Kentucky State Tax

In the United States, state taxes are an essential part of the fiscal landscape, and Kentucky is no exception. The Bluegrass State, known for its rich history, horse racing, and bourbon, has a unique tax system that influences the lives of its residents and businesses. This article aims to delve into the intricacies of Kentucky's state tax system, providing an in-depth analysis for those seeking to understand its workings.

Unraveling Kentucky’s State Tax Landscape

Kentucky, with its vibrant economy and diverse industries, has developed a tax system that caters to its specific needs and characteristics. The state’s tax policies impact everything from personal income to business operations, shaping the financial landscape of the region.

Personal Income Tax: A Detailed Overview

Kentucky imposes a progressive personal income tax on its residents. This means that as your income increases, so does the tax rate. Currently, there are six tax brackets, ranging from 2% to 6% for taxable income over $7,700. These brackets are adjusted annually for inflation, ensuring tax fairness over time.

For example, consider a resident earning $50,000 annually. Their income would fall into the 5% tax bracket for taxable income between $10,000 and $70,000, meaning they would pay taxes at this rate on the portion of their income within this bracket.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $3,850 | 2% |

| $3,851 - $7,700 | 3% |

| $7,701 - $10,000 | 4% |

| $10,001 - $70,000 | 5% |

| $70,001 - $125,000 | 5.8% |

| Over $125,000 | 6% |

Sales and Use Tax: Understanding the Basics

Kentucky applies a 6% sales and use tax to most retail transactions. This tax is collected by businesses at the point of sale and is an important source of revenue for the state. However, certain items are exempt from this tax, including prescription drugs, residential energy, and some agricultural equipment.

Additionally, Kentucky offers a reduced tax rate of 3% for qualifying manufacturing equipment. This incentive is designed to encourage investment in the state's manufacturing sector, promoting economic growth and job creation.

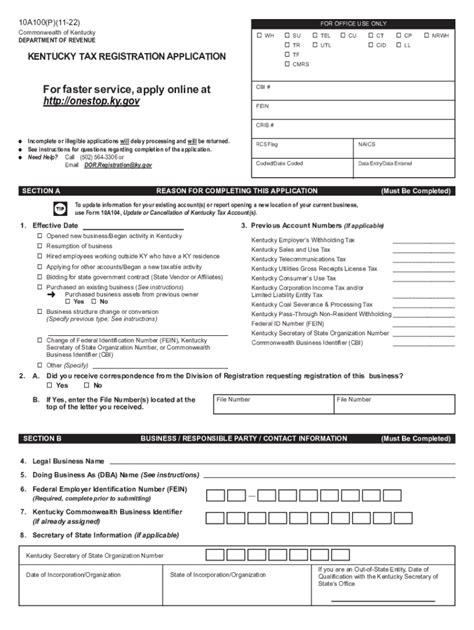

Corporate Income Tax: A Competitive Advantage

Kentucky aims to attract businesses with a relatively low corporate income tax rate of 5%. This rate is applied to taxable income, which includes profits derived from business activities within the state. The state also offers various tax incentives and credits to businesses that meet specific criteria, further enhancing its attractiveness as a business destination.

One notable incentive is the Kentucky Business Investment (KBI) program, which provides a tax credit of up to 7.5% of the cost of certain qualifying capital investments. This program is designed to encourage businesses to expand their operations in Kentucky, creating new jobs and driving economic growth.

Property Tax: A Local Perspective

Property taxes in Kentucky are assessed and collected at the local level, with rates varying across the state. These taxes fund essential services such as education, infrastructure, and public safety. The average effective property tax rate in Kentucky is approximately 0.81%, which is slightly lower than the national average.

The state's property tax system is based on the assessed value of the property, which is determined by local assessors. This value is then multiplied by the applicable tax rate to calculate the tax liability. Kentucky also offers various property tax exemptions and credits, particularly for seniors and disabled residents, to provide relief and support.

Kentucky’s Tax Incentives and Benefits

Kentucky has implemented a range of tax incentives and benefits to stimulate economic growth and support various industries. These incentives are designed to attract new businesses, encourage job creation, and promote innovation.

Research and Development Tax Credits

Businesses engaged in research and development activities in Kentucky may be eligible for tax credits. These credits are designed to offset the costs associated with R&D, making Kentucky an attractive location for innovative companies.

For instance, a company investing $1 million in qualifying R&D activities in Kentucky could be eligible for a tax credit of up to $250,000, significantly reducing their tax liability and providing an incentive for continued investment in the state.

Job Creation Tax Credits

Kentucky offers tax credits to businesses that create new jobs in the state. These credits are available for a period of up to five years and can provide a significant financial benefit to businesses, helping to offset the costs associated with hiring and training new employees.

Consider a business that creates 50 new jobs with an average salary of $40,000. This business could be eligible for a tax credit of up to $200,000 over five years, offering a strong incentive for job creation and economic development.

Film and Entertainment Incentives

Kentucky has recognized the economic potential of the film and entertainment industry and has implemented incentives to attract productions to the state. These incentives include tax credits for qualified film production expenditures, providing a boost to the state’s creative industries and tourism.

A film production with a qualified spend of $5 million in Kentucky could be eligible for a tax credit of up to $1 million, making the state an appealing location for filmmakers and a hub for cultural and economic activity.

The Impact of Kentucky’s State Taxes

Kentucky’s state tax system has a profound impact on the state’s economy and its residents. By implementing a balanced approach to taxation, the state aims to foster economic growth, support businesses, and provide essential services to its citizens.

Economic Growth and Development

The combination of competitive tax rates, targeted incentives, and a skilled workforce has made Kentucky an attractive destination for businesses. This influx of investment has led to job creation, increased tax revenues, and a thriving economy.

For instance, a large manufacturing company's decision to expand its operations in Kentucky could result in hundreds of new jobs and a significant boost to the local economy. The company's increased tax contribution would, in turn, support vital services and infrastructure development, benefiting the community as a whole.

Supporting Small Businesses

Kentucky’s tax system is designed to support small businesses, which are the backbone of the state’s economy. With a low corporate income tax rate and various incentives, small businesses can thrive and contribute to the state’s economic vitality.

A small business owner, for example, could benefit from the state's tax incentives for job creation, allowing them to hire additional employees without a significant increase in tax liability. This support can be instrumental in helping small businesses grow and succeed.

Funding Essential Services

Tax revenues collected by the state are crucial for funding essential services such as education, healthcare, and public safety. These services are vital to the well-being of Kentucky’s residents and contribute to the state’s overall quality of life.

For instance, property tax revenues fund local schools, ensuring that Kentucky's youth receive a quality education. Similarly, sales tax revenues support healthcare initiatives, providing access to essential services for all residents.

Kentucky’s Tax Reform and Future Outlook

Kentucky’s tax system is subject to ongoing review and reform to ensure it remains fair, efficient, and aligned with the state’s economic goals. Recent initiatives and proposed reforms highlight the state’s commitment to continuous improvement.

Recent Tax Reforms

In recent years, Kentucky has implemented several tax reforms aimed at simplifying the tax system, reducing administrative burdens, and promoting economic growth.

One notable reform was the introduction of a flat tax rate for certain small businesses, providing a simplified and predictable tax environment. This reform has been well-received by small business owners, who can now focus more on their core operations.

Proposed Tax Reforms

There are ongoing discussions and proposals for further tax reforms in Kentucky. Some of the proposed changes include:

- Expanding the sales tax base to include certain services, which could provide a more stable revenue source for the state.

- Implementing a state-level earned income tax credit to provide financial support to low-income workers.

- Streamlining the corporate income tax system to make it more competitive and attractive to businesses.

Future Implications

Kentucky’s tax system is likely to evolve in response to changing economic conditions, technological advancements, and the needs of its residents and businesses. By staying adaptable and responsive, the state can continue to foster a thriving economy and a high quality of life for its citizens.

As Kentucky continues to attract businesses and support its existing industries, the state's tax revenues are expected to grow, providing the resources needed to invest in infrastructure, education, and other vital areas. This, in turn, will contribute to the state's long-term economic sustainability and prosperity.

Conclusion

Kentucky’s state tax system is a dynamic and evolving entity, designed to support the state’s economic growth, attract businesses, and provide essential services to its residents. By offering a balanced approach to taxation and implementing targeted incentives, Kentucky has created an attractive environment for businesses and individuals alike.

As the state continues to adapt and reform its tax policies, it remains committed to fostering economic prosperity and ensuring a high quality of life for its citizens. The future looks bright for Kentucky, with its vibrant economy and forward-thinking approach to taxation.

What is the tax rate for online sales in Kentucky?

+Online sales in Kentucky are subject to the same 6% sales and use tax as traditional retail transactions. However, Kentucky also has a use tax for purchases made outside the state but used within Kentucky. This ensures that online purchases are taxed similarly to in-state purchases.

Are there any tax breaks for seniors in Kentucky?

+Yes, Kentucky offers several tax breaks for seniors. These include property tax exemptions and credits, as well as a state-level homestead exemption. These incentives provide financial relief to seniors, allowing them to maintain their homes and manage their finances more comfortably.

How does Kentucky’s corporate income tax compare to other states?

+Kentucky’s corporate income tax rate of 5% is relatively competitive compared to other states. Some states have lower rates, while others have higher rates, but Kentucky’s rate is generally seen as favorable for businesses, especially when combined with the state’s various tax incentives.