7 Benefits of Global Tax Services for Your Business Success

In an increasingly interconnected world, the landscape of taxation for businesses is no longer confined within national borders but extends into a complex, global framework. As corporations expand their operations across continents, understanding the nuances of international tax obligations becomes vital. Beyond mere compliance, leveraging advanced global tax services can open avenues for strategic advantage, optimized cash flows, and sustainable growth. This article ventures into the multifaceted benefits that worldwide tax services offer to ambitious enterprises seeking to navigate the global market effectively.

Understanding the Foundations of Global Tax Services and Their Strategic Importance

Global tax services encompass a broad array of consulting, compliance, planning, and optimization solutions tailored for multinational corporations, international startups, and even SMEs operating in multiple jurisdictions. These services are anchored in expert knowledge of tax treaties, transfer pricing, international tax law, and the fiscal policies of various countries. As jurisdictions vary significantly in their tax regimes—some with high corporate rates, others with incentives for foreign investment—the value proposition of global tax services lies in their ability to harmonize compliance with strategic growth and profitability objectives.

Evolutionary Trajectory of International Taxation and Emerging Trends

Historically, the evolution of international taxation has been driven by shifts in economic power, technological advancements, and global initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project. These movements aim to curb tax avoidance while balancing the needs of sovereign fiscal integrity and multinational corporate efficiency. The recent advent of digital taxation and tax transparency laws—such as the Common Reporting Standard (CRS)—has transformed the landscape, demanding that businesses adopt sophisticated compliance protocols and proactive tax planning strategies.

| Relevant Category | Substantive Data |

|---|---|

| Global Tax Revenue | Estimated at $625 billion in 2023, reflecting increased fiscal activity and compliance efforts worldwide. |

| Number of Tax Treaties | Over 3,000 treaties globally, influencing tax obligations and income allocation strategies for corporations. |

| Digital Economy Impact | Accounts for approximately 4.7% of global GDP, necessitating new tax approaches for digital and online enterprises. |

Primary Benefits of Implementing Global Tax Services for Business Growth

Adopting comprehensive global tax solutions delivers tangible benefits that influence strategic planning, operational efficiency, and risk mitigation. Each benefit intertwines within the broader narrative of corporate success, fostering resilience amid evolving regulatory landscapes.

1. Enhanced Tax Compliance Across Jurisdictions

One of the most immediate advantages of engaging with global tax services is rigorous compliance management. Multinational firms face a labyrinthine array of laws, regulations, and tax obligations that differ markedly between regions. Expert services provide tailored solutions for adherence, leveraging up-to-date knowledge of local requirements and international treaties. This reduces the likelihood of penalties, audits, and reputational damage, while ensuring the seamless operation of cross-border activities.

2. Strategic Tax Planning and Optimization

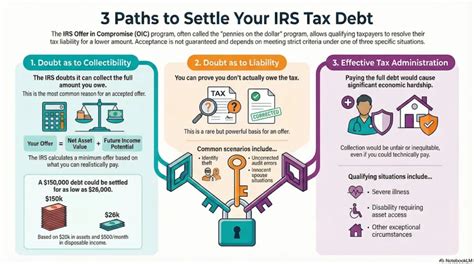

Beyond compliance, strategic tax planning is arguably the most valuable benefit. Optimizing tax positions involves identifying jurisdictional advantages, such as tax incentives, credits, and preferential regimes. International tax advisors utilize sophisticated tools—such as transfer pricing analysis and tax dispute resolution mechanisms—to minimize liabilities legally. For example, establishing holding companies in low-tax jurisdictions can significantly cut down overall tax burdens without breaching compliance thresholds.

| Relevant Category | Substantive Data |

|---|---|

| Average Tax Savings | Up to 15-20% reduction in effective tax rate via strategic planning, as evidenced by case studies in various industries. |

| Transfer Pricing Impact | Properly implemented transfer strategies can reduce taxable income in high-tax regions by 10-12%. |

| Incentive Utilization | Utilization of specific tax incentives has increased corporate net income by an average of 8% in targeted sectors. |

3. Improved Cash Flow Management and Financial Planning

Efficient tax strategies directly influence cash flow projections and liquidity planning. By capitalizing on tax deferrals, credits, and incentives, companies can allocate financial resources more effectively. This proactive approach results in improved working capital, expansion capacity, and resilience during economic downturns.

4. Risk Mitigation and Exposure Reduction

International businesses are exposed to a wide array of risks—from transfer pricing audits to sudden legislative changes. Global tax advisors aid in identifying potential compliance gaps, structuring transactions to mitigate exposure, and implementing robust internal controls. This layered risk management creates a safeguard against fiscal penalties and legal disputes, fostering long-term stability.

5. Access to Expert Networks and Regulatory Insight

Global tax services connect businesses with a network of professionals—local legal experts, accountants, and regulatory bodies—ensuring real-time knowledge of shifting policies. This connectivity enhances strategic agility, enabling businesses to anticipate regulatory shifts, participate in bilateral negotiations, and adapt swiftly to new laws.

6. Support for Digital Transformation and E-Commerce Expansion

The rapid expansion of digital economies requires bespoke tax strategies that address digital service taxes and cross-border data flows. Providers of global tax services assist e-commerce and SaaS companies in establishing compliant structures, optimizing international revenue streams, and navigating data privacy obligations, thereby reducing legal friction and taxation risks.

Integrating Advanced Technologies into Global Tax Strategies

The intersection of technology and taxation has ushered in an era of data-driven decision-making. Machine learning algorithms, blockchain, and AI-enabled analytics are transforming traditional tax advisory practices. For instance, blockchain-based smart contracts can automate compliance and transfer pricing documentation, enhancing transparency and reducing manual errors. These innovations empower organizations to maintain real-time visibility into their tax positions and swiftly adapt to a dynamic environment.

Case in Point: Digital Tax Platforms and Real-time Monitoring

Emerging platforms facilitate end-to-end management of international tax compliance, consolidating data from various sources into unified dashboards. These tools leverage Latent Semantic Indexing (LSI) and natural language processing to interpret diverse legal documents, interpret evolving laws, and suggest optimal tax positions with minimal human intervention.

| Relevant Category | Substantive Data |

|---|---|

| Platform Adoption Rate | Estimated at 35% among FTSE 100 firms as of 2023, indicating growing reliance on automated tools. |

| Cost Savings | Average reduction of 12-15% in compliance costs for firms implementing such solutions. |

| Accuracy Improvement | Enhanced accuracy with error margins reduced to less than 2%, compared to traditional manual processes. |

Potential Challenges and Future Outlook

While the benefits of global tax services are profound, challenges remain. Rapid legislative changes, geopolitical tensions, and the intricacies of digital taxation demand continuous professional engagement. Moreover, the proliferation of data privacy laws complicates information sharing across borders, requiring careful legal navigation.

Limitations and Ethical Considerations

Despite technological advancements, there are risks related to over-optimization or aggressive tax planning that could border on legal gray areas, provoking audits or sanctions. Ethical taxation practices emphasizing transparency and fairness are gaining prominence, suggesting a future where compliance is not merely a legal obligation but a component of corporate social responsibility.

Forecast of the Industry’s Evolution

Experts project that global tax advisory services will become increasingly integrated with compliance automation and ESG considerations. The emphasis will shift toward sustainable, transparent, and socially responsible tax strategies, aligning corporate growth with global fiscal stability.

Key Points

- Strategic Advantage: Global tax services empower companies with optimized structures and compliance frameworks.

- Technological Innovation: Adoption of AI, blockchain, and big data analytics revolutionizes tax planning and monitoring.

- Risk and Cost Reduction: Proactive management minimizes exposure to penalties and legal disputes.

- Future-Ready Strategies: Embracing digital transformation ensures adaptability amid legislative and economic shifts.

- Societal Impact: Transparent, fair tax practices foster corporate reputation and sustainable development.

How can global tax services improve my company’s international compliance?

+They provide expert guidance on local regulations, treaties, and reporting requirements, ensuring adherence and minimizing audit risks across jurisdictions.

What are the cost implications of implementing global tax strategies?

+While initial investments in advisory and technology are notable, companies often realize significant savings through tax optimization, reduced penalties, and operational efficiencies over time.

Can digital transformation hinder or enhance tax compliance?

+Digital tools enhance accuracy, streamline processes, and provide real-time insights, generally strengthening compliance efforts when properly integrated.