Texas Homeowners Tax

The topic of Texas homeowners tax is an important one for residents of the Lone Star State, as it directly impacts their financial planning and overall cost of living. With a unique tax system compared to many other states, understanding the intricacies of Texas property taxes is crucial for homeowners to make informed decisions and potentially save on their annual tax obligations.

The Fundamentals of Texas Homeowners Tax

Texas stands out in the United States for its lack of a state income tax, instead relying heavily on property taxes to fund local governments and school districts. This means that homeowners in Texas pay taxes based on the appraised value of their property, with the revenue going towards essential public services and education.

The Texas property tax system is primarily administered by local taxing units, including cities, counties, school districts, and special districts. These entities set their own tax rates, which can vary significantly across the state. As a result, property tax rates and amounts can differ greatly depending on the location of a homeowner's property.

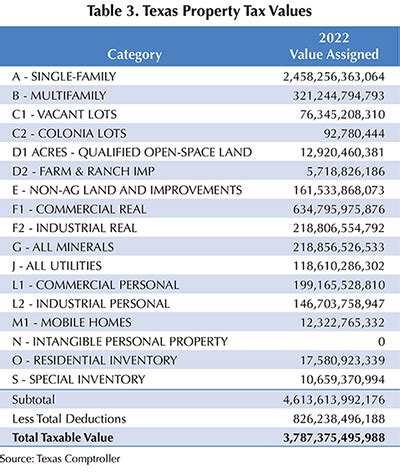

Tax Rates and Assessments

Property tax rates in Texas are expressed as a percentage, typically ranging from 1.5% to 2.5% of the property’s appraised value. These rates are set annually by the local taxing authorities and are used to calculate the tax bill for each property. For instance, a home with an appraised value of 200,000 and a tax rate of 2% would have an annual tax bill of 4,000.

The appraised value of a property is determined by local appraisal districts, which are responsible for assessing the value of all taxable properties within their jurisdiction. These appraisals are based on various factors, including the property's size, location, and recent sales data for similar properties.

| Property Tax Rate | Appraised Value | Estimated Annual Tax |

|---|---|---|

| 1.5% | $200,000 | $3,000 |

| 2% | $200,000 | $4,000 |

| 2.5% | $200,000 | $5,000 |

Payment Options and Deadlines

Texas homeowners have the option to pay their property taxes in one lump sum or in installments, depending on the policies of their local taxing unit. The payment deadlines can vary, but generally, property taxes are due by January 31st of each year. Failure to pay by the deadline may result in penalties, interest, and potential legal consequences.

Some taxing units may offer online payment options, allowing homeowners to conveniently pay their taxes through secure websites. Others might require payment by check or money order, with specific instructions provided on the tax bill.

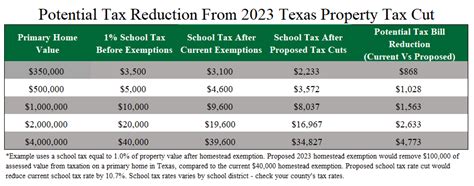

Reducing Your Texas Property Tax Burden

Given the significant impact property taxes can have on a homeowner’s finances, it’s natural to seek ways to reduce this burden. Texas offers several strategies and exemptions that can help alleviate the tax burden, making it important for homeowners to be aware of these options.

Tax Exemptions and Discounts

Texas provides various exemptions and discounts that can lower the taxable value of a property, thereby reducing the tax bill. These include:

- Residence Homestead Exemption: The most common exemption, this reduces the appraised value of a primary residence by up to $25,000. This exemption is automatically applied to qualified properties, making it essential for homeowners to ensure their residence is designated as their primary homestead.

- Over-65 Homestead Exemption: Homeowners who are 65 years or older and meet certain income requirements can qualify for this exemption, which freezes the taxable value of their property at its current level. This ensures that their tax bill does not increase as their property value rises.

- Disability Exemption: Disabled individuals who are 100% disabled, blind, or a veteran with a service-connected disability may be eligible for this exemption. It reduces the taxable value of the property by up to $10,000.

- Optional Tax Ceilings: Known as "optional rollback tax rates," these ceilings limit the annual increase in property taxes. If a taxing unit's tax rate exceeds this optional ceiling, voters can petition for an election to roll back the rate to the ceiling level.

Appealing Your Property Value

If a homeowner believes that their property’s appraised value is too high, they have the right to appeal the valuation. This process involves submitting an appeal to the local appraisal review board (ARB), which will schedule a hearing to review the evidence and determine if a reduction is warranted.

To support their case, homeowners should gather evidence such as recent sales data for similar properties, expert opinions on the property's value, and any relevant factors that may affect the property's worth. It's important to note that appealing one's property value can be a complex process, and it's advisable to seek professional assistance or guidance if needed.

Property Tax Liens and Foreclosures

In cases where a homeowner fails to pay their property taxes, the taxing unit may place a tax lien on the property. This lien gives the taxing unit the right to foreclose on the property and sell it at a public auction to recover the unpaid taxes. However, Texas law requires that the taxing unit must first file a lawsuit and obtain a court order before proceeding with a foreclosure.

Homeowners facing foreclosure due to unpaid taxes should take immediate action. They can work with the taxing unit to set up a payment plan or explore other options, such as applying for a property tax loan, which allows them to pay off the overdue taxes and avoid foreclosure.

Texas Property Tax Trends and Outlook

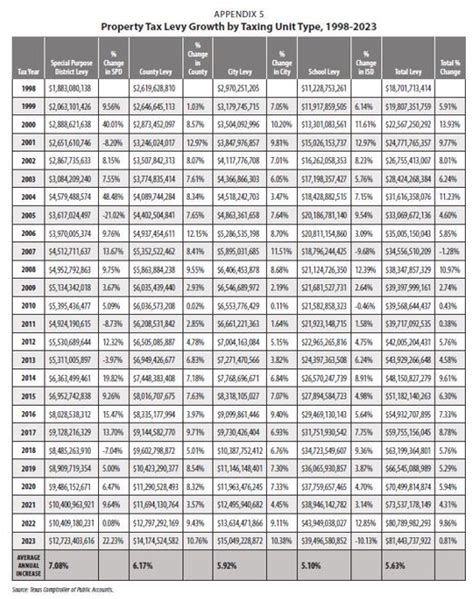

Understanding the historical trends and future projections of Texas property taxes can provide valuable insights for homeowners. By analyzing these trends, homeowners can make more informed decisions about their property investments and tax planning strategies.

Historical Property Tax Rates

Texas property tax rates have been relatively stable over the past decade, with an average effective rate of around 1.75%. This rate has fluctuated slightly due to economic conditions and changes in local tax policies. For example, during the COVID-19 pandemic, some taxing units experienced budget shortfalls and may have increased tax rates to make up for lost revenue.

It's worth noting that while the state average provides a useful benchmark, property tax rates can vary significantly across different counties and cities in Texas. Some areas may have lower rates due to a more diverse tax base, while others may rely more heavily on property taxes to fund local services and infrastructure.

Future Projections and Challenges

Looking ahead, the Texas property tax landscape faces several challenges and potential changes. One key issue is the state’s rapid population growth, which puts pressure on local governments to provide additional services and infrastructure while maintaining a balanced tax burden.

As the state's population continues to expand, particularly in urban areas, the demand for public services such as education, transportation, and public safety will increase. This may lead to higher property tax rates in some regions to meet these growing needs. However, the state's commitment to keeping income taxes low could also drive further reliance on property taxes.

Additionally, the impact of climate change and natural disasters on property values and tax assessments is a growing concern. Severe weather events, such as hurricanes and wildfires, can significantly affect property values and tax bases, potentially leading to revenue shortfalls for local governments.

To address these challenges, Texas policymakers and local governments are exploring various strategies, including:

- Implementing more efficient and equitable property tax assessment and collection systems.

- Expanding the tax base through economic development initiatives.

- Exploring alternative revenue sources, such as user fees or sales taxes, to reduce the reliance on property taxes.

- Enhancing financial transparency and accountability to build trust with taxpayers.

The Impact of Texas Property Taxes on Homeownership

The Texas property tax system has a direct impact on homeownership rates and affordability across the state. High property taxes can make it more challenging for first-time buyers to enter the housing market and for existing homeowners to maintain their properties.

To address these challenges, some cities and counties in Texas have implemented strategies to promote affordable housing and homeownership. These initiatives often include tax incentives, such as reduced tax rates or exemptions, for homeowners who meet certain income or property value criteria. Additionally, some local governments offer down payment assistance programs to help first-time buyers overcome the financial barriers to homeownership.

Texas Property Tax Resources and Assistance

Navigating the complexities of Texas property taxes can be daunting, but homeowners have access to a wealth of resources and support to help them understand their rights and obligations.

Local Appraisal Districts and Taxing Units

Every county in Texas has an appraisal district responsible for appraising property values and maintaining property tax records. These districts provide valuable resources, including property tax records, appraisal notices, and information about exemptions and discounts. Homeowners can visit their local appraisal district’s website or office to access these resources and seek assistance with any tax-related inquiries.

Additionally, homeowners should familiarize themselves with their local taxing units, such as their city government and school district. These entities are responsible for setting tax rates and budgets, and they often provide information on their websites about tax policies, budgets, and community engagement opportunities.

State Agencies and Organizations

The Texas Comptroller of Public Accounts plays a crucial role in overseeing the state’s tax system. While the Comptroller’s office does not directly administer property taxes, it provides valuable resources and information to help taxpayers understand their rights and responsibilities. This includes guides on tax exemptions, tax protest procedures, and tax relief programs.

The Texas Taxpayer Education Foundation is another valuable resource, offering educational materials and advocacy for taxpayers. Their website provides detailed information on property taxes, including guides on understanding tax bills, appealing property values, and navigating the tax protest process.

For homeowners facing financial difficulties, the Texas Property Tax Loan Program can provide assistance. This program allows eligible homeowners to borrow funds to pay their overdue property taxes, with the loan being repaid over time. Homeowners can contact their local appraisal district or the Texas State Comptroller's office for more information on this program.

Conclusion

Texas homeowners navigate a unique tax landscape, where property taxes play a significant role in funding local services and infrastructure. Understanding the fundamentals of the Texas property tax system, including tax rates, assessments, and payment options, is crucial for effective financial planning.

Homeowners have various tools at their disposal to reduce their tax burden, such as tax exemptions, value appeals, and financial assistance programs. Staying informed about these options and the evolving tax landscape in Texas can help homeowners make strategic decisions to manage their property tax obligations.

By leveraging the resources available through local appraisal districts, taxing units, and state agencies, homeowners can ensure they are compliant with their tax obligations while also exploring opportunities to minimize their tax burden. As Texas continues to address the challenges and opportunities presented by its unique tax system, homeowners can stay engaged and proactive in managing their property taxes.

How often are property tax rates in Texas adjusted?

+Property tax rates in Texas are typically set annually by local taxing units, such as cities and counties. These entities assess their budget needs and set the tax rate accordingly. However, it’s important to note that tax rates can be adjusted more frequently if necessary, such as in response to budget shortfalls or changes in local circumstances.

Are there any online tools to estimate my property taxes in Texas?

+Yes, many local appraisal districts in Texas provide online tools and calculators to help homeowners estimate their property taxes. These tools consider factors such as the property’s appraised value, tax rate, and any applicable exemptions or discounts. It’s a good idea to check with your local appraisal district for specific resources.

Can I appeal my property tax bill if I disagree with the assessed value?

+Absolutely! Texas homeowners have the right to appeal their property’s assessed value if they believe it is inaccurate or too high. The process involves submitting an appeal to the local appraisal review board (ARB) and attending a hearing to present evidence supporting your case. It’s beneficial to gather relevant data and seek professional guidance if needed.

What happens if I can’t afford to pay my property taxes in Texas?

+If you’re facing financial difficulties and unable to pay your property taxes, it’s important to take immediate action. You can contact your local appraisal district or taxing unit to discuss potential options, such as setting up a payment plan or applying for a property tax loan. These programs can help you manage your tax obligations and avoid penalties or foreclosure.