State Tax Deadline California

For individuals and businesses residing in California, understanding the state tax deadlines is crucial to ensure timely filing and avoid penalties. California, known for its vibrant economy and diverse population, has a well-defined tax system with specific deadlines to navigate. This article aims to provide an in-depth guide to the California state tax deadlines, offering valuable insights for taxpayers and businesses alike.

The California State Tax Deadlines

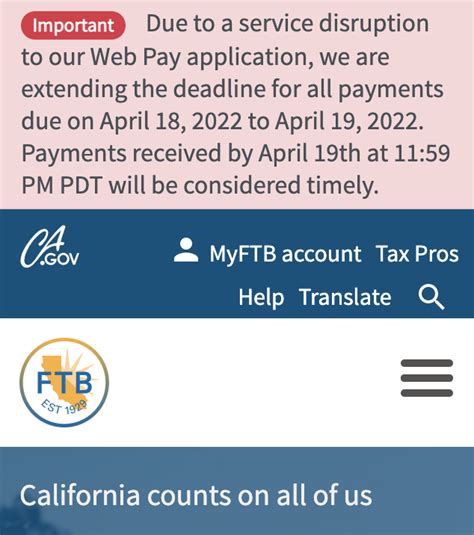

California’s tax system is governed by the Franchise Tax Board (FTB), which sets the annual tax deadlines for residents and businesses operating within the state. These deadlines are pivotal for tax planning and compliance, ensuring that taxpayers meet their obligations efficiently.

Individual Income Tax Deadlines

For individuals filing their personal income tax returns, the key deadline to remember is April 15th of each year. This date marks the end of the standard tax filing season, allowing taxpayers to report their earnings, deductions, and credits for the previous fiscal year.

However, it’s important to note that California offers an extension for those who require additional time. By filing Form FTB 3519, individuals can extend their tax filing deadline to October 15th. This extension provides a valuable opportunity for taxpayers to gather necessary documentation, seek professional advice, or simply buy some extra time to complete their returns accurately.

Business Tax Deadlines

California’s business landscape is diverse, and so are its tax requirements. The state offers a range of tax deadlines for businesses, depending on their entity type and tax obligations.

- Corporations: Corporations in California generally follow the same income tax deadline as individuals, with the April 15th filing due date. However, corporations can also opt for the extension, pushing their deadline to October 15th by filing Form 1045.

- Partnerships and LLCs: For pass-through entities like partnerships and LLCs, the tax deadline is slightly different. These entities must file their tax returns by March 15th, providing a slightly earlier deadline compared to individuals and corporations.

- Sales and Use Tax: Businesses engaged in selling goods or services in California must also comply with sales and use tax regulations. The monthly filing deadline for these taxes is typically the 20th day of the following month. For instance, sales made in January would need to be reported by February 20th.

- Franchise Tax: Corporations and certain LLCs in California are subject to an annual franchise tax. The deadline for paying this tax is aligned with the income tax deadline, falling on April 15th. However, if the franchise tax is not included in the income tax return, a separate payment must be made by the same date.

Special Circumstances and Deadlines

California’s tax system acknowledges that not all taxpayers can adhere to the standard deadlines due to various reasons. To accommodate these situations, the FTB offers several special circumstances and deadlines.

- Military Service: Active-duty military personnel stationed outside the United States are granted an automatic extension for filing their tax returns. They can file by June 15th without the need for a formal request.

- Disaster Relief: In the event of a natural disaster or emergency, the FTB may offer a disaster relief extension to affected taxpayers. This extension provides additional time to file and pay taxes without incurring penalties.

- Death or Incapacity: If a taxpayer passes away or becomes incapacitated during the tax year, their representative or executor can file a final return on their behalf. The deadline for such returns is the original due date or six months after the date of death or incapacity, whichever is later.

Filing and Payment Options

California offers a range of filing and payment options to accommodate different taxpayer preferences and needs.

- Online Filing: The FTB encourages taxpayers to file their returns electronically. The California Online Tax Service (COTS) is a secure platform that allows individuals and businesses to file their tax returns online. It’s user-friendly, efficient, and often the quickest way to receive a refund.

- Paper Filing: For those who prefer a traditional approach, paper filing is still an option. Taxpayers can download and print the necessary forms from the FTB website and mail them to the designated address.

- Electronic Funds Transfer (EFT): EFT is a convenient and secure method for paying taxes. Taxpayers can authorize the FTB to withdraw the tax amount directly from their bank account, ensuring timely payment without the hassle of checks or money orders.

- Credit Card Payment: California accepts credit card payments for taxes through authorized payment processors. This option provides flexibility and allows taxpayers to earn rewards or points on their credit card purchases.

Penalty and Interest Charges

While California aims to accommodate taxpayers with various deadlines and payment options, late filing and payment can result in penalties and interest charges. These charges are designed to encourage timely compliance and ensure the state’s revenue stream remains stable.

| Penalty Type | Description |

|---|---|

| Late Filing Penalty | A penalty of 5% of the unpaid tax is charged for each month or part of a month that a return is late, up to a maximum of 25%. |

| Late Payment Penalty | If taxes are not paid by the due date, a penalty of 0.5% is charged per month or part of a month, up to a maximum of 25%. |

| Interest on Unpaid Taxes | Interest accrues on any unpaid tax balance from the original due date until the balance is paid in full. The interest rate is adjusted annually and is currently set at 3%. |

Resources and Assistance

The Franchise Tax Board (FTB) understands that tax deadlines and regulations can be complex, especially for new residents or businesses. To ensure taxpayers have the support they need, the FTB provides a wealth of resources and assistance options.

- FTB Website: The official FTB website is a comprehensive resource hub. It offers detailed information on tax deadlines, forms, publications, and frequently asked questions. Taxpayers can find guidance on specific tax topics and stay updated on any changes or updates to tax laws.

- Taxpayer Assistance Centers (TACs): California has physical Taxpayer Assistance Centers located across the state. These centers provide in-person assistance for taxpayers who prefer face-to-face interaction. TACs offer help with tax forms, payment plans, and resolving tax-related issues.

- FTB Customer Service: Taxpayers can reach out to the FTB’s customer service team for assistance. The team can be contacted via phone, email, or live chat, providing timely support for a range of tax-related queries.

- Tax Preparation Assistance: For those who need help preparing their tax returns, California offers various tax preparation assistance programs. These programs provide free or low-cost tax preparation services, ensuring that even those with limited resources can file their taxes accurately.

Conclusion

Navigating California’s state tax deadlines is an essential part of financial responsibility for individuals and businesses alike. By understanding the key deadlines, filing options, and available resources, taxpayers can ensure they meet their obligations efficiently and avoid unnecessary penalties. The Franchise Tax Board’s comprehensive support system ensures that taxpayers have the tools and assistance they need to navigate the complex world of state taxes.

Frequently Asked Questions

Can I file my California state tax return early?

+Yes, you can file your California state tax return early if you have all the necessary information and documentation. However, keep in mind that the FTB may not process early returns until the official filing season begins.

What happens if I miss the state tax deadline?

+If you miss the state tax deadline, you may be subject to late filing and late payment penalties, as well as interest on any unpaid taxes. It’s important to file and pay as soon as possible to minimize these charges.

Are there any tax deadlines for estimated tax payments in California?

+Yes, California requires estimated tax payments for individuals and businesses with significant income or tax liabilities. The deadlines for estimated tax payments are typically April 15th, June 15th, September 15th, and January 15th of the following year.

Can I request an extension for filing my state tax return?

+Yes, you can request an extension for filing your state tax return. California offers an automatic extension until October 15th for individuals and some businesses. To request an extension, you must file the appropriate form, such as Form FTB 3519.

How can I stay updated on tax deadlines and changes in California?

+To stay informed about tax deadlines and changes in California, you can bookmark the FTB website and subscribe to their email updates. They also provide tax news and updates on social media platforms like Twitter and Facebook.