What Is Nc Sales Tax

The North Carolina (NC) Sales Tax is a crucial component of the state's tax system, impacting both residents and businesses alike. It is an essential revenue generator for the state, contributing significantly to funding various public services and infrastructure development. Understanding the NC Sales Tax is vital for anyone living, working, or doing business in the state, as it directly affects their financial obligations and planning.

The NC Sales Tax: An Overview

The NC Sales and Use Tax, commonly known as the Sales Tax, is a consumption tax levied on the sale of tangible personal property and certain services within the state. It is a percentage-based tax, which means the tax amount is calculated as a percentage of the sale price. The revenue collected from this tax is used to support vital state functions, including education, healthcare, transportation, and more.

The NC Sales Tax is administered by the North Carolina Department of Revenue (NCDOR), which is responsible for enforcing tax laws, collecting revenues, and ensuring compliance. The NCDOR provides comprehensive guidelines and resources to help taxpayers understand their obligations and rights under the tax system.

Key Features of the NC Sales Tax

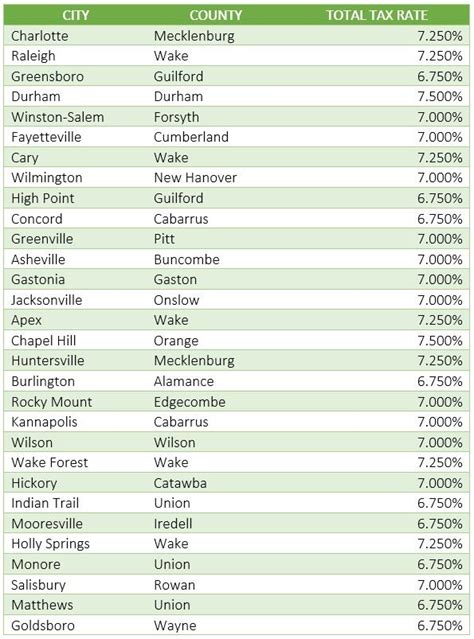

- Tax Rates: The NC Sales Tax is comprised of two components: the state sales tax rate and any local sales tax rates applicable to the specific jurisdiction. The state sales tax rate is currently 4.75%, while local sales tax rates can vary depending on the county and municipality. These local rates are added to the state rate to determine the total sales tax applicable in a specific location.

- Taxable Items: The NC Sales Tax applies to a wide range of goods and services, including clothing, electronics, furniture, vehicles, restaurant meals, and many other tangible items. However, certain items are exempt from sales tax, such as prescription medications, non-prepared food items, and some services like legal and medical services.

- Tax Collection: Businesses that sell taxable goods or services are generally responsible for collecting the sales tax from their customers and remitting it to the NCDOR. This process is often integrated into the point-of-sale systems, ensuring that the tax is automatically calculated and added to the customer’s bill.

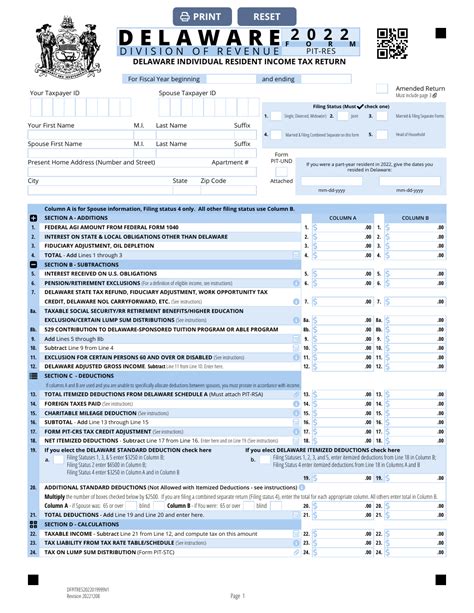

- Registration and Filing: Any business that makes taxable sales in North Carolina must register with the NCDOR to obtain a Sales and Use Tax Permit. This permit allows the business to collect and remit sales tax. Businesses are required to file sales tax returns periodically, usually on a monthly, quarterly, or annual basis, depending on their revenue and sales volume.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 4.75% |

| Local Sales Tax | Varies by Location |

Compliance and Enforcement

The NCDOR takes compliance and enforcement seriously to ensure a fair and equitable tax system. Businesses are required to maintain accurate records of their sales and tax collections to demonstrate compliance. Failure to comply with sales tax regulations can result in penalties, interest, and even criminal charges in severe cases.

The NCDOR conducts audits and investigations to verify compliance and identify potential tax evasion. These audits can be random or based on specific indicators of potential non-compliance. Businesses and individuals are encouraged to familiarize themselves with the tax laws and regulations to avoid unintentional errors and potential penalties.

Sales Tax Exemptions and Discounts

While the NC Sales Tax applies to a broad range of goods and services, there are certain exemptions and discounts available to specific groups. For example, veterans and active-duty military personnel may be eligible for sales tax exemptions on certain purchases. Additionally, certain periods, such as the Back-to-School Sales Tax Holiday, offer tax-free shopping on select items, providing relief for families and encouraging consumer spending.

Impact on Businesses and Consumers

The NC Sales Tax has a significant impact on both businesses and consumers. For businesses, it represents a cost of doing business in the state, as they are responsible for collecting and remitting the tax. However, it also provides an opportunity for businesses to build customer loyalty by clearly communicating their role in tax collection and providing transparency in pricing.

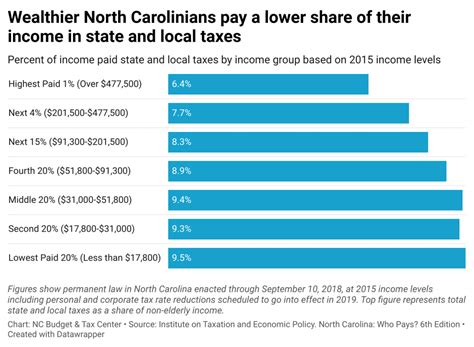

For consumers, the NC Sales Tax directly affects their purchasing power and budgeting. The tax can significantly impact the overall cost of goods and services, particularly for large purchases. However, it's important to note that the tax also supports essential public services that benefit the community, such as education and infrastructure development.

Sales Tax Planning and Strategy

Businesses operating in NC often need to develop strategies to manage their sales tax obligations effectively. This includes understanding the tax rates applicable to their specific location, ensuring accurate tax collection and remittance, and staying updated with any changes to tax laws and regulations. Proper sales tax planning can help businesses avoid penalties and ensure they are not overburdened by tax obligations.

Consumers, too, can benefit from understanding the NC Sales Tax. By being aware of the tax rates and exemptions, consumers can make more informed purchasing decisions and plan their budgets accordingly. Additionally, understanding the sales tax can help consumers advocate for their rights and ensure they are not overcharged.

Future of NC Sales Tax

The NC Sales Tax, like any tax system, is subject to potential changes and reforms. The state’s changing economic landscape, shifts in consumer behavior, and advancements in technology may all influence the future of the sales tax. For instance, the growing e-commerce sector and the increasing popularity of online sales may lead to adjustments in the tax system to ensure fairness and compliance in this evolving marketplace.

Furthermore, ongoing discussions about tax reform at the state level may impact the NC Sales Tax. Proposals for tax rate adjustments, changes in tax exemptions, or even the implementation of new tax structures could significantly affect businesses and consumers. Staying informed about these potential changes is crucial for both businesses and individuals to adapt their strategies and planning accordingly.

Conclusion

The NC Sales Tax is a critical component of the state’s tax system, playing a vital role in funding public services and infrastructure. Understanding this tax is essential for businesses and consumers to navigate their financial obligations and plan effectively. With a clear understanding of the tax rates, exemptions, and compliance requirements, both parties can contribute to a fair and efficient tax system while also reaping the benefits of the services it supports.

How often do businesses need to file sales tax returns in NC?

+The frequency of filing sales tax returns depends on the business’s sales volume. Businesses with higher sales volumes may be required to file monthly or quarterly, while those with lower sales may file annually. The NCDOR provides guidelines based on the business’s specific circumstances.

Are there any online tools available to help calculate sales tax in NC?

+Yes, the NCDOR provides an online Sales Tax Calculator tool on its website. This tool allows users to input the purchase amount and location to determine the applicable sales tax rate and calculate the total sales tax due.

What happens if a business makes an error in calculating or remitting sales tax?

+Errors in sales tax calculation or remittance can result in penalties and interest charges. However, the NCDOR encourages voluntary disclosure and provides opportunities for businesses to correct errors and avoid penalties. It’s essential for businesses to keep accurate records and seek guidance if they are unsure about their tax obligations.