Sales Tax San Diego: Debunking the Biggest Myths about Local Rates

From the sun-drenched coastline of San Diego to the bustling urban core, the topic of sales tax often presents a seemingly complex web of figures, regulations, and community perceptions. As local residents, business owners, and visitors navigate the economic landscape, misconceptions about sales tax rates—particularly in San Diego—persist and can influence both shopping behavior and fiscal planning. This article aims to peel back the layers of myth surrounding San Diego's sales tax, offering a clear, evidence-based understanding while immersing readers in the tangible realities of local taxation policies. The nuanced interplay between state mandates, municipal adjustments, and economic development strategies forms an intricate puzzle that demands expert insight and transparent discussion.

Understanding Sales Tax Mechanics in San Diego: More Than Just a Number

San Diego’s sales tax rate is often perceived as a static, singular figure—something fixed and universally understood. In reality, it is a composite of multiple layered taxes, each with their own historical roots, legislative origins, and targeted allocations. The fundamental sales tax rate in San Diego combines the California state base rate with various local levies, including district taxes earmarked for transportation, public safety, and community development projects. This layered structure results in a somewhat labyrinthine calculation, often leading to public confusion and, consequently, the propagation of myths that obscure the true nature of local taxation policy.

The Foundations of San Diego’s Sales Tax Rate

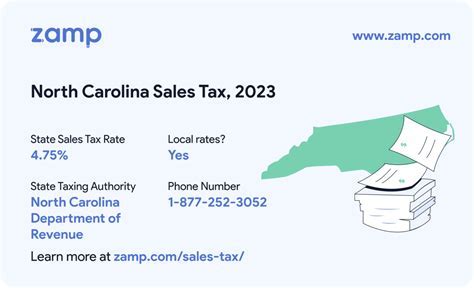

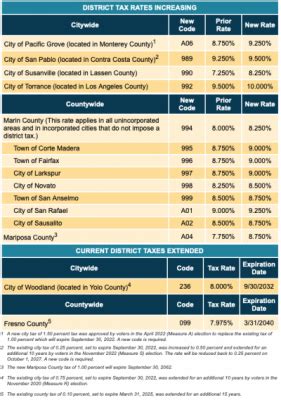

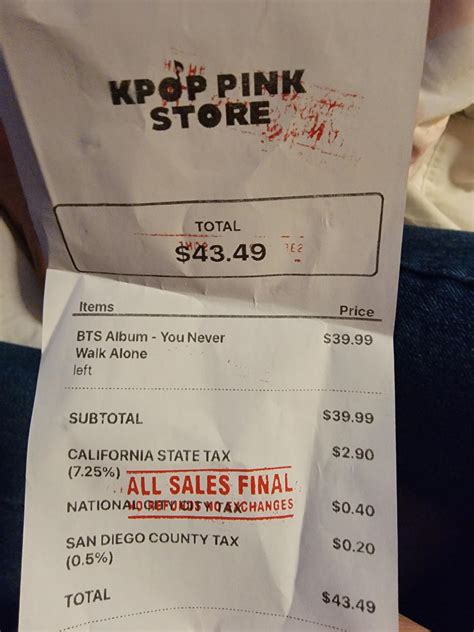

At the core, California’s statewide base sales tax rate is 7.25%, a figure established through decades of fiscal policy balancing expenditures on infrastructure, education, and public services. For San Diego County, this base is augmented by additional district taxes approved through voter initiatives, which aim to fund specific projects within the community. As of 2023, San Diego’s total combined sales tax rate hovers around 7.75%, though this number can fluctuate slightly depending on recent local ballot measures and legislative adjustments. These incremental increases serve to finance transportation improvements, background infrastructure, and targeted community programs—yet public perception often treats the entire rate as a fixed or universally applicable figure.

| Relevant Category | Substantive Data |

|---|---|

| California State Base Rate | 7.25%, established nationwide in 2011 after legislative adjustments |

| San Diego District Taxes | Approximately 0.50%, allocated for specific regional projects |

| Additional Local Levies | Varies by neighborhood, up to an additional 0.25% in some districts |

| Total Sales Tax Rate | Generally around 7.75%, but can be slightly higher in certain zones |

Myth One: ‘San Diego’s Sales Tax is Higher Than Other Cities in California’

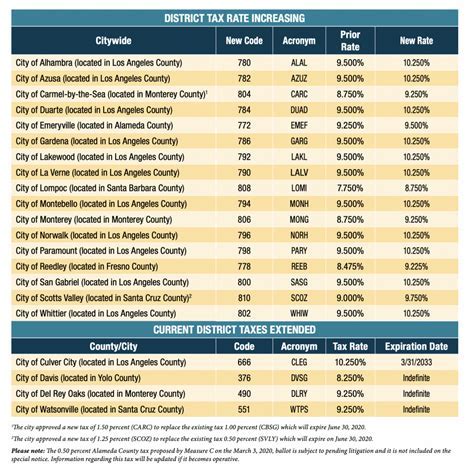

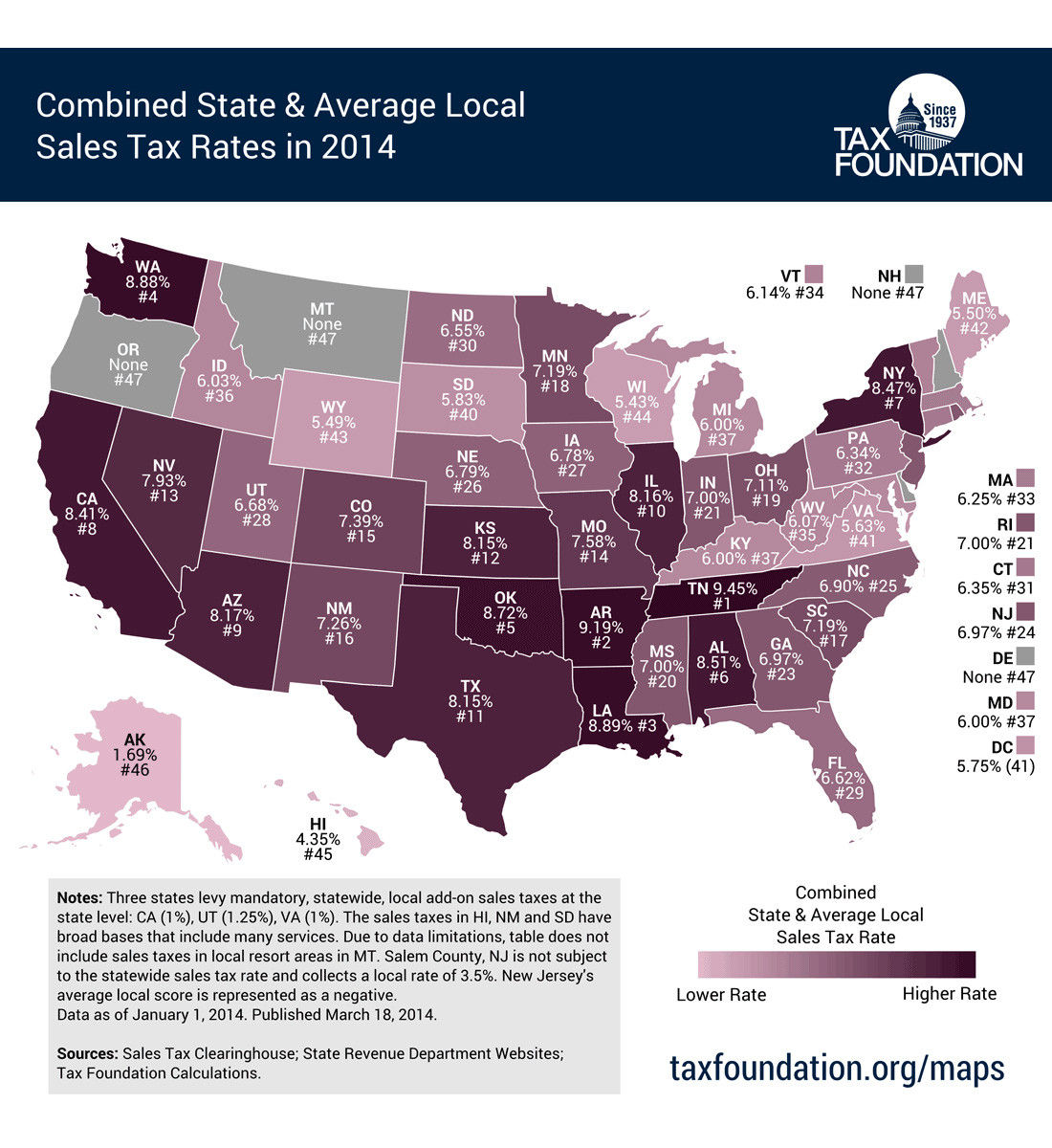

A common misconception among residents and visitors alike is that San Diego’s sales tax surpasses neighboring cities like Los Angeles or Sacramento. While this belief might seem intuitive given San Diego’s reputation for suburban sprawl and economic activity, the reality is more nuanced. For example, Los Angeles County often levies a combined rate reaching or exceeding 9%, depending on specific district taxes and transit levies. Meanwhile, San Diego’s rate remains reasonably competitive—its approximately 7.75% aligns with many peer Californian cities operating under similar state and local tax frameworks.

Factors Contributing to Misconceptions

Media reports, anecdotal experiences, and the perception of higher living costs contribute to this myth. Additionally, tourists and newcomers might focus on advertised total prices without accounting for regional differences in local taxes. The key lies in understanding that tax rates fluctuate based on geographic and legislative factors, making broad generalizations misleading. Detailed, geographic-specific data illustrates that, relative to California’s diverse tax landscape, San Diego’s rate remains within a moderate spectrum.

| Relevant Category | Data with Context |

|---|---|

| Los Angeles County | Up to 9.25%, with local transit and special district taxes included |

| San Diego County | About 7.75%, with recent measures aiming for minimal increases |

| Implication | San Diego’s sales tax is competitive, not universally "higher," especially when considering variance in local tax districts |

Myth Two: ‘Sales Tax in San Diego Is Unfair or Excessive’

This myth tests the balance between tax fairness and economic sustainability. Critics argue that sales taxes disproportionately burden low-income households or are used inefficiently. Yet, the structured nature of California’s sales tax, including exemptions on essentials like food and prescription medications, reveals an attempt at progressive fairness. For instance, groceries purchased for home consumption remain exempt from sales tax, significantly alleviating the burden on vulnerable populations.

The Role of Exemptions and Allocation

Exemptions are integral to addressing equity concerns, with California law intentionally designed to cap the regressivity of sales taxes. Moreover, revenues from these taxes fund critical infrastructure, emergency services, and public education—areas that benefit society collectively. While some may perceive these taxes as excessive, evidence indicates they are balanced by the overall tax system’s progressivity and targeted expenditures.

| Relevant Category | Data and Context |

|---|---|

| Tax Exemptions | Groceries, prescriptions, and certain medical devices are exempt nationwide; local exemptions vary |

| Revenue Allocation | Majority diverted to transportation, infrastructure, health, and education |

| Impact on Low-Income Households | Research shows minimal disproportionate burden because of exempted essentials |

Myth Three: ‘Tax Rates Have Risen Significantly in Recent Years’

While local political debates frequently spotlight increased sales tax rates, the historical trend suggests gradual shifts rather than radical jumps. Over the past decade, San Diego has experimented with small, voter-approved measures to boost infrastructure investment, typically adding 0.25 to 0.50 percentage points at a time. These increments are carefully calibrated, reflecting fiscal discipline and community consensus.

Examining the Evidence

For example, the 2016 Measure A added 0.25% for transit projects, aligning with broader economic development goals. When compared with historical rates—such as the 7% rate in the early 2010s—these adjustments appear moderate, and their purpose transparent. Data shows that significant rate hikes are rare and usually preceded by extensive public consultation.

| Relevant Category | Specific Data |

|---|---|

| Historical Rate | 7.0% in 2010, increased to approximately 7.75% by 2023 |

| Major Adjustments | Incremental increases, averaging 0.25%, mostly to fund transportation projects |

| Trend | Gradual, community-supported, with transparent legislative processes |

Decoding the Real Impact of San Diego’s Sales Tax

Delving into the tangible implications of sales tax policies reveals a nuanced picture. For consumers, the effective tax burden varies depending on shopping habits, data transparency, and local exemptions. For businesses, understanding these rates influences pricing strategies and financial planning in highly competitive markets. For policymakers, balancing revenue needs with economic vitality requires ongoing assessment, community engagement, and clear communication.

Implications for Residents and Entrepreneurs

Residents benefit from well-funded public services, but must also contend with the perception of tax burdens. Entrepreneurs navigate the tax landscape to optimize profit margins while complying with regulations. Both groups benefit from accurate, accessible information to dispel myths, make informed decisions, and contribute to a resilient local economy.

| Relevant Category | Data/Implication |

|---|---|

| Consumer Impact | Paid on retail goods in most categories, with exemptions for essentials |

| Business Strategy | Pricing, inventory, and tax compliance considerations |

| Economic Outlook | Strategic investments supported by tax revenues facilitate expansion and job creation |

Key Points

- Meticulous layering of taxes in San Diego reflects strategic funding, not excessive burden.

- Misconceptions about rates often stem from a lack of detail on local tax districts and exemptions.

- Historical trends demonstrate responsible, incremental adjustments aligned with community needs.

- Transparency and education can dispel myths and foster informed civic engagement.

- Altogether, the system balances fiscal health with social equity, supporting San Diego’s vibrant economy.

How is the San Diego sales tax rate calculated?

+The rate combines California’s 7.25% base with various local district taxes, which are earmarked for specific projects like transportation, public safety, and infrastructure, resulting in an approximate total of 7.75% in San Diego.

Are sales tax rates significantly higher now than in previous years?

+Incremental increases, often driven by voter-approved measures for specific projects, have raised rates gradually over the last decade. Overall, these are moderate and transparent adjustments, not sudden hikes.

Why do some believe San Diego’s sales tax is unjust?

+Misconceptions stem from misunderstandings about local district taxes, exemptions on essentials, and comparisons with other jurisdictions. Fact-based understanding reveals a balanced, well-structured system supporting community growth.

What practical steps can residents take to understand their local taxes better?

+Reviewing official state and local fiscal reports, utilizing online tax calculators, and participating in community forums can help residents grasp the specifics of sales tax rates and their impact.

How do sales taxes influence business operations in San Diego?

+Business owners consider sales tax rates when pricing, inventory management, and compliance strategies. Understanding the rate structure enables them to optimize revenue while adhering to legal requirements.