Santa Rosa County Tax Collector

The Santa Rosa County Tax Collector's Office is a vital entity in the Florida county of Santa Rosa, responsible for a wide range of financial and administrative services. From property taxes to vehicle registrations, the office plays a crucial role in the local economy and community. In this article, we will delve into the various functions, services, and impact of the Santa Rosa County Tax Collector, exploring how it operates and its significance to the residents and businesses of the county.

Overview of Santa Rosa County Tax Collector’s Office

The Santa Rosa County Tax Collector’s Office is headed by the elected Tax Collector, a position that holds a term of four years. The current Tax Collector, Lauren Book, was elected in 2020 and has brought a fresh perspective and innovative approaches to the role. The office is committed to providing efficient and convenient services to the residents, ensuring a smooth and transparent process for tax-related matters.

The Tax Collector's Office is divided into several key departments, each with its own specialized functions. These departments work in harmony to manage the diverse range of responsibilities entrusted to the office. Here's an overview of the main departments and their roles:

Property Tax Department

The Property Tax Department is responsible for the assessment and collection of taxes on real estate properties within Santa Rosa County. This includes:

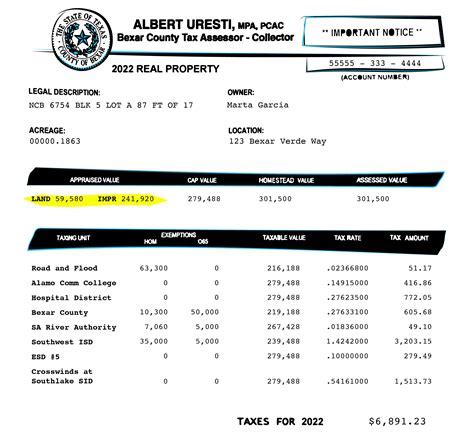

- Assessment: Determining the value of each property for tax purposes, which is a complex process involving property inspections, market analysis, and compliance with state regulations.

- Billing: Generating and sending tax bills to property owners, providing clear and detailed information on the amount due and payment deadlines.

- Collection: Handling the receipt of property tax payments, offering various payment methods for convenience, and managing any delinquent accounts through enforcement procedures.

- Exemptions and Appeals: Processing applications for property tax exemptions, such as homestead exemptions, and providing guidance and assistance to residents during the appeals process.

Vehicle Services Department

The Vehicle Services Department is the go-to resource for all matters related to vehicle registration, titling, and tags. Here’s an overview of their key responsibilities:

- Registration: Processing vehicle registrations, including renewals and new registrations for residents who have recently purchased a vehicle. This involves verifying ownership, assessing applicable fees, and issuing registration documents.

- Titling: Handling vehicle titling, which is the legal documentation of vehicle ownership. This department ensures accurate and timely titling processes, protecting the rights of vehicle owners.

- Tags and Decals: Issuing vehicle tags and decals, which are required for all registered vehicles in Santa Rosa County. They ensure compliance with state regulations and provide convenient options for tag renewal and replacement.

- Specialty Plates: Managing the issuance and renewal of specialty license plates, such as college alumni plates or military-affiliated plates, offering a personalized touch to vehicle ownership.

Taxpayer Assistance and Collections

This department acts as a vital support system for taxpayers, offering guidance and assistance throughout the tax payment process. Their key roles include:

- Customer Service: Providing excellent customer service to taxpayers, answering inquiries, and resolving issues related to tax payments, refunds, or any other tax-related concerns.

- Payment Plans: Assisting taxpayers who may have difficulty paying their taxes in full by offering flexible payment plans, ensuring compliance with tax obligations while accommodating individual financial situations.

- Delinquent Tax Enforcement: Handling delinquent tax accounts through a range of enforcement measures, including liens, levies, and seizure of assets, in compliance with state laws.

Other Services and Departments

In addition to the above, the Santa Rosa County Tax Collector’s Office offers a range of other services and has specialized departments to cater to specific needs. These include:

- Passport Services: A dedicated department assists residents in applying for or renewing their U.S. passports, providing a convenient service for international travel needs.

- Hunting and Fishing Licenses: The office issues hunting and fishing licenses, ensuring compliance with state regulations and promoting responsible outdoor activities.

- Business Tax Receipts: This department handles the registration and issuance of business tax receipts, which are required for businesses operating within Santa Rosa County.

- Tax Deed Sales: In cases of delinquent property taxes, the Tax Collector’s Office conducts tax deed sales, offering an opportunity for investors to purchase properties through a public auction process.

The Impact of the Santa Rosa County Tax Collector’s Office

The Santa Rosa County Tax Collector’s Office has a profound impact on the county’s residents and the overall economy. Its efficient operations and dedicated services contribute to the financial stability and growth of the community. Here are some key ways in which the office makes a difference:

Efficient Tax Collection and Management

The office’s primary responsibility is the collection and management of taxes, which are essential for funding public services and infrastructure. By ensuring timely and accurate tax collection, the office contributes to the financial stability of the county, allowing for the allocation of resources to vital areas such as education, healthcare, and public safety.

The Property Tax Department's assessment process ensures that property values are fairly and accurately determined, promoting equity and fairness in the tax system. This, in turn, helps to maintain a stable and healthy real estate market, benefiting both homeowners and potential buyers.

Streamlined Vehicle Registration and Titling

The Vehicle Services Department plays a crucial role in streamlining the vehicle registration and titling process. By providing efficient services, the office saves residents time and effort, ensuring that their vehicles are properly registered and titled in compliance with state laws. This not only benefits individual motorists but also contributes to road safety and traffic management.

Assisting Taxpayers and Promoting Compliance

The Taxpayer Assistance and Collections department is a vital support system for taxpayers. By offering guidance and assistance, the office ensures that residents understand their tax obligations and can navigate the tax payment process smoothly. This promotes compliance and reduces the likelihood of unintentional tax delinquency.

Additionally, the department's payment plan options provide a safety net for taxpayers facing financial challenges, allowing them to fulfill their tax obligations over time without incurring excessive penalties. This approach fosters a positive relationship between the Tax Collector's Office and the community, encouraging voluntary tax compliance.

Diverse Services for a Wide Range of Needs

Beyond tax collection and management, the Santa Rosa County Tax Collector’s Office offers a diverse range of services to cater to the needs of its residents. From passport services to hunting and fishing licenses, the office provides a one-stop shop for many essential services, saving residents time and hassle. This integrated approach to service delivery enhances the overall convenience and efficiency of the office’s operations.

Conclusion: A Dedicated Service to Santa Rosa County

The Santa Rosa County Tax Collector’s Office is a dedicated and vital entity, committed to serving the residents and businesses of the county. Through its efficient operations, specialized departments, and comprehensive range of services, the office ensures that tax-related matters are handled with transparency, fairness, and convenience. Its impact extends beyond tax collection, contributing to the overall stability, growth, and well-being of the Santa Rosa County community.

How often are property taxes assessed in Santa Rosa County?

+Property taxes in Santa Rosa County are assessed annually, typically based on the property’s value as of January 1st of each year. The assessment process involves evaluating the property’s market value and applying the appropriate tax rates to determine the tax liability.

What are the hours of operation for the Tax Collector’s Office?

+The Santa Rosa County Tax Collector’s Office is open from Monday to Friday, typically from 8:00 AM to 5:00 PM. However, it’s best to check the official website or contact the office directly for the most up-to-date information on hours of operation, as they may vary on certain days or during busy periods.

Can I renew my vehicle registration online?

+Yes, the Santa Rosa County Tax Collector’s Office offers online renewal services for vehicle registrations. Residents can access the online portal through the official website, where they can renew their registration, pay the applicable fees, and receive their updated registration documents electronically.

How can I apply for a passport through the Tax Collector’s Office?

+To apply for a passport through the Santa Rosa County Tax Collector’s Office, you’ll need to schedule an appointment. Visit their official website or contact the office to book an appointment. During your appointment, you’ll need to provide the required documentation, including proof of citizenship, identity documents, and passport photos. The office will guide you through the application process and assist with any questions you may have.

Are there any payment options available for those who cannot pay their taxes in full?

+Yes, the Taxpayer Assistance and Collections department offers payment plans for taxpayers who may be facing financial difficulties. These plans allow taxpayers to pay their taxes over a specified period of time, reducing the financial burden and helping them comply with their tax obligations. To explore your options, contact the Tax Collector’s Office, and they will provide guidance and assistance based on your specific circumstances.