Florida Tax Deadline 2025

The Florida tax deadline is an important date for residents and businesses alike. Understanding the timeline for filing taxes and the potential consequences of missing the deadline is crucial for financial planning and compliance with state regulations. This article will delve into the specifics of the Florida tax deadline for the year 2025, providing an in-depth analysis of the key dates, filing requirements, and any relevant changes or updates.

Florida Tax Deadline: A Comprehensive Overview for 2025

The Florida tax system operates under a well-defined calendar, ensuring taxpayers have a clear understanding of their obligations and responsibilities. For the upcoming tax year 2025, it’s essential to familiarize yourself with the key dates and processes to ensure timely and accurate filing.

Key Dates for 2025 Tax Filing

The Florida Department of Revenue sets the tax deadline, and for the year 2025, the key dates are as follows:

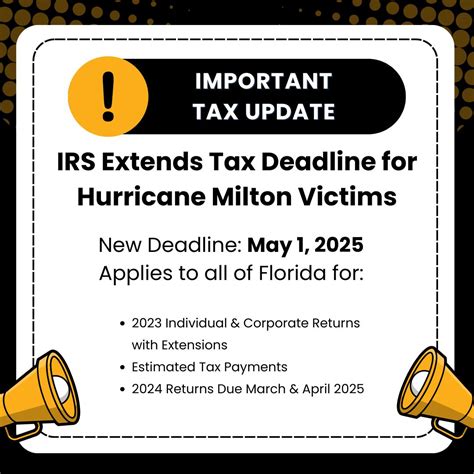

- Income Tax Return Deadline: April 15, 2025 - This is the primary deadline for filing your individual income tax returns for the previous year. It’s important to note that this date often remains consistent, but it’s always advisable to check for any potential adjustments or extensions offered by the state.

- Estimated Tax Payments: Throughout the year, taxpayers with income not subject to withholding must make quarterly estimated tax payments. The due dates for these payments are typically set for April 15, June 15, September 15, and January 15 of the following year. However, the specific dates for 2025 will be officially announced closer to the tax year.

- Corporate Tax Deadlines: Corporations in Florida have specific filing requirements. The deadline for corporate income tax returns is typically aligned with the individual income tax deadline, which is April 15, 2025. However, corporations with a fiscal year ending on December 31 must file their returns by March 15, 2025.

Filing Requirements and Preparations

To ensure a smooth filing process, taxpayers should begin preparing well in advance of the deadlines. Here are some key considerations:

- Gathering Documents: Collect all necessary financial records, including income statements, expense receipts, and any relevant tax forms. This step is crucial for accurate reporting and minimizing the risk of errors.

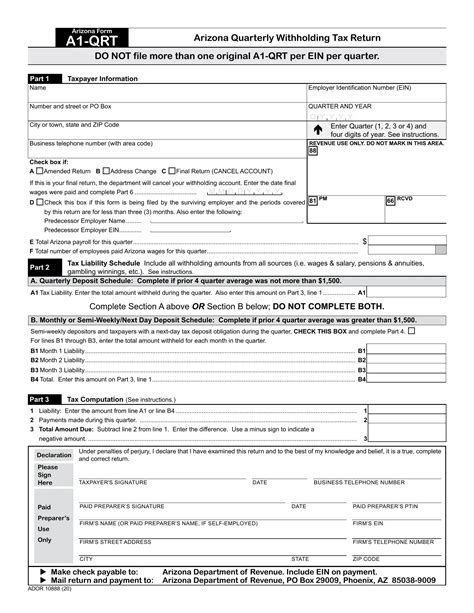

- Choosing the Right Form: Florida offers various tax forms based on the taxpayer’s status and income sources. It’s essential to select the appropriate form, such as Form 1040 for individuals or Form 1120 for corporations. The state’s website provides detailed guidance on form selection.

- Electronic Filing: Florida encourages electronic filing, which offers faster processing and reduced errors. Taxpayers can utilize the state’s online filing system or authorized e-file providers. It’s worth noting that electronic filing often comes with additional benefits, such as faster refunds and easier tracking of the filing status.

- Payment Options: Taxpayers have several payment methods available, including direct debit, credit or debit cards, and electronic funds transfer. It’s advisable to explore these options and choose the most convenient and secure method for your financial situation.

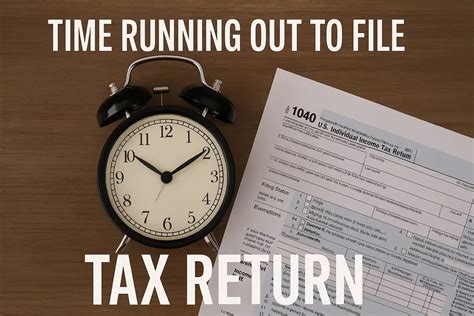

Extensions and Late Filing

In certain circumstances, taxpayers may require an extension to file their tax returns. Florida allows for extension requests, but it’s important to note that an extension only grants additional time to file, not to pay any taxes owed. To request an extension, taxpayers must submit Form FTB 3519, which provides a six-month extension from the original filing deadline.

Late filing can result in penalties and interest charges. The state imposes a penalty of 5% of the unpaid tax for each month the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 3% per quarter, compounded annually. It’s crucial to avoid late filing to prevent these financial consequences.

Special Considerations for 2025

As we approach the tax year 2025, it’s worth highlighting some key considerations and potential changes:

- Tax Reform Updates: Florida regularly reviews and updates its tax policies. Stay informed about any potential tax reforms or changes in legislation that may impact your tax obligations for 2025. The state’s official website often provides updates and resources to help taxpayers understand these changes.

- COVID-19 Considerations: The ongoing COVID-19 pandemic may continue to influence tax policies and deadlines. It’s essential to monitor any pandemic-related updates or relief measures that could impact your tax filing. The state’s response to the pandemic may include extended deadlines or specific relief programs for affected taxpayers.

- Amended Returns: In the event of an error or change in circumstances, taxpayers may need to file an amended return. Florida allows taxpayers to amend their returns within three years from the original filing date or two years from the date the tax was paid, whichever is later. It’s important to correct any mistakes promptly to avoid potential penalties.

Expert Insights and Tips

Here are some valuable insights and tips from tax professionals to help you navigate the Florida tax landscape:

💡 Start Early: Begin your tax preparations well in advance of the deadlines. Gathering documents, reviewing your financial records, and seeking professional advice can save you time and reduce stress during the filing process.

💡 Utilize Online Resources: Florida’s Department of Revenue website offers a wealth of information and resources to guide taxpayers through the filing process. Take advantage of these tools to ensure accuracy and compliance.

💡 Stay Informed: Subscribe to tax newsletters or follow reputable tax blogs to stay updated on the latest news, changes, and deadlines. Being proactive about your tax obligations can help you avoid surprises and penalties.

Conclusion: Plan Ahead for a Seamless Filing Experience

The Florida tax deadline for 2025 is an important date to mark on your calendar. By understanding the key dates, filing requirements, and potential changes, you can ensure a smooth and stress-free filing process. Planning ahead, gathering necessary documents, and staying informed about tax updates are crucial steps to navigate the Florida tax landscape successfully.

Frequently Asked Questions

What happens if I miss the Florida tax deadline?

+Missing the Florida tax deadline can result in penalties and interest charges. The state imposes a 5% penalty for each month the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 3% per quarter. It’s important to file as soon as possible to minimize these financial consequences.

Are there any tax relief programs available for Florida taxpayers?

+Florida offers various tax relief programs to assist taxpayers facing financial hardships. These programs may include payment plans, penalty waivers, or temporary relief due to specific circumstances. It’s recommended to explore these options and consult with a tax professional to determine eligibility.

Can I file my Florida tax return online?

+Yes, Florida encourages electronic filing through its online system or authorized e-file providers. Electronic filing offers faster processing, reduced errors, and easier tracking of your return status. It’s a convenient and secure way to fulfill your tax obligations.

What are the estimated tax payment deadlines for 2025?

+The estimated tax payment deadlines for 2025 are typically set for April 15, June 15, September 15, and January 15 of the following year. However, the official dates will be announced closer to the tax year. It’s important to make these payments on time to avoid penalties and interest charges.

How can I stay updated on tax reforms and changes in Florida?

+To stay informed about tax reforms and changes, it’s recommended to subscribe to tax newsletters, follow reputable tax blogs, and regularly visit the Florida Department of Revenue’s website. These sources provide timely updates on any legislative changes or tax policy adjustments that may impact your obligations.