Earned Income Tax Credit Calculator

The Earned Income Tax Credit (EITC), also known as the Earned Income Credit (EIC), is a vital financial tool for many working individuals and families in the United States. It's a refundable tax credit designed to provide a boost to low- and moderate-income earners, helping them keep more of their hard-earned money. In this comprehensive guide, we'll explore the intricacies of the EITC, how it works, who is eligible, and how to calculate it, ensuring you have the knowledge to make the most of this valuable credit.

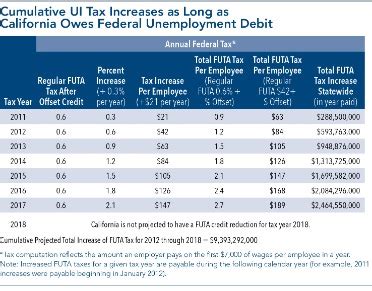

Understanding the Earned Income Tax Credit

The Earned Income Tax Credit is a tax benefit introduced to alleviate the financial burden on working individuals and families, particularly those with low to moderate incomes. It was implemented to encourage and support work, reduce poverty, and stimulate the economy. The credit amount varies depending on several factors, including income level, marital status, and the number of qualifying children in the household.

The EITC is a powerful tool in the fight against poverty, as it can significantly increase the disposable income of eligible individuals and families. It has proven to be a successful policy, with studies showing that it has lifted millions of people out of poverty each year. This credit is often a critical component of an individual's annual tax refund, making it a highly anticipated and beneficial financial boost.

Eligibility Criteria

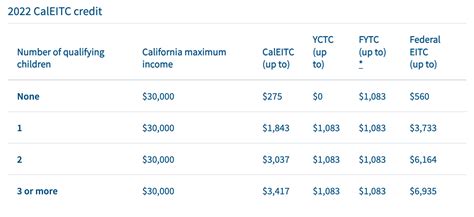

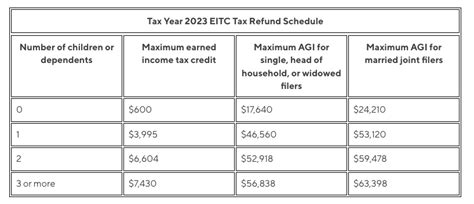

To be eligible for the EITC, taxpayers must meet certain criteria based on their income, marital status, and the presence of qualifying children. The Internal Revenue Service (IRS) sets specific guidelines each year, which can be found in their official publication. Generally, the rules dictate that taxpayers must have earned income from employment or self-employment, and their income must fall below certain thresholds.

| Income Limits (Single Filers) | Income Limits (Married Filing Jointly) |

|---|---|

| With No Qualifying Children: $16,020 | With No Qualifying Children: $22,060 |

| With One Qualifying Child: $41,293 | With One Qualifying Child: $47,378 |

| With Two Qualifying Children: $48,980 | With Two Qualifying Children: $55,060 |

| With Three or More Qualifying Children: $53,930 | With Three or More Qualifying Children: $59,910 |

It's important to note that these income limits are adjusted annually to account for inflation and changes in the economy. Additionally, the IRS defines specific rules for what constitutes a qualifying child, which include age, relationship, and residency requirements.

Calculation of the EITC

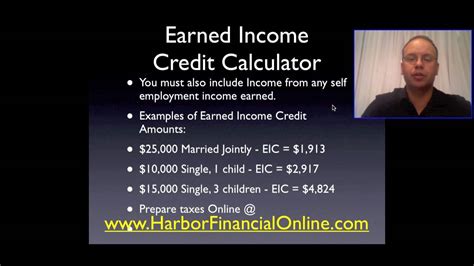

The amount of EITC a taxpayer is eligible for depends on a formula that considers their income, marital status, and number of qualifying children. The IRS provides a detailed chart outlining the credit amounts for different scenarios. Here’s a simplified version of the calculation process:

- For taxpayers without qualifying children, the EITC is calculated as a percentage of their earned income, up to a maximum credit amount.

- For taxpayers with one qualifying child, the credit amount increases significantly, and it's calculated based on a more complex formula that takes into account their income and a phaseout rate.

- The credit amount further increases for taxpayers with two or more qualifying children, and the calculation involves additional factors to determine the exact credit amount.

It's worth mentioning that the EITC has a phaseout range, beyond which the credit amount starts to reduce as income increases. This phaseout range varies based on marital status and the number of qualifying children.

Maximizing Your EITC

To make the most of the Earned Income Tax Credit, taxpayers should be aware of certain strategies and considerations. Here are some tips to maximize your EITC benefits:

Keep Detailed Records

Maintaining accurate and organized records of your income, expenses, and any qualifying children is crucial. This ensures you have the necessary documentation to support your EITC claim and simplifies the tax preparation process.

Explore Tax Preparation Options

Utilize tax preparation software or seek assistance from a tax professional. These tools can guide you through the process of claiming the EITC and ensure you receive the maximum credit you’re eligible for. Many tax preparers are well-versed in the EITC and can provide valuable advice.

Understand Qualifying Child Rules

The rules for qualifying children can be complex. Ensure you understand the requirements, including the age limits, residency, and relationship criteria. This knowledge will help you determine if your children qualify and maximize your EITC benefits.

File Your Taxes Promptly

Don’t delay in filing your taxes. The sooner you file, the sooner you can receive your EITC refund. Additionally, filing early reduces the risk of tax-related identity theft.

Stay Informed on Tax Law Changes

Tax laws and regulations can change annually. Stay updated on any modifications to the EITC rules and income limits to ensure you’re aware of any potential changes that may affect your eligibility or credit amount.

Consider Long-Term Financial Planning

While the EITC provides a valuable short-term financial boost, consider using this credit as an opportunity to explore long-term financial planning strategies. Explore ways to save, invest, or pay down debt to build financial stability and security.

EITC and Economic Impact

The Earned Income Tax Credit has a significant economic impact on individuals, families, and communities. It serves as a powerful tool for income redistribution, helping to reduce income inequality and alleviate poverty. Studies have shown that the EITC encourages work, as individuals are incentivized to enter the workforce or work more hours to maximize their credit.

Furthermore, the EITC has a positive effect on children's well-being. Families receiving the EITC often use the additional funds to invest in their children's education, healthcare, and nutrition, leading to improved outcomes and opportunities for future generations.

FAQs

Can I claim the EITC if I don’t have children?

+Yes, individuals without qualifying children can still be eligible for the EITC, although the credit amount is typically lower compared to those with children. The income limits for this category are lower as well.

How often do EITC rules change?

+The EITC rules and income limits can change annually, usually as part of the federal budget process. It’s important to stay updated with the latest guidelines to ensure accurate eligibility and calculation.

Can I use tax software to calculate my EITC?

+Yes, tax preparation software can be a valuable tool for calculating your EITC. These programs are designed to guide you through the process and ensure you receive the maximum credit you’re eligible for.

What happens if I receive too much EITC?

+If you receive more EITC than you’re eligible for, the IRS may request a repayment. It’s important to ensure your tax return is accurate to avoid any potential issues.

Can I claim the EITC if I’m self-employed?

+Yes, self-employed individuals can be eligible for the EITC as long as they meet the income and other eligibility criteria. Net earnings from self-employment are considered earned income for the purposes of the EITC.