What Is The Sales Tax For Ny

The sales tax in New York is a critical aspect of the state's revenue system and an important consideration for both residents and businesses operating within the state. With a complex tax structure, understanding the sales tax rate and its implications is essential for accurate financial planning and compliance with state regulations.

The Complexity of New York’s Sales Tax System

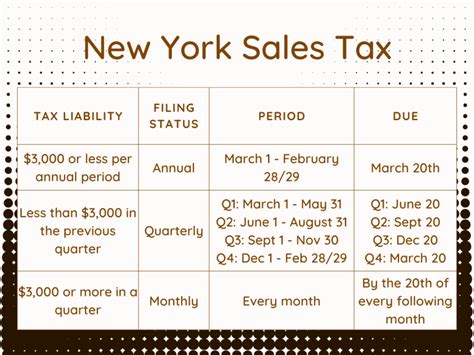

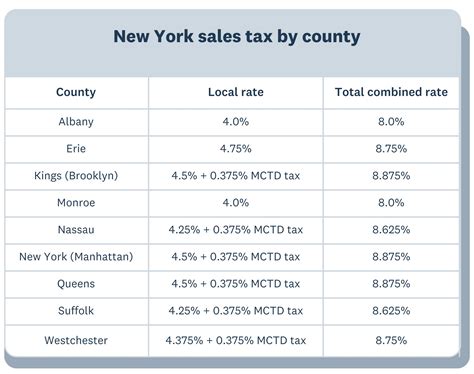

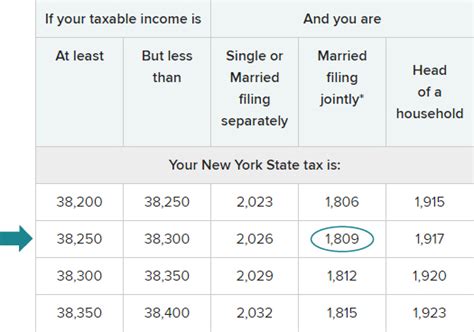

New York’s sales tax system is renowned for its complexity, primarily due to the variation in tax rates across different localities within the state. While the statewide sales tax rate is 4%, many counties and cities impose additional local sales taxes, resulting in a wide range of effective sales tax rates across the state.

Statewide Sales Tax

The base sales tax rate in New York is 4%, which applies to most retail sales of tangible personal property and certain services. This rate is uniform across the state and is levied by the New York State Department of Taxation and Finance.

| Tax Category | Sales Tax Rate |

|---|---|

| General Sales Tax | 4% |

Local Sales Taxes

In addition to the statewide sales tax, many counties and cities in New York impose their own local sales taxes. These local taxes can significantly impact the overall sales tax rate that consumers pay. For instance, New York City’s sales tax rate is 4.5% on top of the state rate, bringing the total effective sales tax rate to 8.5% within the city limits.

| Location | Local Sales Tax Rate | Effective Sales Tax Rate |

|---|---|---|

| New York City | 4.5% | 8.5% |

| Albany County | 3% | 7% |

| Buffalo | 3% | 7% |

Impact on Business and Consumers

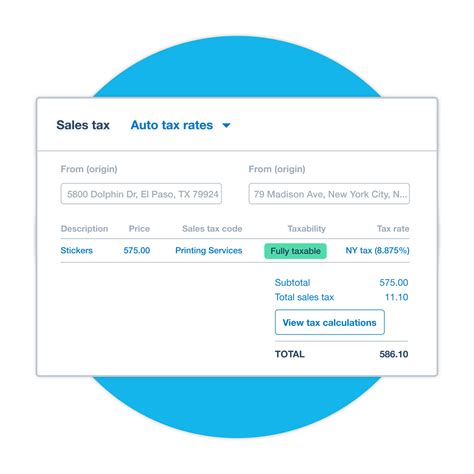

The diverse sales tax landscape in New York can have significant implications for both businesses and consumers. For businesses, especially those with multiple locations or e-commerce operations, navigating the complex tax structure can be a logistical and financial challenge. They must ensure compliance with various tax rates and regulations to avoid penalties and maintain a positive relationship with the state.

For consumers, understanding the sales tax rate in their specific locality is crucial for budgeting and financial planning. The wide variation in sales tax rates across New York can result in significant differences in the cost of goods and services, particularly for high-value purchases. It's essential for consumers to be aware of these variations to make informed purchasing decisions.

Sales Tax Exemptions and Special Considerations

While most retail sales in New York are subject to sales tax, there are several categories of goods and services that are exempt from sales tax. These exemptions include essential items such as prescription drugs, residential energy, and some types of food. Additionally, certain types of businesses, like nonprofit organizations, may qualify for sales tax exemptions or reduced rates.

New York also offers various sales tax incentives and programs to encourage economic development and support specific industries. For instance, the Empire Zones Program provides tax incentives, including reduced sales tax rates, to businesses operating within designated economically distressed areas of the state.

Key Sales Tax Exemptions and Incentives

- Prescription Drugs: Medications purchased with a valid prescription are exempt from sales tax.

- Residential Energy: Sales tax does not apply to energy used for residential purposes.

- Food Exemptions: Prepared food for immediate consumption and some grocery items are exempt from sales tax.

- Empire Zones Program: Businesses operating in designated zones may benefit from reduced sales tax rates and other incentives.

Future Outlook and Potential Changes

As New York’s economy and tax landscape continue to evolve, there is a growing discussion around the future of the state’s sales tax system. Advocates for tax reform argue that the current system is overly complex and burdensome, particularly for small businesses. They propose simplifying the tax structure and reducing the number of localities with additional sales taxes.

On the other hand, there are concerns that simplifying the sales tax system could lead to reduced revenue for local governments, potentially impacting the provision of essential services. Balancing the need for a simplified tax structure with the financial needs of local governments will be a key challenge for policymakers in the coming years.

Additionally, the ongoing trend of online shopping and e-commerce presents unique challenges for sales tax collection. New York, like many other states, is grappling with how to effectively tax remote sellers and online marketplaces to ensure a level playing field for brick-and-mortar businesses and maintain a fair revenue system.

Conclusion

Understanding New York’s sales tax system is crucial for businesses and consumers alike. With a complex web of state and local taxes, accurate information and compliance are essential. While the state’s tax structure presents challenges, it also offers opportunities for economic development and support through various incentive programs.

As the state's tax landscape continues to evolve, staying informed about potential changes and their implications will be vital for businesses and individuals operating within New York. The future of the sales tax system will undoubtedly shape the economic landscape of the state, impacting everything from local government budgets to consumer spending habits.

How often do sales tax rates change in New York?

+Sales tax rates in New York can change annually, typically as part of the state’s budget process. Local governments may also propose changes to their sales tax rates, which require approval from the state legislature.

Are there any special sales tax rates for certain industries or products in New York?

+Yes, New York offers various sales tax exemptions and reduced rates for specific industries and products. For instance, there are exemptions for certain agricultural products, manufacturing machinery, and energy-efficient equipment. Additionally, the state has special tax rates for lodging and restaurant meals.

How does New York handle sales tax for online purchases?

+New York has implemented a law requiring remote sellers and online marketplaces to collect and remit sales tax on transactions with New York residents. This law aims to ensure that online sellers contribute to the state’s revenue and that local businesses are not at a competitive disadvantage.