Jersey City Tax

Taxation is an essential aspect of any city's economy, and understanding its intricacies is crucial for residents, businesses, and investors alike. In the vibrant city of Jersey City, New Jersey, the tax landscape is multifaceted and plays a significant role in shaping the local economy. This comprehensive guide aims to shed light on the various tax obligations and opportunities within Jersey City, offering valuable insights for those navigating its financial ecosystem.

Unraveling the Jersey City Tax Landscape

Jersey City boasts a diverse tax structure, reflecting its position as a major urban center in the Garden State. From income taxes to property assessments, understanding these components is key to making informed financial decisions. Here’s a detailed breakdown of the taxes that shape Jersey City’s fiscal landscape.

Income Tax: A Significant Contributor

Jersey City levies an income tax on its residents and businesses, contributing significantly to the city’s revenue. The tax rate varies based on income brackets, with higher earners paying a proportionately larger share. This progressive income tax system ensures a fair distribution of tax burden and aligns with the city’s commitment to fiscal responsibility.

For residents, the income tax is an annual obligation, typically due by April. Businesses, on the other hand, may have varying due dates depending on their legal structure and revenue cycle. The city provides clear guidelines and resources to assist taxpayers in calculating and remitting their income taxes accurately.

A unique aspect of Jersey City’s income tax is its local tax credit program. Residents who pay income taxes in other jurisdictions can claim a credit against their Jersey City income tax liability, ensuring that they’re not double-taxed. This incentive promotes transparency and fairness in the tax system, fostering a positive relationship between the city and its taxpayers.

Property Taxes: An Essential Revenue Stream

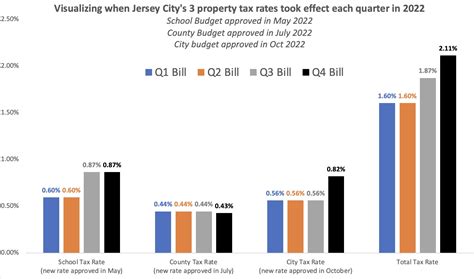

Property taxes are a cornerstone of Jersey City’s revenue generation. The city’s assessed property value, which forms the basis for tax calculations, is determined through a meticulous process that considers factors like location, size, and recent sales data. This ensures that property owners pay their fair share based on the actual value of their holdings.

The property tax rate in Jersey City is set annually by the municipal government. It’s expressed as a millage rate, where one mill represents 1 of tax for every 1,000 of assessed property value. This rate can fluctuate based on the city’s budgetary needs and priorities, impacting property owners’ tax liabilities.

Jersey City also offers property tax abatements and incentives to attract businesses and promote development. These abatements can significantly reduce a property owner’s tax burden, making Jersey City an attractive location for commercial ventures. However, these abatements are typically granted on a case-by-case basis and are subject to specific eligibility criteria.

| Property Tax Statistics | Jersey City |

|---|---|

| Average Property Tax Rate | 6.78% |

| Median Home Value | $500,000 |

| Estimated Property Tax | $34,000 |

Sales and Use Taxes: Everyday Transactions

Jersey City, like the rest of New Jersey, imposes a sales and use tax on most retail transactions. This tax is added to the purchase price of goods and services, with the proceeds going directly to the city’s coffers. The sales tax rate is uniform across the state but can be impacted by local taxes and special assessments, resulting in variations from one municipality to another.

Businesses operating within Jersey City are responsible for collecting and remitting sales tax to the state and local authorities. The city provides resources and support to ensure compliance with sales tax regulations, which are essential for maintaining a fair and transparent market environment.

Business Taxes: A Vital Economic Engine

Jersey City’s vibrant business community is a key driver of economic growth, and the city’s tax policies play a pivotal role in fostering this environment. Business taxes, including corporate income taxes and franchise taxes, contribute significantly to the city’s revenue stream.

The city offers a range of tax incentives and abatement programs to attract and retain businesses. These initiatives, often tailored to specific industries or development zones, can provide substantial tax savings for qualifying businesses. By encouraging investment and job creation, these incentives contribute to Jersey City’s economic vitality and competitiveness.

Additionally, Jersey City provides resources and support for businesses navigating the tax landscape. From tax workshops to online resources, the city ensures that businesses have the tools they need to comply with tax obligations efficiently and effectively.

Navigating the Jersey City Tax System: Tips and Insights

Understanding the tax landscape is the first step; leveraging it effectively is the key to success. Here are some expert tips and insights to help residents and businesses navigate Jersey City’s tax system:

Income Tax Strategies

- Stay informed about income tax brackets and rates. Adjust your financial planning accordingly to optimize your tax liability.

- Take advantage of the local tax credit if you pay income taxes in other jurisdictions. This can reduce your Jersey City tax burden and simplify your tax calculations.

- Consider seeking professional tax advice, especially if you have complex financial situations or business ventures.

Property Tax Management

- Understand the assessment process and review your property’s assessed value regularly. If you believe your assessment is inaccurate, you can appeal to ensure fair taxation.

- Explore property tax abatements and incentives, especially if you’re considering a commercial venture or real estate investment in Jersey City.

- Stay informed about local tax initiatives and developments. Jersey City’s tax policies can evolve, and being aware of changes can help you plan strategically.

Sales and Use Tax Compliance

- Ensure your business is registered for sales tax collection and remittance. Stay compliant with sales tax regulations to avoid penalties and maintain a positive relationship with the city.

- Consider using sales tax software to streamline your sales tax management. This can simplify calculations, ensure accuracy, and save time.

- Provide clear and transparent pricing to your customers. Including sales tax in your pricing can enhance customer trust and reduce confusion at the point of sale.

Maximizing Business Tax Benefits

- Research and understand the tax incentives and abatements available to businesses in Jersey City. These can significantly impact your bottom line and make your venture more profitable.

- Engage with the city’s economic development offices. They can provide valuable insights and guidance on how to leverage tax incentives for your specific business needs.

- Consider partnering with local businesses or joining industry associations. These connections can provide access to insider knowledge and resources for navigating the tax landscape.

Future Outlook: Jersey City’s Tax Evolution

As Jersey City continues to evolve, its tax landscape is likely to adapt and transform. The city’s commitment to fiscal responsibility and economic growth will shape future tax policies, ensuring a balanced approach that benefits both taxpayers and the city’s overall well-being.

Looking ahead, several key trends and initiatives are poised to impact Jersey City’s tax system:

Digital Economy and Tax Innovation

The rise of the digital economy is reshaping tax systems worldwide, and Jersey City is no exception. As more economic activity moves online, the city may explore innovative tax strategies to capture value from this evolving landscape. This could include initiatives like digital services taxes or e-commerce-specific tax policies, ensuring that the city remains competitive in the digital age.

Green Initiatives and Sustainable Taxation

Jersey City’s commitment to sustainability is evident in its environmental policies, and this ethos may extend to its tax system. The city could explore green tax incentives to encourage eco-friendly practices and investments. For instance, tax credits for energy-efficient buildings or incentives for businesses adopting sustainable practices could promote environmental stewardship while driving economic growth.

Tax Simplification and Transparency

As Jersey City continues to attract businesses and residents, simplifying its tax system could become a priority. Efforts to streamline tax processes, enhance transparency, and provide clear guidelines can foster a positive tax environment, making the city more attractive to investors and entrepreneurs.

Additionally, the city may explore digital transformation initiatives to make tax filing and payment processes more efficient and user-friendly. This could involve leveraging technology to create a seamless tax experience, reducing administrative burdens for taxpayers.

Community Engagement and Tax Equity

Jersey City’s vibrant community is a vital asset, and engaging residents in tax policy discussions can foster a sense of ownership and fairness. The city could explore initiatives to involve residents in shaping tax policies, ensuring that the tax system reflects the needs and aspirations of the community it serves.

Furthermore, promoting tax equity and ensuring that tax burdens are distributed fairly across different income brackets could be a key focus. This could involve adjusting tax rates or implementing progressive tax policies to ensure that the city’s growth benefits all its residents.

Conclusion: Jersey City’s Tax Journey

Jersey City’s tax landscape is a dynamic and integral part of its economic ecosystem. From income taxes to property assessments, each component plays a vital role in shaping the city’s fiscal health and its ability to invest in its future. By understanding and leveraging these tax opportunities, residents and businesses can contribute to Jersey City’s prosperity while optimizing their financial well-being.

As Jersey City continues to evolve, its tax system will adapt, reflecting the city’s commitment to innovation, sustainability, and community engagement. This journey towards a more robust and equitable tax system will not only benefit the city’s finances but also enhance its position as a leading urban center in the Garden State.

What is the current income tax rate in Jersey City for residents?

+The income tax rate for Jersey City residents varies based on income brackets. For earnings up to 100,000, the rate is 1.5%, while for incomes between 100,001 and 400,000, the rate increases to 2%. Incomes above 400,000 are taxed at a rate of 3%.

How often does Jersey City update its property tax assessments?

+Jersey City conducts a comprehensive reassessment of property values every four years. However, the city may also conduct interim assessments to ensure property values remain up-to-date and fair.

Are there any tax incentives for renewable energy installations in Jersey City?

+Yes, Jersey City offers tax abatements for property owners who install renewable energy systems like solar panels. The abatements can significantly reduce property taxes for these environmentally conscious investments.

How can businesses stay informed about tax incentives and abatements in Jersey City?

+Businesses can stay updated by regularly checking the city’s official website, which provides information on tax incentives and abatements. Additionally, attending local business forums and workshops can provide valuable insights into these opportunities.