City Of Miami Sales Tax

Welcome to the comprehensive guide on the City of Miami Sales Tax! In this article, we will delve into the intricacies of the sales tax landscape in Miami, providing you with an in-depth understanding of the rates, regulations, and impact on businesses and consumers alike. As a bustling metropolis and a major economic hub, Miami's sales tax system plays a crucial role in the city's revenue generation and business environment.

Understanding the Miami Sales Tax Landscape

The City of Miami, located in Miami-Dade County, Florida, imposes a sales tax on various goods and services sold within its boundaries. This sales tax is a crucial component of the city’s tax structure, contributing significantly to the local government’s revenue stream. The tax is applied at different rates, depending on the type of transaction and the location of the sale.

The sales tax in Miami is comprised of several components, including the state sales tax, county sales tax, and optional municipal sales tax. These taxes are collectively referred to as the Total Sales Tax Rate, which can vary depending on the specific location within the city.

Understanding the Miami sales tax landscape is essential for businesses operating within the city, as it directly impacts their pricing strategies, tax compliance, and overall financial operations. Consumers, too, benefit from a clear understanding of the sales tax system, as it allows them to make informed purchasing decisions and budget effectively.

Key Components of Miami Sales Tax

Let’s break down the key components of the Miami sales tax to gain a clearer picture:

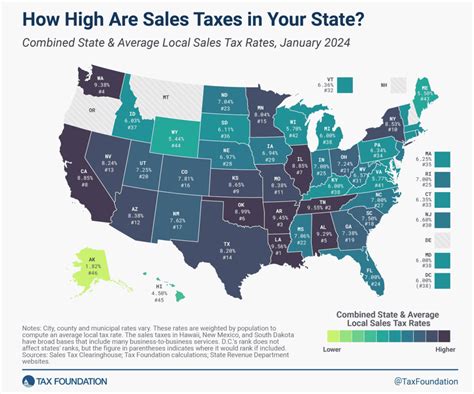

- State Sales Tax: Florida imposes a state sales tax rate of 6%, which is applied to most tangible personal property and certain services sold within the state. This rate is a fundamental part of the Miami sales tax structure.

- County Sales Tax: Miami-Dade County, where the City of Miami is located, adds an additional 1% to the state sales tax, bringing the county-wide rate to 7%. This county tax is applied uniformly across the county, including the city limits.

- Municipal Sales Tax: The City of Miami has the authority to impose an optional municipal sales tax, which is typically used to fund specific local projects or initiatives. The rate of this tax can vary, and it is often dependent on voter approval through referendums or other legislative processes. The current municipal sales tax rate in Miami is 1.5%, bringing the total sales tax rate within the city to 8.5%.

It's important to note that while the municipal sales tax is an optional component, it is a critical part of the city's tax structure, providing additional revenue for essential services and development projects.

Sales Tax Exemptions and Special Considerations

Like many other sales tax systems, Miami’s sales tax framework includes exemptions and special considerations for certain goods and services. These exemptions are designed to encourage specific economic activities or support particular industries. Understanding these exemptions is vital for businesses to ensure compliance and optimize their tax strategies.

Key Exemptions and Special Rates

Here are some of the notable sales tax exemptions and special rates in Miami:

- Food and Groceries: Prepared food and groceries for home consumption are generally exempt from sales tax in Miami. This exemption aims to alleviate the tax burden on essential household items and encourages consumers to spend more on non-taxable necessities.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax, providing a crucial relief for individuals with medical needs. This exemption ensures that essential medications are more affordable and accessible to residents.

- Manufacturing and Resale: Sales of goods intended for manufacturing or resale are often exempt from sales tax. This exemption supports the local manufacturing sector and encourages businesses to invest in production and distribution within the city.

- Non-Profit Organizations: Many non-profit organizations, such as charities and religious institutions, are exempt from sales tax on certain goods and services. This exemption recognizes the valuable contributions of these organizations to the community and reduces their tax burden.

- Special Event Tickets: Tickets for live performances, sporting events, and other cultural activities may be subject to a special tax rate. This rate is often lower than the standard sales tax, making it more attractive for consumers and encouraging attendance at these events.

It's crucial for businesses to stay informed about these exemptions and special rates to ensure they are not overpaying on sales tax and to avoid potential penalties for non-compliance.

Impact on Businesses and Consumers

The sales tax system in Miami has a significant impact on both businesses and consumers, influencing their decision-making processes and overall financial health.

Business Considerations

For businesses operating in Miami, the sales tax system presents both challenges and opportunities. On the one hand, businesses must navigate the complexities of tax compliance, ensuring they collect and remit the correct sales tax on all applicable transactions. This requires a robust tax management system and a dedicated tax team.

On the other hand, businesses can leverage the sales tax system to their advantage. By understanding the tax rates and exemptions, businesses can optimize their pricing strategies, making their products more competitive in the market. Additionally, businesses can use the sales tax as a marketing tool, highlighting the tax-free status of certain items to attract consumers.

Furthermore, the municipal sales tax rate provides an opportunity for businesses to contribute to local development projects, fostering a sense of community engagement and potentially enhancing their reputation among residents.

Consumer Impact

For consumers, the sales tax in Miami can significantly impact their purchasing decisions and overall spending habits. The total sales tax rate of 8.5% is a notable addition to the cost of goods and services, and consumers must factor this into their budgets.

However, the exemptions and special rates can provide some relief for consumers. For instance, the exemption on food and groceries allows consumers to allocate their budgets more efficiently, while the special event ticket tax encourages attendance at cultural and sporting events. Consumers can also take advantage of tax-free shopping days or periods, which are often promoted by the city to stimulate economic activity.

Sales Tax Compliance and Administration

Ensuring compliance with the Miami sales tax regulations is a critical aspect of doing business in the city. The Florida Department of Revenue is responsible for administering and enforcing the sales tax laws, and businesses must adhere to these regulations to avoid penalties and legal consequences.

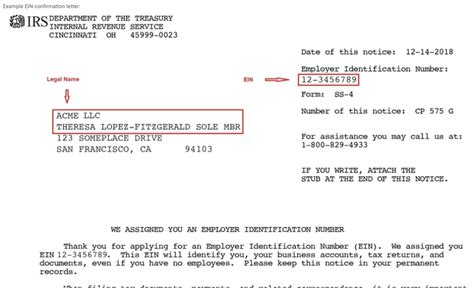

Registration and Remittance

Businesses operating in Miami must register with the Florida Department of Revenue to obtain a sales tax permit. This permit authorizes the business to collect and remit sales tax on behalf of the state and local governments. The registration process involves providing detailed information about the business, its activities, and its tax obligations.

Once registered, businesses must collect the applicable sales tax on all taxable transactions and remit these taxes to the Department of Revenue on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to annually.

Sales Tax Filing and Payment

Sales tax returns must be filed accurately and timely to ensure compliance. The returns should include a detailed breakdown of taxable sales, exemptions, and any applicable tax credits or deductions. Late or inaccurate filings can result in penalties and interest charges.

Businesses have the option to pay their sales tax liabilities online, by mail, or through electronic funds transfer. The payment method and due date are specified in the sales tax return instructions provided by the Department of Revenue.

Sales Tax Audits

The Florida Department of Revenue conducts sales tax audits to ensure compliance and identify any instances of non-compliance. These audits can be random or targeted, and businesses should be prepared to provide comprehensive records and documentation to support their sales tax filings.

During an audit, the Department of Revenue may examine a business's sales records, tax returns, and other financial documents to verify the accuracy of the reported sales tax liabilities. Any discrepancies or errors can lead to penalties and additional tax assessments.

Future Implications and Potential Changes

The sales tax landscape in Miami, like any tax system, is subject to change and evolution. As the city’s economic needs and priorities shift, the sales tax rates and regulations may undergo adjustments to accommodate these changes.

Potential Future Developments

Here are some potential future developments and implications for the Miami sales tax system:

- Rate Adjustments: The municipal sales tax rate, currently at 1.5%, may be subject to future adjustments. Depending on the city's economic goals and the need for additional revenue, the rate could be increased or decreased through legislative processes or referendums.

- Expansion of Exemptions: As the city continues to grow and diversify its economy, there may be calls to expand the list of sales tax exemptions. This could include new exemptions for emerging industries, such as technology or renewable energy, to encourage investment and innovation.

- Simplification of Tax Structure: To enhance compliance and reduce administrative burdens, there could be efforts to simplify the sales tax structure. This might involve consolidating tax rates or streamlining the registration and filing processes to make it more accessible for businesses.

- Digital Sales Tax: With the rise of e-commerce and online sales, there may be a need to address the taxation of digital transactions. Miami, like other cities, could explore the implementation of a digital sales tax to ensure fairness and generate revenue from online sales.

- Regional Collaboration: Miami may collaborate with neighboring municipalities or counties to develop a unified sales tax system, harmonizing rates and regulations across the region. This could lead to a more efficient and consistent tax environment for businesses operating in multiple jurisdictions.

Conclusion

The City of Miami’s sales tax system is a complex yet vital component of the city’s economic ecosystem. It provides a substantial revenue stream for the local government while impacting businesses and consumers alike. Understanding the intricacies of the sales tax landscape is essential for all stakeholders to navigate the system effectively and contribute to the city’s economic growth.

As Miami continues to thrive and evolve, the sales tax framework will likely adapt to meet the changing needs of the city. By staying informed and engaged with the latest developments, businesses and consumers can make informed decisions and optimize their tax strategies, ensuring a sustainable and prosperous future for the City of Miami.

What is the current total sales tax rate in Miami, including state, county, and municipal taxes?

+

The current total sales tax rate in Miami is 8.5%, consisting of the 6% state sales tax, 1% county sales tax, and 1.5% municipal sales tax.

Are there any sales tax holidays in Miami, and if so, when do they occur?

+

Yes, Miami often has sales tax holidays to encourage shopping and stimulate the economy. These holidays typically occur during specific periods, such as back-to-school season or holiday shopping season. During these times, certain items are exempt from sales tax, making them more affordable for consumers.

How often do businesses need to remit sales tax to the Florida Department of Revenue?

+

The frequency of sales tax remittance depends on the business’s sales volume. Businesses with higher sales volumes may need to remit sales tax monthly, while those with lower sales may remit quarterly or annually. The specific remittance schedule is outlined in the sales tax permit and registration documents.

Are there any online resources or tools available to help businesses calculate and manage their sales tax obligations in Miami?

+

Yes, the Florida Department of Revenue provides online tools and resources to assist businesses with sales tax calculations and compliance. These resources include tax rate lookup tools, sales tax calculators, and guidance on registering, filing, and remitting sales tax. Businesses can access these resources on the Department’s website.

Can individuals who work remotely or have an online business be exempt from Miami’s sales tax requirements?

+

No, individuals or businesses operating remotely or online are still subject to Miami’s sales tax requirements if they have a nexus (a significant connection) with the city. This includes selling goods or services to Miami residents or having a physical presence in the city, such as a warehouse or office. Remote sellers may need to register, collect, and remit sales tax just like any other business.