Santa Rosa Sales Tax

In the heart of California's vibrant wine country, nestled among rolling hills and picturesque vineyards, lies the city of Santa Rosa. Beyond its renowned vineyards and wineries, Santa Rosa is a bustling hub with a thriving business community. One aspect that plays a crucial role in the city's economy and impacts its residents is the Santa Rosa Sales Tax. This comprehensive guide aims to delve into the intricacies of the Santa Rosa Sales Tax, shedding light on its rates, applicability, and implications for both businesses and consumers.

Understanding the Santa Rosa Sales Tax

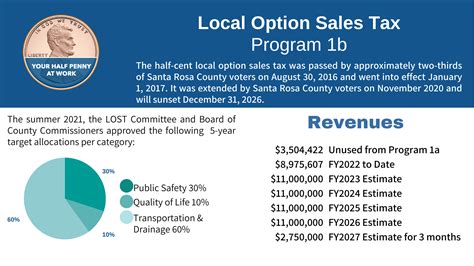

The Santa Rosa Sales Tax is a consumption tax levied on the sale of goods and certain services within the city limits of Santa Rosa. It is a critical revenue source for the city, funding essential public services and infrastructure projects. Understanding the nuances of this tax is vital for businesses operating in Santa Rosa and consumers alike.

The sales tax in Santa Rosa is comprised of several components, including the state sales tax, the county sales tax, and the city sales tax. Each of these components is mandated by different levels of government and is used to fund various initiatives.

State Sales Tax

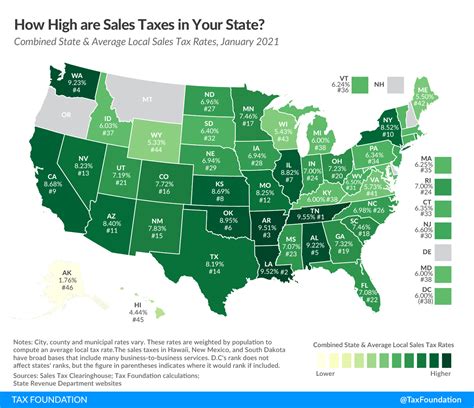

The state sales tax is a uniform tax rate applicable across California. As of the time of writing, the state sales tax rate stands at 7.25%. This tax is imposed on a wide range of goods and services, with certain exceptions and exemptions.

County Sales Tax

In addition to the state sales tax, Santa Rosa falls under Sonoma County, which levies its own county sales tax. The current county sales tax rate for Sonoma County is 0.25%. This additional tax contributes to funding specific county-wide projects and initiatives.

City Sales Tax

The city sales tax is the component that varies based on the city in which the transaction takes place. In Santa Rosa, the city sales tax rate is 0.50%. This tax is vital for funding city-specific projects, maintenance, and development.

When a transaction occurs within the city of Santa Rosa, the applicable sales tax is calculated by adding the state, county, and city sales tax rates. As such, the total sales tax rate in Santa Rosa currently stands at 8.00% (7.25% state tax + 0.25% county tax + 0.50% city tax). This rate is applied to the taxable portion of the transaction, which can vary depending on the nature of the goods or services being purchased.

Taxable Goods and Services

Not all goods and services are subject to sales tax in Santa Rosa. Understanding which items are taxable and which are exempt is crucial for businesses and consumers to navigate the sales tax landscape effectively.

Taxable Goods

The majority of tangible personal property is subject to sales tax in Santa Rosa. This includes items such as:

- Clothing and apparel

- Electronics and appliances

- Furniture and home goods

- Automotive parts and accessories

- Sporting goods

- Books and magazines

- Jewelry and accessories

- Art and collectibles

- Grocery items (excluding certain food items)

It's important to note that certain items, such as prescription medications and certain medical devices, are exempt from sales tax to alleviate the financial burden on consumers.

Taxable Services

Sales tax in Santa Rosa is not limited to tangible goods. Certain services are also subject to sales tax, including:

- Hotel and lodging accommodations

- Restaurant meals and prepared foods

- Admission fees for entertainment events (concerts, movies, sporting events)

- Membership fees for gyms and fitness centers

- Some professional services (e.g., legal and accounting services)

- Vehicle rentals

- Telephone and internet services

It's essential for businesses providing these services to understand their tax obligations and ensure accurate tax collection.

Exemptions and Special Considerations

While the majority of goods and services are subject to sales tax, there are specific exemptions and special considerations that businesses and consumers should be aware of. These exemptions can vary based on federal, state, and local regulations.

For example, certain agricultural equipment and supplies may be exempt from sales tax to support the local farming industry. Additionally, certain nonprofit organizations and government entities may be exempt from sales tax to encourage community development and public service initiatives.

It's crucial for businesses to stay informed about these exemptions and ensure compliance with the applicable regulations to avoid potential legal and financial consequences.

Sales Tax Collection and Remittance

The process of collecting and remitting sales tax is a critical responsibility for businesses operating in Santa Rosa. Accurate tax collection and timely remittance are essential to maintain compliance with the law and avoid penalties.

Sales Tax Registration

Any business operating in Santa Rosa that engages in taxable transactions must obtain a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax on behalf of the state, county, and city.

The application process typically involves providing detailed information about the business, including its legal structure, location, and the types of goods and services it offers. The CDTFA reviews the application and issues a unique permit number to the business, which is used for tax reporting purposes.

Sales Tax Calculation and Collection

Once a business is registered and authorized to collect sales tax, it must calculate the applicable tax rate for each transaction. The tax rate, as previously mentioned, is the combined state, county, and city sales tax rates, which total 8.00% in Santa Rosa.

The business then adds the calculated tax to the sale price of the goods or services being provided. For example, if a consumer purchases an item priced at $100, the business would add $8 in sales tax (8.00% of $100), resulting in a total price of $108.

It's important for businesses to clearly display the tax amount on sales receipts and invoices to ensure transparency with their customers.

Sales Tax Remittance

After collecting sales tax from customers, businesses have a responsibility to remit the collected taxes to the appropriate tax authorities. In Santa Rosa, businesses typically remit sales tax on a monthly or quarterly basis, depending on their tax liability and filing frequency.

The remittance process involves submitting tax returns to the CDTFA, reporting the total sales and the amount of tax collected during the specified period. Businesses must also make the appropriate payments to the CDTFA to cover the collected tax amounts.

Failure to remit sales tax in a timely manner can result in penalties and interest charges, so it's crucial for businesses to stay organized and maintain accurate records of their sales and tax collections.

Sales Tax Compliance and Enforcement

Ensuring compliance with sales tax regulations is not only a legal obligation but also essential for maintaining a fair and equitable tax system. The California Department of Tax and Fee Administration (CDTFA) plays a vital role in enforcing sales tax compliance and ensuring that businesses and consumers alike understand their responsibilities.

Sales Tax Audits

The CDTFA conducts periodic audits to ensure that businesses are accurately collecting and remitting sales tax. These audits can be triggered by various factors, including random selection, suspicious activity, or complaints from consumers.

During an audit, the CDTFA examines a business's records, including sales receipts, invoices, and tax returns, to verify the accuracy of tax calculations and remittances. Businesses are required to provide access to their records and cooperate fully with the audit process.

If an audit reveals discrepancies or errors in tax calculations or remittances, the business may be subject to penalties, interest charges, and even criminal prosecution in severe cases.

Sales Tax Education and Outreach

The CDTFA recognizes the importance of educating businesses and consumers about sales tax obligations and regulations. To this end, the department provides extensive resources and guidance materials on its website, including:

- Sales tax rate charts and calculators

- Taxability guides for specific industries

- Publications and newsletters with tax updates and compliance tips

- Workshops and webinars for businesses

- Online tools and resources for consumers

By providing comprehensive education and outreach, the CDTFA aims to foster a culture of compliance and ensure that businesses and consumers understand their rights and responsibilities regarding sales tax.

Sales Tax Disputes and Appeals

In cases where a business or consumer disagrees with a sales tax assessment or penalty, there are established procedures for resolving disputes and appealing decisions.

The CDTFA has a dedicated Dispute Resolution Unit that handles formal protests and appeals. Businesses and consumers can file a written protest, providing detailed reasons for their disagreement with the assessment. The CDTFA reviews the protest and may request additional information or hold a hearing to gather evidence.

If the dispute remains unresolved, the aggrieved party may have the right to appeal the decision to an independent administrative law judge or the California State Board of Equalization.

Sales Tax and the Economy

The sales tax in Santa Rosa not only serves as a revenue source for the city but also has broader economic implications. Understanding the economic impact of sales tax can provide valuable insights into the city’s fiscal health and the overall well-being of its residents.

Revenue Generation

The sales tax in Santa Rosa is a significant source of revenue for the city. The funds generated from sales tax contribute to various public services and infrastructure projects, including:

- Police and fire protection

- Road maintenance and construction

- Public parks and recreational facilities

- Schools and education

- Social services and welfare programs

- Economic development initiatives

By collecting and remitting sales tax, businesses contribute to the overall fiscal health of the city, enabling the provision of essential services and improvements to the community.

Economic Impact on Businesses

While sales tax is a revenue generator for the city, it also has implications for businesses operating in Santa Rosa. The tax can affect businesses in various ways, including:

- Pricing and Competitiveness: Sales tax can impact the pricing strategy of businesses. To remain competitive, businesses may need to absorb some of the tax burden or pass it on to consumers, potentially affecting their market position.

- Profit Margins: Sales tax can reduce a business’s profit margins, particularly for businesses with thin margins or those selling low-cost items. Managing sales tax obligations becomes an important aspect of financial planning and strategy.

- Compliance Costs: Compliance with sales tax regulations requires businesses to invest time and resources in tax calculation, collection, and remittance processes. This can add to the administrative burden and costs associated with running a business.

Businesses must carefully consider the impact of sales tax on their operations and develop strategies to mitigate any negative effects while remaining compliant with the law.

Consumer Behavior and Spending Patterns

Sales tax also influences consumer behavior and spending patterns in Santa Rosa. The presence of a sales tax can affect consumer purchasing decisions, especially for high-value items or frequent purchases.

Consumers may opt to shop online or in neighboring cities with lower sales tax rates to save money. This can impact local businesses and potentially reduce the tax revenue generated in Santa Rosa. On the other hand, sales tax can encourage consumers to support local businesses and contribute to the community's economic vitality.

Future of Sales Tax in Santa Rosa

As with any tax system, the sales tax in Santa Rosa is subject to change and evolution. Understanding the potential future directions and implications of sales tax can provide valuable insights for businesses, consumers, and policymakers.

Potential Rate Changes

Sales tax rates are not static and can be adjusted over time to meet changing fiscal needs or address economic conditions. The city of Santa Rosa, along with the state and county governments, may consider rate adjustments to:

- Address budget shortfalls or fund specific initiatives

- Encourage economic growth and development

- Reduce the tax burden on certain industries or consumer groups

- Address social or environmental concerns

Businesses and consumers should stay informed about any proposed or impending rate changes to understand their potential impact and adjust their strategies accordingly.

Technological Advancements

The advent of e-commerce and online sales has presented new challenges and opportunities for sales tax collection and compliance. To address these changes, the CDTFA and other tax authorities are embracing technological advancements to streamline tax collection and enforcement.

For example, the use of electronic sales tax calculation and remittance systems can simplify the process for businesses, reducing the risk of errors and ensuring timely compliance. Additionally, data analytics and artificial intelligence can be leveraged to identify tax evasion and non-compliance, enhancing enforcement efforts.

Policy and Regulatory Changes

The sales tax landscape is subject to ongoing policy and regulatory changes at the state and local levels. These changes can impact the taxability of goods and services, the applicability of tax rates, and the overall tax collection process.

Businesses and consumers should stay abreast of any proposed or enacted changes to sales tax regulations to ensure compliance and understand the potential implications for their operations or purchasing decisions.

Community Engagement and Feedback

The city of Santa Rosa recognizes the importance of community engagement and feedback in shaping tax policies. By actively involving residents, businesses, and community leaders in the decision-making process, the city can better understand the impact of sales tax on the community and make informed choices.

Town hall meetings, public forums, and online surveys can provide valuable insights into the community's perspectives on sales tax, allowing the city to make data-driven decisions that align with the needs and aspirations of its residents.

FAQ

How often do sales tax rates change in Santa Rosa?

+Sales tax rates can change periodically to address budget needs or economic conditions. While there is no set schedule, rate changes are typically proposed and enacted by the state, county, or city governments. It is essential for businesses and consumers to stay informed about any proposed or enacted changes to ensure compliance and understand the impact on their operations or purchases.

Are there any special sales tax holidays in Santa Rosa?

+Santa Rosa, like many other cities in California, does not typically observe sales tax holidays. However, the state of California may declare specific sales tax holidays for certain items or occasions. These holidays provide temporary relief from sales tax for qualifying purchases. It is advisable to check the California Department of Tax and Fee Administration’s website for updates on any upcoming sales tax holidays.

How can businesses ensure they are collecting and remitting sales tax correctly?

+Businesses can take several steps to ensure accurate sales tax collection and remittance:

- Obtain a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA)

- Calculate the applicable sales tax rate for each transaction

- Clearly display the tax amount on sales receipts and invoices

- Maintain accurate records of sales and tax collections

- Submit tax returns and make payments to the CDTFA on a timely basis

- Stay updated on sales tax regulations and changes