Sales Tax Auto Missouri

The state of Missouri, nestled in the heartland of the United States, has a unique approach to sales tax, especially when it comes to the automotive industry. This article delves into the specifics of Sales Tax Auto Missouri, providing an in-depth analysis of the tax structure, its implications for consumers and businesses, and its role in shaping the state's economy.

Understanding the Basics of Sales Tax in Missouri

Missouri, like many other states, imposes a sales and use tax on the sale of tangible personal property, including vehicles. This tax is a crucial revenue source for the state, contributing to infrastructure development, education, and other essential public services.

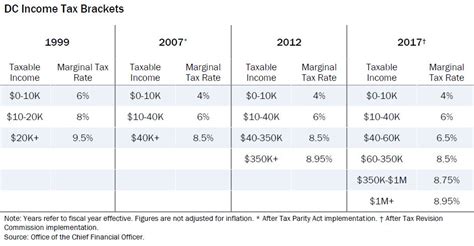

The sales tax rate in Missouri is comprised of a state sales tax and additional local taxes that vary by jurisdiction. As of my last update in January 2023, the state sales tax rate stands at 4.225%, which is a composite of the state sales tax of 4.225% and a state administrative fee of 0%.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 4.225% |

| State Administrative Fee | 0% |

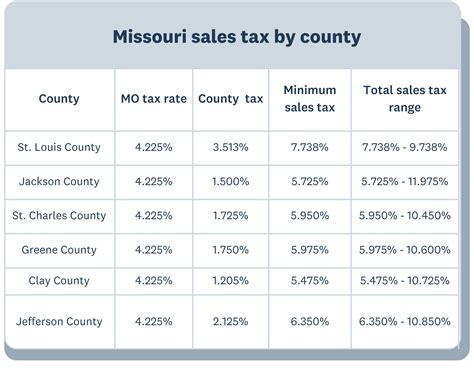

However, it's important to note that Missouri's sales tax structure is not uniform, as local jurisdictions have the authority to levy additional taxes, resulting in varying total sales tax rates across the state.

Sales Tax on Automobiles in Missouri

When it comes to the automotive industry, Missouri’s sales tax regime becomes more nuanced. The state imposes a sales tax on the purchase of vehicles, which is applied to the gross sales price of the vehicle.

Calculating Sales Tax on Vehicles

The sales tax on vehicles in Missouri is calculated by multiplying the gross sales price by the applicable sales tax rate for the specific jurisdiction. This rate includes both the state sales tax and any local taxes that may apply.

For instance, if a vehicle is purchased in a jurisdiction with a total sales tax rate of 8.225% (including both state and local taxes), the sales tax calculation would be as follows:

Sales Tax = Gross Sales Price x Total Sales Tax Rate

Let's consider an example where the gross sales price of a vehicle is $30,000 and the total sales tax rate is 8.225%:

Sales Tax = $30,000 x 0.08225

Sales Tax = $2,467.50

Therefore, the sales tax on this vehicle would be $2,467.50.

Exemptions and Special Considerations

While the sales tax on vehicles is a standard practice in Missouri, there are certain exemptions and special considerations to be aware of:

- Trade-Ins: When trading in a vehicle, the trade-in value is typically subtracted from the gross sales price of the new vehicle before calculating the sales tax. This can significantly reduce the sales tax liability.

- Taxable Value: Missouri uses the gross sales price as the basis for sales tax calculation. However, if a vehicle is purchased from a private party, the taxable value is determined by the Department of Revenue based on the vehicle's average trade-in value or blue book value, whichever is higher.

- Special Vehicle Types: Certain types of vehicles, such as electric vehicles, hybrid vehicles, and motorcycles, may be eligible for tax credits or reduced tax rates in Missouri. These incentives are designed to promote the use of environmentally friendly vehicles.

Impact on Consumers and Businesses

The sales tax on vehicles in Missouri has a significant impact on both consumers and businesses within the automotive industry.

Consumer Perspective

For consumers, the sales tax on vehicles adds a substantial cost to the purchase price. This tax can significantly impact the affordability of a vehicle, especially for those on a tight budget. However, it’s important to note that Missouri’s sales tax rate is relatively competitive compared to some other states, which can make it more attractive for vehicle purchases.

Additionally, the varying local tax rates across Missouri can influence consumers' purchasing decisions. Buyers may choose to purchase vehicles in jurisdictions with lower sales tax rates, especially for high-value items like automobiles.

Business Implications

For automotive businesses in Missouri, the sales tax regime presents both opportunities and challenges. On the one hand, the sales tax is a significant source of revenue for dealerships and contributes to their overall profitability. It also plays a role in pricing strategies, as dealerships may need to adjust their prices to remain competitive while accounting for the sales tax.

However, the complexity of the sales tax system, with its varying rates and rules, can present administrative challenges for businesses. They must ensure compliance with the ever-changing tax landscape and accurately calculate and collect sales tax to avoid penalties.

Role in Missouri’s Economy

Sales tax on vehicles is a vital component of Missouri’s economy, contributing to the state’s overall fiscal health. The revenue generated from this tax is used to fund essential services and infrastructure projects that benefit residents and businesses alike.

Revenue Allocation

The sales tax revenue collected from vehicle purchases is allocated to various funds and programs, including:

- Transportation Funds: A significant portion of the sales tax revenue is directed towards transportation infrastructure, such as road construction and maintenance, bridge repairs, and public transit systems.

- Education Funding: Sales tax revenue also contributes to public education, supporting schools, teachers, and educational resources.

- Economic Development: A share of the revenue is allocated to economic development initiatives, promoting business growth and job creation in Missouri.

- Local Government Support: Local jurisdictions receive a portion of the sales tax revenue, which they can use for local projects and community development.

Economic Impact

The sales tax on vehicles has a significant economic impact on Missouri. It encourages consumer spending, which drives economic growth and supports local businesses. Additionally, the revenue generated helps to maintain and improve the state’s infrastructure, making it more attractive for businesses to operate and invest in Missouri.

Future Implications and Considerations

As Missouri’s economy and automotive industry continue to evolve, the sales tax regime on vehicles may face future considerations and potential changes.

Potential Policy Changes

There have been discussions and proposals to reform Missouri’s sales tax system, including suggestions to simplify the tax structure and reduce the overall sales tax rate. These changes could have significant implications for both consumers and businesses, impacting the affordability of vehicles and the competitiveness of the automotive industry.

Technology and E-Commerce

The rise of e-commerce and online vehicle sales presents a unique challenge for sales tax collection. Missouri, like many states, is navigating the complex issue of collecting sales tax on online transactions, ensuring compliance, and maintaining a level playing field for traditional dealerships.

Electric and Sustainable Vehicles

With the growing popularity of electric vehicles and sustainable transportation, Missouri may consider further incentivizing the adoption of these vehicles through tax credits or reduced tax rates. This could encourage a shift towards more environmentally friendly transportation options.

Regional Competition

Missouri’s sales tax rates and policies are often compared to those of neighboring states, which can influence consumer behavior and business decisions. As such, Missouri may need to consider its competitive position and ensure its tax structure remains attractive to consumers and businesses.

Conclusion

In conclusion, Missouri’s sales tax on vehicles is a critical component of the state’s tax system, impacting consumers, businesses, and the overall economy. While it presents challenges and complexities, it also plays a vital role in funding essential services and infrastructure. As the automotive industry and economic landscape evolve, Missouri will need to adapt its sales tax policies to remain competitive and meet the changing needs of its residents and businesses.

How often are sales tax rates updated in Missouri?

+Sales tax rates in Missouri are typically updated annually, effective from January 1st of each year. These updates are based on legislative changes and economic considerations. It’s important for businesses and consumers to stay informed about any changes to the sales tax rates to ensure compliance.

Are there any tax incentives for buying electric vehicles in Missouri?

+Yes, Missouri offers tax incentives for the purchase of electric vehicles (EVs) and certain other alternative fuel vehicles. These incentives include a state income tax credit of up to $5,000 for the purchase of a new EV. Additionally, there are exemptions from certain fees and taxes for EVs. It’s recommended to consult the Missouri Department of Revenue for the most current information on these incentives.

How can I calculate the sales tax on a vehicle purchase in Missouri?

+To calculate the sales tax on a vehicle purchase in Missouri, you need to know the gross sales price of the vehicle and the applicable sales tax rate for the jurisdiction where the purchase is made. Multiply the gross sales price by the sales tax rate to determine the sales tax amount. Remember to consider any trade-in value or other adjustments that may impact the taxable amount.