Missouri Sales Tax Estimator

Welcome to the comprehensive guide on the Missouri Sales Tax Estimator, an essential tool for businesses and individuals operating within the state of Missouri. In this article, we will delve into the intricacies of Missouri's sales tax system, providing you with an in-depth understanding of how to calculate and estimate sales tax accurately. Whether you're a business owner looking to comply with tax regulations or an individual curious about the tax landscape, this guide will equip you with the knowledge you need.

Understanding Missouri’s Sales Tax Structure

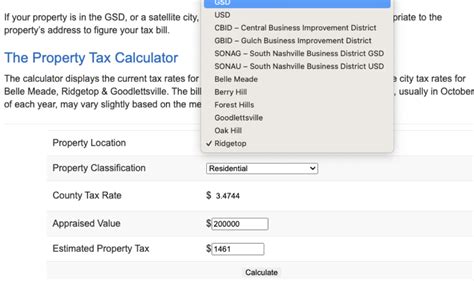

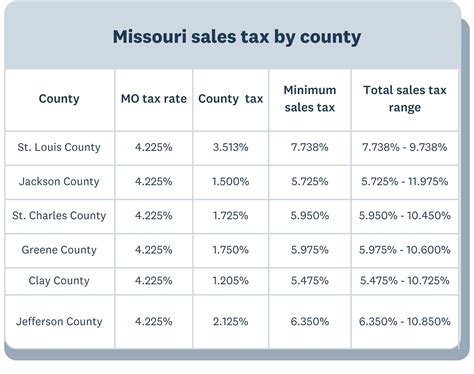

Missouri’s sales tax system is a complex yet crucial component of the state’s economy. The state imposes a state sales tax rate, which is currently set at 4.225%, and local jurisdictions have the authority to levy additional local sales taxes. This combination of state and local taxes creates a unique tax environment that requires careful consideration when calculating sales tax.

State Sales Tax: A Unified Approach

The state sales tax in Missouri is a flat rate applied to all taxable sales and services. This uniformity simplifies the calculation process to a certain extent, as businesses and individuals can rely on a consistent rate across the state. However, it’s important to note that the state sales tax is just the starting point, as local sales taxes can significantly impact the final tax liability.

| State Sales Tax Rate | Current Rate |

|---|---|

| Missouri State Sales Tax | 4.225% |

Local Sales Taxes: A Dynamic Landscape

Local sales taxes in Missouri add a layer of complexity to the sales tax landscape. Counties, cities, and other local jurisdictions have the power to impose their own sales taxes, resulting in varying rates across the state. These local taxes can be as low as 0% in some areas or as high as 4.75%, creating a dynamic and diverse tax environment.

The existence of local sales taxes means that businesses operating in multiple jurisdictions within Missouri must navigate a web of varying tax rates. This complexity underscores the importance of accurate sales tax estimation tools like the Missouri Sales Tax Estimator.

| Local Sales Tax Rate Range | Lowest Rate | Highest Rate |

|---|---|---|

| Local Sales Taxes in Missouri | 0% | 4.75% |

The Role of the Missouri Sales Tax Estimator

In the face of Missouri’s multifaceted sales tax system, the Missouri Sales Tax Estimator emerges as a crucial tool for businesses and taxpayers. This estimator is designed to simplify the process of calculating sales tax, ensuring compliance with state and local regulations.

Key Features of the Estimator

- State and Local Tax Integration: The estimator takes into account both the state sales tax rate and the applicable local sales tax rates, providing a comprehensive calculation.

- User-Friendly Interface: With a straightforward design, the estimator allows users to input essential details such as the purchase amount, location, and tax rate, making it accessible to businesses of all sizes.

- Real-Time Calculations: By leveraging advanced algorithms, the estimator provides instant sales tax calculations, offering businesses and taxpayers quick and accurate results.

Benefits for Businesses

For businesses operating in Missouri, the Missouri Sales Tax Estimator offers a range of advantages:

- Compliance Assurance: Accurate sales tax calculations ensure businesses remain compliant with state and local tax regulations, avoiding potential penalties and legal issues.

- Streamlined Tax Management: By integrating state and local tax rates, the estimator simplifies the tax management process, saving businesses time and resources.

- Enhanced Customer Experience: Providing customers with precise tax information at the point of sale can improve customer satisfaction and build trust.

Benefits for Taxpayers

Individual taxpayers in Missouri can also benefit from using the sales tax estimator:

- Tax Awareness: Understanding the sales tax landscape empowers taxpayers to make informed decisions about their purchases and tax obligations.

- Budgeting and Planning: Accurate tax calculations aid in financial planning, helping individuals allocate their budgets effectively.

- Reduced Confusion: The estimator simplifies the often-confusing world of sales taxes, providing clarity and peace of mind to taxpayers.

How the Missouri Sales Tax Estimator Works

The Missouri Sales Tax Estimator is a sophisticated tool designed to handle the complexities of Missouri’s sales tax system. Let’s explore the inner workings of this estimator step by step.

Step 1: Input Essential Details

Users begin by inputting key information into the estimator. This includes the purchase amount, which serves as the basis for the tax calculation. Additionally, users specify the location of the purchase, as this determines the applicable local sales tax rate.

Step 2: State and Local Tax Calculation

Behind the scenes, the estimator retrieves the relevant tax rates based on the user’s location. It combines the state sales tax rate with the specific local sales tax rate, applying the appropriate percentages to the purchase amount.

Step 3: Instant Results

Within seconds, the Missouri Sales Tax Estimator provides users with the total sales tax amount, breaking down the calculation into state and local components. This instant feedback allows businesses and taxpayers to make informed decisions and plan their finances effectively.

Example Calculation

Let’s consider an example to illustrate the estimator’s functionality. Suppose a business operates in a jurisdiction with a local sales tax rate of 2.5%. If a customer makes a purchase of $100, the estimator would calculate the sales tax as follows:

| State Sales Tax | Local Sales Tax | Total Sales Tax |

|---|---|---|

| $4.225 (4.225% of $100) | $2.50 (2.5% of $100) | $6.725 |

In this example, the total sales tax of $6.725 would be added to the purchase amount, resulting in a final price of $106.725.

The Impact of Sales Tax on Businesses

Sales tax is a critical factor in the financial health of businesses operating in Missouri. It influences pricing strategies, customer behavior, and overall profitability. Let’s explore how sales tax impacts businesses and the strategies they employ to navigate this complex landscape.

Pricing and Profitability

Sales tax directly affects the pricing of goods and services. Businesses must carefully consider the impact of tax rates on their margins and pricing structures. A well-planned pricing strategy can help businesses maintain profitability while staying competitive in the market.

Customer Perception

Sales tax can influence customer behavior and perceptions. Clear communication about tax rates and their inclusion in pricing can build trust with customers. Businesses that provide transparency in their pricing and tax calculations are more likely to foster customer loyalty.

Strategic Tax Planning

To optimize their tax obligations, businesses engage in strategic tax planning. This involves analyzing sales tax rates, exploring tax incentives, and staying informed about tax regulations. By staying proactive, businesses can minimize their tax burden and allocate resources more efficiently.

Sales Tax and Consumer Behavior

Sales tax is not only a consideration for businesses but also a factor that influences consumer behavior. Understanding how sales tax impacts purchasing decisions is crucial for both businesses and policymakers.

Price Sensitivity

Consumers are often sensitive to price changes, and sales tax can significantly impact their purchasing power. Higher sales tax rates may discourage purchases, especially for non-essential items. Businesses must consider this price sensitivity when setting their pricing strategies.

Online vs. In-Store Shopping

The rise of e-commerce has led to a shift in consumer behavior. Online shopping often provides a more transparent comparison of prices, including tax rates. This transparency can influence consumers’ choices between online and in-store purchases.

Tax Incentives and Consumer Response

Tax incentives, such as sales tax holidays, can stimulate consumer spending. These temporary tax breaks encourage consumers to make purchases during specific periods, benefiting both businesses and the local economy.

Future Outlook: Missouri’s Sales Tax Landscape

As Missouri’s economy evolves, so does its sales tax landscape. Staying informed about potential changes and trends is essential for businesses and taxpayers.

Potential Rate Adjustments

Sales tax rates are subject to change, and Missouri’s tax environment is no exception. While the state sales tax rate has remained stable, local tax rates can fluctuate. Businesses and taxpayers should stay vigilant for any proposed changes to local sales tax rates.

Technological Advancements

The continuous advancement of technology is transforming the sales tax estimation process. Tools like the Missouri Sales Tax Estimator are becoming more sophisticated, offering improved accuracy and efficiency. Businesses can leverage these advancements to streamline their tax management processes.

Regulatory Updates

Staying updated with tax regulations is crucial. Missouri, like other states, may introduce new laws or amend existing ones to adapt to economic changes. Businesses should regularly review tax guidelines to ensure compliance and take advantage of any tax incentives.

Conclusion

The Missouri Sales Tax Estimator is a powerful tool that empowers businesses and taxpayers to navigate the state’s complex sales tax landscape. By understanding the estimator’s capabilities and the broader impact of sales tax, individuals and businesses can make informed decisions, ensure compliance, and optimize their financial strategies.

As Missouri's economy continues to evolve, staying informed and adaptable is key. The Missouri Sales Tax Estimator serves as a valuable resource, offering clarity and precision in an ever-changing tax environment.

What are the current state and local sales tax rates in Missouri?

+

The state sales tax rate in Missouri is currently set at 4.225%, while local sales tax rates can vary from 0% to 4.75% depending on the jurisdiction. It’s essential to check the specific local sales tax rate for your location.

How does the Missouri Sales Tax Estimator calculate sales tax?

+

The estimator calculates sales tax by combining the state sales tax rate with the applicable local sales tax rate for your location. It applies these rates to the purchase amount you input, providing an accurate estimation of the total sales tax.

Are there any exemptions or special tax rates for certain products or services in Missouri?

+

Yes, Missouri offers exemptions and special tax rates for specific items like groceries, prescription drugs, and some services. It’s important to consult the Missouri Department of Revenue for a comprehensive list of exemptions and their applicable tax rates.

How often should I update my knowledge of Missouri’s sales tax rates and regulations?

+

It’s advisable to review Missouri’s sales tax rates and regulations at least annually, especially if you’re a business owner. This ensures you stay compliant with any changes and take advantage of any updated tax incentives or programs.

Can the Missouri Sales Tax Estimator be used for large-scale tax calculations for businesses?

+

Absolutely! The estimator is designed to handle various purchase amounts, making it suitable for businesses of all sizes. It provides accurate and efficient tax calculations, aiding businesses in managing their tax obligations effectively.