Sales Tax Rate Orange County

Understanding the intricacies of sales tax rates is essential for businesses and consumers alike, especially when navigating the complex landscape of Orange County, California. This article aims to provide an in-depth analysis of the sales tax rate in Orange County, exploring its history, current regulations, and potential future implications. By delving into the specifics, we can offer a comprehensive guide that aids businesses in tax compliance and helps consumers make informed decisions.

The Historical Perspective of Sales Tax in Orange County

To grasp the current sales tax rate in Orange County, it’s beneficial to trace its evolution over time. The sales tax in California, including Orange County, has undergone several adjustments since its inception. The state’s sales and use tax came into effect in 1933, initially set at 2.5% and primarily aimed at generating revenue for the state during the Great Depression.

Over the decades, the sales tax rate has seen numerous fluctuations. As of January 2024, the state's general sales tax rate stands at 7.25%, a rate that has remained consistent since 2013. However, it's crucial to note that local jurisdictions, such as counties and cities, have the authority to impose additional sales tax rates, creating a more complex landscape for businesses and consumers.

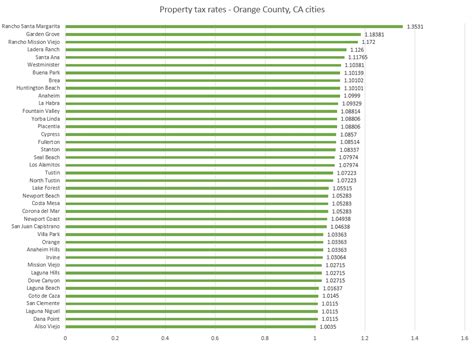

In the context of Orange County, the county-wide sales tax rate has historically been 1.0% on top of the state rate, resulting in a combined rate of 8.25%. This additional county tax is often referred to as the "county discretionary sales tax" and is utilized for various public services and infrastructure projects.

| Sales Tax Rate Component | Rate (%) |

|---|---|

| State Sales Tax | 7.25 |

| Orange County Sales Tax | 1.0 |

| Total Sales Tax Rate in Orange County | 8.25 |

It's worth mentioning that within Orange County, certain cities may have additional local sales tax rates, which can further increase the total tax burden. For instance, cities like Anaheim and Santa Ana have local sales tax rates of 0.5% and 0.25%, respectively, on top of the state and county rates.

The Current Sales Tax Landscape in Orange County

As of the latest updates, the sales tax rate in Orange County remains at 8.25%, comprising the state rate of 7.25% and the county rate of 1.0%. This rate is applicable to a broad range of goods and services, with a few notable exceptions.

Goods and Services Subject to Sales Tax

In Orange County, like most places in California, sales tax is levied on a wide array of tangible personal property and certain services. This includes items such as clothing, electronics, furniture, and vehicles. Additionally, services like automotive repairs, haircuts, and certain professional services are subject to sales tax.

It's important to note that the sales tax rate may vary depending on the specific product or service. For instance, certain categories of food, prescription drugs, and some agricultural products are exempt from sales tax. Additionally, certain services, such as legal and medical services, are typically not subject to sales tax.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Orange County is 8.25%, there are specific scenarios where sales tax may not apply or be reduced. Here are some key exemptions and considerations:

- Resale Exemption: Businesses that purchase goods for resale are generally exempt from paying sales tax on these purchases. This exemption applies to retailers, wholesalers, and other businesses involved in the distribution chain.

- Manufacturing Exemption: Manufacturers may be eligible for a sales tax exemption on certain purchases of machinery, equipment, and raw materials used in the manufacturing process.

- Agricultural Exemption: Sales of agricultural products, such as livestock and certain farm equipment, are often exempt from sales tax.

- Food and Beverage Exemption: While most food items are taxable, there are exemptions for unprepared food products and certain restaurant meals. The specific rules can be complex, so businesses in the food industry should consult the relevant guidelines.

- Remote Sellers and Marketplace Facilitators: Remote sellers and marketplace facilitators who sell goods into Orange County may be required to collect and remit sales tax, even if they don't have a physical presence in the county. The specific rules for remote sellers can be intricate, and businesses should stay updated with the latest regulations.

The Impact of Sales Tax on Businesses and Consumers

The sales tax rate in Orange County, like any tax policy, has a profound impact on both businesses and consumers. For businesses, understanding and managing sales tax obligations is crucial for maintaining compliance and avoiding penalties. It also influences pricing strategies and competitive positioning.

From a consumer perspective, the sales tax rate directly affects the cost of goods and services. A higher sales tax rate can make certain purchases more expensive, potentially influencing consumer behavior and spending patterns. On the other hand, a lower sales tax rate can make a region more attractive for consumers, particularly for large-ticket items.

Business Compliance and Tax Obligations

Businesses operating in Orange County must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller’s permit. This permit allows businesses to collect and remit sales tax on behalf of the state and county. The registration process typically involves providing business details, selecting a tax filing frequency, and understanding the reporting and payment obligations.

Once registered, businesses must collect the appropriate sales tax rate on all taxable sales. This includes maintaining accurate records, ensuring proper tax calculation, and providing clear breakdowns of tax charges to customers. Businesses should also stay informed about any changes to sales tax rates or regulations, as non-compliance can result in penalties and interest charges.

Pricing Strategies and Consumer Behavior

The sales tax rate can significantly influence pricing strategies for businesses. In regions with a higher sales tax rate, businesses may opt to adjust their pricing to maintain competitiveness or absorb the tax cost to avoid price increases. This decision can impact profit margins and market positioning.

For consumers, the sales tax rate can influence purchasing decisions. When comparing prices between different regions or online and in-store, consumers may factor in the sales tax rate to determine the overall cost. This can lead to a shift in consumer behavior, with some individuals choosing to shop in areas with lower sales tax rates or opt for online purchases to avoid in-store tax charges.

Future Outlook and Potential Changes

Predicting future changes to the sales tax rate in Orange County is challenging, as it often depends on various economic, political, and social factors. However, understanding the trends and potential influences can provide insights into the possible directions of sales tax policy.

Economic Factors

The economic health of Orange County and California as a whole plays a significant role in sales tax rate decisions. During periods of economic growth and increased consumer spending, the demand for public services and infrastructure projects often rises. To fund these initiatives, local governments may consider increasing the sales tax rate or introducing new taxes.

Conversely, during economic downturns, there may be pressure to reduce or maintain sales tax rates to stimulate consumer spending and support businesses. The balance between generating revenue for essential services and stimulating the economy is a delicate one that policymakers must navigate.

Political Influences

Political factors can also shape the future of sales tax rates. Local governments and elected officials have the power to propose and approve changes to sales tax rates. This can be influenced by public sentiment, political ideologies, and the specific needs of the region. For instance, a change in local leadership or a shift in political priorities could lead to proposals for tax rate adjustments.

Technological Advances and E-Commerce

The rise of e-commerce and digital platforms has significantly impacted sales tax collection and compliance. Remote sellers and online marketplaces have presented new challenges for tax authorities. As a result, there may be increased efforts to streamline and enforce sales tax collection from these sources, potentially impacting the overall tax burden on businesses and consumers.

Potential Scenarios and Implications

Here are some potential scenarios and their implications for the sales tax rate in Orange County:

- Economic Growth and Infrastructure Projects: If Orange County experiences sustained economic growth, there may be increased pressure to fund infrastructure upgrades and public services. This could lead to proposals for a higher sales tax rate to generate the necessary revenue.

- Economic Downturn and Tax Relief: In the event of an economic recession or slowdown, there may be calls for tax relief to stimulate consumer spending. This could result in proposals to reduce or freeze the sales tax rate temporarily.

- Enhanced Sales Tax Collection for E-Commerce: With the continued growth of online sales, there may be efforts to streamline and enforce sales tax collection from remote sellers. This could lead to a more uniform tax rate across online and in-store purchases, impacting the overall tax landscape.

- Tax Reform and Simplification: There have been ongoing discussions about tax reform at the state and local levels. If sales tax reform is implemented, it could result in changes to the tax rate structure, exemptions, or collection methods, which would have wide-ranging implications for businesses and consumers.

Conclusion: Navigating the Sales Tax Landscape in Orange County

Understanding the sales tax rate in Orange County is a complex but crucial task for businesses and consumers. The current rate of 8.25% is a combination of state and county taxes, with potential additional local taxes in certain cities. This rate applies to a broad range of goods and services, with specific exemptions and considerations.

The impact of the sales tax rate extends beyond simple calculations. It influences business strategies, consumer behavior, and the overall economic landscape of the region. Staying informed about sales tax regulations and potential changes is essential for both businesses and consumers to make informed decisions and plan effectively.

As we look to the future, the sales tax rate in Orange County is likely to remain a dynamic and evolving aspect of the local economy. Economic, political, and technological factors will continue to shape the tax landscape, presenting both challenges and opportunities for businesses and consumers alike.

What is the sales tax rate in Orange County for online purchases?

+

The sales tax rate for online purchases in Orange County is the same as for in-store purchases, which is 8.25%. This rate applies to most tangible personal property and certain services. However, there are specific considerations for remote sellers and marketplace facilitators, who may have different tax obligations depending on their business structure and the nature of the sale.

Are there any sales tax holidays in Orange County?

+

Currently, there are no specific sales tax holidays in Orange County. However, the state of California has periodically implemented sales tax holidays for certain items, such as clothing or school supplies. These holidays typically occur for a short period and are announced in advance by the state government. It’s important for businesses and consumers to stay updated on any such initiatives.

How often do sales tax rates change in Orange County?

+

Sales tax rates in Orange County can change periodically, but they are not subject to frequent adjustments. The current rate of 8.25% has been in effect since 2013, with the state rate remaining at 7.25% and the county rate at 1.0%. However, it’s important for businesses and consumers to stay informed about any potential changes, as local governments may propose rate adjustments to address economic or budgetary needs.