Ca Estimated Tax Payments

Navigating the world of taxes can be complex, especially when it comes to understanding and managing estimated tax payments. In California, estimated tax payments are a vital part of the state's tax system, impacting individuals, businesses, and even freelancers. This comprehensive guide aims to demystify the process, offering a detailed breakdown of everything you need to know about California's estimated tax payments.

Understanding Estimated Tax Payments in California

Estimated tax payments are a method used by the Internal Revenue Service (IRS) and the California Franchise Tax Board (FTB) to collect taxes from individuals and businesses whose income is not subject to withholding tax. This includes self-employed individuals, freelancers, sole proprietors, and partners in partnerships. The purpose of estimated tax payments is to ensure that taxpayers pay their taxes in a timely manner, even if they do not have traditional employment where taxes are withheld from their paychecks.

In California, estimated tax payments are especially important due to the state's high income tax rates and the diverse range of industries and businesses operating within its borders. Whether you're a tech entrepreneur in Silicon Valley, a filmmaker in Los Angeles, or a small business owner in San Diego, understanding and managing your estimated tax payments is crucial to staying compliant with state tax laws.

Who Needs to Make Estimated Tax Payments in California

The requirement to make estimated tax payments in California generally applies to individuals and businesses who expect to owe $1,000 or more in taxes for the year after subtracting their withholdings and credits. This includes:

- Self-employed individuals, freelancers, and independent contractors

- Sole proprietors and partners in partnerships

- Corporations and S corporations

- Individuals with substantial capital gains or other one-time income sources

If you fall into any of these categories and anticipate owing taxes after accounting for withholdings and credits, you are likely required to make estimated tax payments. It's important to note that even if you don't owe taxes at the end of the year, failing to make estimated payments when required can result in penalties and interest.

The California Estimated Tax Payment Schedule

In California, estimated tax payments are due on specific deadlines throughout the year. The payment schedule is as follows:

| Due Date | Period Covered |

|---|---|

| April 15 | January 1 - March 31 |

| June 15 | April 1 - May 31 |

| September 15 | June 1 - August 31 |

| January 15 of the following year | September 1 - December 31 |

Each of these deadlines represents a quarterly payment period. It's important to note that these are the due dates for payment, but you are required to file Form 540-ES, the Estimated Tax for Individuals, for each quarter as well. This form helps you calculate the correct amount to pay and ensures you stay compliant with California's tax laws.

Calculating Your Estimated Tax Payments

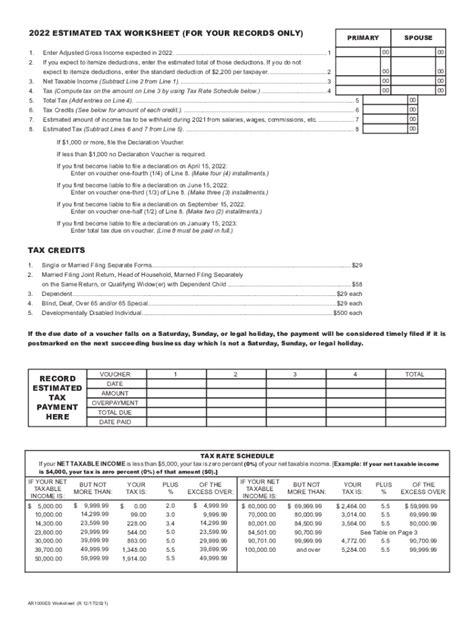

Calculating your estimated tax payments in California involves several steps to ensure accuracy. Here’s a detailed breakdown of the process:

Step 1: Estimate Your Annual Income and Taxes

The first step is to estimate your total income for the year. This includes all sources of income, such as wages, salaries, commissions, business income, rental income, and any other taxable income. It’s important to be as accurate as possible in this estimation to avoid underpayment penalties.

Once you have your estimated annual income, you can calculate your estimated annual tax liability. This involves applying the appropriate tax rates and deductions to your income. You can use the FTB's estimated tax worksheet or tax preparation software to help with this calculation.

Step 2: Determine Your Withholdings and Credits

Next, you need to account for any withholdings and credits you expect to receive during the year. This includes any taxes withheld from your wages, salaries, or pensions, as well as any applicable tax credits, such as the Child Tax Credit or the Earned Income Tax Credit.

Subtract your estimated withholdings and credits from your estimated annual tax liability. The resulting amount is your estimated tax payment obligation for the year.

Step 3: Calculate Quarterly Payments

To ensure you meet the quarterly payment deadlines, you’ll need to divide your annual estimated tax payment obligation into four equal installments. Each quarterly payment should be 25% of your annual obligation.

However, it's important to note that you should not underpay in any quarter. If your income varies significantly throughout the year, you may need to adjust your quarterly payments to ensure you're paying enough to avoid penalties. The FTB provides a safe harbor rule to help you calculate the minimum amount you need to pay each quarter to avoid penalties.

Step 4: Adjustments and Amendments

As the year progresses and your income and expenses become more clear, you may need to adjust your estimated tax payments. Significant changes in income, deductions, or tax laws can impact your tax liability and estimated payments. It’s important to review your estimated payments throughout the year and make adjustments as necessary to avoid penalties and ensure accuracy.

Making Estimated Tax Payments in California

Once you’ve calculated your estimated tax payments, it’s time to make the actual payments to the FTB. Here’s a step-by-step guide to the payment process:

Step 1: Obtain a Payment Voucher

The FTB provides payment vouchers with your estimated tax form (Form 540-ES). These vouchers are used to make your payments and ensure they are credited to your account correctly. You can also download additional vouchers from the FTB’s website if needed.

Step 2: Choose Your Payment Method

The FTB offers several payment methods for estimated tax payments, including:

- Electronic Payments: You can make payments online through the WebPay portal or by phone using the Automated Payment Service (APS). Electronic payments are typically processed within one business day.

- Credit or Debit Card: You can pay by credit or debit card using the Official Payments website. A convenience fee applies to this method.

- Check or Money Order: Make your check or money order payable to the California Franchise Tax Board and include your payment voucher. Mail your payment to the address provided on the voucher.

Step 3: Ensure Timely Payment

It’s crucial to ensure your estimated tax payments are made on time to avoid penalties and interest. Late payments can result in additional fees, so be sure to mark your calendar with the quarterly due dates and make your payments accordingly.

FAQs

What happens if I don’t make estimated tax payments when required in California?

+Failing to make estimated tax payments when required can result in penalties and interest. The FTB may impose a penalty of up to 10% of the unpaid tax for each quarter, with a maximum penalty of 25% for the year. Additionally, interest may be charged on the unpaid tax, further increasing your liability.

Can I make extra estimated tax payments in California to reduce my tax burden?

+Yes, you can make additional estimated tax payments in California. This can be beneficial if you anticipate a higher income or tax liability than initially estimated. Making extra payments can help reduce your overall tax burden and avoid underpayment penalties. However, be sure to accurately calculate your additional payments to avoid overpayment.

How do I know if I’m eligible for tax credits in California, and how do they impact my estimated tax payments?

+Tax credits can significantly impact your tax liability and estimated tax payments. California offers various tax credits, such as the Earned Income Tax Credit and the California Film and Television Tax Credit. To determine your eligibility for these credits, review the specific requirements and guidelines provided by the FTB. These credits can reduce your tax liability and may impact the amount of estimated tax payments you need to make.