Missouri State Taxes

Missouri, the "Show-Me State," is known for its vibrant cities, stunning natural landscapes, and a tax system that has its unique characteristics. Let's delve into the world of Missouri state taxes, exploring the rates, structures, and key considerations for individuals and businesses operating within this diverse state.

Understanding Missouri’s Tax Landscape

Missouri’s tax system is a blend of traditional and progressive elements, offering a unique experience for taxpayers. Here’s an in-depth look at the various aspects of state taxes in Missouri.

Personal Income Tax: A Progressive Approach

Missouri employs a progressive income tax structure, meaning that higher incomes are taxed at a higher rate. As of the 2023 tax year, Missouri’s income tax rates are as follows:

- 1.5% on taxable income up to 1,000</li> <li><strong>2.0%</strong> on taxable income between 1,001 and 2,000</li> <li><strong>2.5%</strong> on taxable income between 2,001 and 3,000</li> <li>And so on, with rates increasing up to a maximum of <strong>6.0%</strong> for taxable income over 9,000.

This progressive system ensures that those with higher incomes contribute a larger portion to the state’s revenue. Missouri’s income tax structure is designed to be fair and balanced, recognizing the varying financial circumstances of its residents.

Sales and Use Tax: A Statewide Standard

Missouri imposes a 4.225% sales and use tax rate on most goods and services sold within the state. This rate is comprised of a 4.225% state sales tax, with no additional local sales taxes applied. However, it’s important to note that some localities may impose additional taxes on specific items, such as hotel stays or restaurant meals.

The sales tax is levied on the retail sale, lease, or rental of tangible personal property, as well as certain services. Missouri’s sales tax is relatively straightforward, providing a consistent and predictable tax environment for businesses and consumers.

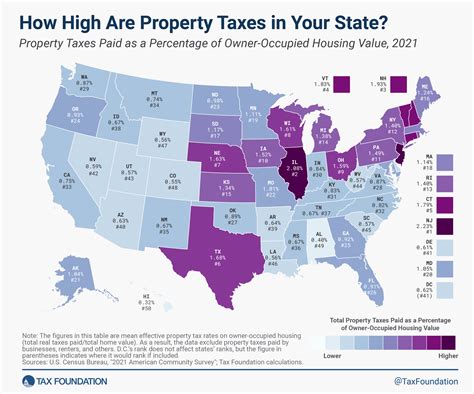

Property Tax: A Local Focus

Property taxes in Missouri are primarily a local responsibility, with each county and city setting its own tax rates. These rates can vary significantly, depending on the location and the needs of the local government. The state, however, does provide some guidelines and limitations to ensure fairness and prevent excessive taxation.

Property taxes are based on the assessed value of real estate and personal property. The assessed value is then multiplied by the tax rate to determine the tax liability. Missouri’s property tax system is designed to support local services and infrastructure, ranging from schools to road maintenance.

Corporate Income Tax: A Competitive Rate

Missouri aims to attract businesses with a 6.25% corporate income tax rate, which is relatively low compared to many other states. This flat rate applies to all corporations, regardless of their size or industry. The state offers a competitive environment for businesses, recognizing the importance of a stable and predictable tax climate for economic growth.

Missouri also provides various incentives and credits to encourage business investment and job creation. These incentives can significantly reduce a corporation’s tax liability, making the state an attractive destination for businesses seeking to expand or relocate.

Estate and Inheritance Tax: A Limited Scope

Missouri has a limited estate tax and no inheritance tax. The estate tax is imposed on the transfer of property at the time of death, but only if the value of the estate exceeds a certain threshold. As of 2023, this threshold is $5.49 million, meaning that most estates are not subject to the tax.

Additionally, Missouri does not have an inheritance tax, which means that heirs and beneficiaries do not pay taxes on the property they receive from the deceased.

Tax Incentives and Credits

Missouri offers a range of tax incentives and credits to promote economic development and support specific industries. These incentives can be particularly beneficial for businesses considering expansion or relocation to the state.

Economic Development Incentives

The Missouri Department of Economic Development (DED) administers several programs aimed at attracting and retaining businesses. These programs include:

- Missouri Works: A performance-based incentive program offering cash incentives to companies creating new jobs and making capital investments in the state.

- Enhanced Enterprise Zone Tax Credits: Incentives for businesses operating in designated economically distressed areas, providing tax credits for job creation and investment.

- Quality Jobs Program: Provides tax credits to companies based on the number of new full-time jobs created and retained over a specified period.

These incentives can significantly reduce a business’s tax liability, making Missouri an attractive location for economic growth and job creation.

Industry-Specific Credits

Missouri offers a variety of tax credits to support specific industries and initiatives. These include:

- Research and Development Tax Credits: Encourages businesses to invest in research and development activities, providing a credit based on qualified research expenses.

- Historic Preservation Tax Credits: Incentivizes the rehabilitation of historic buildings, providing tax credits for qualified rehabilitation expenses.

- Film Production Tax Credits: Supports the film and television industry by offering tax credits for qualified production expenses incurred in Missouri.

- New Markets Tax Credits: Aimed at encouraging investment in low-income communities, providing tax credits for qualified equity investments.

These industry-specific credits demonstrate Missouri’s commitment to fostering economic diversity and innovation.

Tax Compliance and Filing

Understanding Missouri’s tax laws and compliance requirements is essential for both individuals and businesses. Here’s a closer look at the filing process and key considerations.

Individual Tax Filing

Missouri residents and non-residents with income sourced from the state must file an individual income tax return. The filing deadline is typically April 15th, following the tax year. Missouri offers both paper and electronic filing options, with the latter being the most convenient and efficient method.

Individual taxpayers can access a range of resources and tools on the Missouri Department of Revenue’s website, including tax forms, instructions, and helpful guides. The department also provides assistance through its call center and local offices.

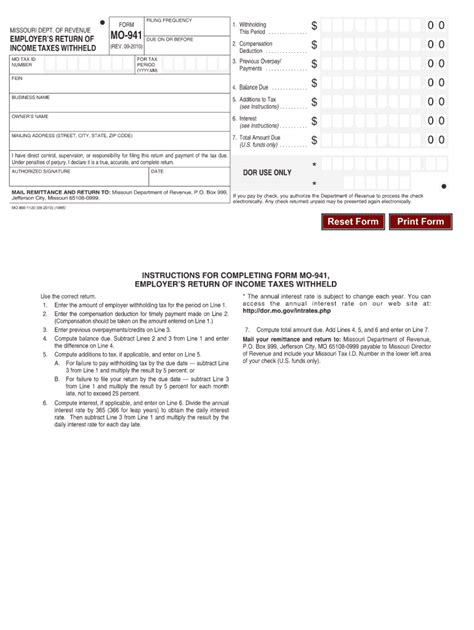

Business Tax Filing

Businesses operating in Missouri have various tax obligations, depending on their structure and activities. These may include corporate income tax, sales and use tax, withholding tax, and more.

The Missouri Department of Revenue provides a comprehensive guide to business taxes, outlining registration requirements, tax rates, and filing deadlines. Businesses can register online and access a range of resources to ensure compliance with state tax laws.

Taxpayer Rights and Responsibilities

Missouri taxpayers have certain rights and responsibilities when it comes to tax compliance. These include the right to privacy, the right to a fair and impartial tax system, and the right to appeal tax assessments. On the other hand, taxpayers are responsible for accurately reporting their income, paying taxes on time, and keeping adequate records.

The Missouri Department of Revenue works to ensure that taxpayers’ rights are respected while also enforcing the state’s tax laws. This balance between taxpayer rights and responsibilities is essential for maintaining a fair and effective tax system.

The Future of Missouri’s Tax Landscape

As Missouri continues to evolve, its tax system will likely undergo changes and adaptations to meet the needs of its residents and businesses. Here are some potential future developments and their implications.

Tax Reform and Simplification

There have been ongoing discussions about tax reform in Missouri, with a focus on simplifying the tax code and reducing the tax burden on individuals and businesses. Potential reforms could include:

- Broadening the tax base to reduce reliance on a few key revenue sources.

- Adjusting tax rates to make the system more competitive and encourage economic growth.

- Streamlining tax administration to improve efficiency and reduce compliance costs.

Tax reform efforts aim to create a more modern and responsive tax system, better suited to the needs of a dynamic economy.

Economic Growth and Tax Revenue

Missouri’s tax revenue is closely tied to the state’s economic performance. As the economy grows, tax revenue typically increases, providing resources for essential services and infrastructure. However, economic downturns can lead to revenue shortfalls, impacting the state’s ability to fund critical programs.

The state’s tax system must be resilient and adaptable to navigate economic cycles effectively. This includes having sufficient reserves and the flexibility to adjust tax policies as needed.

Emerging Industries and Tax Policy

Missouri’s tax policy will need to adapt to the emergence of new industries and technologies. As the state looks to diversify its economy, it will need to consider how to support and tax emerging sectors, such as renewable energy, advanced manufacturing, and technology startups.

A forward-thinking tax policy can help Missouri attract and retain businesses in these innovative sectors, contributing to long-term economic growth and prosperity.

Regional Cooperation and Tax Competition

Missouri’s tax policies are not isolated from those of its neighboring states. Regional cooperation and competition play a significant role in shaping the state’s tax landscape. As other states implement tax reforms and incentives, Missouri may need to respond to remain competitive and attract businesses and residents.

Collaborative efforts among states can lead to more consistent tax policies, benefiting businesses operating across state lines and promoting regional economic integration.

Conclusion

Missouri’s tax system is a complex yet balanced blend of progressive and traditional elements. The state offers a competitive corporate tax rate, a straightforward sales tax, and a range of incentives to support economic development. For individuals, the progressive income tax structure ensures fairness, while property taxes are primarily a local responsibility.

As Missouri continues to evolve, its tax system will play a crucial role in shaping the state’s economic future. By staying responsive to the needs of its residents and businesses, Missouri can maintain a tax climate that fosters growth, innovation, and prosperity.

What is Missouri’s tax rate for online sales?

+

Missouri imposes a 4.225% sales and use tax on online sales, the same rate as for in-person transactions. However, businesses making online sales must register with the Missouri Department of Revenue and collect and remit the appropriate taxes.

Are there any special tax considerations for small businesses in Missouri?

+

Yes, Missouri offers several tax incentives for small businesses. These include the Small Business Job Creation Tax Credit, which provides a credit for creating new jobs, and the Small Business Investment Tax Credit, which encourages investment in small businesses. Additionally, small businesses may be eligible for tax breaks through the Missouri Main Street Connection program.

How often must Missouri businesses file sales tax returns?

+

The frequency of sales tax filing depends on a business’s sales volume. Monthly filing is required for businesses with sales exceeding 100,000 in a calendar year, while quarterly filing is required for those with sales between 10,001 and 100,000. Annual filing is an option for businesses with sales of 10,000 or less.

Are there any tax benefits for renewable energy projects in Missouri?

+

Yes, Missouri offers tax incentives for renewable energy projects. The Renewable Energy Systems Tax Credit provides a credit for the installation of solar, wind, and other renewable energy systems. Additionally, the Missouri Property Assessment Clean Energy (PACE) program allows property owners to finance energy efficiency and renewable energy projects through property tax assessments.