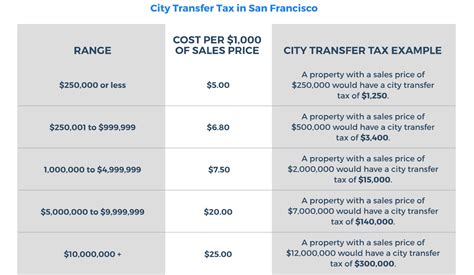

Retail Tax In San Francisco

In the bustling city of San Francisco, California, retail operations and consumer spending are integral to the local economy. Understanding the retail tax landscape is crucial for businesses and consumers alike. This comprehensive guide aims to delve into the intricacies of retail tax in San Francisco, providing an in-depth analysis of the applicable taxes, their implications, and how they impact various sectors.

Navigating the Retail Tax System in San Francisco

The retail tax system in San Francisco is a multifaceted structure, consisting of a combination of city, county, and state taxes. This complex web of taxes can pose challenges for both retailers and consumers, making it essential to have a thorough understanding of the system.

City and County Taxes: A Local Focus

San Francisco, as a city and county, imposes its own set of taxes on retail activities. These local taxes are designed to support city infrastructure, services, and initiatives. The San Francisco Gross Receipts Tax is a notable component, levied on the total sales made by businesses within the city limits. This tax varies based on the gross receipts of the business, with higher receipts resulting in a higher tax rate.

| Gross Receipts | Tax Rate |

|---|---|

| $10,000,000 or more | 0.1835% |

| $5,000,000 - $9,999,999 | 0.1525% |

| $1,000,000 - $4,999,999 | 0.132% |

| $500,000 - $999,999 | 0.1115% |

| Less than $500,000 | 0.091% |

In addition to the gross receipts tax, San Francisco imposes a City Sales Tax of 1.5% on most retail transactions. This tax is collected by the retailer and remitted to the city government. It's important to note that certain items, such as food and medicine, are exempt from this sales tax, offering some relief to consumers.

California State Taxes: A Statewide Impact

Beyond the local taxes, retailers in San Francisco must also comply with the state-level taxes administered by the California Department of Tax and Fee Administration (CDTFA). The California Sales and Use Tax is a key component, with a base rate of 7.25% applied to most retail sales. However, this base rate is often augmented by county-specific and city-specific add-on taxes, leading to a higher overall tax burden.

For instance, in San Francisco County, the County Transportation Excise Tax is levied at 0.5%, bringing the total sales tax to 7.75% for most items. This county-specific tax funds transportation infrastructure projects.

| Tax Type | Tax Rate |

|---|---|

| California Sales and Use Tax | 7.25% |

| San Francisco County Transportation Excise Tax | 0.5% |

| Total Sales Tax in San Francisco | 7.75% |

Tax Implications for Different Retail Sectors

The retail tax landscape in San Francisco affects various sectors differently. For instance, e-commerce businesses face unique challenges in tax compliance, given the complex rules around nexus and the need to collect and remit taxes in multiple jurisdictions. The Marketplace Facilitator Law in California further adds to this complexity, requiring online marketplaces to collect and remit sales tax on behalf of third-party sellers.

On the other hand, brick-and-mortar retailers have the advantage of a physical presence, which simplifies tax collection and compliance to a certain extent. However, they still need to navigate the intricacies of local and state tax regulations, including the potential for audit and the need to stay updated with any tax law changes.

Retail Tax and Consumer Behavior

The retail tax structure in San Francisco also influences consumer behavior. With a combined sales tax rate of 7.75%, consumers may be incentivized to shop in nearby counties with lower tax rates or even cross state lines to avoid the higher tax burden. This can impact the local retail economy and influence consumer choices.

The Future of Retail Tax in San Francisco

As San Francisco continues to evolve, the retail tax landscape is also subject to change. The city’s commitment to infrastructure development and its focus on funding public services means that tax policies may adapt to meet these evolving needs. Additionally, with the rise of e-commerce and the changing retail landscape, tax regulations are likely to see updates to ensure fair tax collection and compliance.

Staying informed about tax changes and seeking professional advice can help businesses and consumers navigate the complex world of retail tax in San Francisco. Understanding the current tax structure and its potential future shifts is crucial for long-term financial planning and success in the retail industry.

What is the penalty for non-compliance with retail taxes in San Francisco?

+

Non-compliance with retail tax regulations in San Francisco can result in significant penalties, including fines, interest, and potential legal consequences. The severity of the penalty depends on factors such as the amount of tax owed, the duration of non-compliance, and the cooperation shown by the business during the audit process. It is crucial for businesses to maintain accurate records and ensure timely tax filings to avoid these penalties.

Are there any tax incentives for retailers in San Francisco?

+

Yes, San Francisco offers various tax incentives to support local businesses. These include the Small Business Tax Registration Discount Program, which provides a 50% discount on the city’s business tax registration fee for eligible businesses. Additionally, certain sectors, like green businesses or those focused on social impact, may qualify for specific tax incentives aimed at promoting sustainable and community-oriented practices.

How often do tax rates change in San Francisco?

+

Tax rates in San Francisco can change periodically, typically driven by changes in city or state policies, budgetary needs, or shifts in economic priorities. While major tax rate changes are not frequent, businesses and consumers should stay updated with any announcements or proposals for tax adjustments to ensure they are prepared for any potential changes in their tax obligations.

Can I claim tax refunds for overpaid retail taxes in San Francisco?

+

Yes, if you believe you have overpaid retail taxes in San Francisco, you can file a claim for a refund. This process involves submitting the necessary documentation and forms to the appropriate tax authority, detailing the overpayment and the reasons for the claim. It’s important to note that there are specific time limits for filing refund claims, so it’s best to act promptly if you suspect an overpayment.

Are there any online resources to help with retail tax compliance in San Francisco?

+

Absolutely! San Francisco, along with the state of California, provides a wealth of online resources to assist businesses and consumers with retail tax compliance. These include official government websites, such as the San Francisco Office of the Treasurer & Tax Collector and the California Department of Tax and Fee Administration, which offer comprehensive guides, forms, and tools to ensure proper tax filing and payment. Additionally, various tax software providers offer solutions tailored to the specific tax needs of San Francisco businesses.