, such as the county government, school districts, and special districts.

The property tax system in Arapahoe County is governed by state and local laws, ensuring a fair and equitable approach to taxation. The county assessor's office plays a pivotal role in this process, responsible for assessing the value of each property and determining the applicable tax rate. This assessment is crucial, as it forms the basis for calculating the annual property tax liability for each property owner.

Key Factors Influencing Property Tax Rates

Several factors come into play when determining the property tax rate in Arapahoe County. These factors are carefully considered to ensure a balanced and sustainable tax structure. Here are some of the key elements that influence property tax rates:

- Property Value: The assessed value of a property is a critical factor in determining the tax liability. The county assessor evaluates the property's market value, considering factors such as its location, size, improvements, and recent sales data. Properties with higher assessed values generally incur higher tax rates.

- Tax Mill Levy: The tax mill levy, often referred to as the "mill rate," is a crucial component of the property tax equation. It represents the number of mills (one-thousandth of a dollar) assessed per dollar of assessed property value. The mill levy is determined by the county commissioners and other taxing authorities, taking into account the revenue needs of various local government entities.

- Tax Districts and Boundaries: Arapahoe County is divided into multiple tax districts, each with its own unique mill levy. These districts may encompass different municipalities, school districts, or special districts. Property owners may be subject to multiple tax districts, each with its own assessment and tax rate, depending on their property's location.

- Special Assessments: In addition to the regular property tax, property owners may be subject to special assessments. These assessments are levied for specific purposes, such as funding local improvement projects, providing fire protection services, or maintaining infrastructure. Special assessments are typically added to the regular property tax bill and are based on the property's location and the services provided.

- Exemptions and Credits: Arapahoe County offers various exemptions and tax credits to eligible property owners. These exemptions can reduce the assessed value of a property, resulting in lower tax liability. Common exemptions include homestead exemptions for primary residences, veteran's exemptions, and senior citizen exemptions. Additionally, tax credits may be available for energy-efficient improvements or historic preservation efforts.

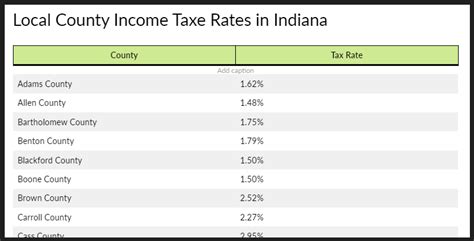

| Tax District | Mill Levy (2023) |

|---|---|

| Arapahoe County | 44.750 |

| Cherry Creek School District | 53.787 |

| Littleton Fire Protection District | 13.778 |

| Littleton Water & Sanitation District | 2.540 |

| Highline Canal Conservancy District | 0.320 |

The Assessment Process: Determining Property Values

The assessment process is a critical step in calculating property taxes. In Arapahoe County, the assessor’s office employs a systematic approach to evaluate property values, ensuring fairness and accuracy. Here’s an overview of the assessment process:

- Mass Appraisal: The assessor's office utilizes mass appraisal techniques to assess the value of all properties within the county. This method involves analyzing market trends, sales data, and other relevant factors to determine the fair market value of each property. Mass appraisal ensures consistency and uniformity in the assessment process.

- Physical Inspection: In certain cases, the assessor's office may conduct physical inspections of properties to verify their characteristics and condition. These inspections help assessors accurately capture improvements, additions, or changes that may impact the property's value. Physical inspections are typically conducted on a random basis or for specific purposes, such as new construction or significant renovations.

- Sales Ratio Studies: Sales ratio studies are conducted to analyze the relationship between assessed values and actual sales prices. These studies help the assessor's office ensure that assessed values are in line with market trends and maintain a fair and equitable assessment system. Sales ratio studies are particularly important in identifying any disparities or anomalies in the assessment process.

- Property Classification: Arapahoe County classifies properties into different categories based on their usage. Residential, commercial, agricultural, and industrial properties are assessed differently, taking into account their unique characteristics and market dynamics. Property classification plays a crucial role in determining the applicable tax rate and ensuring fairness among different property types.

- Notice of Valuation: Property owners receive a Notice of Valuation from the assessor's office, informing them of the assessed value of their property. This notice provides an opportunity for property owners to review the assessment and, if necessary, initiate an appeal process. Property owners can dispute the assessed value if they believe it is inaccurate or inconsistent with market conditions.

Appealing Property Assessments

Property owners in Arapahoe County have the right to appeal their property assessments if they believe the assessed value is incorrect or unfair. The appeal process is designed to provide an opportunity for property owners to present evidence and arguments to support their case. Here’s a step-by-step guide to appealing property assessments:

- Review the Notice of Valuation: Carefully review the Notice of Valuation received from the assessor's office. This notice will provide detailed information about the assessed value, including the property's characteristics, comparable sales data, and the basis for the assessment.

- Gather Evidence: Collect relevant evidence to support your case. This may include recent sales data of similar properties, appraisals, photographs, or any other documentation that demonstrates the inaccuracy of the assessed value. It's important to gather evidence that is specific to your property and its unique circumstances.

- File an Appeal: Submit an appeal with the Arapahoe County Board of Equalization within the specified deadline. The appeal should include a detailed explanation of why you believe the assessed value is incorrect, along with the supporting evidence. The Board of Equalization is an independent body responsible for reviewing and resolving assessment appeals.

- Hearing: If your appeal is accepted, you will be scheduled for a hearing before the Board of Equalization. During the hearing, you will have the opportunity to present your case, provide testimony, and answer questions. It's beneficial to prepare a clear and concise presentation, highlighting the key points that support your appeal.

- Decision: The Board of Equalization will review your appeal and make a decision based on the evidence presented. They may uphold the original assessment, adjust the assessed value, or provide other recommendations. The decision will be communicated to you in writing, along with the reasons for their determination.

Understanding Your Property Tax Bill

When it comes to property taxes, one of the most crucial aspects for property owners is understanding their tax bill. In Arapahoe County, property tax bills provide a detailed breakdown of the taxes owed, allowing property owners to review and analyze their liability. Here’s a breakdown of the key components of a typical Arapahoe County property tax bill:

- Property Information: The tax bill includes essential details about the property, such as the address, legal description, and parcel number. This information helps property owners identify their specific property and ensure they are receiving the correct tax bill.

- Assessed Value: The assessed value of the property is prominently displayed on the tax bill. This value represents the market value of the property as determined by the assessor's office. It serves as the basis for calculating the property taxes owed.

- Tax Mill Levy: The tax mill levy, or mill rate, is clearly stated on the tax bill. This rate is applied to the assessed value to calculate the property taxes. The mill levy is determined by the county commissioners and other taxing authorities, as mentioned earlier.

- Tax Districts and Rates: The tax bill provides a breakdown of the tax districts in which the property is located. Each tax district is associated with a specific mill levy, and the tax bill outlines the rate for each district. This information helps property owners understand the contribution of each district to their overall tax liability.

- Special Assessments: If applicable, special assessments are listed separately on the tax bill. These assessments are typically identified by their purpose, such as fire protection, infrastructure improvements, or specific district-level projects. The amount of the special assessment is added to the regular property tax liability.

- Exemptions and Credits: The tax bill also includes information about any exemptions or tax credits that have been applied to the property. These exemptions or credits reduce the assessed value or the taxable value of the property, resulting in a lower tax liability. Common exemptions and credits are noted on the bill, providing transparency for property owners.

- Payment Due Dates: The tax bill specifies the due dates for property tax payments. Arapahoe County typically offers two payment options: a single annual payment or semi-annual payments. The due dates are clearly indicated, allowing property owners to plan their finances accordingly.

- Penalty and Interest Charges: The tax bill provides information about potential penalty and interest charges if payments are not made by the due dates. Late payments may incur additional fees, so it's important for property owners to stay aware of these consequences and make timely payments.

Online Tax Payment and Resources

Arapahoe County offers convenient online services for property owners to access their tax information and make payments. The county’s official website provides a dedicated portal for property tax payments, allowing property owners to view their tax bills, make secure online payments, and track the status of their payments. This online platform streamlines the payment process and provides real-time updates.

Additionally, the Arapahoe County Treasurer's office maintains a comprehensive resource section on its website. This section includes valuable information about property taxes, assessment processes, exemption programs, and payment options. Property owners can find answers to frequently asked questions, download relevant forms, and access helpful guides to navigate the property tax system effectively.

Conclusion: Navigating Arapahoe County’s Property Tax System

Understanding the property tax system in Arapahoe County is essential for property owners to make informed decisions and effectively manage their tax obligations. From the assessment process to the breakdown of tax rates and the appeal process, this comprehensive guide has provided an in-depth analysis of the key aspects of Arapahoe County property taxes.

By staying informed about the factors influencing tax rates, the assessment process, and the resources available, property owners can navigate the property tax landscape with confidence. The transparency and fairness of the system, coupled with the availability of online tools and resources, ensure that property owners in Arapahoe County have the necessary information to fulfill their tax responsibilities and contribute to the vibrant communities within the county.

How are property tax rates determined in Arapahoe County?

+Property tax rates in Arapahoe County are determined by the county commissioners and other taxing authorities. The tax mill levy, or mill rate, is set based on the revenue needs of various local government entities. The mill levy is applied to the assessed value of each property to calculate the tax liability.

What is the role of the Arapahoe County Assessor’s Office in the property tax process?

+The Arapahoe County Assessor’s Office is responsible for assessing the value of each property within the county. They utilize mass appraisal techniques, conduct physical inspections (if necessary), and analyze sales data to determine fair market values. The assessed value forms the basis for calculating property taxes.

Can property owners appeal their assessed values in Arapahoe County?

+Yes, property owners in Arapahoe County have the right to appeal their assessed values if they believe they are inaccurate or unfair. The appeal process involves submitting an appeal to the Board of Equalization, providing evidence to support the appeal, and potentially attending a hearing to present their case.

How often are property values reassessed in Arapahoe County?

+Property values in Arapahoe County are typically reassessed every odd-numbered year. However, the assessor’s office may conduct reassessments more frequently if there are significant changes to the property, such as new construction or major renovations.

Are there any exemptions or tax credits available for property owners in Arapahoe County?

+Yes, Arapahoe County offers various exemptions and tax credits to eligible property owners. These include homestead exemptions for primary residences, veteran’s exemptions, senior citizen exemptions, and tax credits for energy-efficient improvements or historic preservation efforts. Property owners should check with the assessor’s office or visit the county’s website for detailed information on available exemptions and credits.