Global Blue Tax Refund

In the ever-evolving world of international travel and commerce, the concept of tax refunds for tourists and visitors has become an increasingly significant aspect of the global tourism industry. The Global Blue Tax Refund service, a renowned player in this domain, offers a seamless and efficient solution for travelers to reclaim Value Added Tax (VAT) and Goods and Services Tax (GST) on eligible purchases made during their visits to participating countries.

This comprehensive guide aims to delve into the intricacies of the Global Blue Tax Refund system, exploring its mechanisms, benefits, and impact on the tourism industry. By the end of this article, readers will have a thorough understanding of how this service functions and its role in enhancing the travel experience for millions of tourists worldwide.

The Global Blue Tax Refund System: An Overview

The Global Blue Tax Refund system is a specialized service provider operating in the realm of international tourism. Founded with the vision of simplifying the tax refund process for travelers, Global Blue has established itself as a leading expert in this niche industry.

At its core, the Global Blue system facilitates the reimbursement of Value Added Tax (VAT) and Goods and Services Tax (GST) to non-resident visitors who make eligible purchases in participating countries. This service is particularly beneficial for tourists and business travelers who are not entitled to claim these taxes in their home countries.

The company's extensive network spans across numerous countries, including popular tourist destinations such as the United Kingdom, France, Italy, Germany, and many more. This widespread reach allows Global Blue to cater to a diverse range of travelers, offering them a convenient and reliable tax refund solution.

Key Features and Benefits of the Global Blue System

The Global Blue Tax Refund system offers a host of features and benefits that contribute to its popularity among travelers:

- Convenient Process: Global Blue has streamlined the tax refund process, making it accessible and straightforward for travelers. The system allows for the easy identification of eligible purchases and provides clear instructions for claiming refunds.

- Worldwide Coverage: With a presence in over 40 countries, Global Blue offers a truly global solution. Travelers can benefit from the service regardless of their destination, provided it is part of the Global Blue network.

- Multiple Refund Options: The company provides flexibility in refund methods. Travelers can choose to receive their refunds via bank transfer, credit card, or even as cash at designated refund offices or airports.

- Partnerships with Retailers: Global Blue has established strong partnerships with a wide range of retailers, ensuring that travelers have access to a diverse selection of eligible products and services.

- Digital Platform: The Global Blue website and mobile app offer a user-friendly interface, allowing travelers to track their refund status, manage their tax-free shopping, and access helpful travel tips and guides.

How the Global Blue Tax Refund Process Works

Understanding the step-by-step process of the Global Blue Tax Refund system is essential for travelers to navigate this service efficiently. Here's a detailed breakdown of how the refund process typically unfolds:

- Making Eligible Purchases: The first step involves making purchases that are eligible for tax refunds. These typically include goods purchased from participating retailers, such as clothing, electronics, and souvenirs. The minimum purchase amount and other criteria may vary by country.

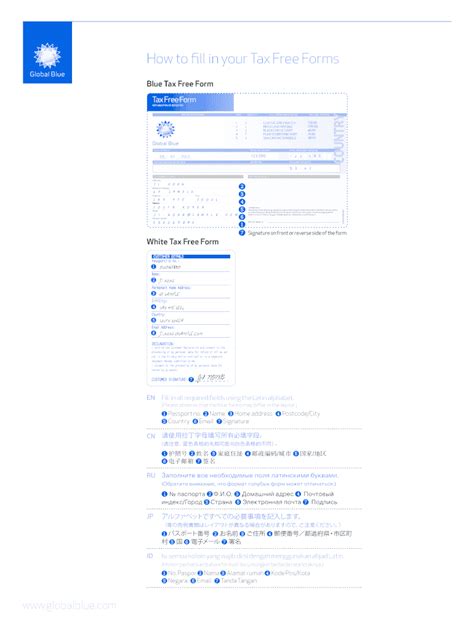

- Obtaining Tax-Free Forms: At the point of sale, travelers must request and complete tax-free forms. These forms are essential for claiming refunds and should be carefully filled out with accurate information.

- Exiting the Country: To qualify for a refund, travelers must exit the country within a specific timeframe. This period varies depending on the country and the type of tax being reclaimed.

- Submitting Refund Claims: Travelers can submit their refund claims in several ways. They can visit a Global Blue refund office, use the company's mobile app, or even drop off their forms at designated collection points. The refund amount is calculated based on the total eligible purchases and the applicable tax rate.

- Refund Processing: Once the refund claim is submitted, Global Blue processes the request. The processing time can vary, but travelers can typically expect their refunds within a few weeks. The refund amount is transferred to the specified bank account or credit card.

Tips for a Smooth Tax Refund Experience

To ensure a hassle-free tax refund journey, travelers can follow these practical tips:

- Check eligibility: Before making purchases, confirm if the country and retailer participate in the Global Blue Tax Refund system.

- Keep records: Maintain a record of all eligible purchases, including receipts and tax-free forms.

- Read the fine print: Understand the terms and conditions, including any exclusions or limitations, associated with the tax refund process.

- Submit claims promptly: Ensure that refund claims are submitted within the specified timeframe to avoid any delays or penalties.

- Stay informed: Stay updated with the latest news and updates from Global Blue to ensure a seamless experience.

Impact on the Tourism Industry

The introduction and widespread adoption of the Global Blue Tax Refund system have had a significant impact on the tourism industry, particularly in popular destination countries. By offering a straightforward and efficient tax refund process, Global Blue has contributed to several key aspects of the industry:

Enhanced Shopping Experience

The availability of tax refunds has become a significant incentive for tourists to engage in shopping during their travels. With the Global Blue system, travelers can make purchases with the assurance that they can reclaim a portion of the taxes paid. This not only encourages spending but also enhances the overall shopping experience, making it more enjoyable and rewarding.

Increased Tourism Revenue

The implementation of the Global Blue Tax Refund system has led to a boost in tourism revenue for participating countries. By attracting more visitors who are inclined to shop, the system contributes to a thriving retail sector. This, in turn, creates a positive economic impact, generating jobs and supporting local businesses.

Promotion of Local Products

The tax refund system serves as a platform to promote local products and brands to an international audience. As travelers explore the tax-free shopping options, they are exposed to a wide range of unique and authentic products, fostering cultural exchange and appreciation.

Improved Visitor Satisfaction

The convenience and efficiency of the Global Blue Tax Refund system have significantly improved visitor satisfaction. By providing a seamless and transparent process, Global Blue ensures that travelers can focus on enjoying their trips without the hassle of complex tax refund procedures. This positive experience contributes to repeat visits and word-of-mouth recommendations.

The Future of Global Blue and Tax Refunds

As the tourism industry continues to evolve, the role of tax refund services like Global Blue is expected to grow and adapt to meet the changing needs of travelers. Here are some insights into the future prospects of the Global Blue Tax Refund system:

Expansion into New Markets

Global Blue is likely to continue expanding its network, reaching new markets and offering its services to a wider range of travelers. As more countries recognize the benefits of tax refunds for tourists, Global Blue can play a pivotal role in implementing and streamlining these processes.

Integration with Digital Platforms

With the rise of digital technologies, Global Blue is expected to further integrate its services with online platforms and mobile apps. This would enable travelers to manage their tax-free shopping and refund claims seamlessly, even before or after their trips.

Enhanced Personalization

To cater to the diverse needs of travelers, Global Blue may explore ways to personalize the tax refund experience. This could involve offering customized recommendations based on individual preferences or providing tailored travel guides and discounts for specific destinations.

Sustainability Initiatives

In line with the growing emphasis on sustainability in the tourism industry, Global Blue may also focus on implementing environmentally friendly practices. This could include promoting sustainable shopping options, partnering with eco-friendly retailers, and offering incentives for travelers who adopt sustainable behaviors during their trips.

| Country | Minimum Purchase Amount | VAT/GST Rate |

|---|---|---|

| United Kingdom | £30 | 20% |

| France | €175 | 20% |

| Italy | €155 | 22% |

| Germany | €25 | 19% |

Frequently Asked Questions

What is the eligibility criteria for the Global Blue Tax Refund system?

+

To be eligible for the Global Blue Tax Refund, travelers must be non-residents of the country they are visiting and have made eligible purchases from participating retailers. The minimum purchase amount and other criteria may vary by country.

How long does it take to receive a tax refund through Global Blue?

+

The processing time for tax refunds can vary, but travelers can typically expect their refunds within a few weeks. The refund amount is transferred to the specified bank account or credit card.

Can I submit tax refund claims online through Global Blue?

+

Yes, Global Blue offers an online platform and mobile app that allow travelers to submit their tax refund claims digitally. This provides a convenient and efficient way to manage tax-free shopping and refunds.

Are there any fees associated with the Global Blue Tax Refund service?

+

While Global Blue does not charge any fees for its tax refund service, travelers should be aware that some retailers or banks may impose processing fees. It is advisable to check with the retailer or bank for any applicable fees.

Can I claim tax refunds for all my purchases made in a participating country?

+

No, not all purchases are eligible for tax refunds. Global Blue provides a list of participating retailers and the types of goods that qualify for refunds. It is important to check the eligibility criteria before making purchases.