New York Sales Tax

Sales tax is an essential aspect of any state's revenue generation and economic system. In New York, sales tax plays a significant role in funding public services and infrastructure. With a unique tax structure and a diverse range of taxable goods and services, understanding the intricacies of New York sales tax is crucial for both businesses and consumers alike. In this comprehensive guide, we will delve into the specifics of New York sales tax, exploring its rates, applicability, exemptions, and the impact it has on the state's economy.

Unraveling the Complexities of New York Sales Tax

New York, known for its vibrant cities and diverse landscapes, boasts a robust economy that relies on a comprehensive sales tax system. The state’s sales tax structure is a multifaceted framework that varies across different regions and types of transactions. Let’s break down the key components and shed light on how it affects businesses and consumers in the Empire State.

Understanding the Sales Tax Rates in New York

The sales tax rates in New York can be a complex matter, as they vary depending on several factors. The state’s base sales tax rate stands at 4%, which is applicable to most goods and services. However, this is just the starting point, as local jurisdictions often impose additional taxes on top of the state rate.

New York City, for instance, adds a 4.5% local sales tax to the state rate, resulting in a total sales tax of 8.5%. Other counties and municipalities within the state have their own unique tax rates, creating a patchwork of varying tax structures across the state. This diversity in rates can make it challenging for businesses to navigate the sales tax landscape, especially for those operating in multiple regions.

To illustrate the variations, let's take a look at some real-world examples of sales tax rates in different parts of New York:

| Region | Sales Tax Rate |

|---|---|

| New York City | 8.5% |

| Albany County | 8% |

| Buffalo (Erie County) | 8% |

| Rochester (Monroe County) | 8% |

| Syracuse (Onondaga County) | 8% |

As you can see, even within major cities and their surrounding counties, the sales tax rates can differ. This complexity arises from the local option of adding a municipal sales tax on top of the state and county rates. It's essential for businesses and consumers to be aware of these variations to ensure accurate tax calculations and compliance.

The Impact of Sales Tax on New York’s Economy

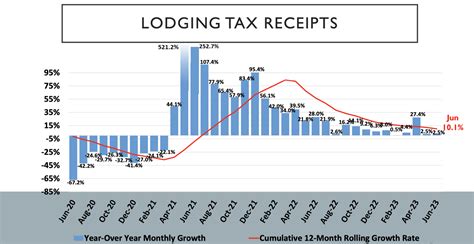

Sales tax plays a pivotal role in New York’s economy, contributing significantly to the state’s revenue generation. According to recent data, the state collected approximately $19.2 billion in sales and use taxes in the fiscal year 2021-2022, which accounted for nearly 14.5% of the total state revenue.

The revenue generated from sales tax is allocated towards various essential public services, including education, healthcare, infrastructure development, and public safety. It also supports critical state initiatives and programs, ensuring the continued growth and prosperity of New York's diverse communities.

However, the impact of sales tax extends beyond revenue generation. It influences consumer behavior, business strategies, and the overall economic landscape of the state. For instance, higher sales tax rates can deter consumers from making certain purchases, leading to a shift in spending patterns and potentially affecting certain industries.

On the other hand, sales tax incentives and exemptions can stimulate economic growth by encouraging specific types of investments or transactions. For example, New York offers tax incentives for businesses that locate or expand their operations within the state, creating a competitive advantage for certain industries and attracting new businesses.

Navigating Sales Tax Exemptions and Special Considerations

While sales tax is applicable to a wide range of goods and services, New York, like many other states, offers exemptions and special considerations to certain transactions. These exemptions are designed to promote specific economic goals, support certain industries, or alleviate the tax burden on vulnerable populations.

One notable exemption in New York is for certain types of food and beverages. Prepared food items, such as meals served in restaurants, are generally subject to sales tax. However, non-prepared food, including groceries and staple foods, are exempt from sales tax. This exemption aims to reduce the tax burden on essential items and make food more affordable for New Yorkers.

Additionally, New York offers tax incentives and exemptions for certain industries, such as manufacturing and technology. These incentives are aimed at attracting businesses, creating jobs, and fostering economic growth in these sectors. For instance, the state provides tax credits for businesses that invest in research and development or engage in specific manufacturing activities.

Another critical consideration is the treatment of online sales. With the rise of e-commerce, states have had to adapt their sales tax policies to accommodate online transactions. New York has implemented a "marketplace facilitator" law, which requires online retailers and marketplace platforms to collect and remit sales tax on behalf of third-party sellers. This ensures that online transactions are subject to the same sales tax rates as in-store purchases, creating a level playing field for businesses and promoting tax compliance.

Sales Tax Compliance and Filing Requirements

Ensuring compliance with New York’s sales tax regulations is a critical responsibility for businesses operating within the state. The New York Department of Taxation and Finance provides detailed guidelines and resources to assist businesses in understanding their sales tax obligations. Failure to comply with these regulations can result in penalties, interest, and legal consequences.

Businesses are required to register with the Department of Taxation and Finance and obtain a Certificate of Authority for Sales Tax. This certificate authorizes the business to collect and remit sales tax on taxable transactions. The registration process involves providing detailed information about the business, its activities, and the goods and services it offers.

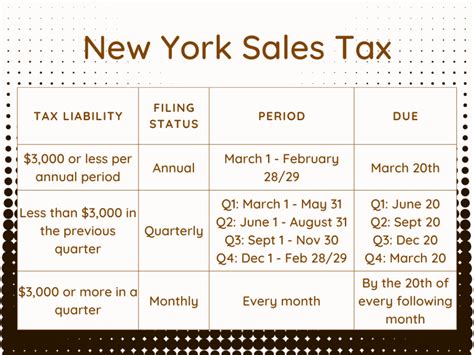

Once registered, businesses must collect the appropriate sales tax from customers and remit it to the state on a regular basis. The frequency of filing and remittance depends on the business's sales volume and can range from monthly to quarterly filings. It's crucial for businesses to maintain accurate records of sales transactions, including the breakdown of taxable and exempt items, to ensure compliance.

In addition to sales tax, businesses may also be subject to other tax obligations, such as withholding income tax from employee wages or collecting and remitting taxes on specific types of services. The Department of Taxation and Finance provides comprehensive resources and guidance to help businesses navigate these complex tax requirements.

Conclusion: A Comprehensive Approach to Sales Tax

New York’s sales tax system is a multifaceted and intricate framework that plays a vital role in the state’s economy. From its diverse rates across regions to the exemptions and incentives offered, understanding and navigating this system is crucial for businesses and consumers alike.

By unraveling the complexities of New York sales tax, we've explored the rates, their impact on the economy, and the considerations that come into play. This knowledge empowers businesses to make informed decisions, comply with regulations, and contribute to the state's economic growth. For consumers, understanding sales tax ensures they are aware of the costs associated with their purchases and can make informed choices.

As we continue to navigate the ever-evolving world of sales tax, staying updated on the latest regulations and guidelines is essential. New York's sales tax landscape is subject to changes and updates, and businesses must remain vigilant to ensure compliance and take advantage of any available incentives or exemptions.

In conclusion, New York sales tax is a critical component of the state's economic fabric, and its comprehensive approach ensures a fair and sustainable revenue generation system. By understanding the intricacies and staying informed, we can all contribute to the prosperity and growth of the Empire State.

How often do businesses need to file sales tax returns in New York?

+The frequency of filing sales tax returns in New York depends on the business’s sales volume. For businesses with higher sales, monthly filing is required. Those with lower sales may file quarterly. It’s essential to consult the specific guidelines provided by the Department of Taxation and Finance to determine the appropriate filing frequency.

Are there any online resources available to help businesses calculate sales tax accurately in New York?

+Yes, the New York Department of Taxation and Finance offers an online sales tax calculator on its website. This tool allows businesses to input the necessary information and calculate the applicable sales tax rate for their transactions. It’s a valuable resource for ensuring accurate tax calculations.

What are the penalties for non-compliance with sales tax regulations in New York?

+Non-compliance with sales tax regulations in New York can result in various penalties, including fines, interest charges, and potential criminal charges. The severity of the penalty depends on the nature and extent of the violation. It’s crucial for businesses to understand their obligations and take compliance seriously to avoid these consequences.