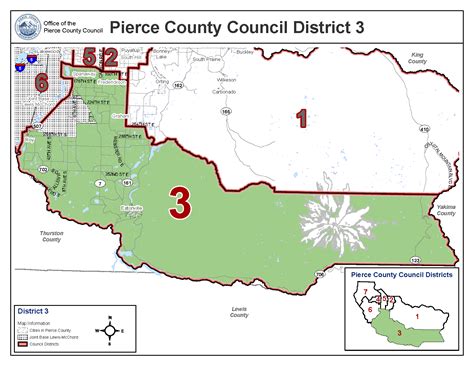

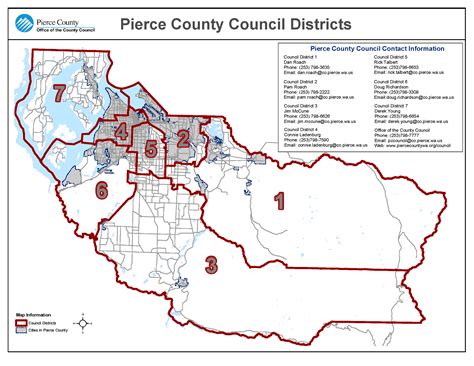

Pierce County Wa Property Tax

Property taxes are an essential part of local government revenue in the United States, and Pierce County, Washington, is no exception. Understanding how property taxes work and their impact on residents is crucial for homeowners and prospective buyers alike. In this comprehensive guide, we will delve into the intricacies of Pierce County's property tax system, exploring its rates, assessment processes, payment options, and more. By the end of this article, you'll have a clear understanding of how property taxes function in this vibrant county and be equipped with the knowledge to navigate this critical aspect of homeownership.

The Fundamentals of Property Taxation in Pierce County

Pierce County, located in the vibrant state of Washington, employs a comprehensive property tax system to fund essential public services and infrastructure. This system is designed to ensure a fair and equitable distribution of tax burdens among property owners, contributing to the county’s overall prosperity and well-being.

The property tax system in Pierce County operates on a straightforward principle: property owners are assessed a tax based on the value of their real estate holdings. This value is determined through a meticulous assessment process, taking into account various factors such as the property's location, size, and market conditions.

The assessed value of a property serves as the basis for calculating the tax amount. This value is then multiplied by the applicable tax rate, which is set by the county government. The resulting figure represents the annual property tax obligation for the owner. It's important to note that this tax rate can vary across different areas within the county, reflecting the unique needs and characteristics of each community.

Key Factors Influencing Property Tax Rates

Several critical factors come into play when determining the property tax rate in Pierce County:

- Assessment Value: The assessed value of a property is a crucial determinant of the tax rate. Properties with higher values typically face higher tax obligations.

- Tax Levy: The tax levy, set by the county commissioners, is a critical component in calculating the tax rate. It represents the total amount of revenue the county aims to raise through property taxes.

- Budgetary Needs: The county's financial requirements, including the funding of public services, infrastructure development, and debt obligations, significantly impact the tax rate.

- Special Assessments: In certain cases, additional assessments may be levied on properties to fund specific projects or improvements benefiting a particular area.

It's essential to understand that property tax rates can vary not only across different areas within Pierce County but also over time. The county commissioners have the authority to adjust tax rates annually, ensuring that the county's financial needs are met while maintaining a balanced and sustainable budget.

Property Tax Assessment Process in Pierce County

The property tax assessment process in Pierce County is a comprehensive and transparent procedure designed to ensure fairness and accuracy. Here’s a step-by-step breakdown of how it works:

- Data Collection: The Pierce County Assessor's Office gathers extensive data on all real estate properties within the county. This data includes information on property characteristics, such as size, location, improvements, and recent sales.

- Market Analysis: Assessors conduct a thorough analysis of the real estate market to determine the fair market value of properties. This involves studying recent sales, rental income data, and other market indicators.

- Assessment: Using the collected data and market analysis, assessors assign a value to each property. This value, known as the assessed value, forms the basis for calculating property taxes.

- Notification: Property owners receive a notice of their assessed value, along with any changes from the previous year. This notice serves as a critical tool for understanding the basis of their property tax obligations.

- Appeals Process: Property owners who believe their assessed value is inaccurate have the right to appeal. The Pierce County Assessor's Office provides a transparent and accessible appeals process, ensuring that property owners can challenge their assessments if needed.

By following this rigorous assessment process, Pierce County ensures that property taxes are levied fairly and accurately, reflecting the true value of each property. This process is a crucial component of the county's commitment to transparency and fairness in taxation.

Understanding Your Property Tax Bill

Receiving a property tax bill can sometimes be a daunting experience for homeowners, especially if they are unfamiliar with the intricacies of the system. Let’s break down the components of a typical Pierce County property tax bill to provide a clearer understanding.

A Pierce County property tax bill typically includes the following key elements:

- Property Information: The bill provides detailed information about the property, including its address, legal description, and parcel number.

- Assessed Value: This is the value assigned to the property by the county assessor, as discussed earlier. It serves as the basis for calculating the tax amount.

- Tax Rate: The tax rate applicable to the property is clearly stated on the bill. This rate is expressed as a percentage and is used to calculate the tax liability.

- Tax Amount: The bill provides the total tax amount due, calculated by multiplying the assessed value by the tax rate.

- Payment Options: Property tax bills in Pierce County typically offer various payment options, including online payments, credit card payments, and traditional mail-in checks.

- Due Dates: The bill outlines the due dates for property tax payments. In Pierce County, property taxes are typically due in two installments, with specific deadlines set by the county.

- Late Payment Penalties: It's important to note that late payments may incur penalties and interest. The bill will provide details on the penalty structure to encourage timely payments.

- Exemptions and Deductions: If applicable, the bill may also highlight any exemptions or deductions that the property owner is eligible for, reducing the overall tax liability.

Understanding the components of your property tax bill is essential for effective financial planning and ensuring timely payments. It's always advisable to review your bill carefully and seek clarification from the Pierce County Assessor's Office if any aspects are unclear.

Exploring Property Tax Relief Options

Property taxes can sometimes pose a financial burden, especially for homeowners on fixed incomes or those facing economic challenges. Fortunately, Pierce County offers various property tax relief programs to assist eligible residents. Let’s explore some of these options.

Senior Citizen Exemption

Pierce County provides a property tax exemption specifically designed to assist senior citizens. To be eligible for this exemption, homeowners must meet the following criteria:

- Be at least 61 years of age

- Have owned and occupied the property as their primary residence for at least three consecutive years

- Meet certain income requirements

Eligible seniors can receive a significant reduction in their property tax liability, making it more affordable to maintain their homes. This exemption aims to support the county's senior population and ensure they can continue to enjoy their homes without excessive financial strain.

Low-Income Property Tax Deferral

For low-income homeowners, Pierce County offers a property tax deferral program. This program allows eligible homeowners to defer a portion of their property taxes, providing much-needed financial relief. To qualify, homeowners must meet the following conditions:

- Have an annual household income below a certain threshold (subject to change annually)

- Be at least 60 years of age or have a disability

- Own and occupy the property as their primary residence

By deferring a portion of their property taxes, eligible homeowners can ease their financial burden and focus on other essential expenses. This program is a testament to Pierce County's commitment to supporting its residents and ensuring that homeownership remains accessible to all.

Property Tax Abatements and Exemptions

Pierce County also offers various property tax abatements and exemptions to promote economic development and support specific industries. These programs aim to attract new businesses, encourage job creation, and stimulate economic growth within the county.

Some common types of abatements and exemptions include:

- Enterprise Zones: Certain areas within the county may be designated as enterprise zones, offering tax incentives to businesses that locate or expand within these zones.

- Industrial Property Exemptions: Industrial properties, such as manufacturing facilities, may be eligible for tax exemptions to encourage investment and job creation.

- Agricultural Land Exemptions: Agricultural lands used for farming or ranching may be exempt from certain property taxes, supporting the county's agricultural industry.

These abatements and exemptions are carefully designed to balance the needs of the county's economic development with the fair distribution of tax burdens among property owners. They play a vital role in fostering a thriving and diverse economy within Pierce County.

Online Tools and Resources for Property Tax Management

In today’s digital age, Pierce County recognizes the importance of providing convenient and accessible online tools for property tax management. These resources empower homeowners to stay informed, manage their property tax obligations efficiently, and access critical information with just a few clicks.

Pierce County Assessor’s Office Website

The Pierce County Assessor’s Office maintains a comprehensive and user-friendly website, serving as a one-stop resource for all property tax-related matters. Here’s an overview of the key features and services offered on the website:

- Property Search: Homeowners can easily search for their property by address, parcel number, or legal description. This feature provides quick access to property information, including assessed value, tax history, and assessment details.

- Tax Bill Lookup: The website allows users to look up their current and past property tax bills, providing transparency and ease of access to critical financial information.

- Payment Options: Property owners can make online payments for their property taxes securely and conveniently. The website offers various payment methods, including credit card and e-check options.

- Appeals and Exemptions: Detailed information and guidelines are provided for property owners wishing to appeal their assessed value or apply for exemptions. The website simplifies the process, making it more accessible for residents.

- News and Updates: The Pierce County Assessor's Office keeps residents informed about the latest property tax-related news, changes in legislation, and important deadlines through regular updates on the website.

By leveraging these online tools, homeowners in Pierce County can stay ahead of their property tax obligations, ensure timely payments, and take advantage of available relief programs and exemptions.

Pierce County Property Tax Calculator

For those interested in estimating their potential property tax liability, Pierce County offers a user-friendly property tax calculator. This online tool allows prospective buyers and homeowners to input critical property information, such as location, size, and assessed value, to estimate their annual tax obligation.

The property tax calculator provides a quick and convenient way to assess the financial implications of owning a property in Pierce County. It empowers individuals to make informed decisions about their real estate investments and understand the ongoing costs associated with homeownership.

Future Outlook and Ongoing Improvements

Pierce County is committed to continuous improvement and innovation in its property tax system. As the county’s population and economy evolve, the county government remains dedicated to ensuring that the property tax system remains fair, efficient, and responsive to the needs of its residents.

Some key areas of focus for future improvements include:

- Assessment Accuracy: The county aims to enhance its assessment processes to ensure even greater accuracy in determining property values. This includes investing in advanced technology and data analytics to stay at the forefront of assessment practices.

- Tax Relief Expansion: Recognizing the importance of property tax relief for vulnerable populations, Pierce County is exploring ways to expand and enhance its relief programs. This includes potential adjustments to eligibility criteria and increased funding to support eligible homeowners.

- Online Services Enhancement: The county plans to further develop and expand its online services, making it even more convenient for residents to access critical property tax information and manage their obligations. This includes potential improvements to the website and the introduction of new digital tools.

- Community Engagement: Pierce County is committed to fostering open communication and engagement with its residents. The county plans to continue hosting community meetings, workshops, and educational events to ensure that residents have a clear understanding of the property tax system and their rights and responsibilities.

By staying focused on these key areas of improvement, Pierce County aims to maintain its position as a leader in fair and efficient property taxation, ensuring that its residents can thrive and contribute to the county's continued growth and prosperity.

FAQs

How often are property values reassessed in Pierce County?

+Property values in Pierce County are typically reassessed every two years. However, in certain circumstances, such as significant improvements or changes to the property, reassessments may occur more frequently.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, Pierce County provides a fair and accessible appeals process for property owners who wish to challenge their assessed value. You can contact the Pierce County Assessor’s Office to initiate the appeal process and provide supporting evidence for your case.

Are there any tax breaks or exemptions available for military veterans in Pierce County?

+Yes, Pierce County offers a property tax exemption for eligible military veterans. To qualify, veterans must meet certain service-related criteria and meet income requirements. It’s advisable to contact the Pierce County Assessor’s Office for detailed information and application procedures.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, you may be subject to late payment penalties and interest. It’s important to stay informed about the payment deadlines and make timely payments to avoid additional financial burdens.

How can I stay updated on property tax-related news and changes in Pierce County?

+The Pierce County Assessor’s Office website is an excellent resource for staying informed about property tax-related news and updates. Additionally, you can sign up for email alerts or follow the office’s social media channels to receive timely notifications about important changes or deadlines.