Restaurant Tax New York City

In the bustling metropolis of New York City, the culinary scene is a vibrant tapestry of diverse cuisines and dining experiences. From iconic landmarks like the Empire State Building to the vibrant streets of Chinatown and Little Italy, the city's culinary offerings are as varied as its neighborhoods. Amidst this gastronomic paradise, one aspect that often sparks curiosity and discussion is the restaurant tax in New York City. In this comprehensive guide, we delve into the intricacies of this tax, its implications for diners and restauranteurs alike, and its role in shaping the city's vibrant food culture.

Understanding the Restaurant Tax in New York City

The restaurant tax in New York City, officially known as the Sales and Use Tax, is a levy imposed on the sale of food and beverages by restaurants, cafes, bars, and other dining establishments. This tax is a crucial component of the city’s revenue stream and is used to fund various public services and infrastructure projects.

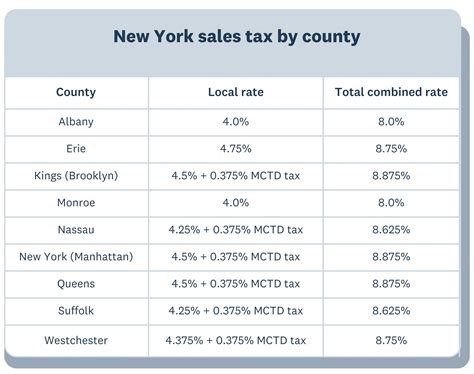

The tax rate varies depending on the location of the restaurant within the city. For instance, establishments located in the five boroughs of New York City (Manhattan, Brooklyn, Queens, The Bronx, and Staten Island) are subject to a higher tax rate compared to those in the surrounding counties. This differentiation aims to account for the varying costs of living and doing business across the region.

Tax Rates and Breakdowns

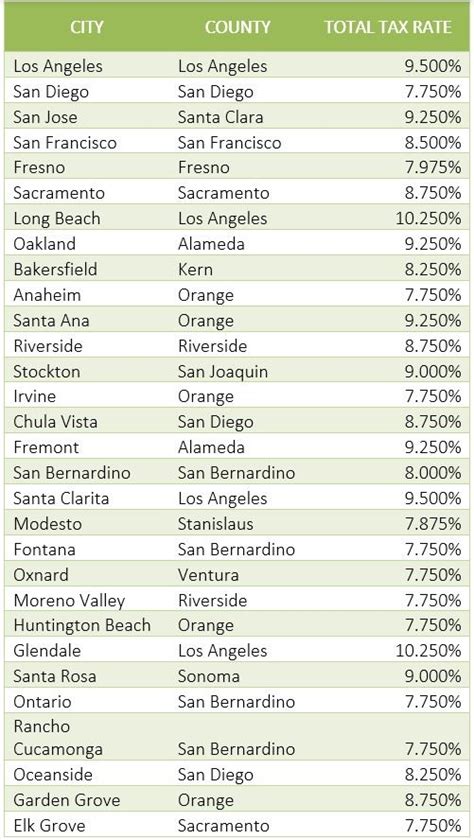

The current restaurant tax rates in New York City are as follows:

| Borough | Sales Tax Rate | Restaurant Tax Rate |

|---|---|---|

| Manhattan | 4.5% | 8.875% |

| Brooklyn, Queens, Bronx, Staten Island | 4.375% | 8.625% |

It's important to note that these rates are subject to change based on legislative decisions and economic factors. The New York State Department of Taxation and Finance provides regular updates on tax rates and regulations, ensuring compliance for businesses and awareness for consumers.

How the Restaurant Tax Works

The restaurant tax is typically included in the total bill presented to diners. It is calculated as a percentage of the pre-tax total, which includes the cost of food and beverages, as well as any applicable service charges or gratuities. For instance, if a diner orders a meal totaling 50 before tax, and the applicable tax rate is 8.875%, the tax amount would be 4.44, resulting in a final bill of $54.44.

Diners often find this tax amount clearly displayed on their bill, providing transparency and awareness of the additional cost. This practice ensures that patrons are well-informed about the total cost of their dining experience, including any applicable taxes and fees.

The Impact on Diners and Restauranteurs

The restaurant tax in New York City has a significant impact on both diners and restauranteurs, influencing dining habits, business strategies, and the overall culinary landscape of the city.

Diners’ Perspective

For diners, the restaurant tax adds an additional cost to their dining experiences. While it may not be a substantial amount for a single meal, over time, it can significantly impact their dining budgets, especially for those who frequent restaurants regularly. Diners often factor in the tax when planning their meals, considering the total cost, including tax and tip, to ensure their dining choices align with their financial preferences.

Moreover, the tax can influence dining decisions, with some patrons opting for more affordable dining options or adjusting their order quantities to stay within their budget constraints. The tax also encourages diners to be more mindful of their spending, promoting a culture of conscious consumption and budget-friendly dining choices.

Restauranteurs’ Perspective

For restauranteurs, the restaurant tax is a crucial aspect of their business operations. It directly impacts their revenue stream, influencing their pricing strategies, menu planning, and overall profitability. Restauranteurs must carefully consider the tax rate when setting menu prices, ensuring that their offerings remain competitive while also generating sufficient revenue to cover operational costs and turn a profit.

The tax also prompts restauranteurs to be innovative in their business models. Some establishments offer value-added services or unique dining experiences to justify higher prices, while others focus on cost-effective strategies to maintain competitive pricing. Additionally, the tax encourages restauranteurs to stay informed about tax regulations and compliance, ensuring they operate within legal boundaries and avoid any potential penalties.

Navigating the Restaurant Tax Landscape

Given the complexities of the restaurant tax in New York City, both diners and restauranteurs can benefit from strategies to navigate this landscape effectively.

Tips for Diners

- Budgeting Awareness: Be mindful of the restaurant tax when planning your dining budget. Consider the tax rate and factor it into your calculations to ensure you’re allocating sufficient funds for your dining experiences.

- Research and Comparison: Explore different dining options and compare prices to find establishments that offer value for your money. Consider factors beyond price, such as ambiance, quality of food, and overall dining experience.

- Tip Calculation: When calculating tips, include the tax amount in your total bill. This ensures you’re tipping based on the full cost of your meal, recognizing the service provided by the restaurant staff.

- Tax-Inclusive Pricing: Look for restaurants that display tax-inclusive pricing on their menus. This transparency simplifies your dining experience, as you know the exact cost of your meal upfront.

- Tax-Free Days: Stay informed about tax-free events or promotions, such as tax-free weekends or special discounts. These can provide opportunities to save on your dining expenses.

Tips for Restauranteurs

- Menu Pricing Strategy: Carefully consider the tax rate when setting menu prices. Ensure your prices are competitive and reflect the quality of your offerings. Regularly review your pricing strategy to stay aligned with market trends and customer expectations.

- Tax Compliance: Stay up-to-date with tax regulations and compliance requirements. Seek professional guidance if needed to ensure your business operations are tax-compliant and avoid any potential legal issues.

- Value-Added Services: Offer unique dining experiences or value-added services to justify higher prices. This could include exclusive events, private dining options, or specialty menus that provide a premium dining experience.

- Tax-Inclusive Pricing: Consider displaying tax-inclusive pricing on your menus to provide transparency to your customers. This simplifies the dining experience and ensures patrons are aware of the total cost of their meal.

- Tax-Free Promotions: Explore opportunities to offer tax-free promotions or discounts to attract customers and boost sales. These promotions can be especially effective during slower periods or to introduce new menu items.

Future Implications and Trends

The restaurant tax in New York City is a dynamic aspect of the city’s culinary landscape, subject to ongoing discussions and potential changes. As the city evolves, both diners and restauranteurs can expect to see shifts in tax policies and regulations that reflect the changing economic landscape and consumer preferences.

Potential Changes and Adaptations

One potential future development is the exploration of tax incentives or rebates for certain types of establishments, such as those promoting sustainable practices or supporting local communities. This could encourage the growth of these establishments and promote positive social and environmental impacts.

Additionally, with the rise of digital technologies and online ordering platforms, there may be opportunities to streamline tax collection processes and enhance transparency. This could involve integrating tax calculations into online ordering systems or exploring blockchain technologies for secure and transparent tax transactions.

The Impact of Changing Dining Trends

As dining habits evolve, the restaurant tax may also adapt to accommodate these changes. With the increasing popularity of delivery services and takeout options, there could be a need to revisit tax regulations for these channels. This could involve exploring separate tax rates or structures for delivery services to ensure fairness and accuracy.

Furthermore, as consumers become more conscious of their spending and seek budget-friendly options, there may be a shift towards promoting value-driven dining experiences. This could influence tax policies, with potential adjustments to support establishments offering affordable, high-quality dining options.

Conclusion

The restaurant tax in New York City is a vital component of the city’s economic landscape, shaping the dining experiences of locals and visitors alike. By understanding the intricacies of this tax, both diners and restauranteurs can navigate the culinary scene with awareness and confidence. As the city continues to evolve, the restaurant tax will undoubtedly play a pivotal role in fostering a vibrant, diverse, and sustainable food culture.

What is the purpose of the restaurant tax in New York City?

+The restaurant tax is a crucial revenue stream for the city, funding public services and infrastructure projects. It ensures that the vibrant dining scene in New York City can thrive while also contributing to the overall economic well-being of the city.

How often are restaurant tax rates reviewed and updated?

+Restaurant tax rates are subject to periodic reviews by the New York State Department of Taxation and Finance. These reviews consider various economic factors and legislative decisions, ensuring that the tax rates remain fair and aligned with the city’s needs.

Are there any exemptions or special considerations for certain types of restaurants?

+While the restaurant tax applies to most dining establishments, there may be special considerations for specific types of restaurants. For example, establishments primarily focused on catering services or take-out options may have different tax implications. It’s essential to consult with tax professionals to understand any potential exemptions or variations.