Communication Service Tax

The Communication Service Tax, commonly known as CST, is a crucial aspect of the telecommunications industry, impacting businesses and consumers alike. This tax, imposed on various communication services, has significant implications for the industry's growth, innovation, and consumer experience. In this comprehensive guide, we will delve into the intricacies of the Communication Service Tax, exploring its definition, scope, impact, and future prospects.

Understanding the Communication Service Tax

The Communication Service Tax is a levy imposed by governmental bodies on a range of communication services, including but not limited to voice calls, text messaging, and data usage. It is a critical revenue stream for many governments, contributing to national budgets and funding various public services.

CST is typically applied as a percentage of the revenue generated by communication service providers (CSPs). The tax rate can vary across jurisdictions, with some countries adopting a flat rate while others opt for a tiered system based on the type of service or the revenue threshold.

Key Components of CST

- Voice Services: Traditional voice calls, whether mobile or landline, are often subject to CST. The tax is usually calculated based on the duration or the number of calls made.

- Messaging: Text messaging, including SMS and MMS, falls under the purview of CST. The tax is often levied per message sent.

- Data Usage: With the rise of internet-based communication, data usage has become a significant component of CST. The tax can be applied as a flat rate per gigabyte or as a percentage of the data plan cost.

- Value-Added Services: Some jurisdictions extend CST to value-added services like video streaming, online gaming, and cloud computing.

Impact on the Telecommunications Industry

The Communication Service Tax has a profound impact on the telecommunications industry, influencing business strategies, investment decisions, and consumer behavior.

Financial Implications for CSPs

For Communication Service Providers, CST represents a significant financial burden. The tax directly affects their revenue streams, reducing the funds available for network upgrades, research and development, and customer acquisition.

| Country | CST Rate (%) |

|---|---|

| United States | 3-15 |

| United Kingdom | 20 |

| Canada | 15 |

| Australia | 10 |

Moreover, CSPs must navigate the complex landscape of varying tax rates across different jurisdictions, which can be a logistical challenge, especially for multinational companies.

Consumer Perspective

From a consumer standpoint, CST directly affects the cost of communication services. Higher tax rates can lead to increased prices for voice calls, text messages, and data plans. This, in turn, may impact consumer behavior, potentially encouraging a shift towards cheaper alternatives or even driving a portion of the population to opt for unlicensed or informal communication services.

Innovation and Investment

The Communication Service Tax also influences the industry’s innovation trajectory. With a substantial portion of revenue going towards taxes, CSPs may have fewer resources to invest in research and development, potentially slowing down technological advancements and network upgrades. This can have long-term implications for the industry’s ability to keep up with evolving consumer demands and emerging technologies.

Global Perspective: CST Across Different Jurisdictions

The implementation and structure of the Communication Service Tax vary significantly across the globe. Let’s explore some regional differences:

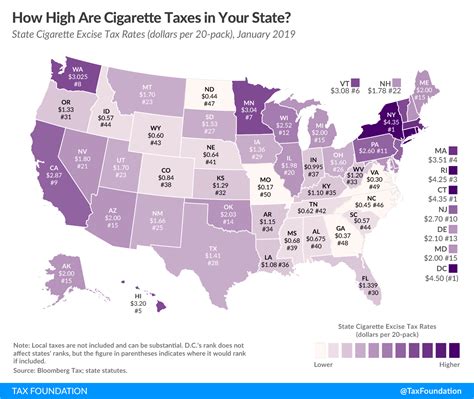

North America

In the United States, CST is applied at the state level, resulting in a diverse landscape of tax rates. Some states, like California and Texas, have relatively high rates, while others, such as Delaware and Montana, have no CST at all. This patchwork of regulations can create complexities for CSPs operating across multiple states.

Europe

European countries generally have a more uniform approach to CST. The UK, for instance, imposes a single-rate CST of 20% on all communication services. In contrast, some European nations, like Sweden and Denmark, have opted for a reduced or zero-rated CST to promote digital inclusion and encourage innovation.

Asia-Pacific Region

The Asia-Pacific region showcases a wide range of CST structures. Countries like Australia and New Zealand have a relatively low and uniform CST rate, while others, such as India and Indonesia, have implemented complex tiered systems based on revenue thresholds.

Future Outlook: Trends and Predictions

As the telecommunications industry continues to evolve, the future of the Communication Service Tax is likely to be shaped by several key factors:

Technological Advancements

The rise of 5G technology and the Internet of Things (IoT) is expected to revolutionize communication services. With an increasing number of connected devices, the demand for data-intensive services will surge. This may lead to a reevaluation of CST structures, potentially shifting the focus from voice and messaging to data usage.

Digital Taxation

The ongoing debate surrounding digital taxation is likely to influence the future of CST. Governments may explore ways to ensure that CSPs, especially those operating in the digital realm, contribute fairly to national revenues. This could result in the expansion of CST to encompass a broader range of digital services.

Consumer Behavior

Shifting consumer preferences and the adoption of new communication platforms, such as social media messaging apps and video conferencing tools, may impact the relevance of traditional voice and messaging services. As a result, governments might need to reconsider the balance between taxing these legacy services and emerging digital alternatives.

Regulatory Changes

The telecommunications industry is subject to frequent regulatory changes. Future regulatory reforms could impact the structure and implementation of CST, potentially simplifying tax systems or introducing new incentives to promote investment and innovation.

How does CST impact consumer prices?

+CST directly affects the cost of communication services for consumers. Higher tax rates can lead to increased prices for voice calls, text messages, and data plans. This can influence consumer behavior, potentially encouraging a shift towards cheaper alternatives or informal services.

What strategies can CSPs employ to mitigate the impact of CST?

+CSPs can adopt various strategies, including offering tax-inclusive pricing plans, exploring partnerships with governments for tax optimization, and focusing on innovative services to offset the financial burden of CST.

How does CST differ across jurisdictions?

+The implementation and structure of CST vary widely. Some countries have a uniform rate, while others employ tiered systems based on revenue thresholds. The diversity of regulations creates complexities for multinational CSPs.